Associate Professor of Finance at Erasmus University Rotterdam and Executive Director at Robeco Asset Management. www.laurensswinkels.com #FinSky #EconSky

📍Oslo, Norway 🇳🇴

#Investing #Finance #FinSky #EconSky

#investing #finance #bitcoin #crypto #etf

As far as I understand, it is not only about returns, but also about low correlation with other assets.

And if you believe that btc will go to zero, you should be short, not hold zero.

Link to paper: doi.org/10.1093/rof/...

#EconSky #FinSky #Bitcoin #Crypto #Investing #Academic

Reposted by Laurens Swinkels

Reposted by Caroline Fohlin

Short video clip about the content on www.laurensswinkels.com, where you can also find the data.

#EconSky #FinSky #Academic #Investing #Finance

Reposted by Laurens Swinkels

#sustainability #esg #finance #investing #india

Link to paper: dx.doi.org/10.2139/ssrn...

#Gold #Bitcoin #Investing #FinSky #EconSKy #Safehaven

Rangvid's blogpost: blog.rangvid.com/2025/10/26/h...

#EconSky #Denmark #Debt #InterestRates #Book

Reposted by Laurens Swinkels, John Hogan

Link to paper: www.nber.org/papers/w34389

#EconSky #War #Economy #Academic #HistorySky

Reposted by Laurens Swinkels

#Climate #Carbon #Investing #Assets #EconSky

Link to paper: www.nber.org/papers/w34342

#Investing #Gold #Stocks #FinSky

Link to paper: dx.doi.org/10.2139/ssrn...

#EMD #EmergingMarkets #Investing #FinSky #EconSky #Academic

Reposted by Laurens Swinkels

#FinSky #EconSky #Investing #Investment #Stocks #Bonds

Link to paper: dx.doi.org/10.2139/ssrn...

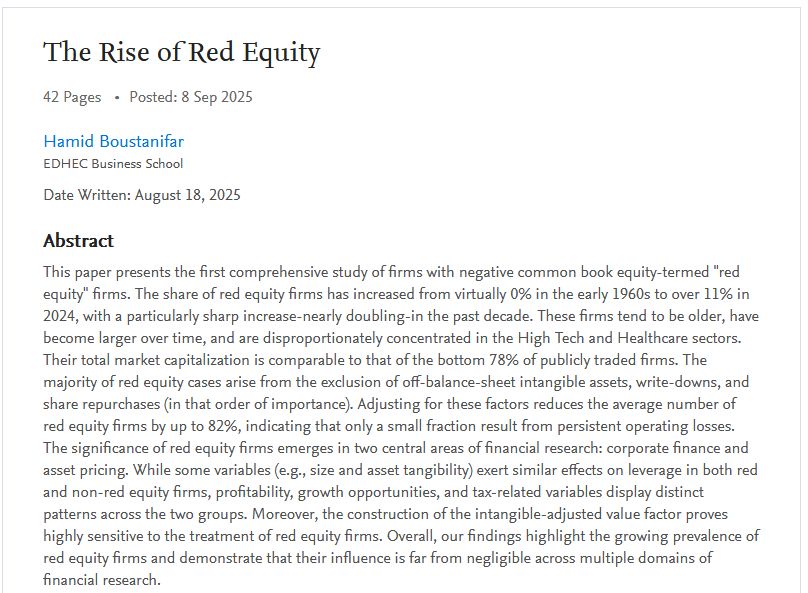

#Investing #EconSky #FinSky #Stocks #Equities #Red

Reposted by Tomasz Mickiewicz, Laurens Swinkels, Maksym Polyakov

Reposted by Laurens Swinkels

Its pretty basic maths informs massive capital allocations.

A no equation explainer: on.ft.com/4p7CwsD