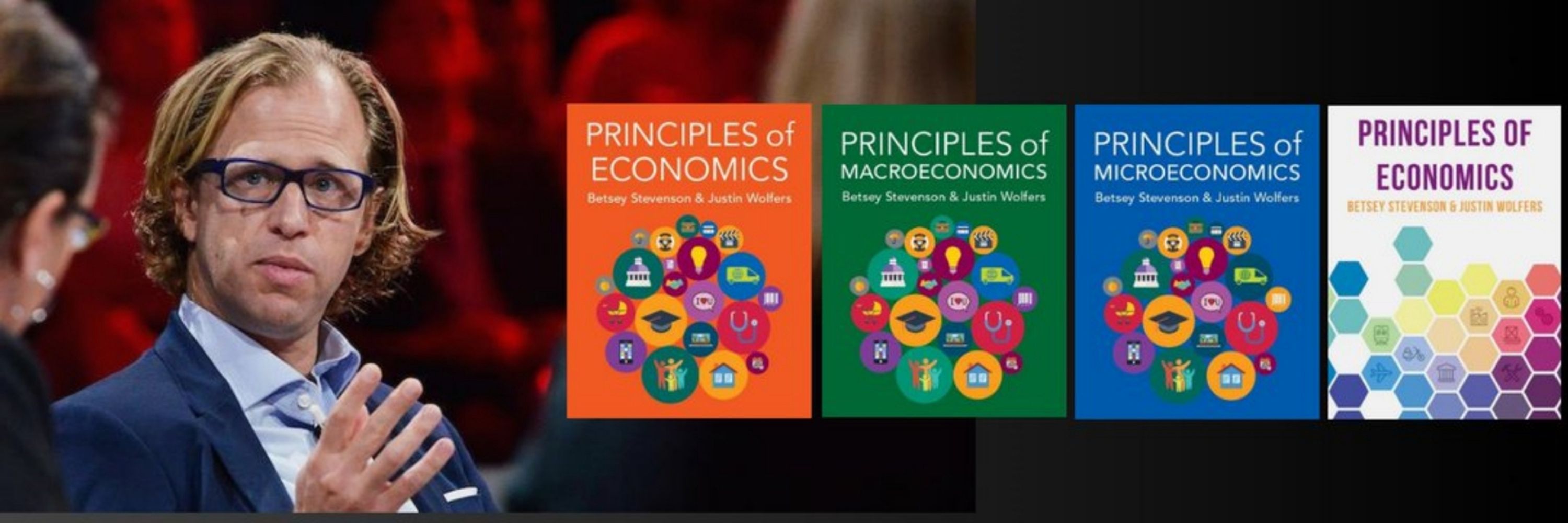

Econ professor at Michigan ● Senior fellow, Brookings ● Intro econ textbook author ● Think Like An Economist podcast ● An economist willing to admit that the glass really is half full.

Justin James Michael Wolfers is an Australian economist and public policy scholar. He is professor of economics and public policy at the Gerald R. Ford School of Public Policy at the University of Michigan, and a Senior Fellow at the Peterson Institute for International Economics. .. more

So new data isn't going to be persuasive for a bit.

Reposted by Greg Linden

And that means it's likely comfortable sticking where it is until the economy screams for change.

The official statement was quite uninformative. If last month is anything to go by, this might be where the real news is.

This says 1 wanted a bigger cut, 12 wanted a quarter point cut, and 6 wanted no change.

For the Fed, that's what passes as a starkly divided board.

Reposted by Greg Linden

1. Inflation is expected to be above target for years.

2. Unemployment is above long-term rate and will be for a while.

3. Surprisingly large uptick in expected growth for 2026.

4. We may get one or two more interest rate cuts, but don't hold your breath.

The revised statement is remarkably buttoned down, probably due to the shutdown-inflicted data blackout.

And we are now up to three dissents - one for lower rates, and two for no change. But the committee is more deeply divided than that.

Me: "Good luck, mate."

“The consensus is we need to come up with something,” Rep. Ralph Norman says.

Reposted by Richard S.J. Tol, Justin Wolfers

“The consensus is we need to come up with something,” Rep. Ralph Norman says.

- 84% of market economists expect Trump to tap Kevin Hassett to lead the Fed.

- Only 11% think that's a good idea (and that's only relative to Trump's existing shortlist).

www.cnbc.com/amp/2025/12/...

Me: "Wow, so grade inflation, huh?"

There's an old Australian expression: Yeah nah.

Reposted by Richard S.J. Tol, Justin Wolfers, Rosemary A. Joyce , and 12 more Richard S.J. Tol, Justin Wolfers, Rosemary A. Joyce, Philip N. Cohen, Christian E. Weller, David R. Miller, Aaron Sojourner, Jacob T. Levy, Stacy D. VanDeveer, Scott A. Imberman, Michael D. McDonald, Kate Jackson, Aviel Roshwald, Nathan P. Kalmoe, David Darmofal

(You can subscribe to my YouTube channel for more unhinged directness: www.youtube.com/@JustinWolfers)

kalshi.com/markets/kxnb...

They need to be courageous.. even when it feels difficult.

They need to serve the American people rather than the White House.

They need to have good judgment and a sensible model.. of how the economy works overall.

And they need to show intellectual leadership

Need a Trump-y twist? Make it “foreign businesses.”

It’s like political Mad Libs: just fill in the villain and skip the economics.

Add in the President's solution — a task force(!)— and you'll understand my fear nothing goo will happen.

Now riddle me this: Why not bail out consumers who are paying more for imported goods?

www.nytimes.com/2025/12/08/u...

"Affordability is the direct result of the actions of the White House."