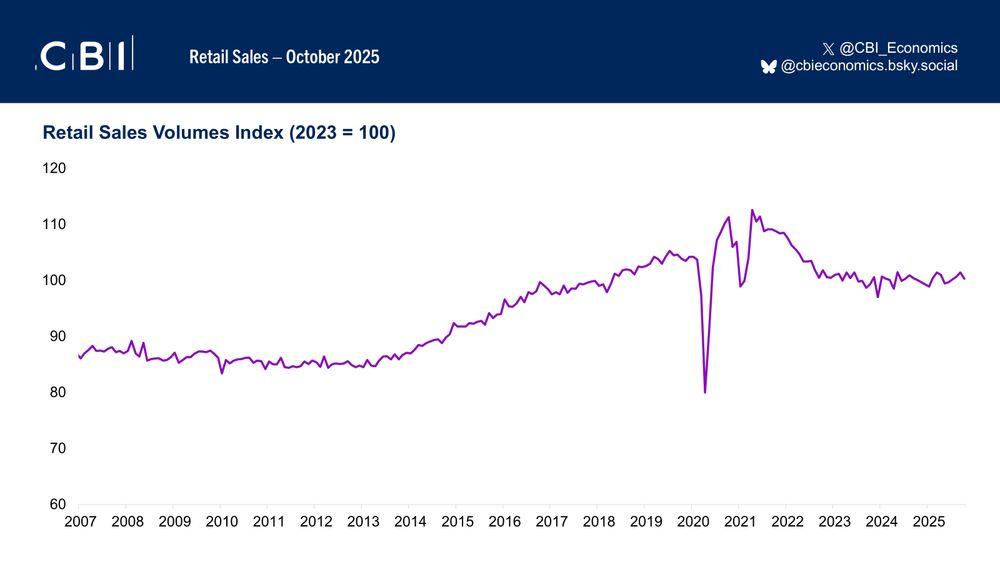

Check out the key figures from the latest CBI DTS 👇

Check out the key figures from the latest CBI DTS 👇

Here is our PN

Here is our PN

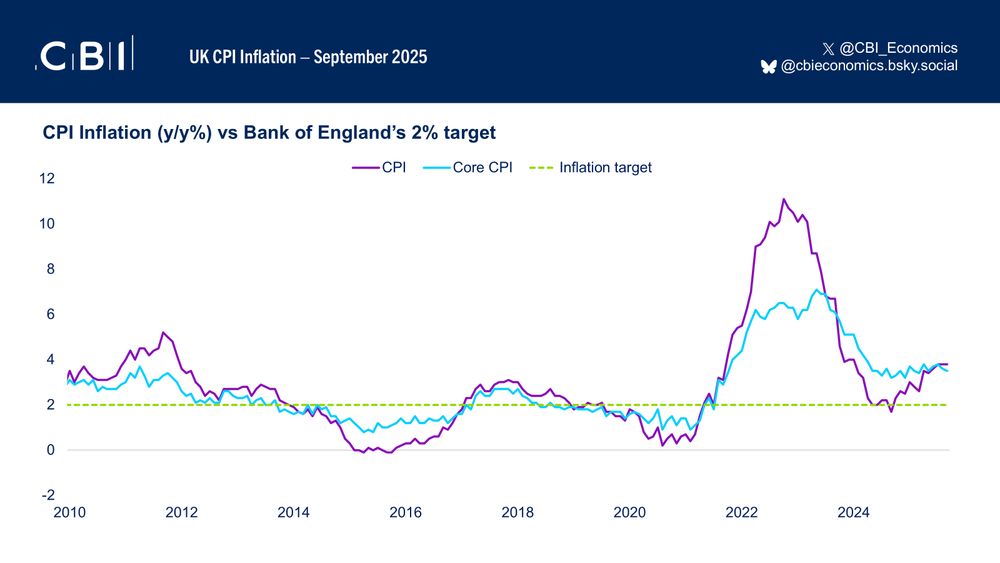

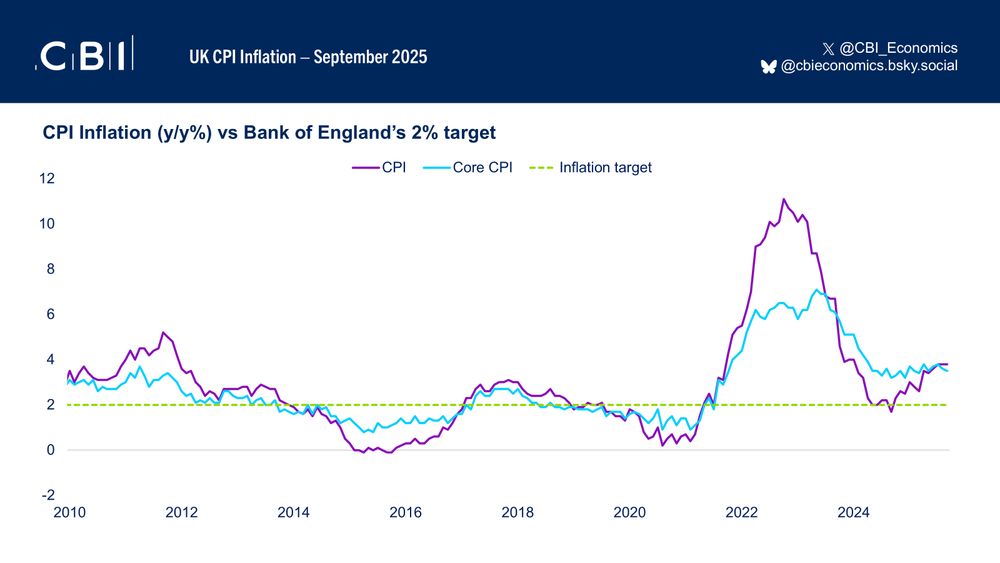

The Bank's central forecast expects inflation to slow to 2% by H1 2027, based on market expectations that interest rates will fall to a terminal rate of 3.5% in H1 2026.

🧵👇

The Bank's central forecast expects inflation to slow to 2% by H1 2027, based on market expectations that interest rates will fall to a terminal rate of 3.5% in H1 2026.

🧵👇

In our latest Economy in Brief, @alpeshpaleja.bsky.social explores what this means for monetary policy and the wider economic outlook.

Read more🔒: www.cbi.org.uk/articles/eco...

In our latest Economy in Brief, @alpeshpaleja.bsky.social explores what this means for monetary policy and the wider economic outlook.

Read more🔒: www.cbi.org.uk/articles/eco...

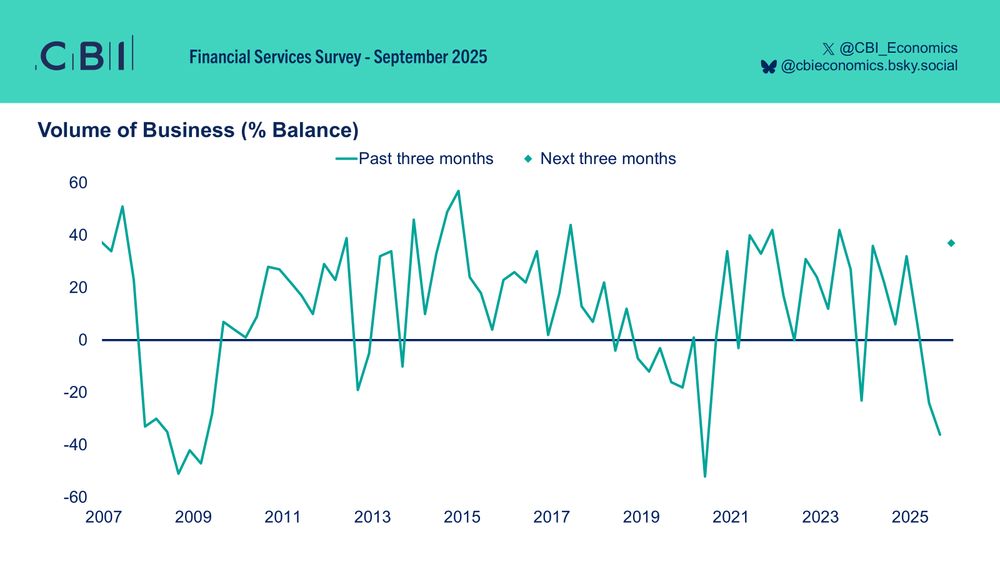

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

🔒 Members only - register here: events.cbi.org.uk/event/2b056a....

🔒 Members only - register here: events.cbi.org.uk/event/2b056a....

Check out the findings from the survey 👇🧵

Check out the findings from the survey 👇🧵