Email: [email protected]

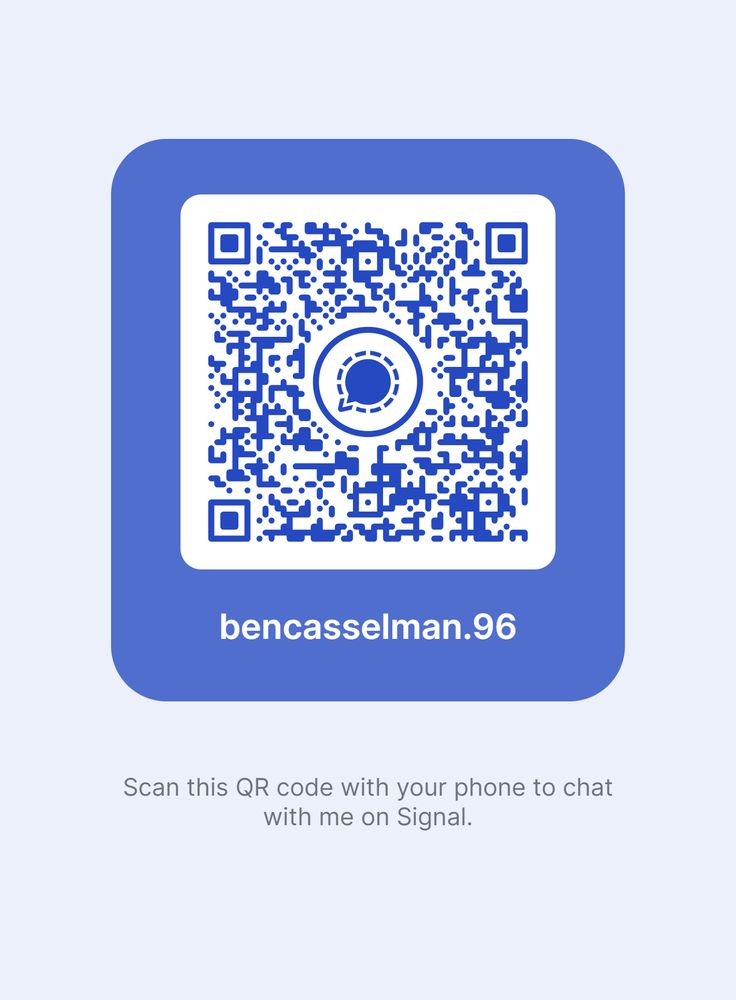

Signal: @bencasselman.96

📸: Earl Wilson/NYT

Details: events.georgetown.edu/event/35638-...

Details: events.georgetown.edu/event/35638-...

* Technically this includes certain excise taxes, not only tariffs. Have to wait for the Monthly Treasury Statement for a full breakdown.

* Technically this includes certain excise taxes, not only tariffs. Have to wait for the Monthly Treasury Statement for a full breakdown.

Most analyses show that most of that money is being paid by American companies and consumers. #NumbersDay #EconSky

Most analyses show that most of that money is being paid by American companies and consumers. #NumbersDay #EconSky

Please see follow up tweets for some clarification of what this does and doesn't mean. #NumbersDay

Please see follow up tweets for some clarification of what this does and doesn't mean. #NumbersDay

www.nytimes.com/2025/10/12/b... #EconSky

www.nytimes.com/2025/10/12/b... #EconSky

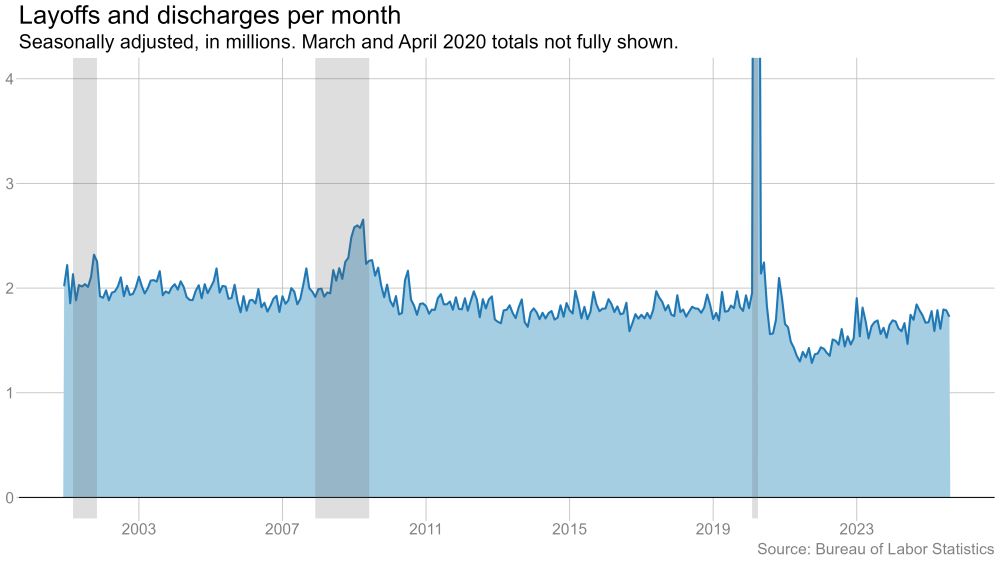

Starting with: Job openings are way down from their peak, but they've fallen slowly if at all in recent months. No obvious sign that labor demand is falling off a cliff.

#NumbersDay

Starting with: Job openings are way down from their peak, but they've fallen slowly if at all in recent months. No obvious sign that labor demand is falling off a cliff.

#NumbersDay

(Are YOU a staffer at BLS or another stats agency with something I should know? Reach out!)

(Are YOU a staffer at BLS or another stats agency with something I should know? Reach out!)