Leverage is lower and interest cover higher

So while they’re clearly leveraging up to pay for AI capex, the starting point is solid

History suggests it could take some time for fundamental vulnerabilities to build

Leverage is lower and interest cover higher

So while they’re clearly leveraging up to pay for AI capex, the starting point is solid

History suggests it could take some time for fundamental vulnerabilities to build

Scotland scored to make it 1-1

Everyone ran into the street screaming, neighbours hugging each other

Can still remember that feeling. Here. We. Go.

Scotland scored to make it 1-1

Everyone ran into the street screaming, neighbours hugging each other

Can still remember that feeling. Here. We. Go.

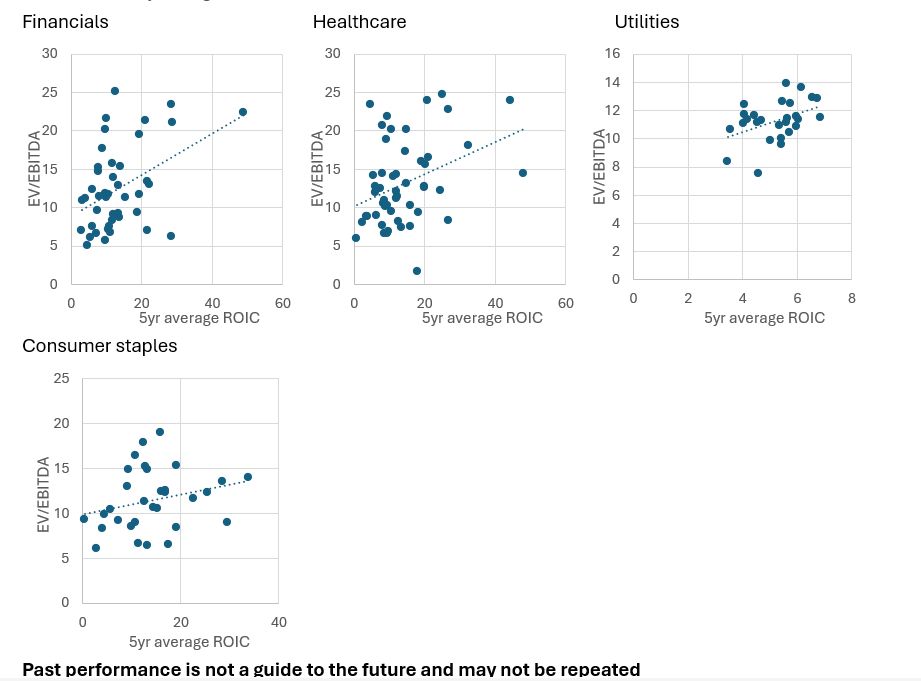

Makes them more capital intensive

❓Is there evidence that higher capital intensity/lower ROIC should result in lower valuation multiples

💡 Yes. Sectors with lower ROIC tend to trade on lower multiples. Big risk!

Stronger relationship between sectors than within them

Makes them more capital intensive

❓Is there evidence that higher capital intensity/lower ROIC should result in lower valuation multiples

💡 Yes. Sectors with lower ROIC tend to trade on lower multiples. Big risk!

Stronger relationship between sectors than within them

Clue: it’s to do with the stock market and has important economic consequences

Big numbers in the billions of dollars, big growth. It’s on track to treble between 2023 and 2026

FYI: it’s not Greggs sausage roll sales

Clue: it’s to do with the stock market and has important economic consequences

Big numbers in the billions of dollars, big growth. It’s on track to treble between 2023 and 2026

FYI: it’s not Greggs sausage roll sales

1️⃣ para from each MPC member in the minutes

2️⃣ clearer explanations/breakdowns of analysis behind decisions

3️⃣ next qtly report adds section on risks/scenarios

➡️ shift from "central projection" driven comms approach of the past

1️⃣ para from each MPC member in the minutes

2️⃣ clearer explanations/breakdowns of analysis behind decisions

3️⃣ next qtly report adds section on risks/scenarios

➡️ shift from "central projection" driven comms approach of the past

Answer is in the RH pane

Answer is in the RH pane

Clue 1: they're consumer-oriented stocks and you've almost certainly been a buyer of both of their products/services many times

Clue 2: you almost certainly have a strong opinion on them

Clue 1: they're consumer-oriented stocks and you've almost certainly been a buyer of both of their products/services many times

Clue 2: you almost certainly have a strong opinion on them

The paper’s title is even better: Option Value of Apex Predators: Evidence from a River Discontinuity

The paper’s title is even better: Option Value of Apex Predators: Evidence from a River Discontinuity

To make it a bit trickier, I've shown it in euro terms

To make it a bit trickier, I've shown it in euro terms

No lycra or a dropped handlebar to be seen, just lots of normal people, wearing clothes for work, cycle-commuting, even though it’s a drizzly day

Love to see it

No lycra or a dropped handlebar to be seen, just lots of normal people, wearing clothes for work, cycle-commuting, even though it’s a drizzly day

Love to see it

It’s my all time favourite and I’d happily read it multiple times

Could maybe re-attempt Bertrand Russell’s history of western philosophy which I gave up on

And an encyclopaedia or the bible. As they’re both long

It’s my all time favourite and I’d happily read it multiple times

Could maybe re-attempt Bertrand Russell’s history of western philosophy which I gave up on

And an encyclopaedia or the bible. As they’re both long

Sorry about the small font but worth something zooming in and reading!

From here:

www.schroders.com/en-gb/uk/int...

Sorry about the small font but worth something zooming in and reading!

From here:

www.schroders.com/en-gb/uk/int...

@robinwigglesworth.ft.com opinions please

@robinwigglesworth.ft.com opinions please

But the market doesn’t seem convinced that the secured bonds merit the same spread as unsecured ones of the same credit rating

Suggests scepticism (caveated with sector/maturity difference making this an imperfect comparison)

But the market doesn’t seem convinced that the secured bonds merit the same spread as unsecured ones of the same credit rating

Suggests scepticism (caveated with sector/maturity difference making this an imperfect comparison)

Why? Issuers rewarded with higher credit rating/lower credit spread/cheaper cost of debt

Investors:

Secured bonds have higher recovery rates on default ✅

But mostly riskier borrowers who do this (needs must) so be wary ❌

Why? Issuers rewarded with higher credit rating/lower credit spread/cheaper cost of debt

Investors:

Secured bonds have higher recovery rates on default ✅

But mostly riskier borrowers who do this (needs must) so be wary ❌

And got a bronze medal (vets) in the east district cross country relays today

Neither was expected, especially after 6 months of on-off injuries. What a week!

And got a bronze medal (vets) in the east district cross country relays today

Neither was expected, especially after 6 months of on-off injuries. What a week!

Clue: it’s hugely important for markets and the economy

Clue: it’s hugely important for markets and the economy