Andrew Goodwin

@andrewgoodwin.bsky.social

Chief UK Economist at Oxford Economics. AFC Wimbledon fanatic.

On the first of those, I find it bizarre that the ONS and particularly the OBR still focus all of their commentary on PSNB and PSND when the fiscal rules switched to PSCB and PSNFL almost a year ago. It's creating unnecessary confusion for some

August 21, 2025 at 10:25 AM

On the first of those, I find it bizarre that the ONS and particularly the OBR still focus all of their commentary on PSNB and PSND when the fiscal rules switched to PSCB and PSNFL almost a year ago. It's creating unnecessary confusion for some

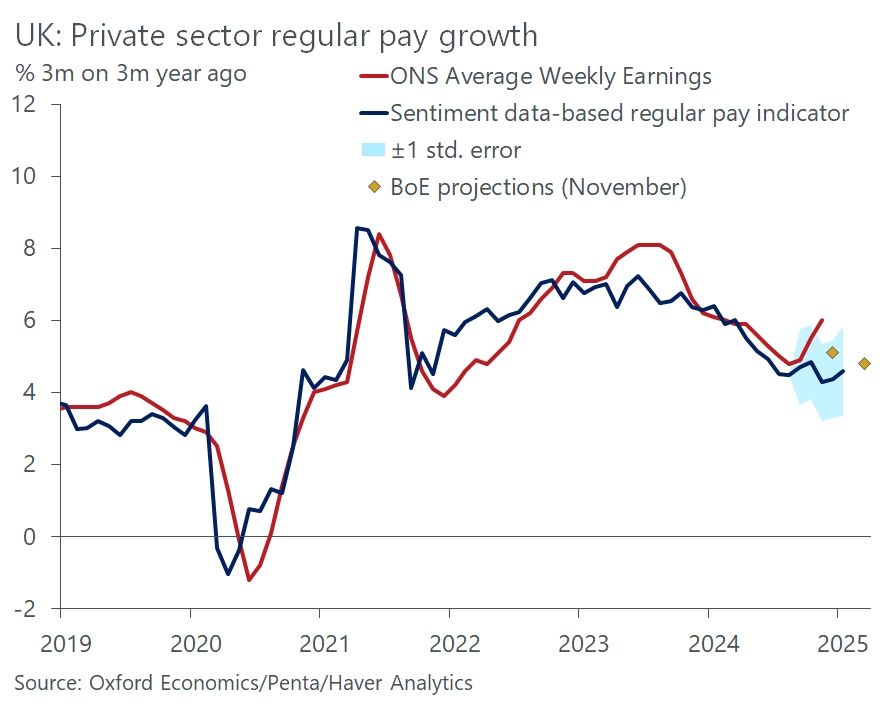

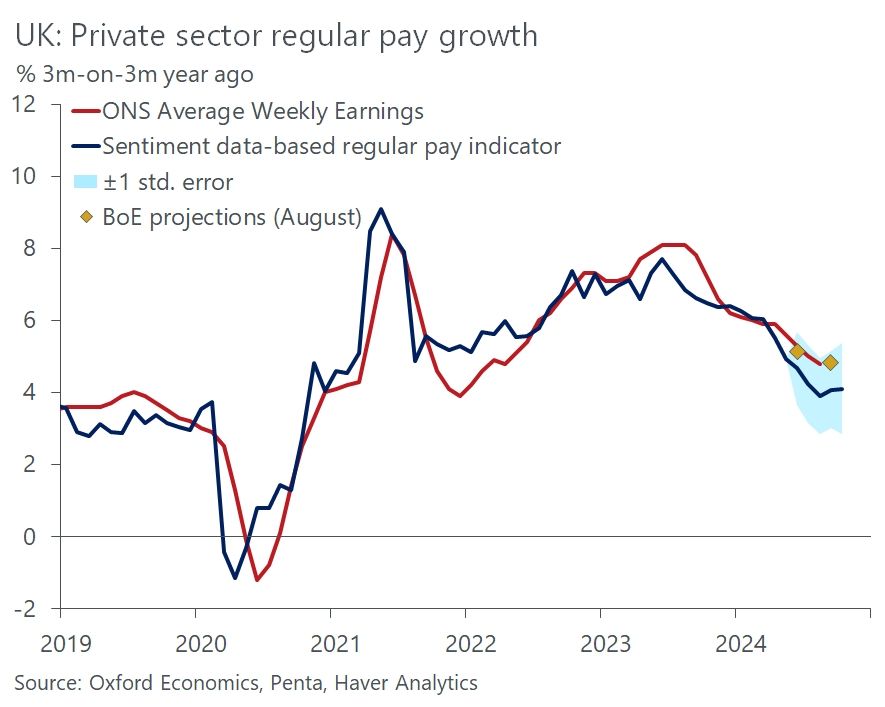

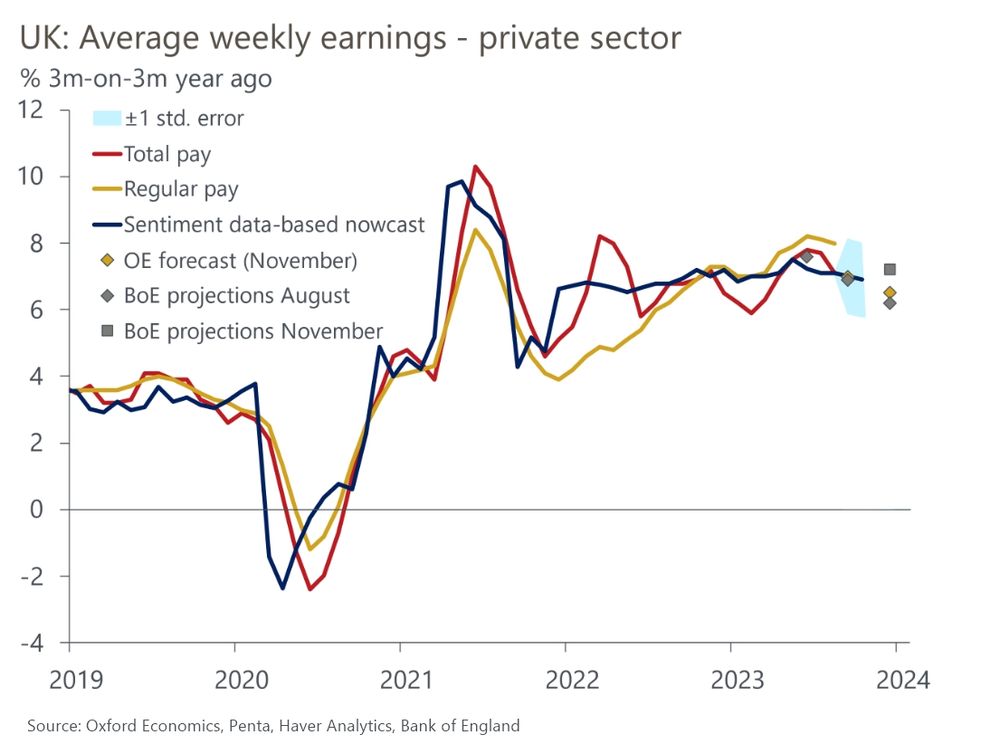

The MPC is trying to gauge where inflation will be in 2 years. As the past few years have shown, pay growth gives a good indication of where services inflation will go. Pay growth is high now, but most of the MPC think it will soften if the jobs market cools. So how that story plays out will be key

January 21, 2025 at 8:15 PM

The MPC is trying to gauge where inflation will be in 2 years. As the past few years have shown, pay growth gives a good indication of where services inflation will go. Pay growth is high now, but most of the MPC think it will soften if the jobs market cools. So how that story plays out will be key

Some more information about our latest note that Andy kindly mentioned: bsky.app/profile/andr...

A short 🧵 on our latest note which looks at shortcomings in official labour market data and where our proprietary high-frequency sentiment dataset can fill in the gaps (1/6) www.oxfordeconomics.com/resource/uk-...

January 21, 2025 at 12:41 PM

Some more information about our latest note that Andy kindly mentioned: bsky.app/profile/andr...

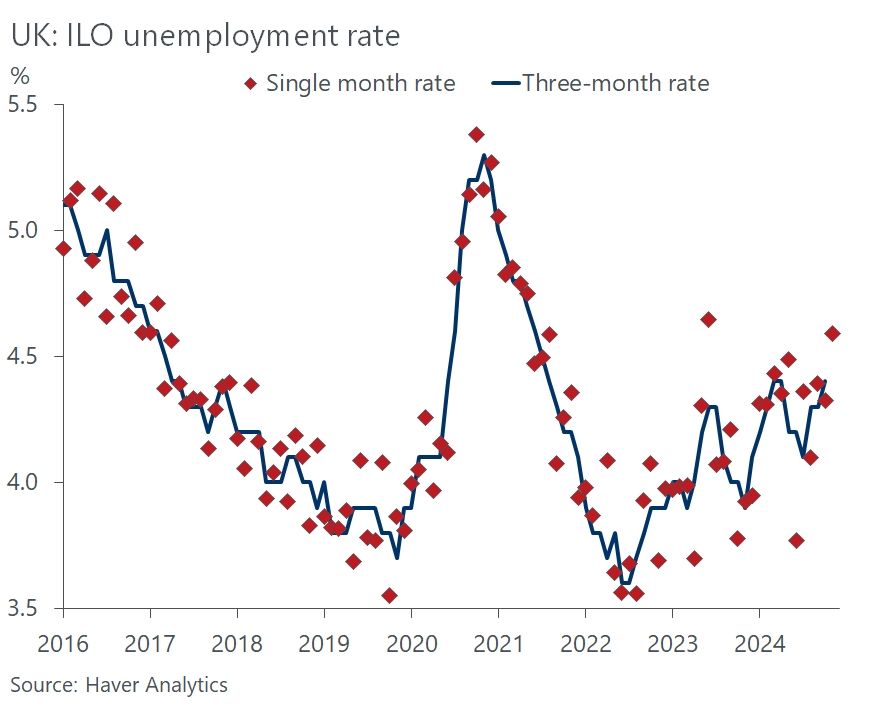

These results highlight the trade-off recently identified by the Bank of England's Monetary Policy Committee between persisting inflation and weak growth and employment prospects. (6/6)

January 21, 2025 at 12:39 PM

These results highlight the trade-off recently identified by the Bank of England's Monetary Policy Committee between persisting inflation and weak growth and employment prospects. (6/6)

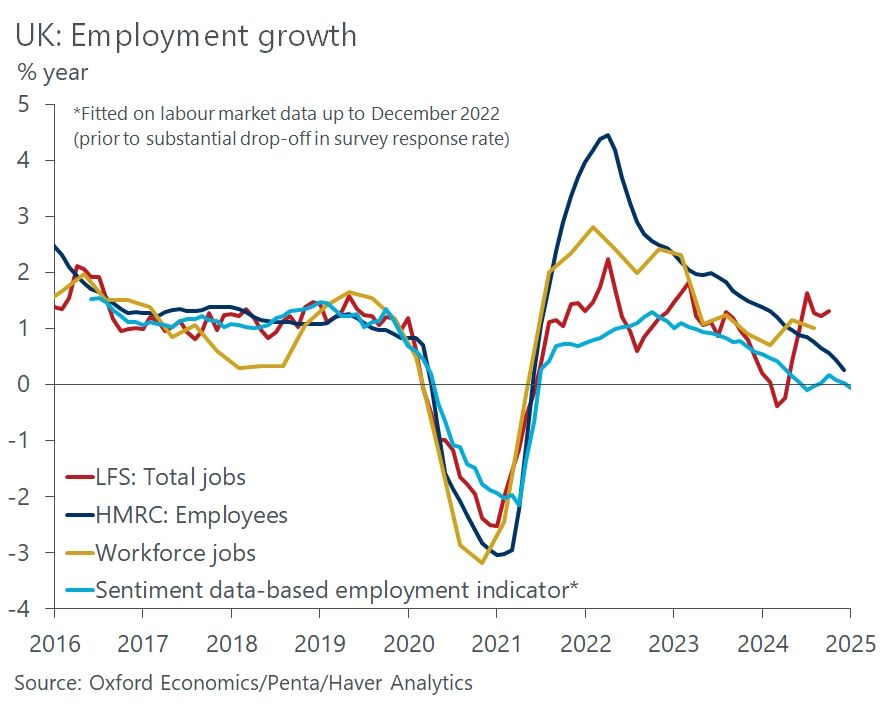

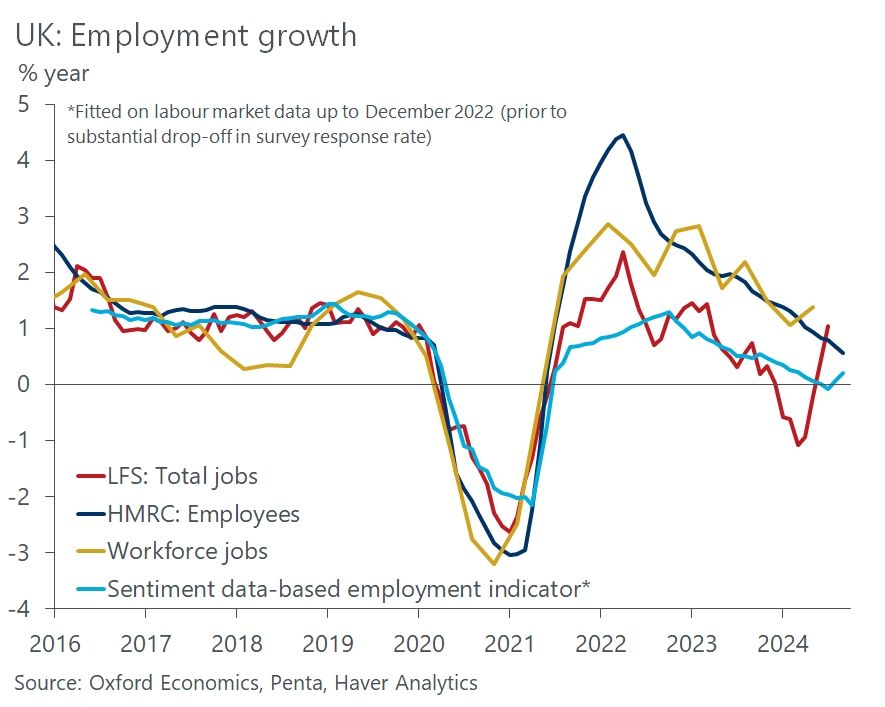

Our nowcasts using this sentiment data suggest employment growth is slowing to zero, and private sector regular pay growth stabilising at around 4.5% at the turn of the year. (5/6)

January 21, 2025 at 12:39 PM

Our nowcasts using this sentiment data suggest employment growth is slowing to zero, and private sector regular pay growth stabilising at around 4.5% at the turn of the year. (5/6)

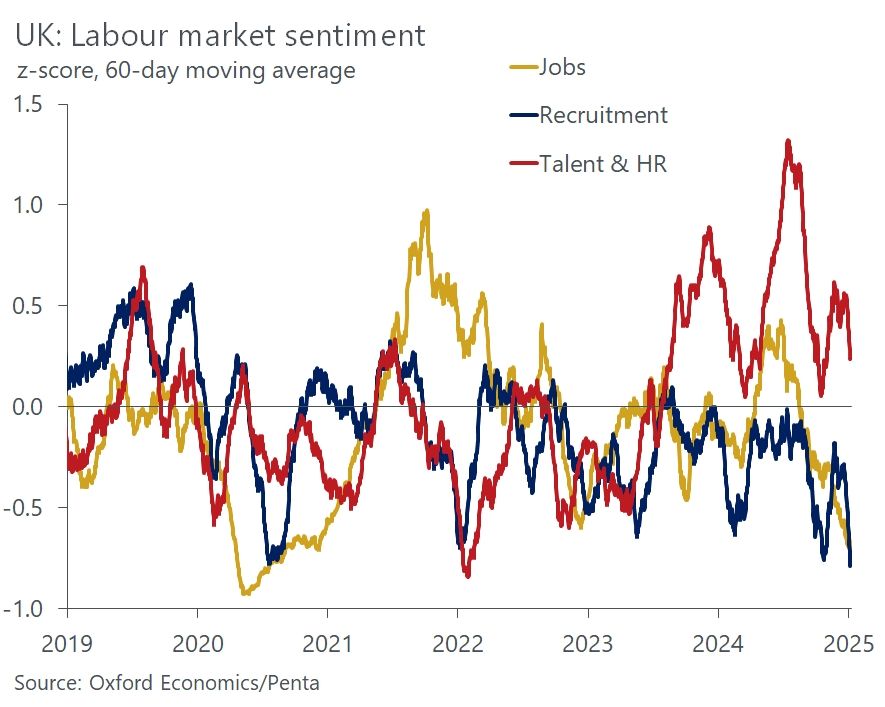

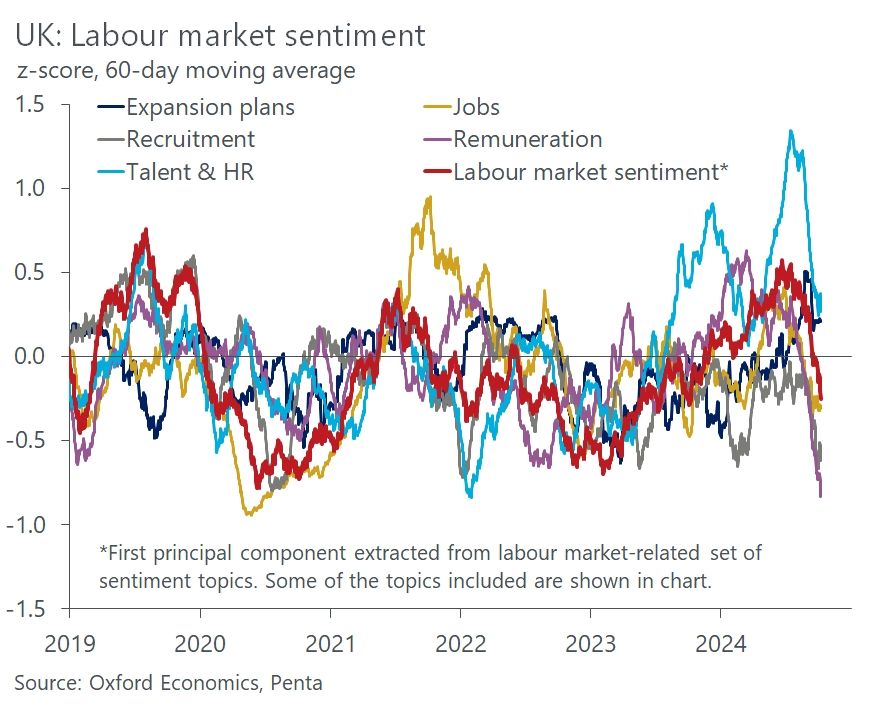

Our proprietary sentiment data, developed with Penta, fills part of the information void, acting as a check on official data as well as being timelier. The latest results for early January suggest that firms are keen to retain existing workers but not to create new roles. (4/6)

January 21, 2025 at 12:39 PM

Our proprietary sentiment data, developed with Penta, fills part of the information void, acting as a check on official data as well as being timelier. The latest results for early January suggest that firms are keen to retain existing workers but not to create new roles. (4/6)

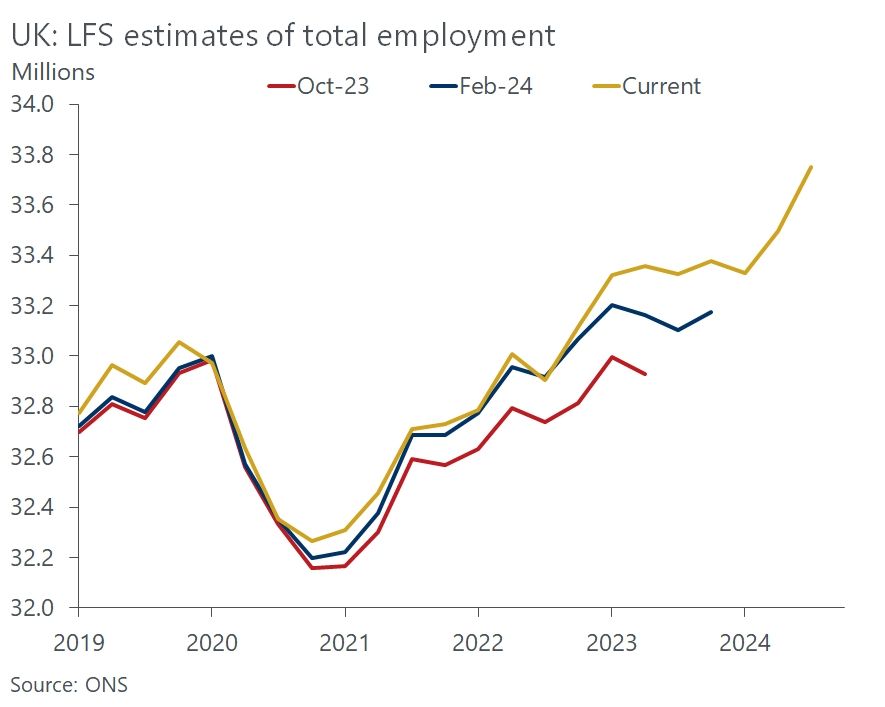

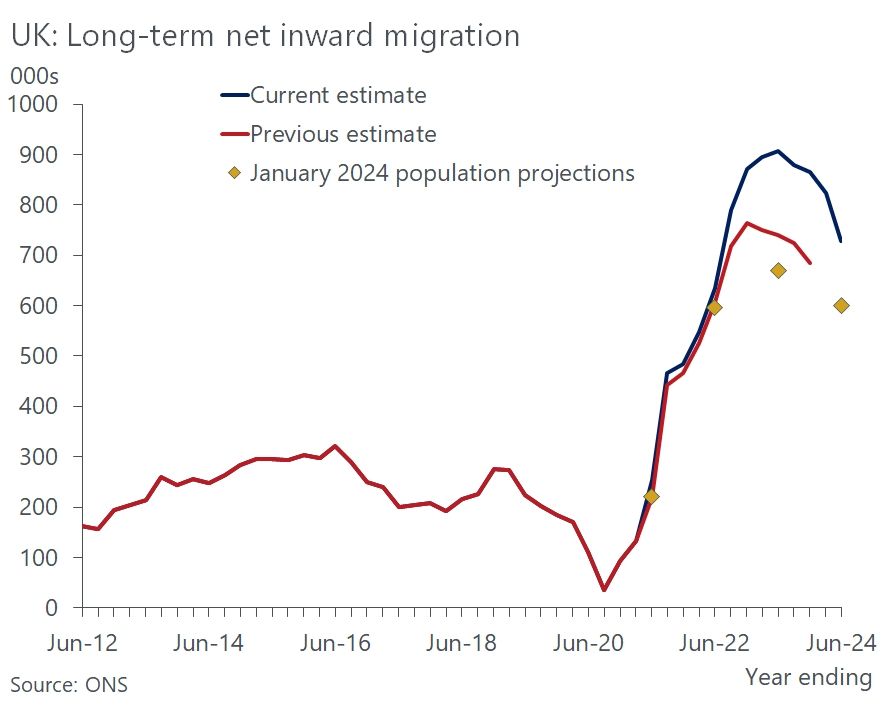

Response rates to the LFS remain very low, resulting in significant data volatility. Problems measuring population compound the problems, resulting in a series of upward revisions to the level of employment, with more revisions to come once the latest migration estimates are incorporated. (3/6)

January 21, 2025 at 12:39 PM

Response rates to the LFS remain very low, resulting in significant data volatility. Problems measuring population compound the problems, resulting in a series of upward revisions to the level of employment, with more revisions to come once the latest migration estimates are incorporated. (3/6)

We think that concerns about the quality of data from the UK's Labour Force Survey (LFS) make it virtually unusable at present. Considering it will likely take another two years to fix the problems, this poses a major headache for policymakers and economists alike. (2/6)

January 21, 2025 at 12:39 PM

We think that concerns about the quality of data from the UK's Labour Force Survey (LFS) make it virtually unusable at present. Considering it will likely take another two years to fix the problems, this poses a major headache for policymakers and economists alike. (2/6)

My concern is more that if yields on safe assets are high in a low growth world then it makes investing in riskier assets look much less attractive

November 26, 2024 at 5:14 PM

My concern is more that if yields on safe assets are high in a low growth world then it makes investing in riskier assets look much less attractive

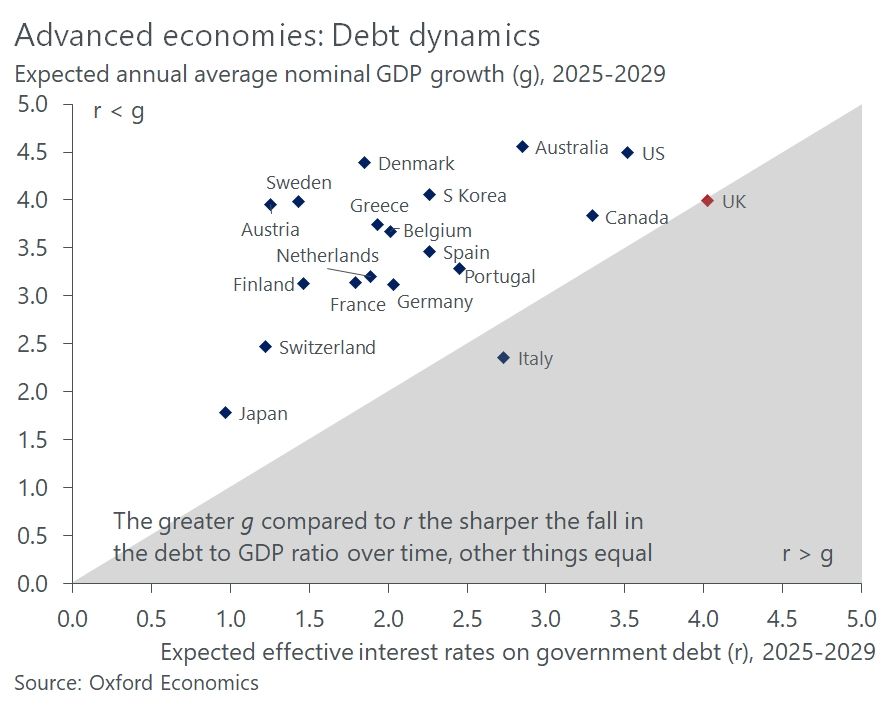

This chart makes for pretty depressing reading. If I substituted in the OBR's forecasts, the UK would be similarly placed relative to other countries

November 26, 2024 at 4:56 PM

This chart makes for pretty depressing reading. If I substituted in the OBR's forecasts, the UK would be similarly placed relative to other countries

Our model also shows an abrupt slowdown in pay growth. If this trend is reflected in official data, it could motivate some MPC members to join Swati Dhingra in voting for rate cuts at successive meetings

October 15, 2024 at 10:27 AM

Our model also shows an abrupt slowdown in pay growth. If this trend is reflected in official data, it could motivate some MPC members to join Swati Dhingra in voting for rate cuts at successive meetings

Our nowcasting model suggests labour market conditions have loosened through the summer. We think this is a more accurate depiction of what's happening than the LFS data

October 15, 2024 at 10:27 AM

Our nowcasting model suggests labour market conditions have loosened through the summer. We think this is a more accurate depiction of what's happening than the LFS data

We've developed a sentiment dataset in collaboration with Penta. Data for September shows sharp falls in most of our individual indicators. Talent & HR is the one exception, suggesting firms continue to place a high value on retaining staff

October 15, 2024 at 10:26 AM

We've developed a sentiment dataset in collaboration with Penta. Data for September shows sharp falls in most of our individual indicators. Talent & HR is the one exception, suggesting firms continue to place a high value on retaining staff

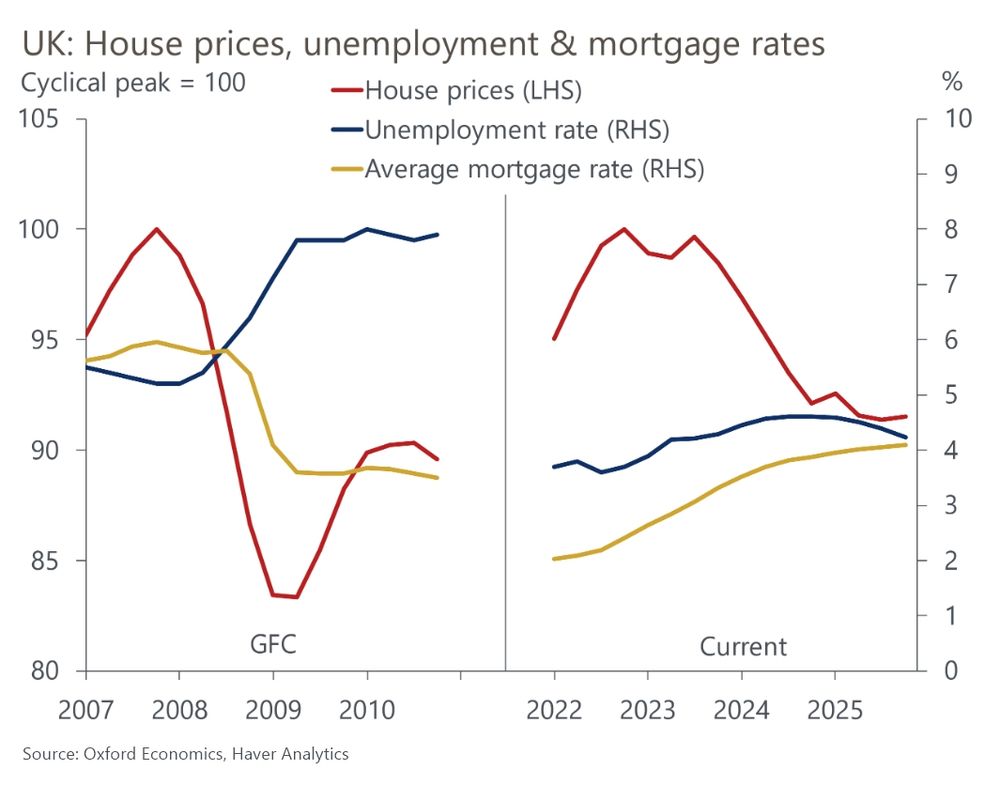

But we forecast only just over half the drop in prices seen in the global financial crisis due to the much lower unemployment rate and slow rise in average mortgage rates www.oxfordeconomics.com/resource/too... (2/2)

November 21, 2023 at 11:43 AM

But we forecast only just over half the drop in prices seen in the global financial crisis due to the much lower unemployment rate and slow rise in average mortgage rates www.oxfordeconomics.com/resource/too... (2/2)

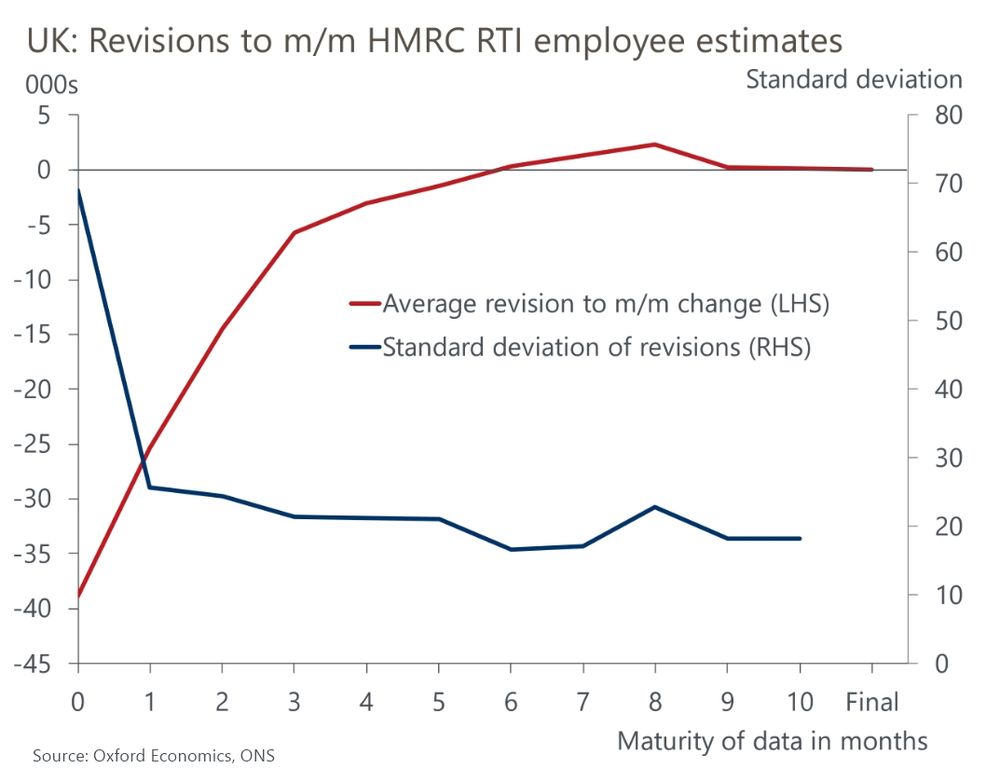

We don't think the ONS's temporary solution adds much value. The flaws in the claimant count are well known. And early HMRC RTI estimates have an upward bias, only settling down after two revision cycles (3/3)

November 10, 2023 at 1:24 PM

We don't think the ONS's temporary solution adds much value. The flaws in the claimant count are well known. And early HMRC RTI estimates have an upward bias, only settling down after two revision cycles (3/3)

The latest sentiment data also suggest that while wage growth is gradually moderating, it is still much faster than would be consistent with achieving the inflation target. So near-term interest rate cuts look unlikely (2/3)

November 10, 2023 at 1:24 PM

The latest sentiment data also suggest that while wage growth is gradually moderating, it is still much faster than would be consistent with achieving the inflation target. So near-term interest rate cuts look unlikely (2/3)