Andrew Goodwin

@andrewgoodwin.bsky.social

Chief UK Economist at Oxford Economics. AFC Wimbledon fanatic.

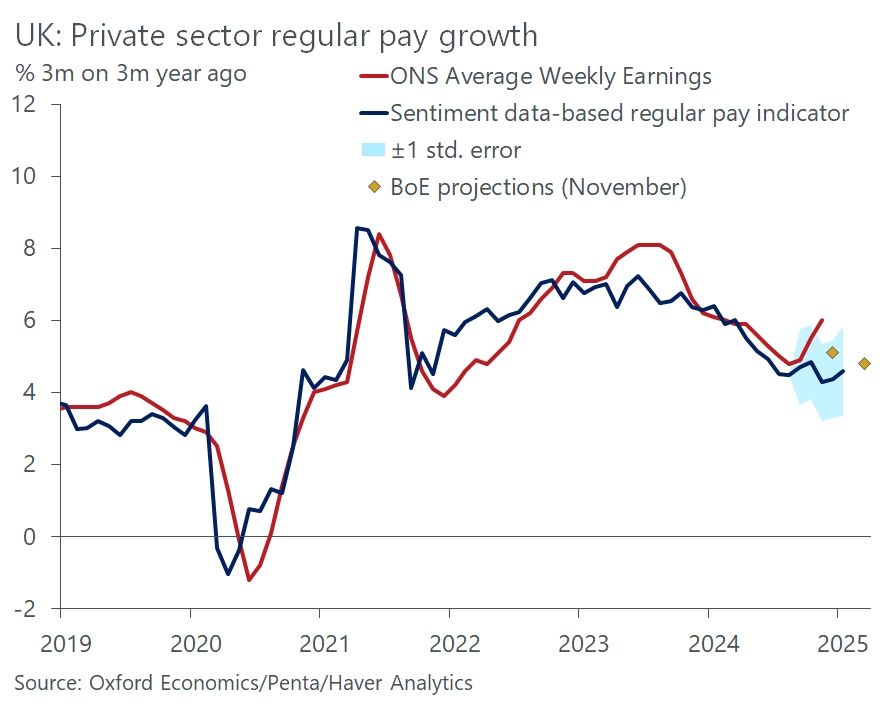

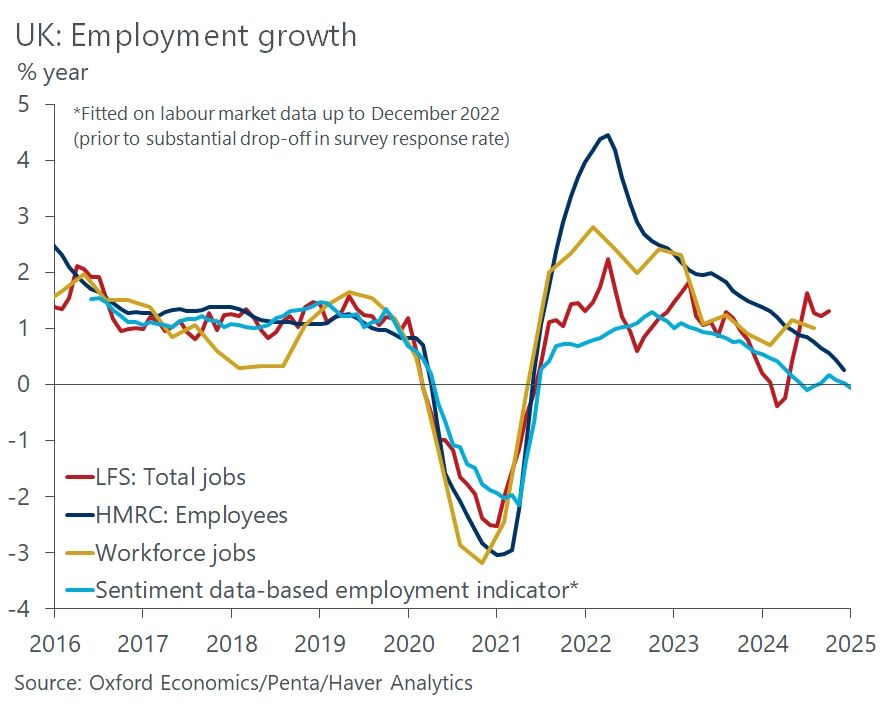

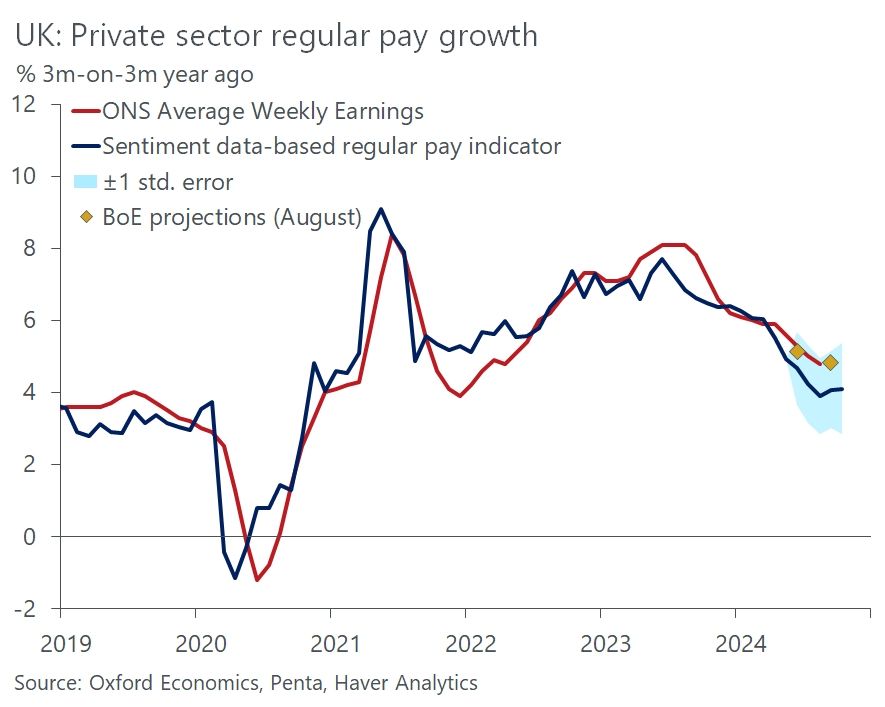

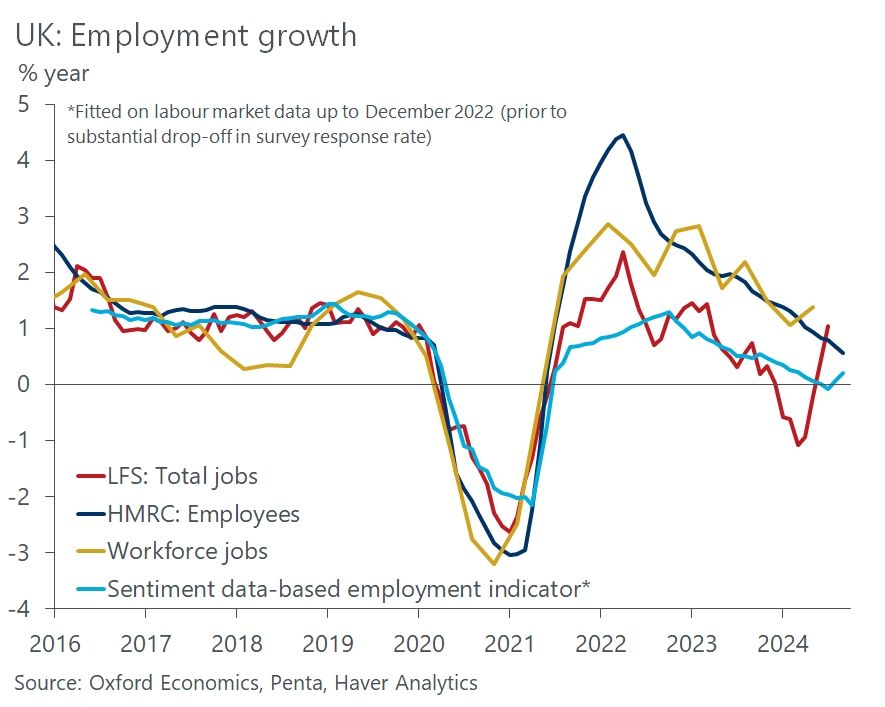

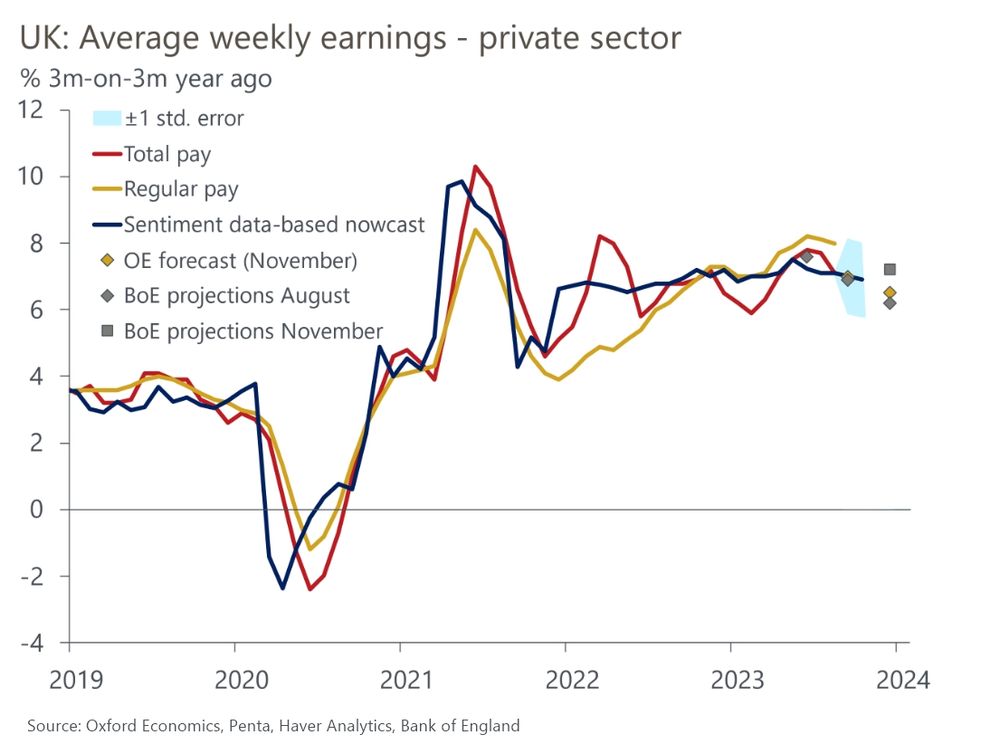

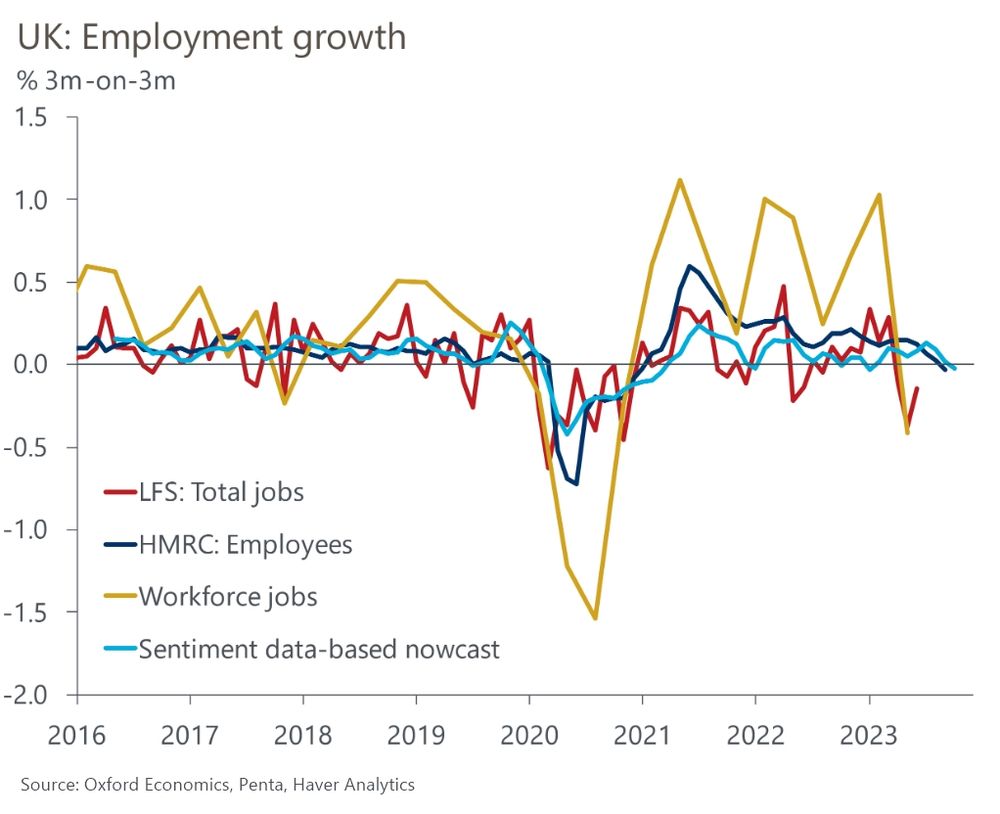

Our nowcasts using this sentiment data suggest employment growth is slowing to zero, and private sector regular pay growth stabilising at around 4.5% at the turn of the year. (5/6)

January 21, 2025 at 12:39 PM

Our nowcasts using this sentiment data suggest employment growth is slowing to zero, and private sector regular pay growth stabilising at around 4.5% at the turn of the year. (5/6)

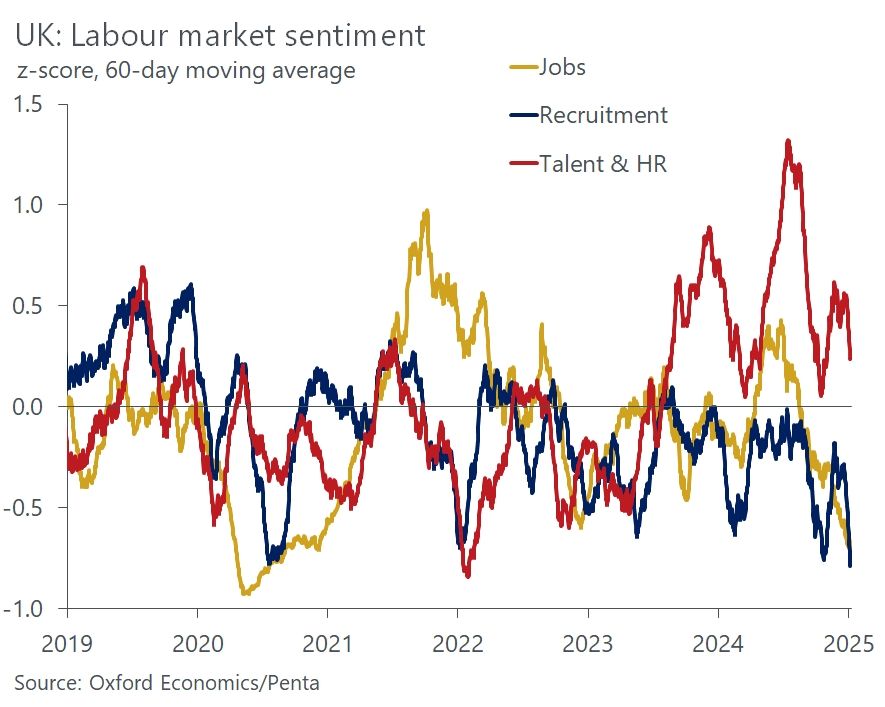

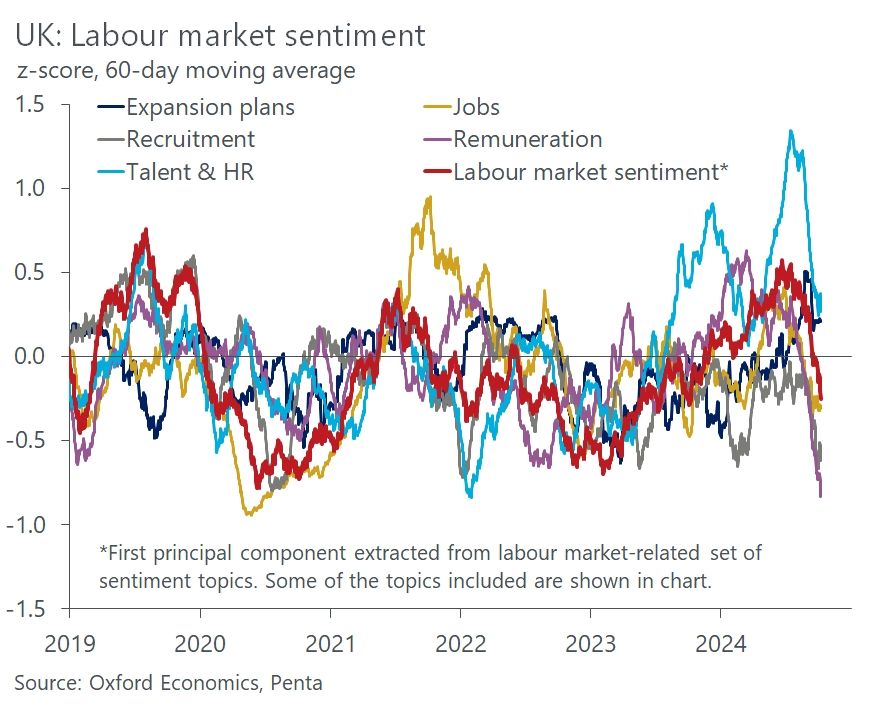

Our proprietary sentiment data, developed with Penta, fills part of the information void, acting as a check on official data as well as being timelier. The latest results for early January suggest that firms are keen to retain existing workers but not to create new roles. (4/6)

January 21, 2025 at 12:39 PM

Our proprietary sentiment data, developed with Penta, fills part of the information void, acting as a check on official data as well as being timelier. The latest results for early January suggest that firms are keen to retain existing workers but not to create new roles. (4/6)

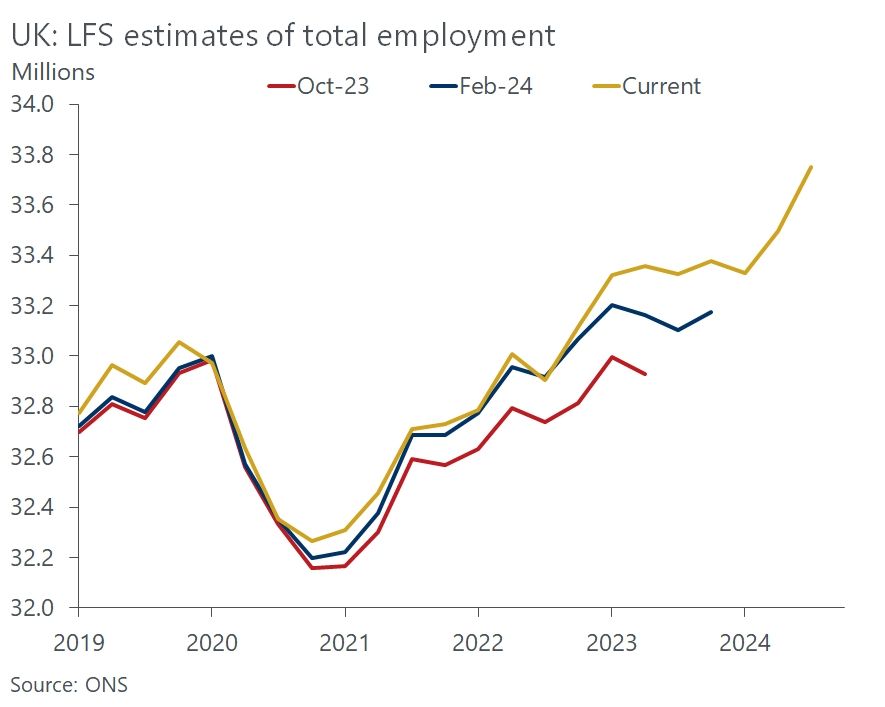

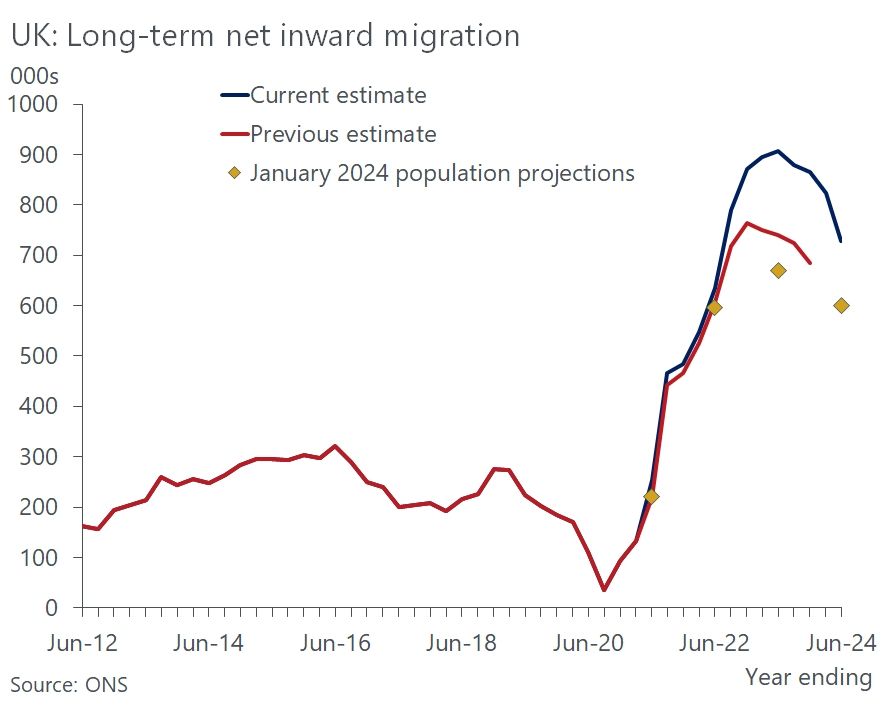

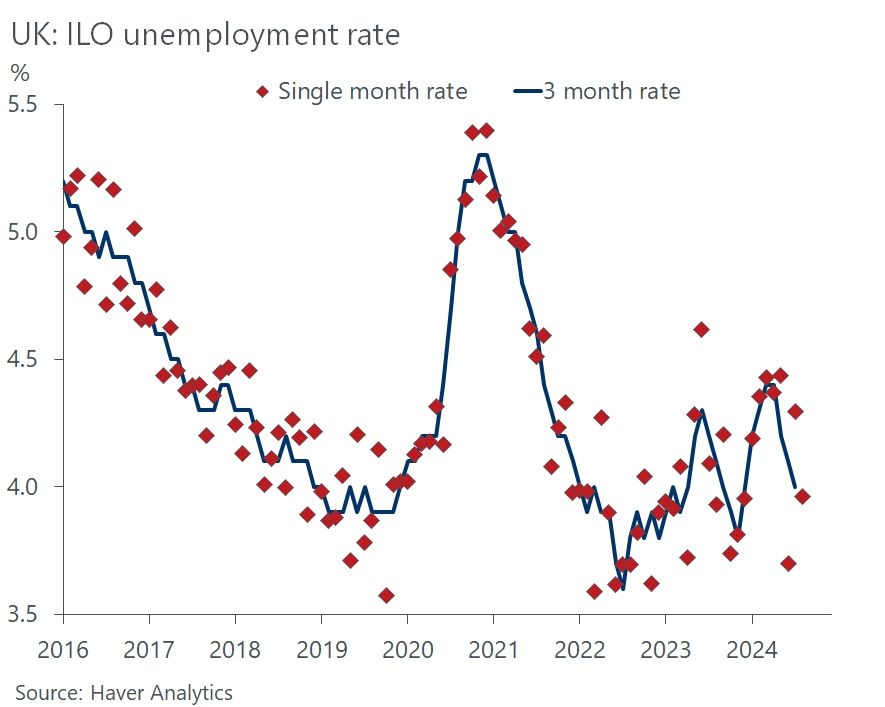

Response rates to the LFS remain very low, resulting in significant data volatility. Problems measuring population compound the problems, resulting in a series of upward revisions to the level of employment, with more revisions to come once the latest migration estimates are incorporated. (3/6)

January 21, 2025 at 12:39 PM

Response rates to the LFS remain very low, resulting in significant data volatility. Problems measuring population compound the problems, resulting in a series of upward revisions to the level of employment, with more revisions to come once the latest migration estimates are incorporated. (3/6)

A short 🧵 on our latest note which looks at shortcomings in official labour market data and where our proprietary high-frequency sentiment dataset can fill in the gaps (1/6) www.oxfordeconomics.com/resource/uk-...

January 21, 2025 at 12:39 PM

A short 🧵 on our latest note which looks at shortcomings in official labour market data and where our proprietary high-frequency sentiment dataset can fill in the gaps (1/6) www.oxfordeconomics.com/resource/uk-...

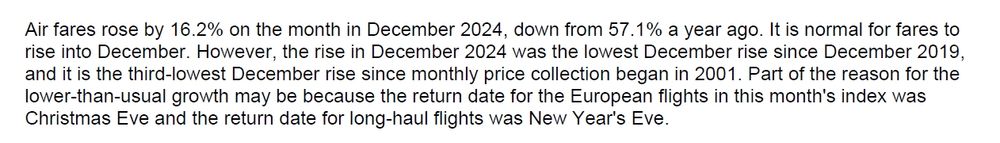

Not sure this morning's inflation data is quite as good as many are suggesting. The downside surprise was mainly due to the volatile air fares component (almost 0.1ppt off of CPI) and that seems to be mainly due to a quirk of the dates that prices were taken (screenshot from ONS release)

January 15, 2025 at 7:44 AM

Not sure this morning's inflation data is quite as good as many are suggesting. The downside surprise was mainly due to the volatile air fares component (almost 0.1ppt off of CPI) and that seems to be mainly due to a quirk of the dates that prices were taken (screenshot from ONS release)

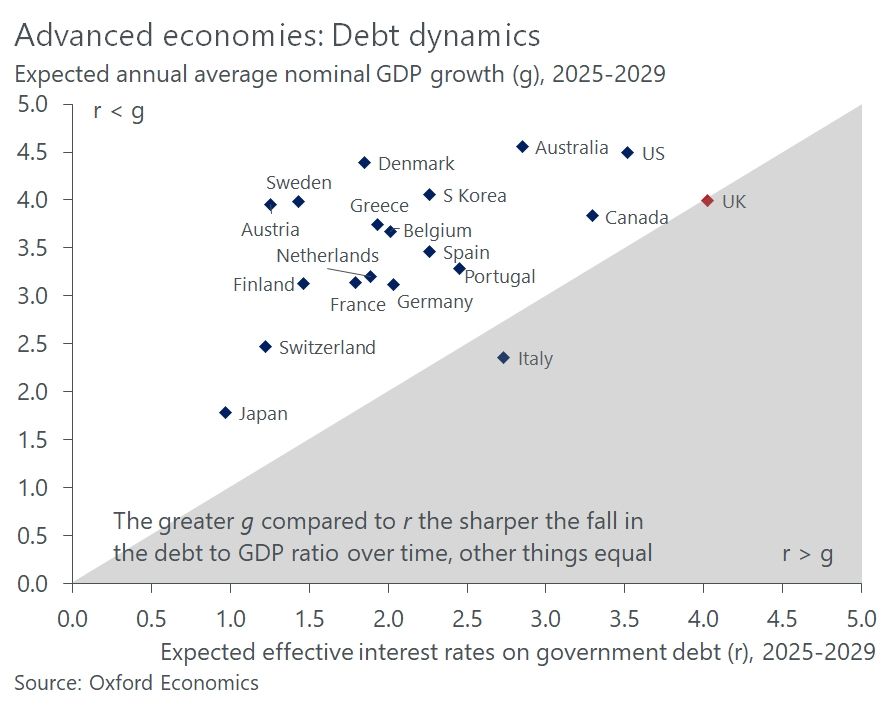

This chart makes for pretty depressing reading. If I substituted in the OBR's forecasts, the UK would be similarly placed relative to other countries

November 26, 2024 at 4:56 PM

This chart makes for pretty depressing reading. If I substituted in the OBR's forecasts, the UK would be similarly placed relative to other countries

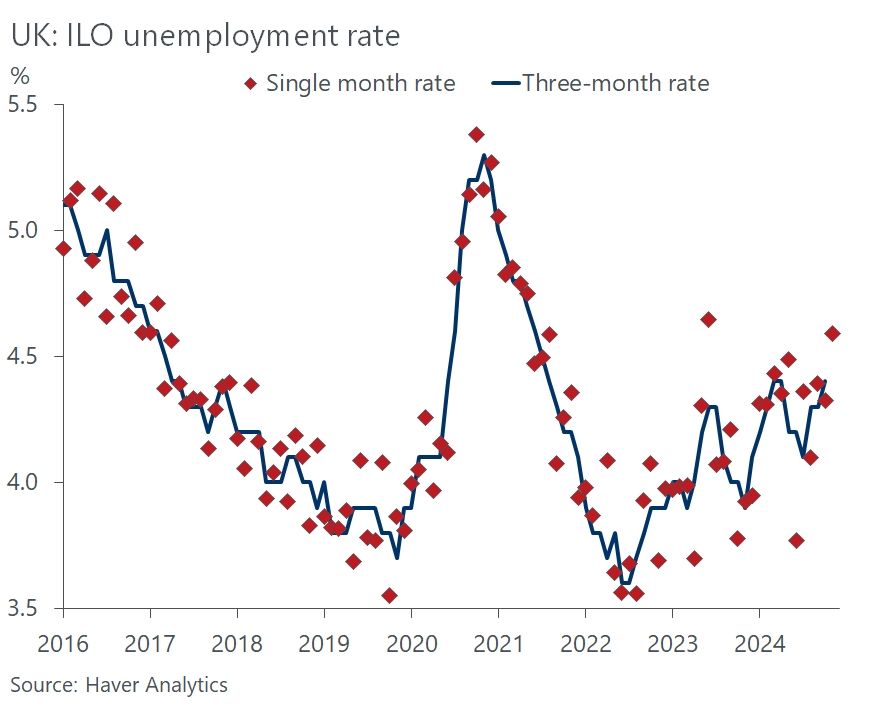

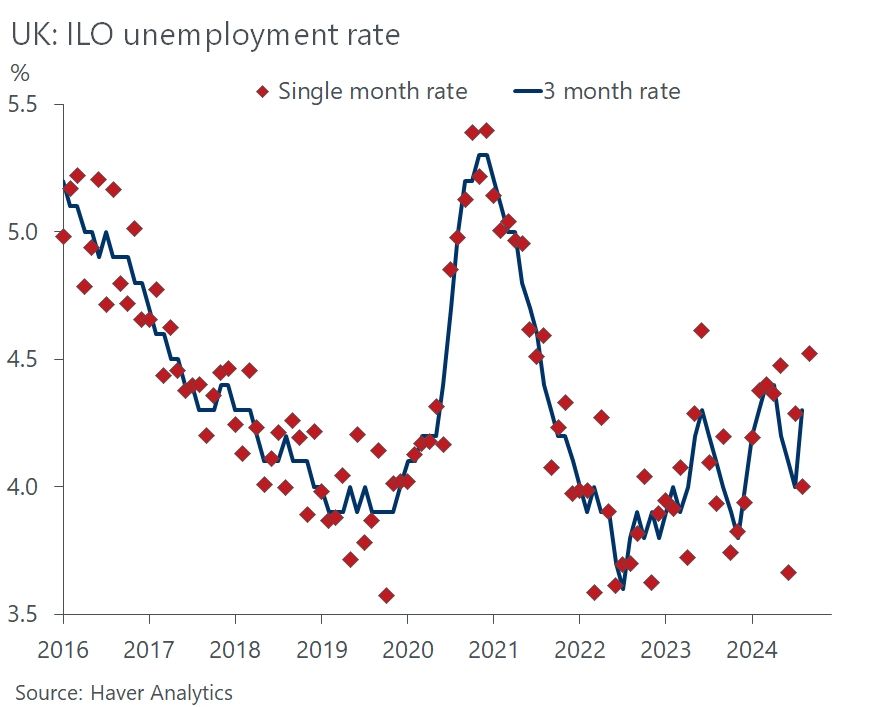

The latest output from the ONS's random number generator. Surely its time to suspend the LFS again...publishing such poor quality data is counter-productive and encouraging bad takes

November 12, 2024 at 9:10 AM

The latest output from the ONS's random number generator. Surely its time to suspend the LFS again...publishing such poor quality data is counter-productive and encouraging bad takes

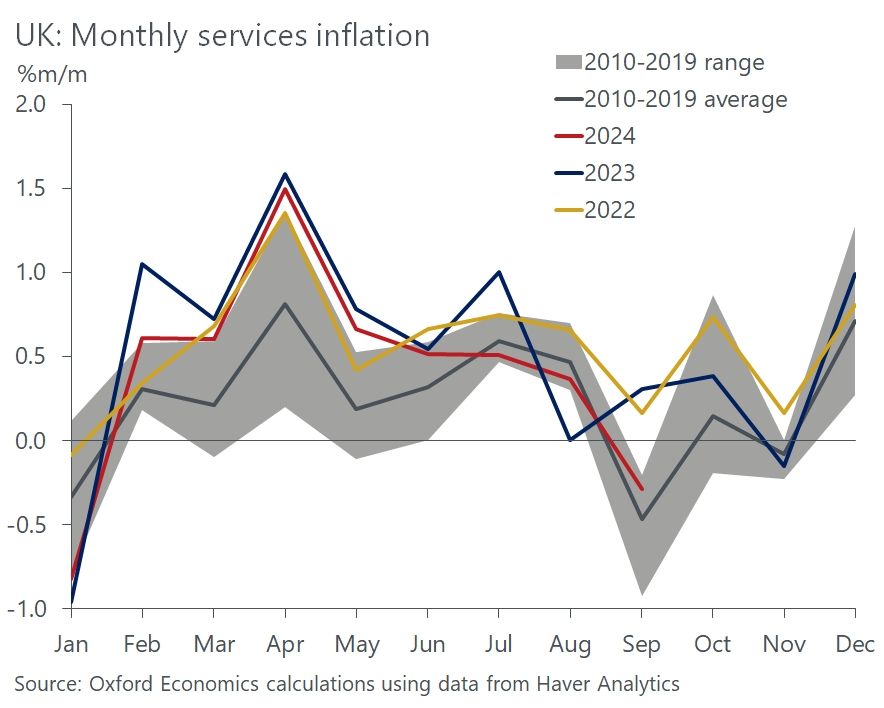

Surprised by the surprise about today's low inflation reading . The September 2023 services inflation reading was a big outlier to the upside so there was always going to be a big base effect. Recent m/m changes in services prices are roughly in line with the pre-pandemic average

October 16, 2024 at 8:50 AM

Surprised by the surprise about today's low inflation reading . The September 2023 services inflation reading was a big outlier to the upside so there was always going to be a big base effect. Recent m/m changes in services prices are roughly in line with the pre-pandemic average

Our model also shows an abrupt slowdown in pay growth. If this trend is reflected in official data, it could motivate some MPC members to join Swati Dhingra in voting for rate cuts at successive meetings

October 15, 2024 at 10:27 AM

Our model also shows an abrupt slowdown in pay growth. If this trend is reflected in official data, it could motivate some MPC members to join Swati Dhingra in voting for rate cuts at successive meetings

Our nowcasting model suggests labour market conditions have loosened through the summer. We think this is a more accurate depiction of what's happening than the LFS data

October 15, 2024 at 10:27 AM

Our nowcasting model suggests labour market conditions have loosened through the summer. We think this is a more accurate depiction of what's happening than the LFS data

We've developed a sentiment dataset in collaboration with Penta. Data for September shows sharp falls in most of our individual indicators. Talent & HR is the one exception, suggesting firms continue to place a high value on retaining staff

October 15, 2024 at 10:26 AM

We've developed a sentiment dataset in collaboration with Penta. Data for September shows sharp falls in most of our individual indicators. Talent & HR is the one exception, suggesting firms continue to place a high value on retaining staff

A short 🧵 on today's labour market data and where our our proprietary high-frequency sentiment dataset can fill in the gaps.

First up - don't use the LFS data....it's complete rubbish. Just a collection of random dots with no pattern

First up - don't use the LFS data....it's complete rubbish. Just a collection of random dots with no pattern

October 15, 2024 at 10:26 AM

A short 🧵 on today's labour market data and where our our proprietary high-frequency sentiment dataset can fill in the gaps.

First up - don't use the LFS data....it's complete rubbish. Just a collection of random dots with no pattern

First up - don't use the LFS data....it's complete rubbish. Just a collection of random dots with no pattern

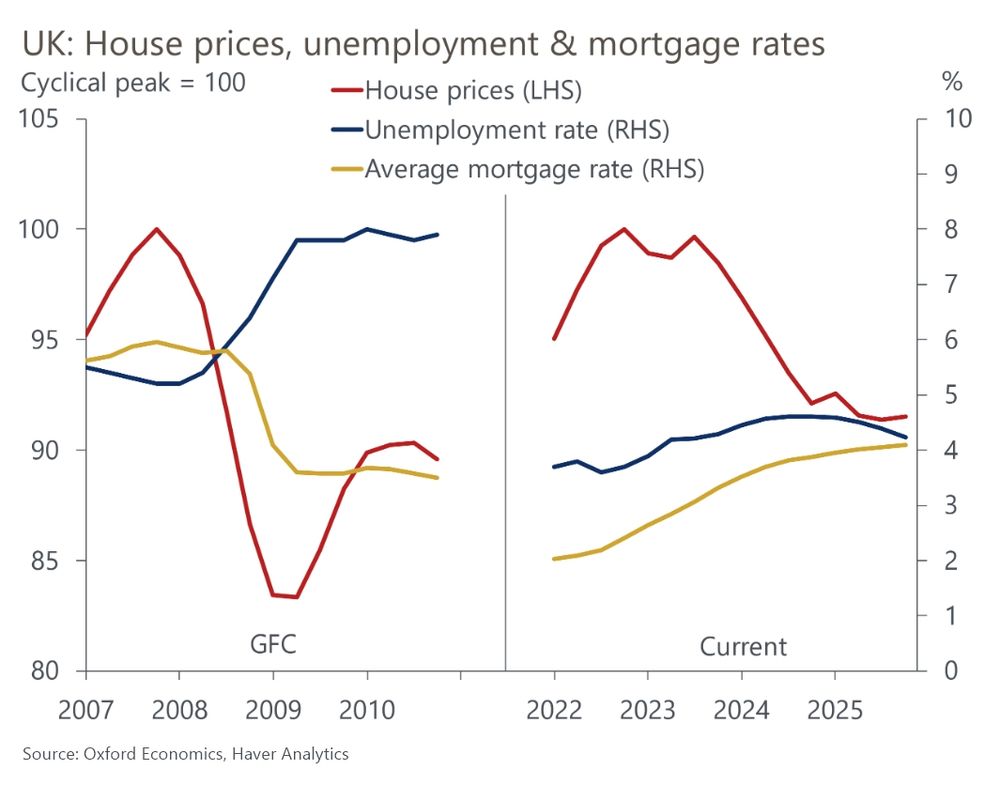

But we forecast only just over half the drop in prices seen in the global financial crisis due to the much lower unemployment rate and slow rise in average mortgage rates www.oxfordeconomics.com/resource/too... (2/2)

November 21, 2023 at 11:43 AM

But we forecast only just over half the drop in prices seen in the global financial crisis due to the much lower unemployment rate and slow rise in average mortgage rates www.oxfordeconomics.com/resource/too... (2/2)

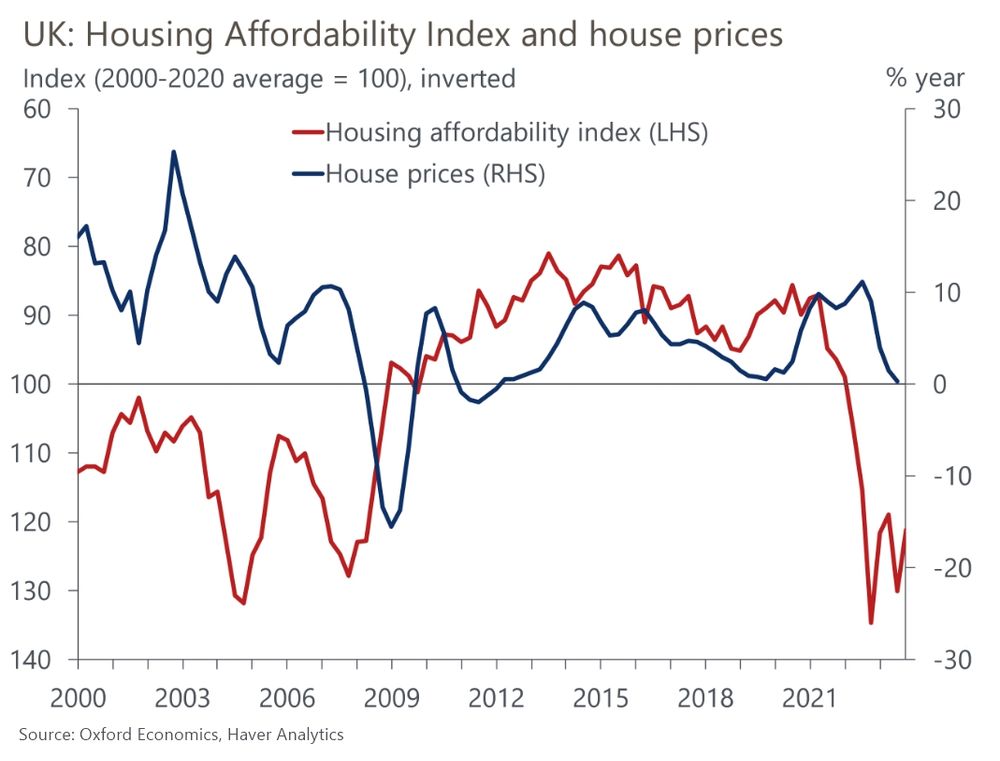

We estimate that UK house prices are still more than 20% overvalued based on the affordability of mortgage payments. This is likely to mean transactions and lending remain very low, and that the house price correction has further to run: www.oxfordeconomics.com/resource/too... (1/2)

November 21, 2023 at 11:42 AM

We estimate that UK house prices are still more than 20% overvalued based on the affordability of mortgage payments. This is likely to mean transactions and lending remain very low, and that the house price correction has further to run: www.oxfordeconomics.com/resource/too... (1/2)

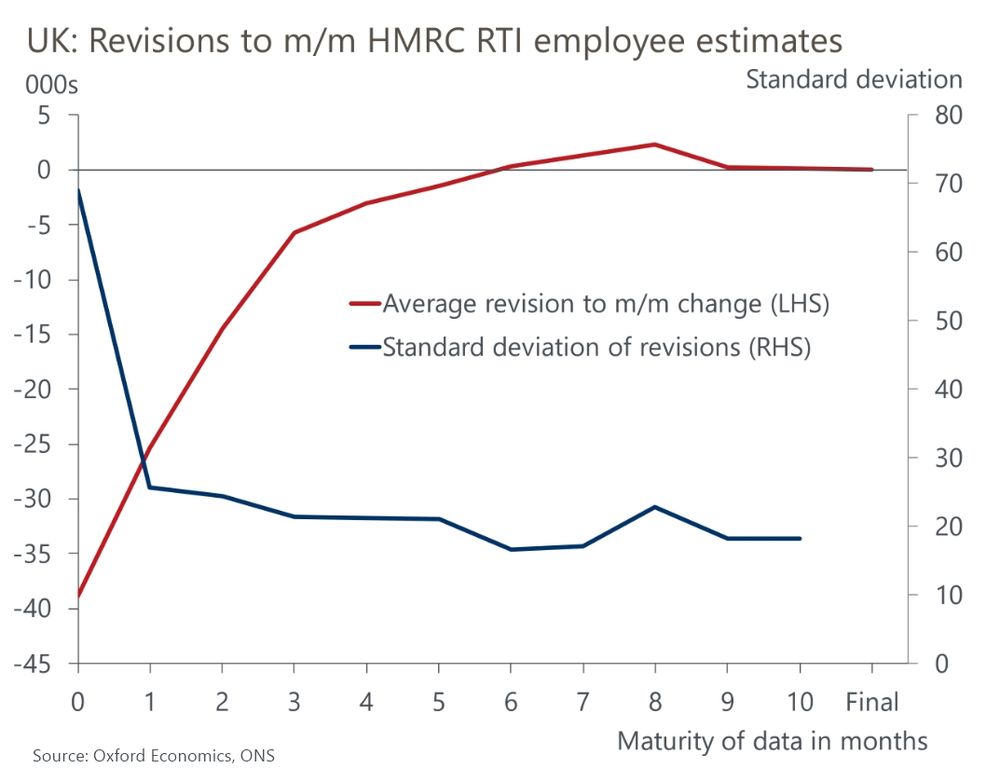

We don't think the ONS's temporary solution adds much value. The flaws in the claimant count are well known. And early HMRC RTI estimates have an upward bias, only settling down after two revision cycles (3/3)

November 10, 2023 at 1:24 PM

We don't think the ONS's temporary solution adds much value. The flaws in the claimant count are well known. And early HMRC RTI estimates have an upward bias, only settling down after two revision cycles (3/3)

The latest sentiment data also suggest that while wage growth is gradually moderating, it is still much faster than would be consistent with achieving the inflation target. So near-term interest rate cuts look unlikely (2/3)

November 10, 2023 at 1:24 PM

The latest sentiment data also suggest that while wage growth is gradually moderating, it is still much faster than would be consistent with achieving the inflation target. So near-term interest rate cuts look unlikely (2/3)

Our proprietary sentiment data, developed with Penta, can help fill the gap left by the suspension of the LFS. It suggests the labour market was more resilient than the unadjusted LFS data implied in the summer, but that labour demand has cooled recently (1/3) www.oxfordeconomics.com/resource/alt...

November 10, 2023 at 1:23 PM

Our proprietary sentiment data, developed with Penta, can help fill the gap left by the suspension of the LFS. It suggests the labour market was more resilient than the unadjusted LFS data implied in the summer, but that labour demand has cooled recently (1/3) www.oxfordeconomics.com/resource/alt...