CBI Economics

@cbieconomics.bsky.social

250 followers

490 following

210 posts

Posts from the economics directorate of the CBI. Follow us for updates and analysis on the UK economy, tax & fiscal policy, our business surveys, and consulting projects.

Posts

Media

Videos

Starter Packs

Reposted by CBI Economics

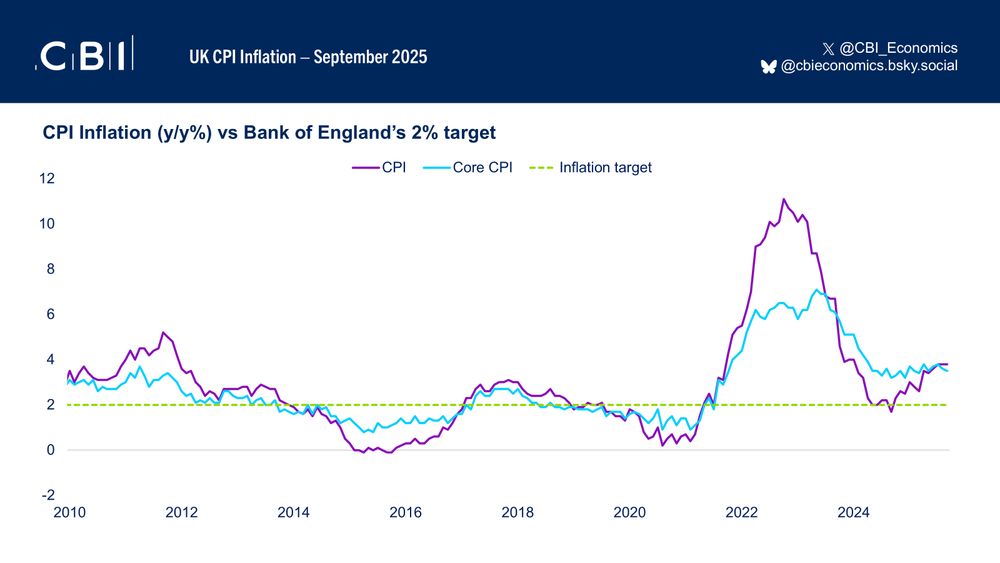

UK #CPI inflation held steady at 3.8% in the year to September, undershooting consensus expectations (of 4.0%). Core CPI inflation (excl. energy, food, alcohol, and tobacco) eased slightly to 3.5% (from 3.6% in August)