I think data could be more accessible to a wider audience so sometimes I’ll quote post with a comment about why I find it surprising.

1/ Hiring is currently extremely weak by historical standards, despite a relatively low unemployment rate. And layoffs are also low.

This is unusual... but not without precedent.

1/ Hiring is currently extremely weak by historical standards, despite a relatively low unemployment rate. And layoffs are also low.

This is unusual... but not without precedent.

How the economy navigates the additional growth on tap will be a function of the cost of debt and, critically, sustaining high growth.

#economy #debt #markets @wsj.com

My guide to data visualization, which includes a very long table of contents, tons of charts, and more.

--> Why data visualization matters and how to make charts more effective, clear, transparent, and sometimes, beautiful.

www.scientificdiscovery.dev/p/salonis-gu...

My guide to data visualization, which includes a very long table of contents, tons of charts, and more.

--> Why data visualization matters and how to make charts more effective, clear, transparent, and sometimes, beautiful.

www.scientificdiscovery.dev/p/salonis-gu...

1. Home prices need to drop -40%

2. Incomes need to increase +60%

3. Interest rates need to drop to 2%

1. Home prices need to drop -40%

2. Incomes need to increase +60%

3. Interest rates need to drop to 2%

Home Sellers outnumber Buyers by more than 500,000, the largest gap ever recorded 👀

Home Sellers outnumber Buyers by more than 500,000, the largest gap ever recorded 👀

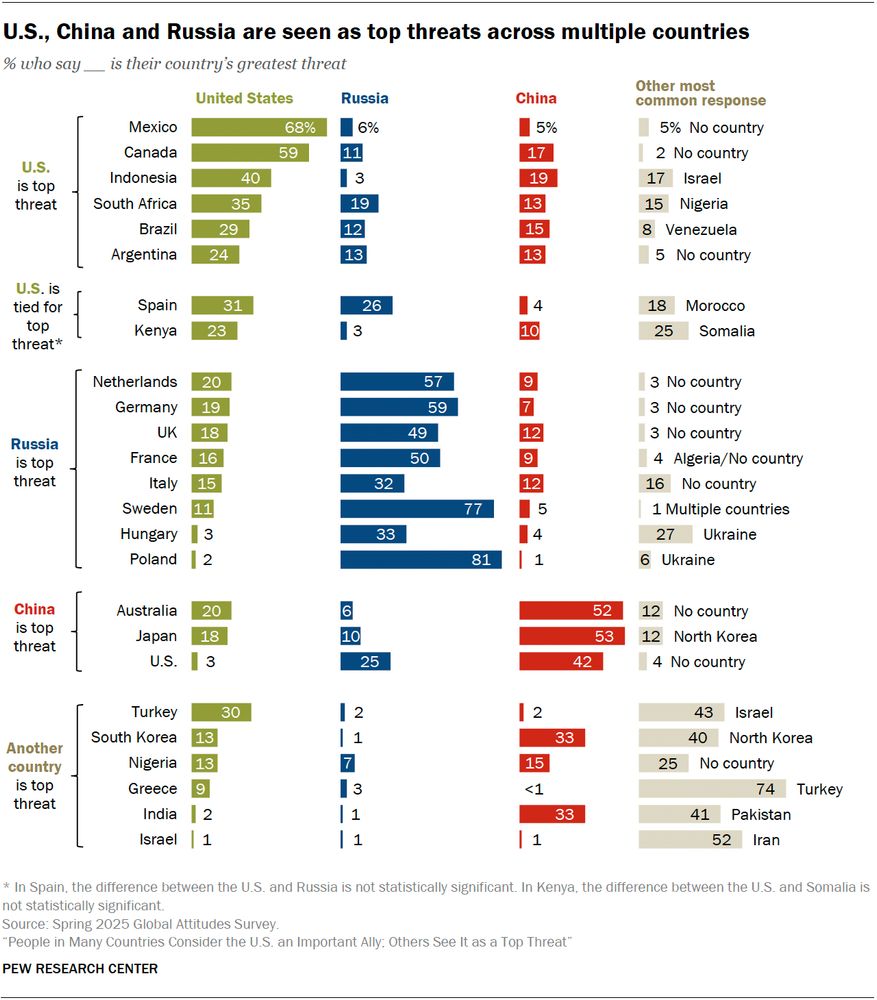

www.pewresearch.org/global/2025/...

www.pewresearch.org/global/2025/...

www.bls.gov/news.release...

While outer ring suburbs are accommodating the most new housing, downtowns are growing a lot faster than inner ring suburbs.

While outer ring suburbs are accommodating the most new housing, downtowns are growing a lot faster than inner ring suburbs.

If you have any questions about this READ THE ALT TEXT FIRST PLEASE then feel free to fire away.

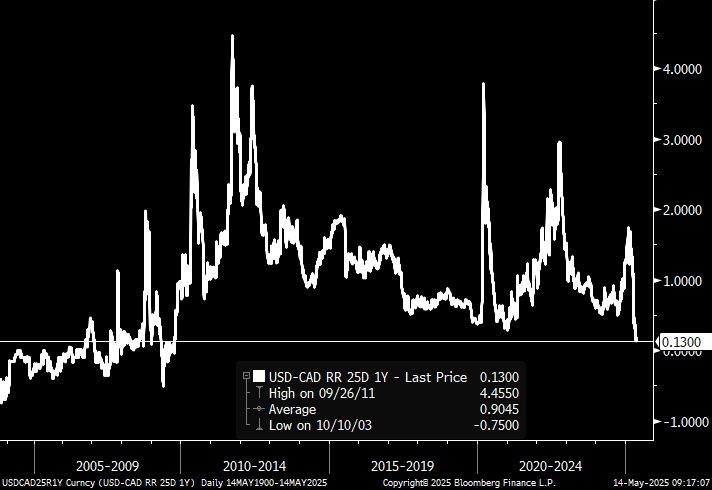

*we're going to ignore the 3/9/20 print IMO

If you have any questions about this READ THE ALT TEXT FIRST PLEASE then feel free to fire away.

*we're going to ignore the 3/9/20 print IMO