3 days later we claimed a “sphere of influence” that includes Ukraine.

3 days later we claimed a “sphere of influence” that includes Ukraine.

Guesses welcome :)

Guesses welcome :)

That would raise the 6-month annualized rate but lower the 12-month to 2.7%

That would raise the 6-month annualized rate but lower the 12-month to 2.7%

www.wsj.com/livecoverage...

More importantly, core PCE inflation is expected to have averaged 0.19% m/m over the July-December period -already at spitting distance from the 2% target.

Governor Waller is onto something.

More importantly, core PCE inflation is expected to have averaged 0.19% m/m over the July-December period -already at spitting distance from the 2% target.

Governor Waller is onto something.

Also, not concerned about claims. Today’s jump mostly due to seasonality. Tracking the 2019 nsa data very closely.

Also, not concerned about claims. Today’s jump mostly due to seasonality. Tracking the 2019 nsa data very closely.

The median forecast has headline CPI rising to 2.7% from 2.6%.

The median forecast has headline CPI rising to 2.7% from 2.6%.

Mostly seasonal noise.

Mostly seasonal noise.

Okay but didn't she just vote in favor of the most recent rate cut?

@mckonomy.bsky.social

@steveliesman.bsky.social

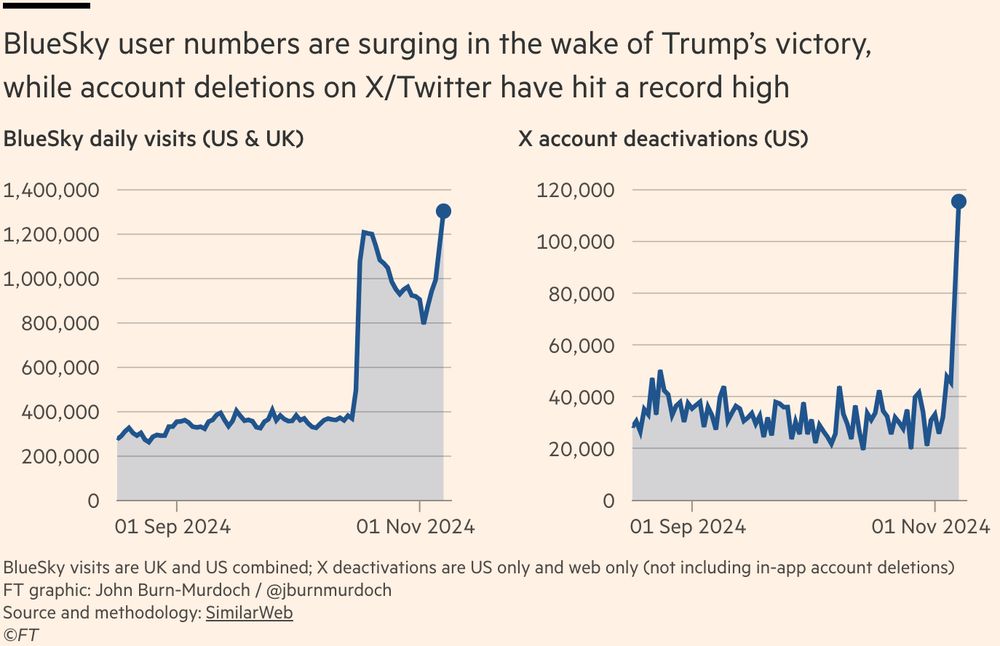

BlueSky user numbers have hit a new record high in recent days, while the number of people deleting their accounts on X/Twitter has rocketed 🚀

BlueSky user numbers have hit a new record high in recent days, while the number of people deleting their accounts on X/Twitter has rocketed 🚀

Another 25bp rate reduction is still in the cards for December though Nov data (CPI/PCE, jobs) will have the last word.

#TDStrategy

Another 25bp rate reduction is still in the cards for December though Nov data (CPI/PCE, jobs) will have the last word.

#TDStrategy