Ben Casselman

@bencasselman.bsky.social

Chief Economics Correspondent for The New York Times. Adjunct at CUNY Newmark. Ex: FiveThirtyEight, WSJ. He/him.

Email: [email protected]

Signal: @bencasselman.96

📸: Earl Wilson/NYT

Email: [email protected]

Signal: @bencasselman.96

📸: Earl Wilson/NYT

Reposted by Ben Casselman

Forgot until just now that this is one of those years when the CPS reference week for November comes early. Is this week. www.bls.gov/cps/definiti...

Concepts and Definitions (CPS)

Concepts and Definitions (CPS)

www.bls.gov

November 7, 2025 at 6:22 PM

Forgot until just now that this is one of those years when the CPS reference week for November comes early. Is this week. www.bls.gov/cps/definiti...

I'm honored to be delivering the annual Ellen C. Gstalder Memorial Lecture at Georgetown next week. I'm talking about what A.I. will mean for the job market. And since the real answer is "I have no idea," I'll be looking at it through a historical lens.

Details: events.georgetown.edu/event/35638-...

Details: events.georgetown.edu/event/35638-...

November 7, 2025 at 2:42 PM

I'm honored to be delivering the annual Ellen C. Gstalder Memorial Lecture at Georgetown next week. I'm talking about what A.I. will mean for the job market. And since the real answer is "I have no idea," I'll be looking at it through a historical lens.

Details: events.georgetown.edu/event/35638-...

Details: events.georgetown.edu/event/35638-...

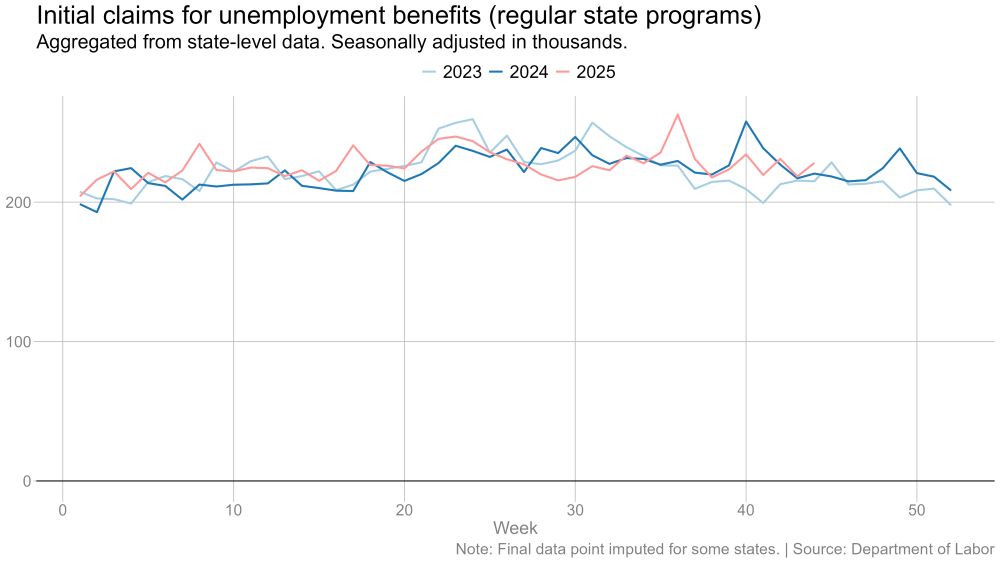

We did get *some* data today: Jobless claims increased slightly in the final week of October. But the four-week average actually fell. Still no sign of a surge in layoffs in these numbers. #NumbersDay

November 7, 2025 at 2:36 PM

We did get *some* data today: Jobless claims increased slightly in the final week of October. But the four-week average actually fell. Still no sign of a surge in layoffs in these numbers. #NumbersDay

It's #jobsday! Except it isn't, because of the government shutdown. Which means that we're left sifting through alternative data sources to try to figure out what's going on in the labor market.

So, what are those sources telling us? A 🧵:

So, what are those sources telling us? A 🧵:

November 7, 2025 at 1:34 PM

It's #jobsday! Except it isn't, because of the government shutdown. Which means that we're left sifting through alternative data sources to try to figure out what's going on in the labor market.

So, what are those sources telling us? A 🧵:

So, what are those sources telling us? A 🧵:

AP calls it for Mamdani.

November 5, 2025 at 2:36 AM

AP calls it for Mamdani.

Reposted by Ben Casselman

We should be cautious in interpreting claims filings right now, several hundred thousand people have been fired from the federal govt but most will be ineligible for UI because layoffs were either structured as voluntary deferred resignations (Fork in the Road) or for cause (provisional workers)

We now have unemployment claims data for all 50 states for the week ending 10/25. Still no sign of a big uptick in initial claims. (Note that these charts do NOT include federal workers -- see down thread for those.) #NumbersDay #EconSky

November 3, 2025 at 6:59 PM

We should be cautious in interpreting claims filings right now, several hundred thousand people have been fired from the federal govt but most will be ineligible for UI because layoffs were either structured as voluntary deferred resignations (Fork in the Road) or for cause (provisional workers)

We now have unemployment claims data for all 50 states for the week ending 10/25. Still no sign of a big uptick in initial claims. (Note that these charts do NOT include federal workers -- see down thread for those.) #NumbersDay #EconSky

November 3, 2025 at 5:22 PM

We now have unemployment claims data for all 50 states for the week ending 10/25. Still no sign of a big uptick in initial claims. (Note that these charts do NOT include federal workers -- see down thread for those.) #NumbersDay #EconSky

Highly recommend @colbylsmith.bsky.social's interview with Steven Miran. She really pushes him to explain his thinking on interest rates, immigration, and other topics. (Whether you find his explanations credible is up to you.) #EconSky

www.nytimes.com/2025/11/01/u...

www.nytimes.com/2025/11/01/u...

Fed Governor Defends Call for Big Rate Cuts

www.nytimes.com

November 3, 2025 at 2:04 PM

Highly recommend @colbylsmith.bsky.social's interview with Steven Miran. She really pushes him to explain his thinking on interest rates, immigration, and other topics. (Whether you find his explanations credible is up to you.) #EconSky

www.nytimes.com/2025/11/01/u...

www.nytimes.com/2025/11/01/u...

Shohei and Vladdy both up in the 11th.

November 2, 2025 at 4:02 AM

Shohei and Vladdy both up in the 11th.

Let’s play another nine, shall we?

November 2, 2025 at 3:39 AM

Let’s play another nine, shall we?

Well, can’t say this isn’t dramatic.

November 2, 2025 at 3:31 AM

Well, can’t say this isn’t dramatic.

Long line to vote in Crown Heights, Brooklyn at noon on Saturday, for whatever prognostication value that carries (probably not much).

November 1, 2025 at 4:34 PM

Long line to vote in Crown Heights, Brooklyn at noon on Saturday, for whatever prognostication value that carries (probably not much).

Reposted by Ben Casselman

Since we are having another round of high profile layoff discourse this week (with ‘blame AI’ to spice things up):

1/ High profile mass layoffs have been the “kid who cried wolf” for the last few years.

Maybe this is changing but we don’t see it, yet, in the data.

1/ High profile mass layoffs have been the “kid who cried wolf” for the last few years.

Maybe this is changing but we don’t see it, yet, in the data.

October 30, 2025 at 3:51 AM

Since we are having another round of high profile layoff discourse this week (with ‘blame AI’ to spice things up):

1/ High profile mass layoffs have been the “kid who cried wolf” for the last few years.

Maybe this is changing but we don’t see it, yet, in the data.

1/ High profile mass layoffs have been the “kid who cried wolf” for the last few years.

Maybe this is changing but we don’t see it, yet, in the data.

Powell says there were “strongly differing views about how to proceed in December" and that another cut is "not a foregone conclusion."

The Federal Reserve cut interest rates by a quarter percentage point for a second straight meeting, as widely expected.

Statement: www.federalreserve.gov/newsevents/p...

Full coverage: www.nytimes.com/live/2025/10...

Statement: www.federalreserve.gov/newsevents/p...

Full coverage: www.nytimes.com/live/2025/10...

Live Updates: Fed to Set Rates With Shutdown Obscuring View of the Economy

www.nytimes.com

October 29, 2025 at 6:38 PM

Powell says there were “strongly differing views about how to proceed in December" and that another cut is "not a foregone conclusion."

The Federal Reserve cut interest rates by a quarter percentage point for a second straight meeting, as widely expected.

Statement: www.federalreserve.gov/newsevents/p...

Full coverage: www.nytimes.com/live/2025/10...

Statement: www.federalreserve.gov/newsevents/p...

Full coverage: www.nytimes.com/live/2025/10...

Live Updates: Fed to Set Rates With Shutdown Obscuring View of the Economy

www.nytimes.com

October 29, 2025 at 6:00 PM

The Federal Reserve cut interest rates by a quarter percentage point for a second straight meeting, as widely expected.

Statement: www.federalreserve.gov/newsevents/p...

Full coverage: www.nytimes.com/live/2025/10...

Statement: www.federalreserve.gov/newsevents/p...

Full coverage: www.nytimes.com/live/2025/10...

The Treasury has collected $31 billion in tariff revenue so far in October, and looks on track to set another monthly record.

Most analyses show that most of that money is being paid by American companies and consumers. #NumbersDay #EconSky

Most analyses show that most of that money is being paid by American companies and consumers. #NumbersDay #EconSky

October 24, 2025 at 8:14 PM

The Treasury has collected $31 billion in tariff revenue so far in October, and looks on track to set another monthly record.

Most analyses show that most of that money is being paid by American companies and consumers. #NumbersDay #EconSky

Most analyses show that most of that money is being paid by American companies and consumers. #NumbersDay #EconSky

CPI data collection issues continued in September. A record 40% of missing data was subject to "different cell" imputation, meaning the data comes from a different region.

Please see follow up tweets for some clarification of what this does and doesn't mean. #NumbersDay

Please see follow up tweets for some clarification of what this does and doesn't mean. #NumbersDay

October 24, 2025 at 3:24 PM

CPI data collection issues continued in September. A record 40% of missing data was subject to "different cell" imputation, meaning the data comes from a different region.

Please see follow up tweets for some clarification of what this does and doesn't mean. #NumbersDay

Please see follow up tweets for some clarification of what this does and doesn't mean. #NumbersDay

Enjoy this inflation report. It could be the last one we get for a while. www.nytimes.com/2025/10/24/b... #NumbersDay #EconSky

Shutdown Could Cancel Next Inflation Report

www.nytimes.com

October 24, 2025 at 1:36 PM

Enjoy this inflation report. It could be the last one we get for a while. www.nytimes.com/2025/10/24/b... #NumbersDay #EconSky

U.S. consumer prices rose 0.3 percent in October and were up 3.0 percent from a year earlier. "Core" prices, excluding food and energy, were up 0.2 percent month-over-month and 3.0 percent year-over-year.

Data: www.bls.gov/news.release...

Full coverage: www.nytimes.com/live/2025/10... #NumbersDay

Data: www.bls.gov/news.release...

Full coverage: www.nytimes.com/live/2025/10... #NumbersDay

Consumer Price Index Summary

- 2025 M09 Results

www.bls.gov

October 24, 2025 at 12:31 PM

U.S. consumer prices rose 0.3 percent in October and were up 3.0 percent from a year earlier. "Core" prices, excluding food and energy, were up 0.2 percent month-over-month and 3.0 percent year-over-year.

Data: www.bls.gov/news.release...

Full coverage: www.nytimes.com/live/2025/10... #NumbersDay

Data: www.bls.gov/news.release...

Full coverage: www.nytimes.com/live/2025/10... #NumbersDay

Reposted by Ben Casselman

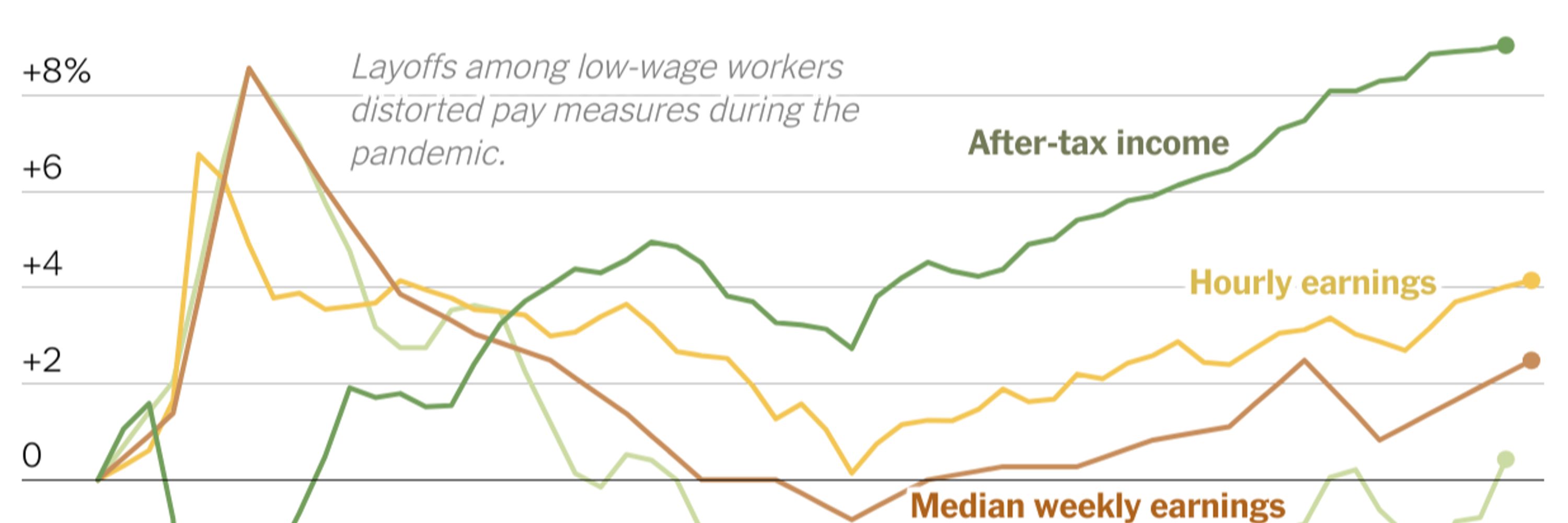

Thanks to @bencasselman.bsky.social and @colbylsmith.bsky.social for featuring my comments. Here's a chart showing that spending on everyday household items tends to be more equal across income quintiles but has been growing more unequal over the past few years.

www.nytimes.com/2025/10/19/b...

www.nytimes.com/2025/10/19/b...

October 20, 2025 at 9:18 PM

Thanks to @bencasselman.bsky.social and @colbylsmith.bsky.social for featuring my comments. Here's a chart showing that spending on everyday household items tends to be more equal across income quintiles but has been growing more unequal over the past few years.

www.nytimes.com/2025/10/19/b...

www.nytimes.com/2025/10/19/b...

Reposted by Ben Casselman

New w/ @bencasselman.bsky.social: Wealthy Americans, buoyed by a booming stock market, are spending freely. Lower-income households, stung by inflation and a slowing labor market, are pulling back

www.nytimes.com/2025/10/19/b... @nytimes.com

www.nytimes.com/2025/10/19/b... @nytimes.com

October 20, 2025 at 2:50 PM

New w/ @bencasselman.bsky.social: Wealthy Americans, buoyed by a booming stock market, are spending freely. Lower-income households, stung by inflation and a slowing labor market, are pulling back

www.nytimes.com/2025/10/19/b... @nytimes.com

www.nytimes.com/2025/10/19/b... @nytimes.com

Reposted by Ben Casselman

NEW from me: California keeps losing tech jobs

Amidst the AI boom, the US is in the largest sustained drawdown in tech employment since the dot-com bust

And what tech jobs remain continue to leave California for the rest of the US 🧵

www.apricitas.io/p/california...

Amidst the AI boom, the US is in the largest sustained drawdown in tech employment since the dot-com bust

And what tech jobs remain continue to leave California for the rest of the US 🧵

www.apricitas.io/p/california...

California Keeps Losing Tech Jobs

Amidst the AI Boom, Employment in Silicon Valley is Shrinking

www.apricitas.io

October 19, 2025 at 5:31 PM

NEW from me: California keeps losing tech jobs

Amidst the AI boom, the US is in the largest sustained drawdown in tech employment since the dot-com bust

And what tech jobs remain continue to leave California for the rest of the US 🧵

www.apricitas.io/p/california...

Amidst the AI boom, the US is in the largest sustained drawdown in tech employment since the dot-com bust

And what tech jobs remain continue to leave California for the rest of the US 🧵

www.apricitas.io/p/california...

Aggregate measures say the economy is doing pretty well right now. But that obscures a growing divide: Wealthy Americans, buoyed by stock market gains, are spending. Low-and middle-income Americans are struggling amid inflation and a weakening labor market. #EconSky

www.nytimes.com/2025/10/19/b...

www.nytimes.com/2025/10/19/b...

Wealthy Americans Are Spending. People With Less Are Struggling.

www.nytimes.com

October 19, 2025 at 2:19 PM

Aggregate measures say the economy is doing pretty well right now. But that obscures a growing divide: Wealthy Americans, buoyed by stock market gains, are spending. Low-and middle-income Americans are struggling amid inflation and a weakening labor market. #EconSky

www.nytimes.com/2025/10/19/b...

www.nytimes.com/2025/10/19/b...

Reposted by Ben Casselman

Nominal wage growth for the bottom quartile is below late 2010’s levels while core inflation and interest rates are higher — it’s probably the worst time for that cohort since at least the early 2010’s:

October 19, 2025 at 12:40 PM

Nominal wage growth for the bottom quartile is below late 2010’s levels while core inflation and interest rates are higher — it’s probably the worst time for that cohort since at least the early 2010’s:

Officially now old enough that Spotify now just lumps my music in with everything else deemed generically “I dunno, a long-ass time ago.”

October 18, 2025 at 11:58 PM

Officially now old enough that Spotify now just lumps my music in with everything else deemed generically “I dunno, a long-ass time ago.”