Law professor at the American University Washington College of Law (but all views expressed here are my own); author of Fintech Dystopia and Driverless Finance; mythbusting crypto, AI, and other fintech

Internet serial: fintechdystopia.com ..

more

Law professor at the American University Washington College of Law (but all views expressed here are my own); author of Fintech Dystopia and Driverless Finance; mythbusting crypto, AI, and other fintech

Internet serial: fintechdystopia.com

fintechdystopia.com/chapters/cha...

Covering

- How much the abundance agenda and VC output suck

- Silicon Valley subsidies we can take away

- How to laugh our way into Silicon Valley skepticism

- A plan to actually fix finance

Reposted by Hilary J. Allen

Barr's dissent (correctly) notes the rule won't achieve its stated purpose of helping Treasury markets. Instead, it will make big banks less resilient.

Reposted by Hilary J. Allen

Barr's dissent (correctly) notes the rule won't achieve its stated purpose of helping Treasury markets. Instead, it will make big banks less resilient.

Reposted by Hilary J. Allen

I'm worried that it will result in a massive upwards transfer of wealth - and further endanger our democracies in the process.

graceblakeley.substack.com/p/the-ai-cir...

fintechdystopia.com/chapters/cha...

This is a great conversation not just about the Antichrist talk, but the broader project of Thiel and his fellow tech billionaires.

This week @gilduran.com joins @parismarx.com to discuss how Thiel casts his enemies as the Antichrist to distract from Silicon Valley’s anti-human project.

Full ep: techwontsave.us/episode/303_...

www.youtube.com/@Americansfo...

Reposted by Hilary J. Allen

This week @gilduran.com joins @parismarx.com to discuss how Thiel casts his enemies as the Antichrist to distract from Silicon Valley’s anti-human project.

Full ep: techwontsave.us/episode/303_...

This is a great conversation not just about the Antichrist talk, but the broader project of Thiel and his fellow tech billionaires.

Reposted by Hilary J. Allen

Reposted by Iñaki Aldasoro, Hilary J. Allen

fintechdystopia.com/chapters/cha...

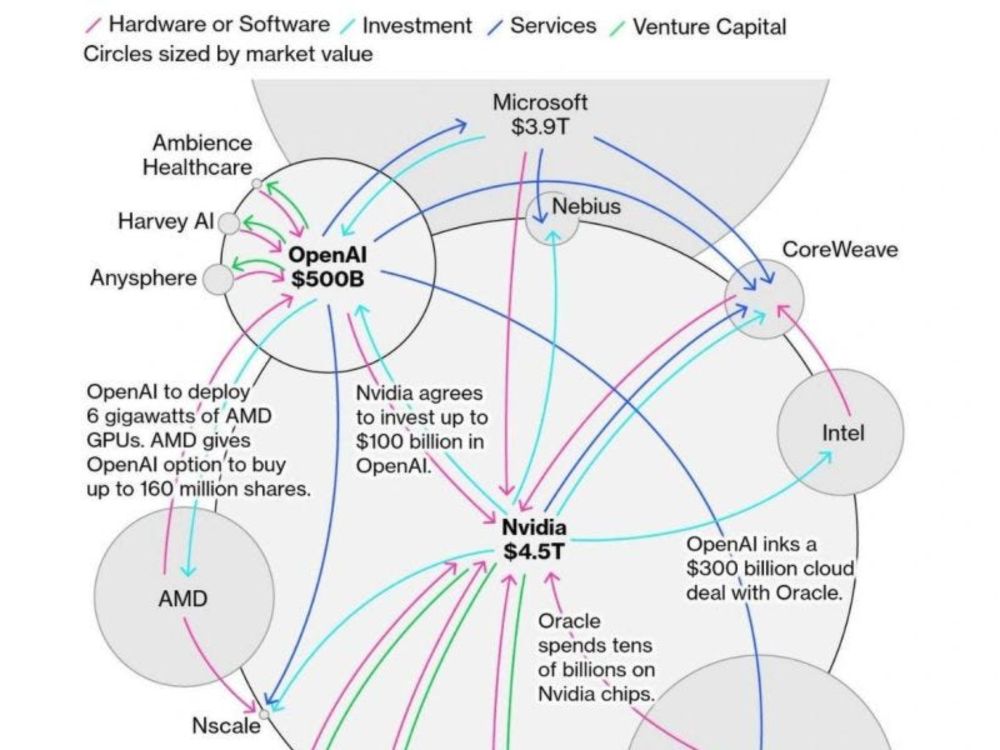

I'm pretty nervous about this ending badly, but everyone's dug in because AI is the only pulse in the economy.

prospect.org/2025/11/19/a...

Reposted by Hilary J. Allen, Brian Jm Quinn

I'm pretty nervous about this ending badly, but everyone's dug in because AI is the only pulse in the economy.

prospect.org/2025/11/19/a...

fintechdystopia.com/chapters/cha...

Reposted by Hilary J. Allen

"I am someone with a master's in computer science, two patents, and nearly a decade working in tech. If they are scared of people who understand their business regulating their business, then they are telling on themselves."

Reposted by Hilary J. Allen

Anthropic has posted two jobs, both paying $200K+.

FOR WRITERS. (Looks like a policy/comms hybrid.)

ANTHROPIC.

IS WILLING TO PAY HALF A MILLION A YEAR.

FOR WRITERS.

Whatsamatter boys, can't your plagiarism machine make a compelling case for you?

LOL. LMAO, even. #AI

fintechdystopia.com/chapters/cha...

Reposted by Hilary J. Allen

Reposted by Fabián Muniesa, Hilary J. Allen

Here are our findings:

![Another goal is for folks in this big tent to vote for people willing to stand up to the Silicon Valley elite. I strongly suspect that the Venn diagram of Congressional Democrats who support the crypto industry and Congressional Democrats who support the abundance agenda looks a lot like a circle. The Crypto Council for Innovation’s Sheila Warren told a group chat of Democratic Party insiders that “nobody is going to get primaried because they voted for [the stablecoin law] GENIUS,” but she may have misread the electorate. We saw last chapter how the crypto industry’s standwithcrypto.com ratings have helped pervert our political process, but we can make lemonade out of lemons and support primary challenges against candidates who have strong pro-crypto rankings – which will probably stop the spread of the abundance agenda too. Silicon Valley’s money and power may seem insurmountable right now, but if we were to go back about fifty years, we would see how the tobacco industry also weaponized publicly subsidized profits to capture Congress and push their preferred narrative. Yet as Sarah Milov relates in The Cigarette: A Political History, in the end, the tobacco industry lost control of the narrative as public interest litigation and grass roots activism made smoking socially unacceptable – and anti-smoking laws followed this narrative shift.](https://cdn.bsky.app/img/feed_thumbnail/plain/did:plc:4bcrv573bktwj6xw5tie2im5/bafkreifnppw5yqr74nujkwzweilyvtk2cf2kedbdamp7hdtdmcifkzjxba@jpeg)