the way we talk about risk is all wrong

www.schroders.com/en-gb/uk/int...

10% drops happen in more years than not, 20% falls happen once every 4 years @Schroders

10% drops happen in more years than not, 20% falls happen once every 4 years @Schroders

The OBR has analysed how likely it is that an economist could be replaced by AI 🤣

TLDR they reckon it complements rather than substitutes. Their jobs are safe!

The OBR has analysed how likely it is that an economist could be replaced by AI 🤣

TLDR they reckon it complements rather than substitutes. Their jobs are safe!

Now 1.5% in 2030, previously 1.8%

Trend productivity growth now only 1.0% down from 1.3%

And this *includes* expected gains from AI

Now 1.5% in 2030, previously 1.8%

Trend productivity growth now only 1.0% down from 1.3%

And this *includes* expected gains from AI

Feels pretty good!

Fell on my arse and skidded down one slope feet first. Still not sure if that lost or bought me time

Feels pretty good!

Fell on my arse and skidded down one slope feet first. Still not sure if that lost or bought me time

Granted I haven’t watched it for years but last time I did the only exciting parts where the start and the pit stops

Convince me

Granted I haven’t watched it for years but last time I did the only exciting parts where the start and the pit stops

Convince me

Leverage is lower and interest cover higher

So while they’re clearly leveraging up to pay for AI capex, the starting point is solid

History suggests it could take some time for fundamental vulnerabilities to build

Leverage is lower and interest cover higher

So while they’re clearly leveraging up to pay for AI capex, the starting point is solid

History suggests it could take some time for fundamental vulnerabilities to build

Scotland scored to make it 1-1

Everyone ran into the street screaming, neighbours hugging each other

Can still remember that feeling. Here. We. Go.

Scotland scored to make it 1-1

Everyone ran into the street screaming, neighbours hugging each other

Can still remember that feeling. Here. We. Go.

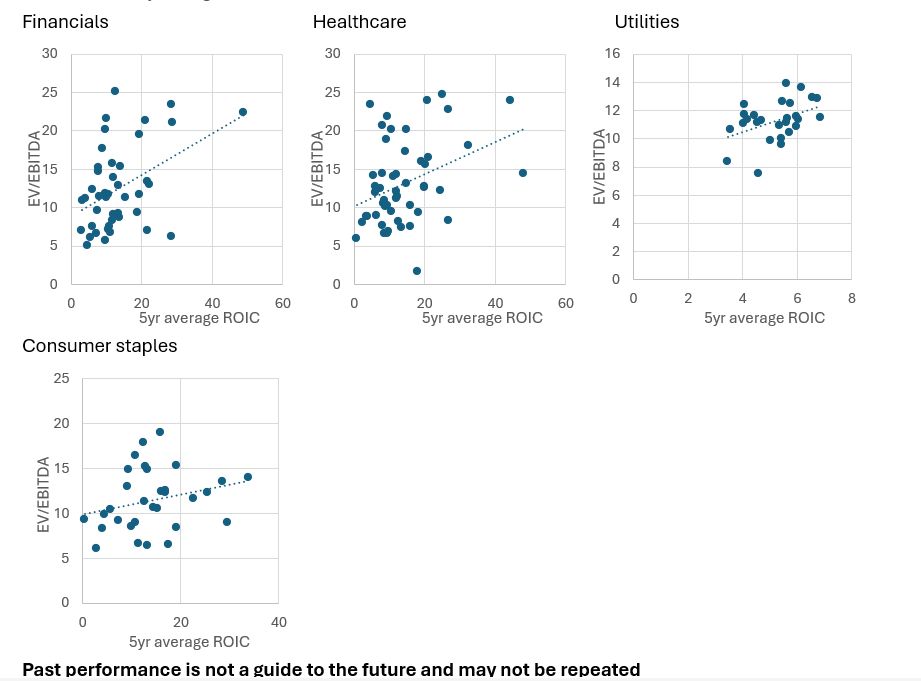

Yes in most but not all sectors but there are lots of individual company exceptions. Big tech are hoping they will be one of those exceptions…

Yes in most but not all sectors but there are lots of individual company exceptions. Big tech are hoping they will be one of those exceptions…

Makes them more capital intensive

❓Is there evidence that higher capital intensity/lower ROIC should result in lower valuation multiples

💡 Yes. Sectors with lower ROIC tend to trade on lower multiples. Big risk!

Stronger relationship between sectors than within them

Makes them more capital intensive

❓Is there evidence that higher capital intensity/lower ROIC should result in lower valuation multiples

💡 Yes. Sectors with lower ROIC tend to trade on lower multiples. Big risk!

Stronger relationship between sectors than within them

Two things: 1. Kerching!

2. I would hope that anyone taking this job would know better than to quote anything to two decimal places

I would probably even bring this detail up in the interview, but maybe that’s just me…

www.civilservicejobs.service.gov.uk/csr/jobs.cgi...

Two things: 1. Kerching!

2. I would hope that anyone taking this job would know better than to quote anything to two decimal places

I would probably even bring this detail up in the interview, but maybe that’s just me…

Clue: it’s to do with the stock market and has important economic consequences

Big numbers in the billions of dollars, big growth. It’s on track to treble between 2023 and 2026

FYI: it’s not Greggs sausage roll sales

Clue: it’s to do with the stock market and has important economic consequences

Big numbers in the billions of dollars, big growth. It’s on track to treble between 2023 and 2026

FYI: it’s not Greggs sausage roll sales

Adding “destiny” makes it sound way cooler

Adding “destiny” makes it sound way cooler

1️⃣ para from each MPC member in the minutes

2️⃣ clearer explanations/breakdowns of analysis behind decisions

3️⃣ next qtly report adds section on risks/scenarios

➡️ shift from "central projection" driven comms approach of the past

1️⃣ para from each MPC member in the minutes

2️⃣ clearer explanations/breakdowns of analysis behind decisions

3️⃣ next qtly report adds section on risks/scenarios

➡️ shift from "central projection" driven comms approach of the past

Answer is in the RH pane

Answer is in the RH pane

Clue 1: they're consumer-oriented stocks and you've almost certainly been a buyer of both of their products/services many times

Clue 2: you almost certainly have a strong opinion on them

Clue 1: they're consumer-oriented stocks and you've almost certainly been a buyer of both of their products/services many times

Clue 2: you almost certainly have a strong opinion on them

The paper’s title is even better: Option Value of Apex Predators: Evidence from a River Discontinuity

The paper’s title is even better: Option Value of Apex Predators: Evidence from a River Discontinuity