Michael Bauer

@michaeldbauer.bsky.social

Economist at San Francisco Fed. Macro-finance, monetary policy, climate finance. Husband and proud dad of two. From Hamburg (Moin!)

Excellent VSME talk by Jordi Gali, who provided a new perspective on monetary policy rules based on his Keynes Lectures and discussion at Jackson Hole of Emi Nakamura's paper. He makes a compelling case for rules for long-term real rates. Video here:

www.youtube.com/watch?v=UrbH...

www.youtube.com/watch?v=UrbH...

November 11, 2025 at 4:12 PM

Excellent VSME talk by Jordi Gali, who provided a new perspective on monetary policy rules based on his Keynes Lectures and discussion at Jackson Hole of Emi Nakamura's paper. He makes a compelling case for rules for long-term real rates. Video here:

www.youtube.com/watch?v=UrbH...

www.youtube.com/watch?v=UrbH...

We launched the Center for Monetary Research about one year ago. The first year brought a flurry of activities, research, and new data&indicators. Special highlight:

Adrien Auclert receiving the inaugural Janet Yellen Award! My blog post has a review and outlook:

www.frbsf.org/research-and...

Adrien Auclert receiving the inaugural Janet Yellen Award! My blog post has a review and outlook:

www.frbsf.org/research-and...

The Center for Monetary Research: First Year in Review - San Francisco Fed

To mark the first year since the Center for Monetary Research’s launch, the San Francisco Fed reviews the Center’s research activities and events.

www.frbsf.org

November 4, 2025 at 10:13 PM

We launched the Center for Monetary Research about one year ago. The first year brought a flurry of activities, research, and new data&indicators. Special highlight:

Adrien Auclert receiving the inaugural Janet Yellen Award! My blog post has a review and outlook:

www.frbsf.org/research-and...

Adrien Auclert receiving the inaugural Janet Yellen Award! My blog post has a review and outlook:

www.frbsf.org/research-and...

Very excited that our third monthly VSME is coming up this Thursday. We'll hear from Jordi Gali about monetary policy in the New Keynesian model.

Please join us on Zoom at 11am Eastern / 5pm CET! Webinar registration here:

cepr-org.zoom.us/webinar/regi...

Please join us on Zoom at 11am Eastern / 5pm CET! Webinar registration here:

cepr-org.zoom.us/webinar/regi...

Virtual Seminar on Monetary Economics

A monthly series joint with the Center for Monetary Research at the SF Fed

6 Nov 17:00 CET

Join us this week for a seminar with Jordi Galí presenting “Rethinking the New Keynesian Model (I): The Monetary Policy Block”

cepr.org/events/event...

#EconSky #EconConf

A monthly series joint with the Center for Monetary Research at the SF Fed

6 Nov 17:00 CET

Join us this week for a seminar with Jordi Galí presenting “Rethinking the New Keynesian Model (I): The Monetary Policy Block”

cepr.org/events/event...

#EconSky #EconConf

November 4, 2025 at 10:12 PM

Very excited that our third monthly VSME is coming up this Thursday. We'll hear from Jordi Gali about monetary policy in the New Keynesian model.

Please join us on Zoom at 11am Eastern / 5pm CET! Webinar registration here:

cepr-org.zoom.us/webinar/regi...

Please join us on Zoom at 11am Eastern / 5pm CET! Webinar registration here:

cepr-org.zoom.us/webinar/regi...

We hope you had a nice summer, the Virtual Seminar on Monetary Economics is now in session! Please join us this Thursday at 8am PT / 11am ET for our first seminar! Zoom webinar registration here: cepr-org.zoom.us/webinar/regi...

The Virtual Seminars on Monetary Economics, hosted by CEPR & the San Francisco Fed start this week!

Session 1: 4 Sept 17:00 CEST

@ivanwerning.bsky.social @mit.edu

Topic: Tariffs as Cost-Push Shocks: Implications for Optimal #MonetaryPolicy

Sign up: cepr.org/events/event...

#EconSky #EconConf

Session 1: 4 Sept 17:00 CEST

@ivanwerning.bsky.social @mit.edu

Topic: Tariffs as Cost-Push Shocks: Implications for Optimal #MonetaryPolicy

Sign up: cepr.org/events/event...

#EconSky #EconConf

September 2, 2025 at 8:52 PM

We hope you had a nice summer, the Virtual Seminar on Monetary Economics is now in session! Please join us this Thursday at 8am PT / 11am ET for our first seminar! Zoom webinar registration here: cepr-org.zoom.us/webinar/regi...

🧵It was a great pleasure to work with excellent colleagues across the @federalreserve.gov on a paper for the FOMC framework review. Thanks to my coauthors Travis Berge, Giuseppe Fiori, Francesca Loria, Molin Zhong. You can find the paper here:

www.federalreserve.gov/econres/feds... 1/3

www.federalreserve.gov/econres/feds... 1/3

Accounting for Uncertainty and Risks in Monetary Policy

The Federal Reserve Board of Governors in Washington DC.

www.federalreserve.gov

August 26, 2025 at 8:05 PM

🧵It was a great pleasure to work with excellent colleagues across the @federalreserve.gov on a paper for the FOMC framework review. Thanks to my coauthors Travis Berge, Giuseppe Fiori, Francesca Loria, Molin Zhong. You can find the paper here:

www.federalreserve.gov/econres/feds... 1/3

www.federalreserve.gov/econres/feds... 1/3

Interested in top-notch research in monetary economics? Join us for this new online seminar series, co-hosted CEPR's Monetary Economics and Fluctuations program and our Center for Monetary Research! @ivanwerning.bsky.social will kick things off on Sep-4.

Sign up: cepr-org.zoom.us/webinar/regi...

Sign up: cepr-org.zoom.us/webinar/regi...

New Virtual Seminar series on #MonetaryEconomics begins September 2025, joint with the Center for Monetary Research of the Federal Reserve Bank of San Francisco.

Monthly sessions explore central bank frameworks, policy design, and international dimensions.

More: cepr.org/events/event...

#EconSky

Monthly sessions explore central bank frameworks, policy design, and international dimensions.

More: cepr.org/events/event...

#EconSky

July 31, 2025 at 3:11 PM

Interested in top-notch research in monetary economics? Join us for this new online seminar series, co-hosted CEPR's Monetary Economics and Fluctuations program and our Center for Monetary Research! @ivanwerning.bsky.social will kick things off on Sep-4.

Sign up: cepr-org.zoom.us/webinar/regi...

Sign up: cepr-org.zoom.us/webinar/regi...

🚨Friendly reminder that Saturday, May 31 is the deadline to submit (a) papers to our fall macro-finance conference and (b) nominations for the new Janet Yellen Award for Monetary Research, both initiatives of our new Center for Monetary Research. Details are here: www.frbsf.org/news-and-med...

Call for Papers: 2nd Annual Conference on Macro-Finance Research - San Francisco Fed

Submissions due by May 31, 2025, for the 2nd Annual Conference on Macro-Finance Research, to be held in San Francisco on October 10, 2025.

www.frbsf.org

May 27, 2025 at 11:12 PM

🚨Friendly reminder that Saturday, May 31 is the deadline to submit (a) papers to our fall macro-finance conference and (b) nominations for the new Janet Yellen Award for Monetary Research, both initiatives of our new Center for Monetary Research. Details are here: www.frbsf.org/news-and-med...

🚀Stay ahead of the curve! If you're interested in events, new papers, and data updates of our Center for Monetary Research, you can sign up for the quarterly newsletter here: frbsf.org/subscription...

#MonetaryPolicy #MacroFinance #CentralBanking #EconSky

#MonetaryPolicy #MacroFinance #CentralBanking #EconSky

Subscriptions - San Francisco Fed

Subscribe to our mailing lists to learn more about what’s happening in the Twelfth District. Receive the latest news, information, research, and insights on

https://frbsf.org/subscriptions/#mce-group[5401]-5401-6

May 19, 2025 at 7:01 PM

🚀Stay ahead of the curve! If you're interested in events, new papers, and data updates of our Center for Monetary Research, you can sign up for the quarterly newsletter here: frbsf.org/subscription...

#MonetaryPolicy #MacroFinance #CentralBanking #EconSky

#MonetaryPolicy #MacroFinance #CentralBanking #EconSky

Excellent papers at the Second Thomas Laubach Conference of the @federalreserve.bsky.social Follow Ben Bernanke's presentation on Central Bank Communication live now, or watch the recording later. Great stuff!

www.federalreserve.gov/conferences/...

www.federalreserve.gov/conferences/...

Second Thomas Laubach Research Conference

economic Conference - The Federal Reserve Board of Governors in Washington DC.

www.federalreserve.gov

May 16, 2025 at 1:51 PM

Excellent papers at the Second Thomas Laubach Conference of the @federalreserve.bsky.social Follow Ben Bernanke's presentation on Central Bank Communication live now, or watch the recording later. Great stuff!

www.federalreserve.gov/conferences/...

www.federalreserve.gov/conferences/...

📢Call for Nominations📢

The SF Fed and its Center for Monetary Research are launching the new Janet Yellen Award!

This award will be given annually to an exceptional early-career researcher who has made significant and policy-relevant contributions to macro-finance and/or monetary economics.

The SF Fed and its Center for Monetary Research are launching the new Janet Yellen Award!

This award will be given annually to an exceptional early-career researcher who has made significant and policy-relevant contributions to macro-finance and/or monetary economics.

May 13, 2025 at 8:50 PM

📢Call for Nominations📢

The SF Fed and its Center for Monetary Research are launching the new Janet Yellen Award!

This award will be given annually to an exceptional early-career researcher who has made significant and policy-relevant contributions to macro-finance and/or monetary economics.

The SF Fed and its Center for Monetary Research are launching the new Janet Yellen Award!

This award will be given annually to an exceptional early-career researcher who has made significant and policy-relevant contributions to macro-finance and/or monetary economics.

The SF Fed's Center for Monetary Research is hosting our 2nd Annual Macro-Finance Conference this fall. If you have a recent paper on the linkages between financial markets, monetary policy, and the macroeconomy, please submit by May 31!

www.frbsf.org/news-and-med...

www.frbsf.org/news-and-med...

Call for Papers: 2nd Annual Conference on Macro-Finance Research - San Francisco Fed

Submissions due by May 31, 2025, for the 2nd Annual Conference on Macro-Finance Research, to be held in San Francisco on October 10, 2025.

www.frbsf.org

May 7, 2025 at 5:20 AM

The SF Fed's Center for Monetary Research is hosting our 2nd Annual Macro-Finance Conference this fall. If you have a recent paper on the linkages between financial markets, monetary policy, and the macroeconomy, please submit by May 31!

www.frbsf.org/news-and-med...

www.frbsf.org/news-and-med...

Our Center for Monetary Research is cosponsoring a session at the 2025 CEBRA meeting. Do you have a recent working paper on international macro-finance/monetary issues? Then please submit to Session 14 of this CfP! Deadline is March 20. We look forward to your submissions! #CEBRA2025 #CFP #EconSky

#CallForPapers for the #CEBRA2025 Annual Meeting

They invite high-quality research papers on central #banking, #monetarypolicy, financial stability and related topics.

Hosted by: Boston Fed and the HBS Pricing Lab D^3

Deadline: 20 March

More info: cebra-events.org/call-for-pap...

#EconSky

They invite high-quality research papers on central #banking, #monetarypolicy, financial stability and related topics.

Hosted by: Boston Fed and the HBS Pricing Lab D^3

Deadline: 20 March

More info: cebra-events.org/call-for-pap...

#EconSky

March 14, 2025 at 3:58 PM

Our Center for Monetary Research is cosponsoring a session at the 2025 CEBRA meeting. Do you have a recent working paper on international macro-finance/monetary issues? Then please submit to Session 14 of this CfP! Deadline is March 20. We look forward to your submissions! #CEBRA2025 #CFP #EconSky

Kristin Forbes distills lessons for monetary policy from her research and the recent experience of central banks, using Sun Tzu's eternal classic "The Art of War" as a framework. Ingenious! (And particularly close to my own martial artist heart.)

cepr.org/publications...

cepr.org/publications...

DP19905 The Art of Monetary Policy: Lessons from Sun Tzu for Central Banks

The 2008 Global Financial Crisis and 2020 COVID-19 pandemic forced central banks to innovate and develop a multifaceted set of new weapons that have substantially expanded their authority and reach. This lecture draws lessons for monetary policy from the last two, tumultuous decades by applying the principles of Sun Tzu, a Chinese philosopher and military strategist from the 6th century BC. Tzu proposed several key principles for success—tenets that also apply to monetary policy today: (1) planning in advance for the next battle; (2) accepting and adapting to the inevitability of powerful, external shocks; (3) establishing a strong tactical position; (4) developing a variety of weapons that can be combined for different situations and maneuvers; (5) maintaining flexibility so that you can quickly modify your strategy; and (6) considering the longer-term costs when evaluating the tradeoffs of different approaches. While the optimal strategy in both war and monetary policy is more of an “art” than a science, these principles provide insights on how central banks should deploy interest rates, balance sheets, emergency support programs, forward guidance, and macroprudential tools when battling the next crisis—as well as to build more resilient economies during more peaceful periods.

cepr.org

February 3, 2025 at 2:46 PM

Kristin Forbes distills lessons for monetary policy from her research and the recent experience of central banks, using Sun Tzu's eternal classic "The Art of War" as a framework. Ingenious! (And particularly close to my own martial artist heart.)

cepr.org/publications...

cepr.org/publications...

Submission deadline for our fixed income conference is this Friday, January 31. Our keynote speaker will be Annette Vissing-Jorgensen. If you have a new paper in this area, please consider submitting it!

🚨Call for Papers🚨

Together with the Bank of Canada and the Chicago Fed, we're organizing a Conference on #FixedIncome Research and Implications for #MonetaryPolicy on May 22-23, 2025, in San Francisco. Submissions due by January 31. More details: www.frbsf.org/news-and-med...

#EconSky

Together with the Bank of Canada and the Chicago Fed, we're organizing a Conference on #FixedIncome Research and Implications for #MonetaryPolicy on May 22-23, 2025, in San Francisco. Submissions due by January 31. More details: www.frbsf.org/news-and-med...

#EconSky

Call for Papers: Fixed Income Research and Implications for Monetary Policy - San Francisco Fed

Submissions due by January 31, 2025 for the Fixed Income Research and Implications for Monetary Policy Conference

www.frbsf.org

January 27, 2025 at 9:06 PM

Submission deadline for our fixed income conference is this Friday, January 31. Our keynote speaker will be Annette Vissing-Jorgensen. If you have a new paper in this area, please consider submitting it!

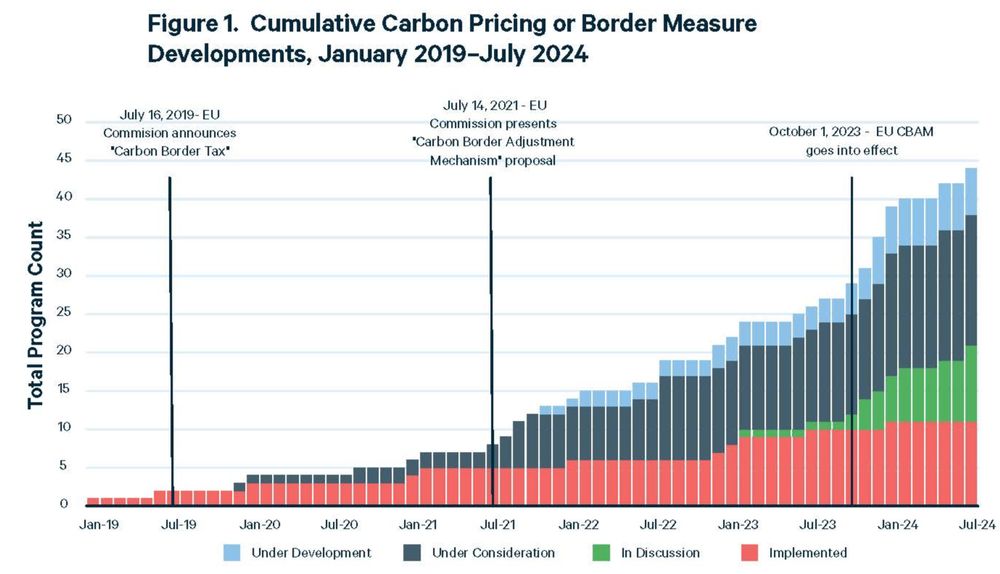

Thank you @cwolfram.bsky.social for a fantastic presentation on CBAM in today's Virtual Seminar on Climate Economics. The slides and recording are here: www.frbsf.org/news-and-med...

Also worth checking out this @rff.org policy brief: www.rff.org/publications...

Also worth checking out this @rff.org policy brief: www.rff.org/publications...

January 16, 2025 at 10:06 PM

Thank you @cwolfram.bsky.social for a fantastic presentation on CBAM in today's Virtual Seminar on Climate Economics. The slides and recording are here: www.frbsf.org/news-and-med...

Also worth checking out this @rff.org policy brief: www.rff.org/publications...

Also worth checking out this @rff.org policy brief: www.rff.org/publications...

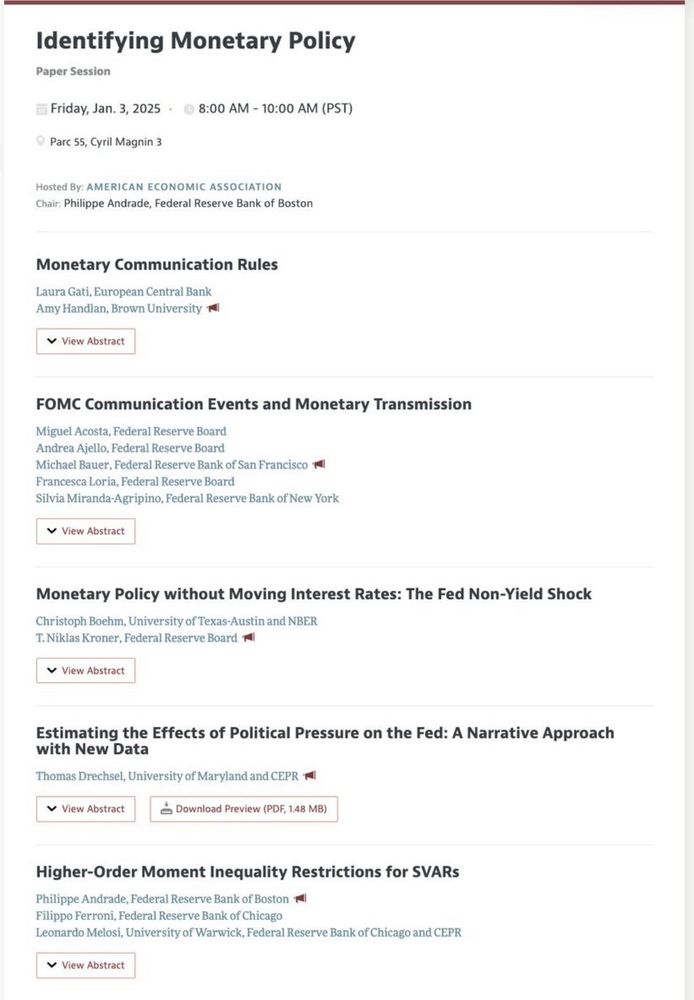

Reposted by Michael Bauer

At the AEA meetings in San Francisco?

Check out this nice session on Friday morning: "Identifying Monetary Policy"

With presentations by Amy Handlan @michaeldbauer.bsky.social @kronerniklas.bsky.social myself and Philippe Andrade

Thank you Philippe for organizing! #ASSA2025

Check out this nice session on Friday morning: "Identifying Monetary Policy"

With presentations by Amy Handlan @michaeldbauer.bsky.social @kronerniklas.bsky.social myself and Philippe Andrade

Thank you Philippe for organizing! #ASSA2025

January 2, 2025 at 2:48 PM

At the AEA meetings in San Francisco?

Check out this nice session on Friday morning: "Identifying Monetary Policy"

With presentations by Amy Handlan @michaeldbauer.bsky.social @kronerniklas.bsky.social myself and Philippe Andrade

Thank you Philippe for organizing! #ASSA2025

Check out this nice session on Friday morning: "Identifying Monetary Policy"

With presentations by Amy Handlan @michaeldbauer.bsky.social @kronerniklas.bsky.social myself and Philippe Andrade

Thank you Philippe for organizing! #ASSA2025

The Virtual Seminar on Climate Economics is finishing the year strong, with a talk by Philippe Agion from INSEAD on "Transition to Green Technology along the Supply Chain". Join us Thursday at 11am ET on Zoom!

www.frbsf.org/news-and-med...

www.frbsf.org/news-and-med...

Philippe Aghion, INSEAD Transition to Green Technology along the Supply Chain - San Francisco Fed

<p> </p>

www.frbsf.org

December 18, 2024 at 5:31 PM

The Virtual Seminar on Climate Economics is finishing the year strong, with a talk by Philippe Agion from INSEAD on "Transition to Green Technology along the Supply Chain". Join us Thursday at 11am ET on Zoom!

www.frbsf.org/news-and-med...

www.frbsf.org/news-and-med...

On Thursday @glennrudebusch.bsky.social will present our new paper "Green stocks and monetary shocks: Evidence from Europe" in the Virtual Seminar on Climate Economics. Join us on Zoom at 11a ET!

All details on the virtual seminar here: www.frbsf.org/news-and-med...

All details on the virtual seminar here: www.frbsf.org/news-and-med...

December 3, 2024 at 9:21 PM

On Thursday @glennrudebusch.bsky.social will present our new paper "Green stocks and monetary shocks: Evidence from Europe" in the Virtual Seminar on Climate Economics. Join us on Zoom at 11a ET!

All details on the virtual seminar here: www.frbsf.org/news-and-med...

All details on the virtual seminar here: www.frbsf.org/news-and-med...

Got my shirt, very excited! Come run with us in SF during the AEA meetings!

2025 ECON5k starts December 1! Details are here sites.google.com/view/econ5k, including how to get a t-shirt and how to upload your results.

Please also feel free to post your results on BlueSky with the hashtag #ECON5k!

Please also feel free to post your results on BlueSky with the hashtag #ECON5k!

Home

Economists running

@econ5k.bsky.social

[email protected]

sites.google.com

December 1, 2024 at 6:52 AM

Got my shirt, very excited! Come run with us in SF during the AEA meetings!

Reposted by Michael Bauer

This looks like a super important paper. Need to dig into it, but from first read, it provides a conceptual justification for departing from rational expectations (besides the empirical evidence that the assumption doesn’t hold).

November 29, 2024 at 6:54 PM

This looks like a super important paper. Need to dig into it, but from first read, it provides a conceptual justification for departing from rational expectations (besides the empirical evidence that the assumption doesn’t hold).

🎈New Working Paper🎈with @ericoffner.bsky.social and @glennrudebusch.bsky.social

Do higher interest rates hurt the green transition? Not so obvious! Evidence from equity markets in US and EU actually shows stronger effects of monetary policy on high-carbon, brown firms.

#EconSky #Climate

Do higher interest rates hurt the green transition? Not so obvious! Evidence from equity markets in US and EU actually shows stronger effects of monetary policy on high-carbon, brown firms.

#EconSky #Climate

Green stocks and monetary policy shocks: Evidence from Europe. New from Michael Bauer, Eric Offner & Glenn Rudebusch. www.brookings.edu/articles/gre... Hutchins Center The Brookings Institution #EconSky

https://brookings.edu/artic…

November 27, 2024 at 9:12 PM

🎈New Working Paper🎈with @ericoffner.bsky.social and @glennrudebusch.bsky.social

Do higher interest rates hurt the green transition? Not so obvious! Evidence from equity markets in US and EU actually shows stronger effects of monetary policy on high-carbon, brown firms.

#EconSky #Climate

Do higher interest rates hurt the green transition? Not so obvious! Evidence from equity markets in US and EU actually shows stronger effects of monetary policy on high-carbon, brown firms.

#EconSky #Climate

"If we don't feel stupid it means we are not really trying"

Very encouraging quote from this inspiring article. The other two are also excellent!

I'll add this piece of advice, which a friendly ultramarathoner once gave me:

"Enjoy the highs, manage the lows!"

#econsky

Very encouraging quote from this inspiring article. The other two are also excellent!

I'll add this piece of advice, which a friendly ultramarathoner once gave me:

"Enjoy the highs, manage the lows!"

#econsky

Three must read papers for PhD students. #scisky #PhD #science #research #academicsky

1. The importance of stupidity in scientific research

Open Access

journals.biologists.com/jcs/article/...

1. The importance of stupidity in scientific research

Open Access

journals.biologists.com/jcs/article/...

November 26, 2024 at 2:04 AM

"If we don't feel stupid it means we are not really trying"

Very encouraging quote from this inspiring article. The other two are also excellent!

I'll add this piece of advice, which a friendly ultramarathoner once gave me:

"Enjoy the highs, manage the lows!"

#econsky

Very encouraging quote from this inspiring article. The other two are also excellent!

I'll add this piece of advice, which a friendly ultramarathoner once gave me:

"Enjoy the highs, manage the lows!"

#econsky

Welcome to Bluesky

@glennrudebusch.bsky.social

Most of you in monetary economics and macro-finance will know Glenn's research. In recent years he has contributed significantly to climate economics and climate finance. If you're interested in any of this, be sure to follow Glenn here!

@glennrudebusch.bsky.social

Most of you in monetary economics and macro-finance will know Glenn's research. In recent years he has contributed significantly to climate economics and climate finance. If you're interested in any of this, be sure to follow Glenn here!

November 26, 2024 at 1:23 AM

Welcome to Bluesky

@glennrudebusch.bsky.social

Most of you in monetary economics and macro-finance will know Glenn's research. In recent years he has contributed significantly to climate economics and climate finance. If you're interested in any of this, be sure to follow Glenn here!

@glennrudebusch.bsky.social

Most of you in monetary economics and macro-finance will know Glenn's research. In recent years he has contributed significantly to climate economics and climate finance. If you're interested in any of this, be sure to follow Glenn here!

Great article. Too bad I missed the Alf thing on here, he used to be my hero growing up! His jokes were so great, even dubbed in German 🤣

I wrote about this app! It’s good! (But you know that, you’re here)

www.nytimes.com/2024/11/22/t...

www.nytimes.com/2024/11/22/t...

Bluesky Is Turning Into a Strong X Alternative

Bluesky has a hint of the old Twitter magic, but the feeling of freedom it offers might be even better.

www.nytimes.com

November 23, 2024 at 4:46 AM

Great article. Too bad I missed the Alf thing on here, he used to be my hero growing up! His jokes were so great, even dubbed in German 🤣

Reposted by Michael Bauer

People adding me through a starter pack

November 11, 2024 at 8:50 PM

People adding me through a starter pack