Senior Reporter, Global Markets

www.spglobal.com/market-intel...

w/ @danielzhao.bsky.social @aaronsojourner.org @prestonmui.bsky.social

www.spglobal.com/market-intel...

w/ @danielzhao.bsky.social @aaronsojourner.org @prestonmui.bsky.social

- @pkrugman.bsky.social on yesterday's jobs report

- @pkrugman.bsky.social on yesterday's jobs report

- S&P Dow Jones Indices

- S&P Dow Jones Indices

www.spglobal.com/market-intel...

www.spglobal.com/market-intel...

www.spglobal.com/market-intel...

www.spglobal.com/market-intel...

"It takes time for the technology to diffuse, and right now it really takes some level of specialized knowledge to apply the technology," said Lucas Hansen w/ CivAI

www.spglobal.com/market-intel...

"It takes time for the technology to diffuse, and right now it really takes some level of specialized knowledge to apply the technology," said Lucas Hansen w/ CivAI

www.spglobal.com/market-intel...

"I continue to see markets as one materially negative catalyst away from a cyclical bear market taking shape"

www.spglobal.com/market-intel...

"I continue to see markets as one materially negative catalyst away from a cyclical bear market taking shape"

www.spglobal.com/market-intel...

"The range of possibilities is very wide, and the direction of how things might go could come down to some personal biases and political views"

www.spglobal.com/market-intel...

"The range of possibilities is very wide, and the direction of how things might go could come down to some personal biases and political views"

www.spglobal.com/market-intel...

"A few firms noted that artificial intelligence replaced entry-level positions or made existing workers productive enough to curb new hiring."

"A few firms noted that artificial intelligence replaced entry-level positions or made existing workers productive enough to curb new hiring."

"Some may choose to use high-cost consumer credit to get through the holiday season. But others may choose to economize and scale down the holiday season spending."

www.spglobal.com/market-intel...

"Some may choose to use high-cost consumer credit to get through the holiday season. But others may choose to economize and scale down the holiday season spending."

www.spglobal.com/market-intel...

"Only 29% of large-cap equity mutual funds have outperformed their benchmarks YTD, compared to a 37% average since 2007. In an attempt to keep up with benchmarks, equity mutual funds have reduced their cash balances to just 1.2% of assets, a record low."

"Only 29% of large-cap equity mutual funds have outperformed their benchmarks YTD, compared to a 37% average since 2007. In an attempt to keep up with benchmarks, equity mutual funds have reduced their cash balances to just 1.2% of assets, a record low."

"That is likely an indicator of broader labor market weakness down the road, or given the lag, maybe now," says @deanbaker13.bsky.social

www.spglobal.com/market-intel...

"That is likely an indicator of broader labor market weakness down the road, or given the lag, maybe now," says @deanbaker13.bsky.social

www.spglobal.com/market-intel...

-Lower immigration

-Lower labor force participation

-Moderate economic growth

-Elevated uncertainty

-AI investments boosting productivity

www.federalreserve.gov/monetarypoli...

-Lower immigration

-Lower labor force participation

-Moderate economic growth

-Elevated uncertainty

-AI investments boosting productivity

www.federalreserve.gov/monetarypoli...

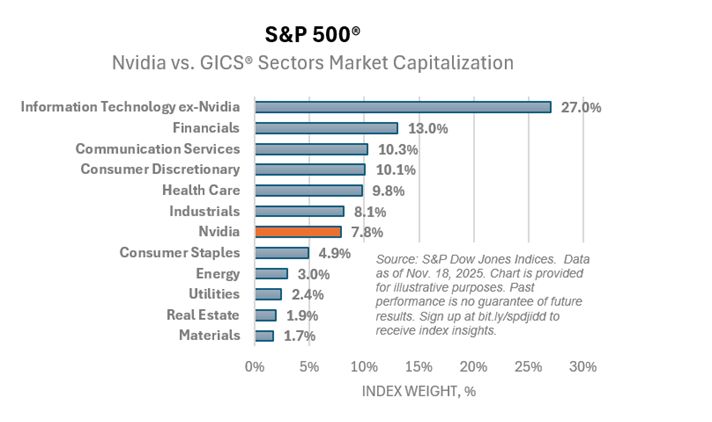

- Benedek Vörös w/ S&P Dow Jones Indices

- Benedek Vörös w/ S&P Dow Jones Indices

www.wsj.com/tech/ai/the-...

www.wsj.com/tech/ai/the-...

"The bull market isn't over. More new highs are coming, but cracks have developed beneath the surface, and that's a story for 2026."

www.spglobal.com/market-intel...

"The bull market isn't over. More new highs are coming, but cracks have developed beneath the surface, and that's a story for 2026."

www.spglobal.com/market-intel...

This streak dies tomorrow

Govt staff could not survey Americans about whether they're working or looking for work in Oct, the 1st time in 934 months

This blind spot will remain forever

On Tues, it couldn't release Sept job openings, hires, layoffs and firings data.

This morning, it couldn't release 2025Q3 business Productivity and Costs data.

Tomorrow, it can't release Oct 2025 #JobsReport

www.bls.gov/schedule/202...

This streak dies tomorrow

Govt staff could not survey Americans about whether they're working or looking for work in Oct, the 1st time in 934 months

This blind spot will remain forever

"Each of those developments in the derivatives space are noteworthy by themselves but not necessarily a reason to panic, however simultaneously combined, they are a more meaningful source of concern"

www.spglobal.com/market-intel...

"Each of those developments in the derivatives space are noteworthy by themselves but not necessarily a reason to panic, however simultaneously combined, they are a more meaningful source of concern"

www.spglobal.com/market-intel...

Goldman Sachs economists see US govt shutdown ending in mid-Nov with BLS releasing the September jobs report within a few days, possibly never releasing the October jobs report and then putting out the November jobs report on time or within a week delay

Goldman Sachs economists see US govt shutdown ending in mid-Nov with BLS releasing the September jobs report within a few days, possibly never releasing the October jobs report and then putting out the November jobs report on time or within a week delay

🔗 www.404media.co/libraries-sc...

🔗 www.404media.co/libraries-sc...

"Normally, risk appetite rejoices when the Fed pulls forward ... but in this case it might be more a sigh of relief that the Fed is taking note of repo strains"

www.spglobal.com/market-intel...

"Normally, risk appetite rejoices when the Fed pulls forward ... but in this case it might be more a sigh of relief that the Fed is taking note of repo strains"

www.spglobal.com/market-intel...

"What do you do if you're driving in the fog? You slow down."

"What do you do if you're driving in the fog? You slow down."