Good luck on Fed Vortex Hell Trading Day.

Good luck on Fed Vortex Hell Trading Day.

Finally, over the past decade gold basically hugs and reverts back to the 50dma. We have a few hundred points to go.

Finally, over the past decade gold basically hugs and reverts back to the 50dma. We have a few hundred points to go.

Remove the 17-month tail and that number shrinks to 3-months.

Remove the 17-month tail and that number shrinks to 3-months.

Maybe they get more stretched and stay there.

But the money tree roulette table doesn’t always work in one direction unless the game has changed.

Maybe it has. But so far it’s just politicians talking.

/FIN

Maybe they get more stretched and stay there.

But the money tree roulette table doesn’t always work in one direction unless the game has changed.

Maybe it has. But so far it’s just politicians talking.

/FIN

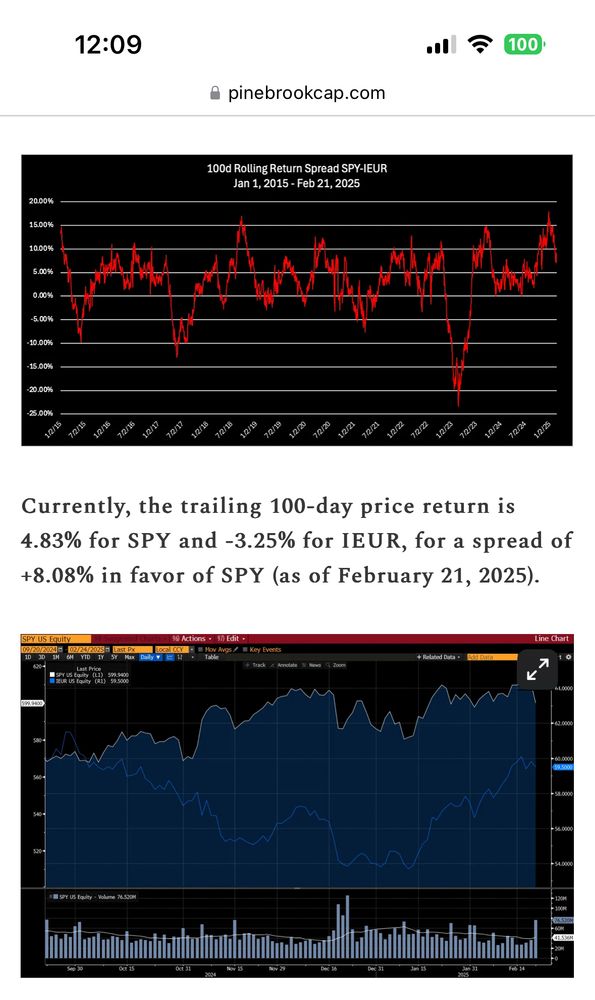

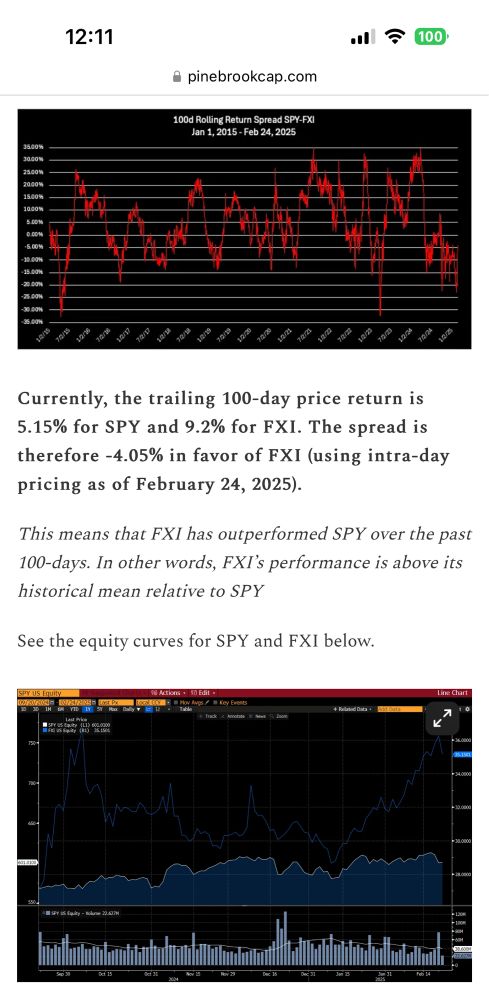

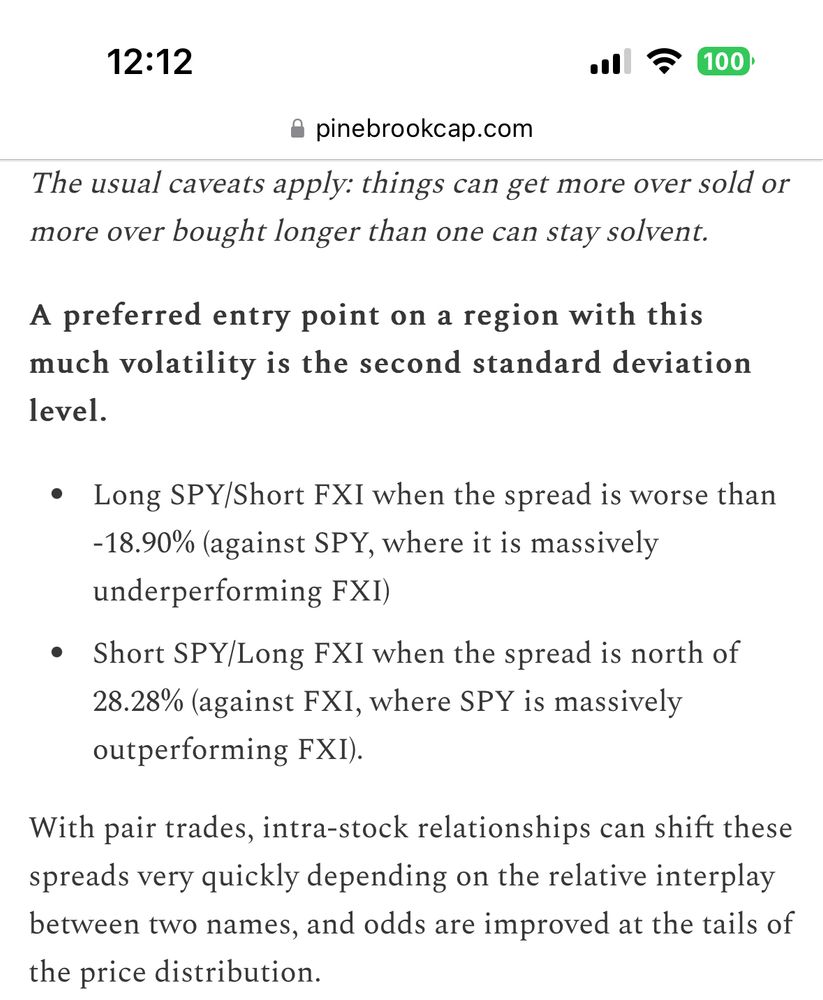

China and Europe are at negative 2 standard deviations compared to short USA.

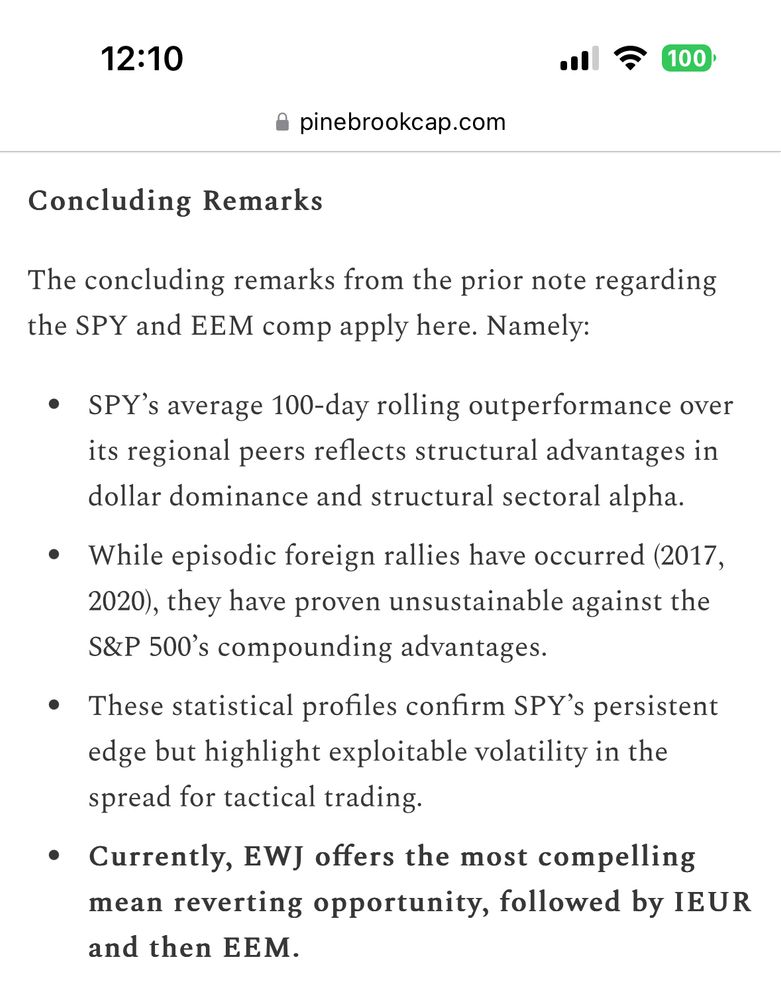

Japan over 1-sigma. And EMM is approaching 1-sigma.

China and Europe are at negative 2 standard deviations compared to short USA.

Japan over 1-sigma. And EMM is approaching 1-sigma.