Finally, over the past decade gold basically hugs and reverts back to the 50dma. We have a few hundred points to go.

Finally, over the past decade gold basically hugs and reverts back to the 50dma. We have a few hundred points to go.

Here's a chart with price action from the last 10-days.

Classic lower highs, weakening bounce.

Whatever. It's a chart.

Here's a chart with price action from the last 10-days.

Classic lower highs, weakening bounce.

Whatever. It's a chart.

Made Substack’s “Top 20 rising in finance”.

Made Substack’s “Top 20 rising in finance”.

The narrow window for a cut was in June.

Oh see that 6500? 😂

The narrow window for a cut was in June.

Oh see that 6500? 😂

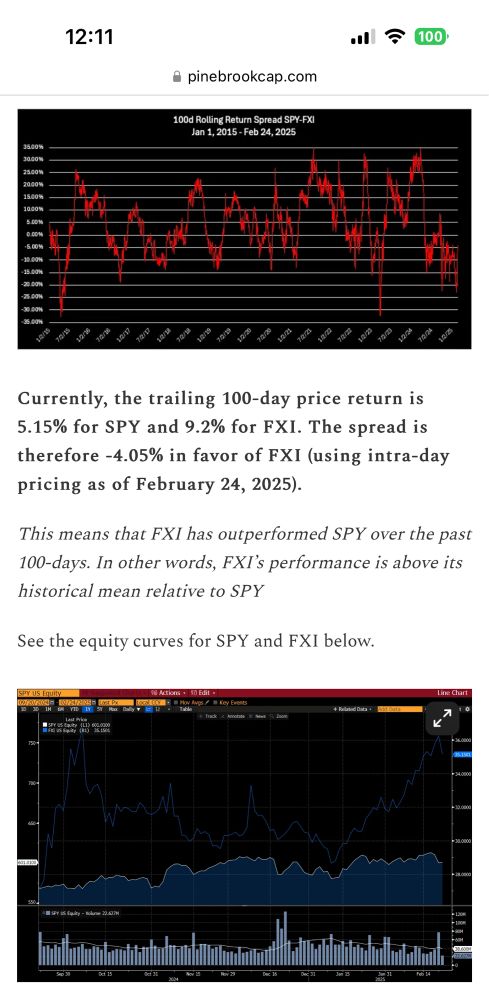

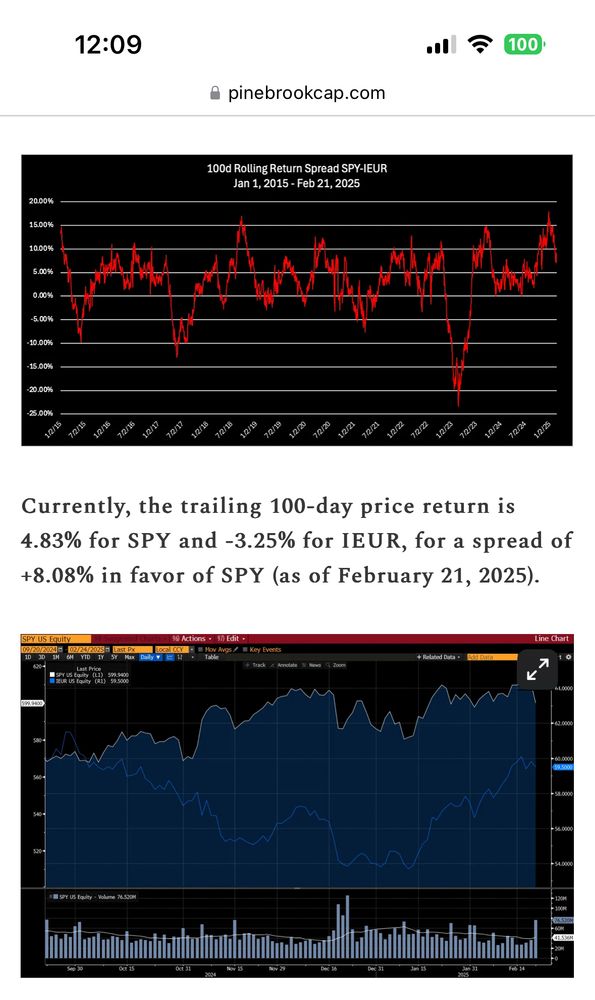

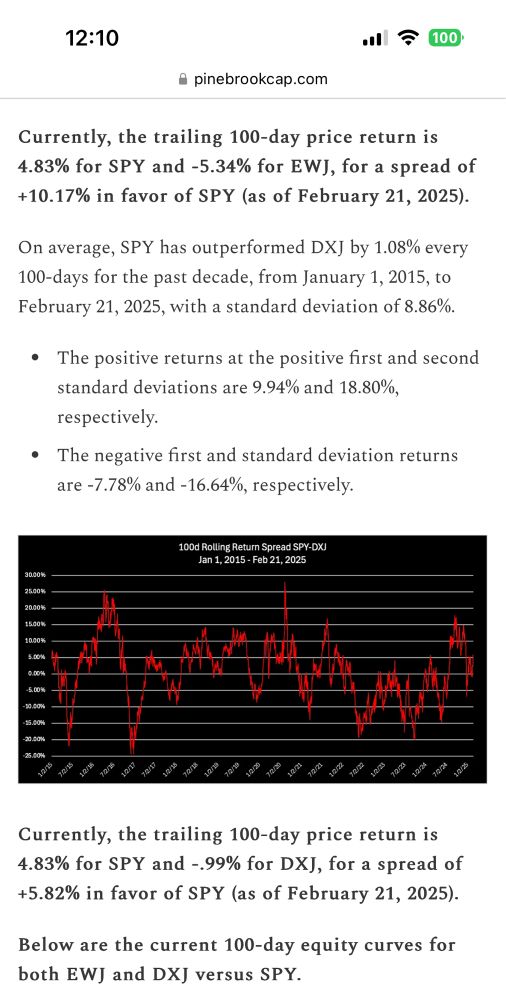

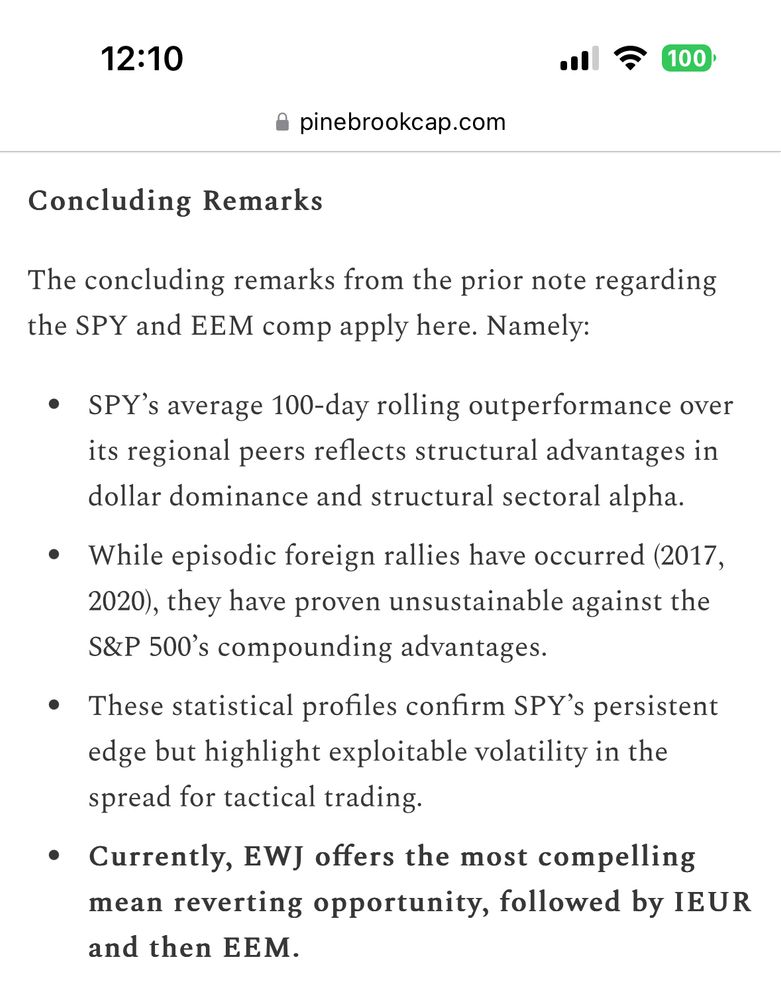

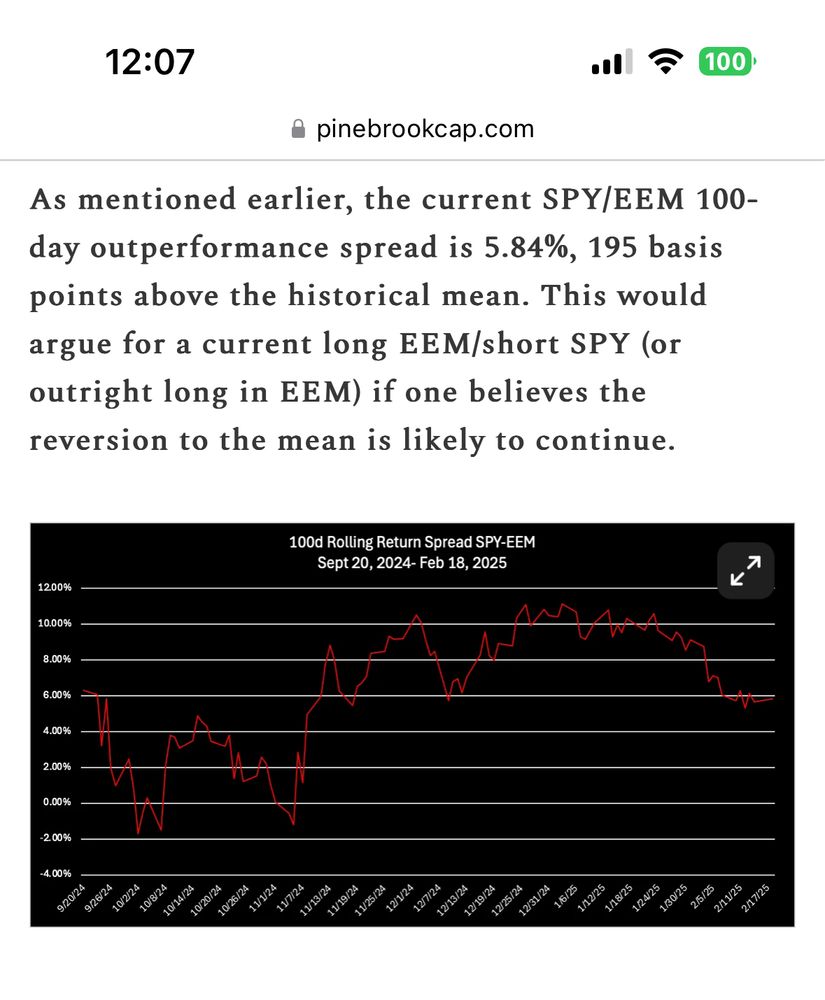

China and Europe are at negative 2 standard deviations compared to short USA.

Japan over 1-sigma. And EMM is approaching 1-sigma.

China and Europe are at negative 2 standard deviations compared to short USA.

Japan over 1-sigma. And EMM is approaching 1-sigma.

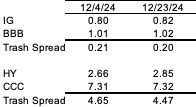

Trash spreads in IG and HY have actually improved a smidgen since December 4th.

Trash spreads in IG and HY have actually improved a smidgen since December 4th.

The Fed WILL tolerate some short term inflation vol as a matter of policy.

The Fed WILL tolerate some short term inflation vol as a matter of policy.

Talk about pinning it and threading a fire hose through a needle.

Talk about pinning it and threading a fire hose through a needle.

Spoiler alert: it’s not as growthy as one would think.

Spoiler alert: it’s not as growthy as one would think.