Multiple measures show poverty rates fell in 2024. However, they remain much higher than in 2021 when pandemic relief and the expanded #ChildTaxCredit lifted millions of families out of poverty, underscoring how policy choices shape hardship: www.cbpp.org/blog/analyzi...

September 12, 2025 at 7:31 PM

Everybody can reply

19 reposts

1 quotes

50 likes

2 saves

In 2024, #SNAP, SSI, the #ChildTaxCredit, housing vouchers, and #Medicaid lifted millions out of poverty, but the harmful Republican megabill and Trump Administration plans cut/would cut them, taking food, housing, and income support from millions. www.cbpp.org/blog/analyzi...

September 9, 2025 at 6:44 PM

Everybody can reply

5 reposts

10 likes

Over 80 organizations sent a letter to Senate leaders urging them to pass the bipartisan #ChildTaxCredit expansion that would benefit 1 in 3 Black/Latino children and 3 in 10 Indigenous American/Alaska Native children: nwlc.org/wp-content/u...

May 7, 2024 at 3:15 PM

Everybody can reply

Join the movement – Install the iGive extension today and turn your online shopping into impactful giving for CAN-DO!

Link: support.igive.com/igive-button/

#candonewton #onlineshopping #donation #affordablehousing #vitataxprep #VITATax #newtonma #supportservices #EITC #childtaxcredit #nonprofit

Link: support.igive.com/igive-button/

#candonewton #onlineshopping #donation #affordablehousing #vitataxprep #VITATax #newtonma #supportservices #EITC #childtaxcredit #nonprofit

December 15, 2024 at 6:11 PM

Everybody can reply

Tell your U.S. Senator: Expand the Child Tax Credit now! Make a call here:

actionnetwork.org/call_campaig...

#Politics #USPolitics #Economics #EconomicPolicy #ChildTaxCredit #CallYourSenators

actionnetwork.org/call_campaig...

#Politics #USPolitics #Economics #EconomicPolicy #ChildTaxCredit #CallYourSenators

Tell your U.S. Senator: Expand the Child Tax Credit now!

Earlier this year the House of Representatives passed a bipartisan tax package (the Tax Relief for American Families and Workers Act of 2024, H.R. 7024) which will temporarily expand the Child Tax Cre...

actionnetwork.org

September 8, 2024 at 5:32 PM

Everybody can reply

1 likes

Taxes Done Right.

Stress Free.

DM us for info.

#Taxes #FileTaxes #Refund #IncomeTax #IRS #ChildTaxCredit #TaxRefund #AdriFinancialAgency

Stress Free.

DM us for info.

#Taxes #FileTaxes #Refund #IncomeTax #IRS #ChildTaxCredit #TaxRefund #AdriFinancialAgency

January 27, 2025 at 1:30 AM

Everybody can reply

Even with federal policymaking on the #childtaxcredit potentially paralyzed, states have the opportunities to take action to address #healthequity for low-income families. @povertyscholar.bsky.social describes variation in state CTC policies in her latest piece: www.milbank.org/quarterly/op...

State Child Tax Credits Are a Crucial Lever for Equity | Milbank Memorial Fund

As we enter a new Presidential administration, the health and well-being of low-income families hangs in the balance. Many of the policies that offer

www.milbank.org

March 28, 2025 at 4:53 PM

Everybody can reply

3 reposts

3 likes

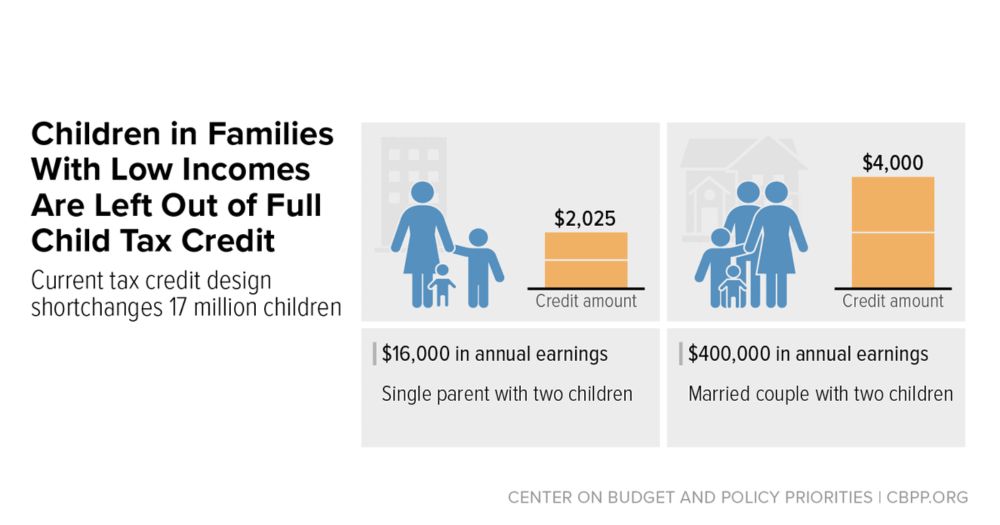

Extending the 2017 TCJA #ChildTaxCredit would do little for the estimated 17 million kids, or roughly 1 in 4 of all U.S. children, who don't get the full #CTC due to their families incomes being too low. Meanwhile, families making up to $400k can get the full credit.

www.cbpp.org/blog/policym...

www.cbpp.org/blog/policym...

Policymakers Should Expand the Child Tax Credit for the 17 Million Children Currently Left Out of the Full Credit | Center on Budget and Policy Priorities

Congressional Republicans may soon release a budget resolution that will set the terms of the tax debate, and which is expected to extend the 2017 tax law, including its changes to the Child Tax...

www.cbpp.org

February 5, 2025 at 9:22 PM

Everybody can reply

1 reposts

1 likes

Thank you @warnock.senate.gov and others for introducing the American Family Act. A ROBUST #ChildTaxCredit, like the one in the American Family Act, is one of the best ways to reduce child poverty and support Black and brown families.

gbpi.org/gbpi-applaud....

gbpi.org/gbpi-applaud....

GBPI Applauds Introduction of the American Family Act, 2025 - Georgia Budget and Policy Institute

Today, U.S. Senator Raphael Warnock introduced the American Family Act , which would expand the federal refundable child tax credit (CTC). This bill would enhance the credit so that it would increase ...

gbpi.org

April 14, 2025 at 1:13 PM

Everybody can reply

2 likes

“A new national report is raising the alarm about a sharp rise in Hawai‘i children living in poverty. The report by the @annieecaseyfdn.bsky.social shows child poverty has risen by one-third since the pandemic.”

#poverty #childtaxcredit #costofliving

www.hawaiinewsnow.com/2025/10/22/n...

#poverty #childtaxcredit #costofliving

www.hawaiinewsnow.com/2025/10/22/n...

New report shows significant increase in keiki poverty in Hawaii

The increase amounts to about 8,000 more children now living in poverty.

www.hawaiinewsnow.com

October 23, 2025 at 1:14 AM

Everybody can reply

1 reposts

4 likes

Welcome Back to School!

Get extra cash when you file your taxes.

Eligibility Tool: apps.irs.gov/app/eitc

Need help filing?

Call 617-906-7293 or email [email protected]

#vitatax #vitataxprep #freetaxprep #taxprep #EITC #eitcawareness

#CTC #EarnedIncomeCredit #ChildTaxCredit

Get extra cash when you file your taxes.

Eligibility Tool: apps.irs.gov/app/eitc

Need help filing?

Call 617-906-7293 or email [email protected]

#vitatax #vitataxprep #freetaxprep #taxprep #EITC #eitcawareness

#CTC #EarnedIncomeCredit #ChildTaxCredit

August 23, 2024 at 6:35 PM

Everybody can reply

1 likes

"COVID-era protections such as expanded #SNAP benefits, guaranteed #freebreakfasts & lunches for all school-aged kids in the country, and the #ChildTaxCredit all made demand at #foodpantries “plummet,” #FeedingAmerica President said. Rates of #childhoodpoverty were temporarily cut in half." #Edusky

Who uses SNAP the most? Working people, kids and seniors. We need to keep it | Editorial (Akron Beacon Journal)

Why do politicians insist on changing programs that work?

That’s the case with the latest Department of Agriculture cuts, which slashed over $1 billion in B...

l.smartnews.com

March 22, 2025 at 12:38 PM

Everybody can reply

CDF-MN’s Alexandra Fitzsimmons recently testified before lawmakers, urging them to enhance Minnesota's #childtaxcredit benefits to support the state's children, young people, and families. Watch and read: bit.ly/42iE7lR

March 27, 2025 at 2:20 AM

Everybody can reply

Eligible families can claim the #EITC with other tax credits. Research shows that children whose families receive income support, like the #EITC and the additional #ChildTaxCredit, experience stronger health, educational, and economic outcomes.

www.cbpp.org/research/fed...

www.cbpp.org/research/fed...

Income Support Associated With Improved Health Outcomes for Children, Many Studies Show | Center on Budget and Policy Priorities

Income significantly contributes to opportunities for good health.[1] People with higher incomes can more easily afford to meet the full range of their children’s needs, from nutritious food and...

www.cbpp.org

January 31, 2025 at 5:11 PM

Everybody can reply

House passes child tax credit bill that could give families a nearly $700 tax break as early as this year

Article:

www.cnbc.com/2024/02/01/h...

#vitatax #vitataxprep #freetaxprep #taxprep #EITC #eitcawareness #childtaxcredit #taxcredit #earnedincometaxcredit #childtaxcredit #CTC

Article:

www.cnbc.com/2024/02/01/h...

#vitatax #vitataxprep #freetaxprep #taxprep #EITC #eitcawareness #childtaxcredit #taxcredit #earnedincometaxcredit #childtaxcredit #CTC

March 7, 2024 at 12:52 AM

Everybody can reply

Anti-immigrant Republican budget proposals will hurt millions of families and children by reinstating the harsh public charge policy, stripping the #ChildTaxCredit from certain families, and restricting state-funded #Medicaid programs: www.cbpp.org/blog/republi...

Republican Budget Reconciliation Options Would Harm People Who Are Immigrants and Their Families | Center on Budget and Policy Priorities

In addition to the numerous anti-immigrant actions the Trump Administration has already taken, congressional Republicans are considering legislative anti-immigrant proposals. The House and Senate...

www.cbpp.org

March 3, 2025 at 8:15 PM

Everybody can reply

1 reposts

2 quotes

6 likes

A new effort by Sen. Ron Wyden (D-OR) and Rep. Jason Smith (R-MO) to modestly increase the Child Tax Credit is worthy of support, even though this new expansion isn't as robust as it was under the American Rescue Plan in 2021. #ChildTaxCredit

popular.info/p/the-least-...

popular.info/p/the-least-...

The least we can do

The pandemic created a unique political environment where, for a brief period of time, there was a working consensus that the government should try to help people. This resulted in a historic expansio...

popular.info

January 25, 2024 at 6:18 PM

Everybody can reply

Under the newly enacted American Rescue Plan, the #ChildTaxCredit, currently up to $2,000 a year per child until they turn 17, will increase to $3,600 for children under 6 and $3,000 for kids up to the age of 18 over the next 12 months....

November 25, 2024 at 3:15 AM

Everybody can reply

Starting July 15th, the #ChildTaxCredit in the American Rescue Plan will provide the largest Child Tax Credit ever!

Most US families will automatically receive monthly payments without having to take any action - learn more here:

https://www.whitehouse.gov/child-tax-credit/

Most US families will automatically receive monthly payments without having to take any action - learn more here:

https://www.whitehouse.gov/child-tax-credit/

November 16, 2024 at 6:07 PM

Everybody can reply

I know so many #GOP voters in #Florida who refused to vote for #KamalaHarris because she's a #Democrat even though they admitted #loanforgiveness & #childtaxcredit and #cleanenergy are good policies / And I'm startin' to feel a lot like Charlton Heston

Stranded on a primate planet #NOFX

Stranded on a primate planet #NOFX

April 15, 2025 at 4:02 AM

Everybody can reply

1 likes

🍎A #ChildTaxCredit and #UniversalBasicIncome allow families to be more nourished and secure!! #EndChildPoverty #California

OpenReseach examined the impact of the 2021 child tax credit expansion on families receiving monthly payments with a tax credit expanded to $3,600 per child. The study found that families spent $15 more a month on food while receiving these checks.

fortune.com/2024/12/05/excl...

fortune.com/2024/12/05/excl...

Sam Altman's OpenResearch examines child tax credit

The child tax credit could complement universal basic income.

fortune.com

December 10, 2024 at 1:05 PM

Everybody can reply

2 likes

Billy Shore of No Kid Hungry says child nutrition programs and the ##ChildTaxCredit "aren’t just good policy; they’re good politics, too."

Finally, This Election Season, Child Hunger is on the Table

Shore: With food prices unusually high, lawmakers on both sides of the aisle must come together and support an anti-hunger agenda.

www.the74million.org

October 28, 2024 at 6:36 PM

Everybody can reply

1 likes

Childhood poverty reached a record low in 2021 due in large part to federal programs. #ChildTaxCredit www.vox.com/future-perfe...

We cut child poverty to historic lows, then let it rebound faster than ever before

The expanded child tax credit was a well-tested solution to child poverty. Bring it back.

www.vox.com

December 11, 2024 at 2:30 AM

Everybody can reply

Minnesota's Senate Bill 2673 could change the tax game for families by repealing child tax credit provisions and altering filing requirements—are you prepared for the impact?

Click to read more!

#MN #TaxReform #FinancialWellbeing #ChildTaxCredit #MinnesotaFamilies #CitizenPortal

Click to read more!

#MN #TaxReform #FinancialWellbeing #ChildTaxCredit #MinnesotaFamilies #CitizenPortal

Minnesota to repeal child tax credit provisions starting in 2026

Minnesota repeals child tax credit provisions effective for tax years after December 2025.

citizenportal.ai

March 17, 2025 at 9:35 AM

Everybody can reply

Here's the proposal. You should be writing your senator about it. https://www.washingtonpost.com/us-policy/2021/01/22/biden-childtaxcredit-stimulus/

November 18, 2024 at 11:26 AM

Everybody can reply