Federal continuing claims continue to rise rapidly.

Soon we'll find out how much is the shutdown (temporary), how much is RIFs (permanent).

Federal continuing claims continue to rise rapidly.

Soon we'll find out how much is the shutdown (temporary), how much is RIFs (permanent).

Next week's IC data will be the last to include part of the shutdown period.

Next week's IC data will be the last to include part of the shutdown period.

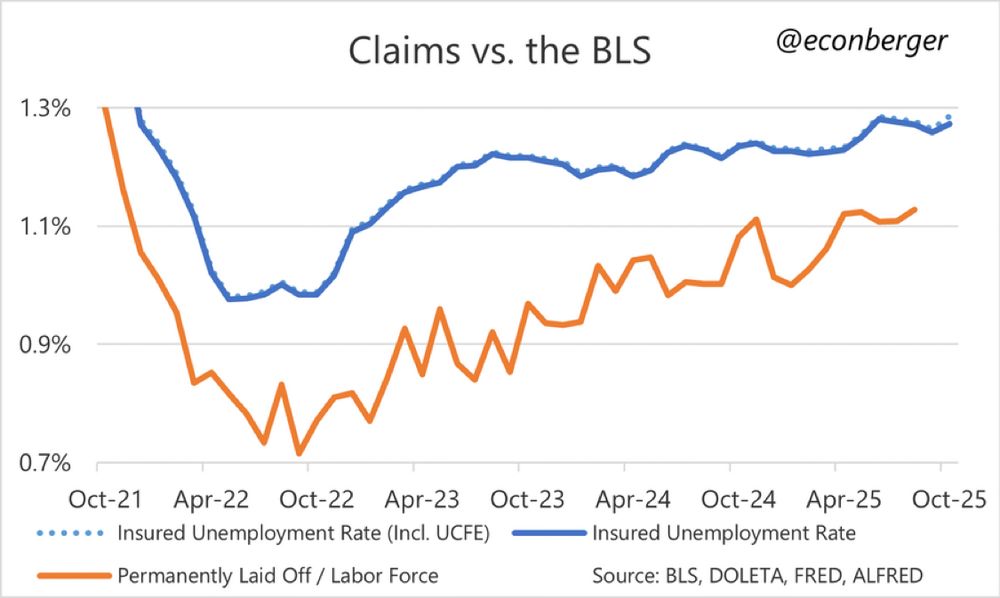

1/ Regular initial claims were "well-behaved" again in the week ended 11/08, no sign of a layoff surge, just modestly above year-ago levels (and nearly identical to 2 years ago)

1/ Regular initial claims were "well-behaved" again in the week ended 11/08, no sign of a layoff surge, just modestly above year-ago levels (and nearly identical to 2 years ago)

(or maybe, which groups like to fill out online quizzes and which do not)

(or maybe, which groups like to fill out online quizzes and which do not)

macromostly.substack.com/p/when-the-b...

macromostly.substack.com/p/when-the-b...

Through early November, maybe *very early* signs of labor market deterioration.

Through early November, maybe *very early* signs of labor market deterioration.

My take - it’s interesting! I am curious to see how it performs out of sample.

My take - it’s interesting! I am curious to see how it performs out of sample.

But assuming the shutdown ends this week, there's precedent for starting data collection late - e.g. 2013.

But assuming the shutdown ends this week, there's precedent for starting data collection late - e.g. 2013.

Link: macromostly.substack.com/p/high-frequ...

Link: macromostly.substack.com/p/high-frequ...

We're really feeling the absence of JOLTS and CPS-based quasi-JOLTS, so this kind of thing is essential.

We're really feeling the absence of JOLTS and CPS-based quasi-JOLTS, so this kind of thing is essential.

I am guessing this has to do with idiosyncrasies in the LI data they are using to calculate employment growth.

I am guessing this has to do with idiosyncrasies in the LI data they are using to calculate employment growth.

But we're starting to cross some potentially more serious and economically destructive milestones...

But we're starting to cross some potentially more serious and economically destructive milestones...

Federal worker continuing claims still rising rapidly (and will continue to do so a while longer). Small in absolute terms - 1.5% of regular continuing claims.

Federal worker continuing claims still rising rapidly (and will continue to do so a while longer). Small in absolute terms - 1.5% of regular continuing claims.