Andrew Goodwin

@andrewgoodwin.bsky.social

Chief UK Economist at Oxford Economics. AFC Wimbledon fanatic.

Reposted by Andrew Goodwin

Excellent 🧵 on UK labour market data

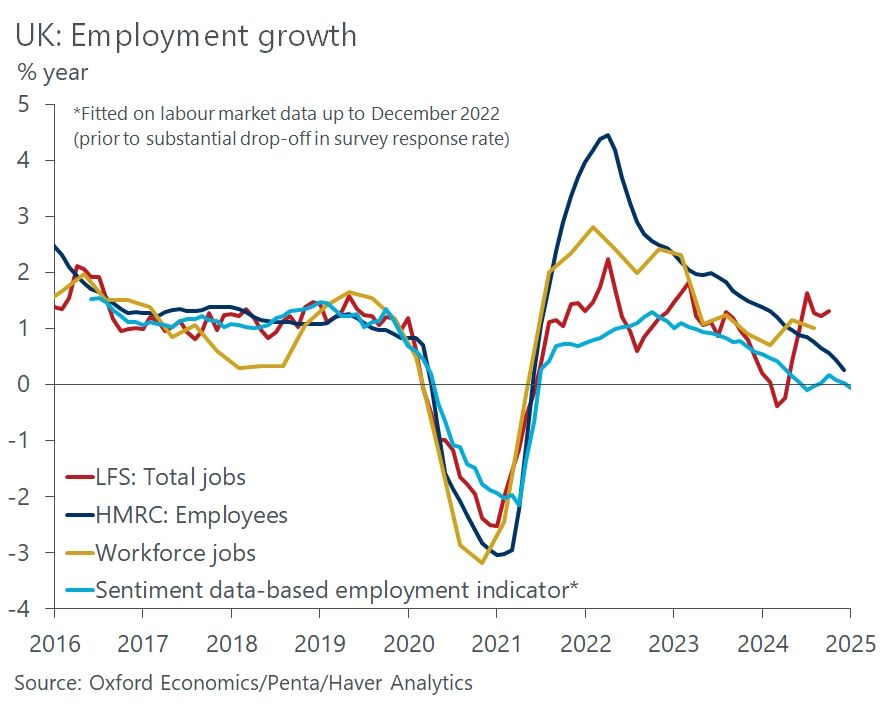

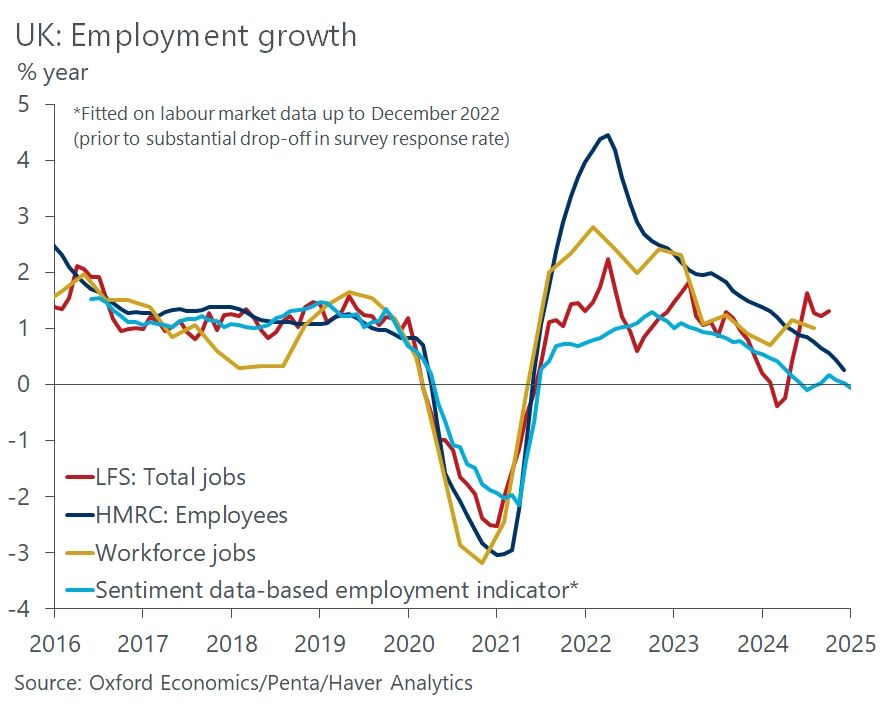

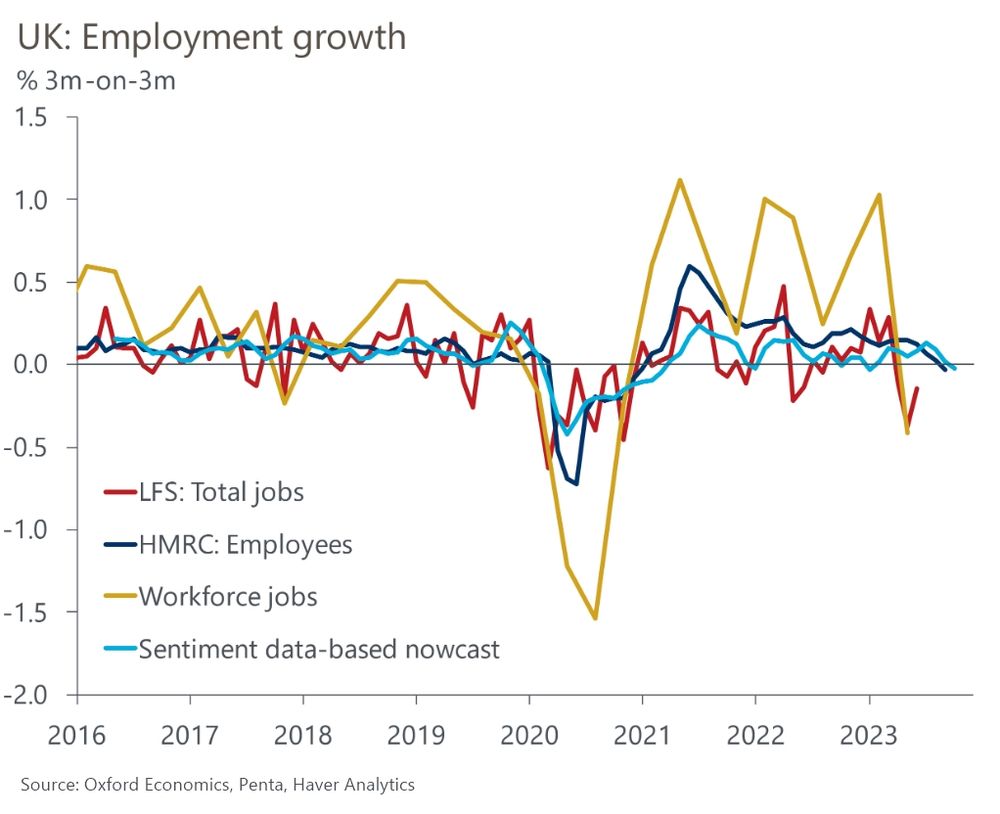

A short 🧵 on our latest note which looks at shortcomings in official labour market data and where our proprietary high-frequency sentiment dataset can fill in the gaps (1/6) www.oxfordeconomics.com/resource/uk-...

January 21, 2025 at 1:19 PM

Excellent 🧵 on UK labour market data

A short 🧵 on our latest note which looks at shortcomings in official labour market data and where our proprietary high-frequency sentiment dataset can fill in the gaps (1/6) www.oxfordeconomics.com/resource/uk-...

January 21, 2025 at 12:39 PM

A short 🧵 on our latest note which looks at shortcomings in official labour market data and where our proprietary high-frequency sentiment dataset can fill in the gaps (1/6) www.oxfordeconomics.com/resource/uk-...

Reposted by Andrew Goodwin

Interesting note from Oxford Economics' @andrewgoodwin.bsky.social.

He says the Labour Force survey is "virtually unusable".

Oxford Economics' proprietary nowcast model shows a weaker picture for employment and wage growth, which seems to have stabilised at around 4.5%.

He says the Labour Force survey is "virtually unusable".

Oxford Economics' proprietary nowcast model shows a weaker picture for employment and wage growth, which seems to have stabilised at around 4.5%.

January 21, 2025 at 9:28 AM

Interesting note from Oxford Economics' @andrewgoodwin.bsky.social.

He says the Labour Force survey is "virtually unusable".

Oxford Economics' proprietary nowcast model shows a weaker picture for employment and wage growth, which seems to have stabilised at around 4.5%.

He says the Labour Force survey is "virtually unusable".

Oxford Economics' proprietary nowcast model shows a weaker picture for employment and wage growth, which seems to have stabilised at around 4.5%.

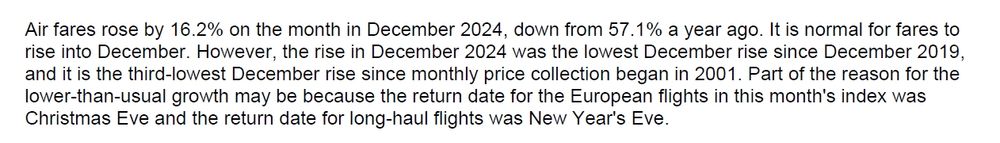

Not sure this morning's inflation data is quite as good as many are suggesting. The downside surprise was mainly due to the volatile air fares component (almost 0.1ppt off of CPI) and that seems to be mainly due to a quirk of the dates that prices were taken (screenshot from ONS release)

January 15, 2025 at 7:44 AM

Not sure this morning's inflation data is quite as good as many are suggesting. The downside surprise was mainly due to the volatile air fares component (almost 0.1ppt off of CPI) and that seems to be mainly due to a quirk of the dates that prices were taken (screenshot from ONS release)

Reposted by Andrew Goodwin

Eye-catching note from Oxford Economics just out:

"Some forecasters are more optimistic about UK growth prospects following the Budget, but we take the opposite view," says @andrewgoodwin.bsky.social.

He says UK debt dynamics "are among the worst of the

advanced economies".

"Some forecasters are more optimistic about UK growth prospects following the Budget, but we take the opposite view," says @andrewgoodwin.bsky.social.

He says UK debt dynamics "are among the worst of the

advanced economies".

November 26, 2024 at 4:51 PM

Eye-catching note from Oxford Economics just out:

"Some forecasters are more optimistic about UK growth prospects following the Budget, but we take the opposite view," says @andrewgoodwin.bsky.social.

He says UK debt dynamics "are among the worst of the

advanced economies".

"Some forecasters are more optimistic about UK growth prospects following the Budget, but we take the opposite view," says @andrewgoodwin.bsky.social.

He says UK debt dynamics "are among the worst of the

advanced economies".

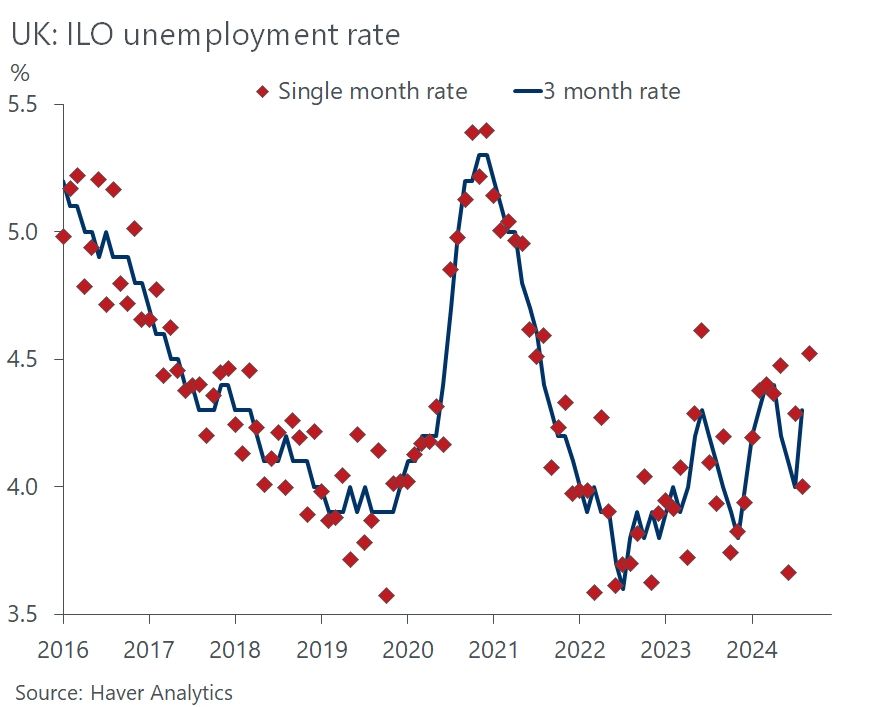

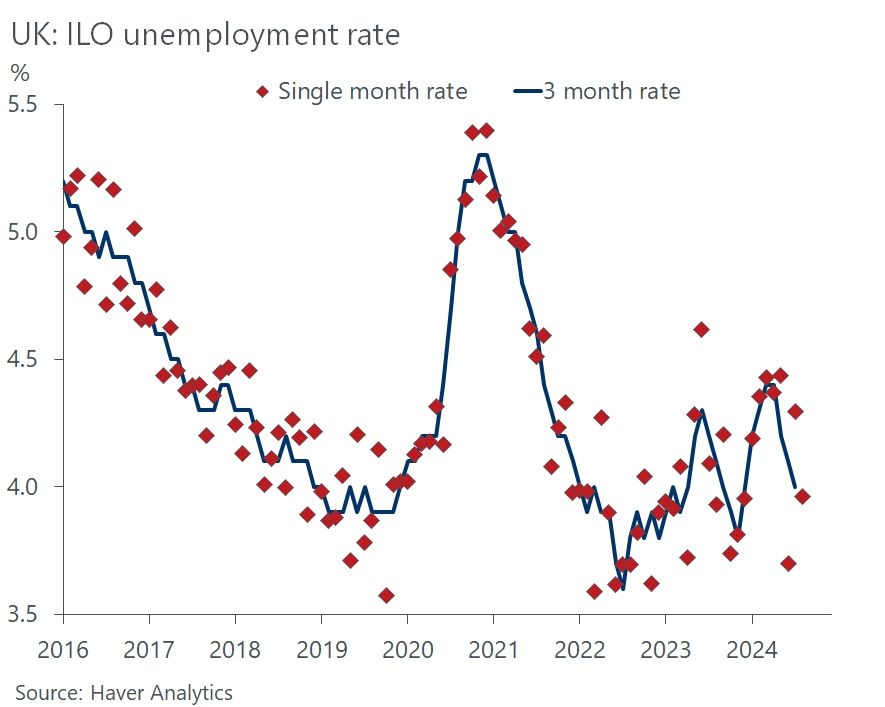

The latest output from the ONS's random number generator. Surely its time to suspend the LFS again...publishing such poor quality data is counter-productive and encouraging bad takes

November 12, 2024 at 9:10 AM

The latest output from the ONS's random number generator. Surely its time to suspend the LFS again...publishing such poor quality data is counter-productive and encouraging bad takes

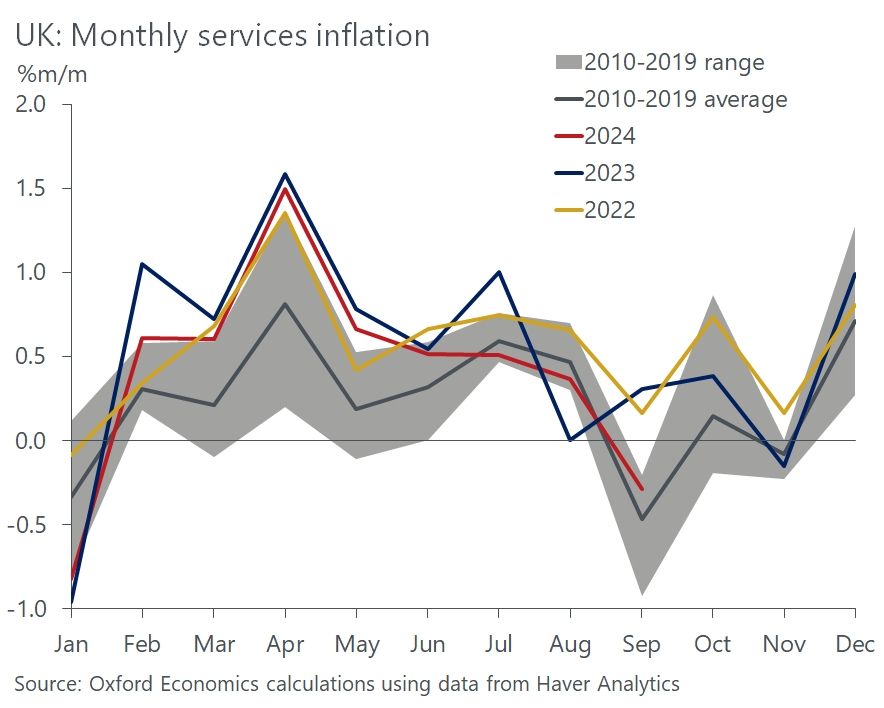

Surprised by the surprise about today's low inflation reading . The September 2023 services inflation reading was a big outlier to the upside so there was always going to be a big base effect. Recent m/m changes in services prices are roughly in line with the pre-pandemic average

October 16, 2024 at 8:50 AM

Surprised by the surprise about today's low inflation reading . The September 2023 services inflation reading was a big outlier to the upside so there was always going to be a big base effect. Recent m/m changes in services prices are roughly in line with the pre-pandemic average

A short 🧵 on today's labour market data and where our our proprietary high-frequency sentiment dataset can fill in the gaps.

First up - don't use the LFS data....it's complete rubbish. Just a collection of random dots with no pattern

First up - don't use the LFS data....it's complete rubbish. Just a collection of random dots with no pattern

October 15, 2024 at 10:26 AM

A short 🧵 on today's labour market data and where our our proprietary high-frequency sentiment dataset can fill in the gaps.

First up - don't use the LFS data....it's complete rubbish. Just a collection of random dots with no pattern

First up - don't use the LFS data....it's complete rubbish. Just a collection of random dots with no pattern

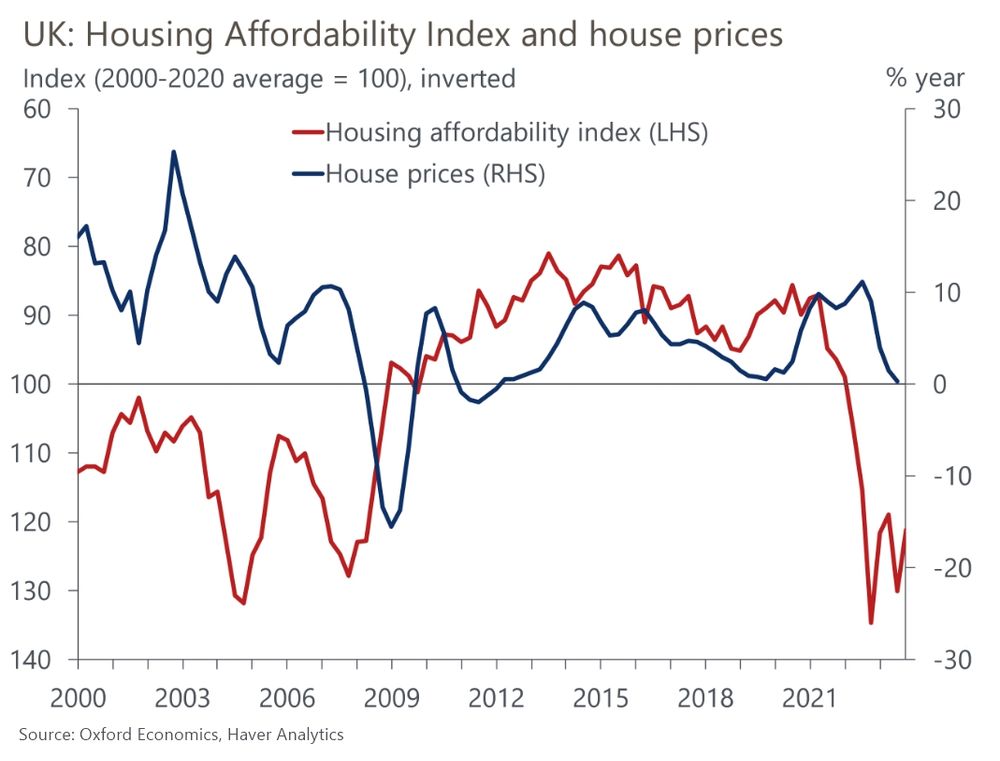

We estimate that UK house prices are still more than 20% overvalued based on the affordability of mortgage payments. This is likely to mean transactions and lending remain very low, and that the house price correction has further to run: www.oxfordeconomics.com/resource/too... (1/2)

November 21, 2023 at 11:42 AM

We estimate that UK house prices are still more than 20% overvalued based on the affordability of mortgage payments. This is likely to mean transactions and lending remain very low, and that the house price correction has further to run: www.oxfordeconomics.com/resource/too... (1/2)

Our proprietary sentiment data, developed with Penta, can help fill the gap left by the suspension of the LFS. It suggests the labour market was more resilient than the unadjusted LFS data implied in the summer, but that labour demand has cooled recently (1/3) www.oxfordeconomics.com/resource/alt...

November 10, 2023 at 1:23 PM

Our proprietary sentiment data, developed with Penta, can help fill the gap left by the suspension of the LFS. It suggests the labour market was more resilient than the unadjusted LFS data implied in the summer, but that labour demand has cooled recently (1/3) www.oxfordeconomics.com/resource/alt...