I’d say I’m more analyst than investor, but trying to adapt/ learn.

I’d say I’m more analyst than investor, but trying to adapt/ learn.

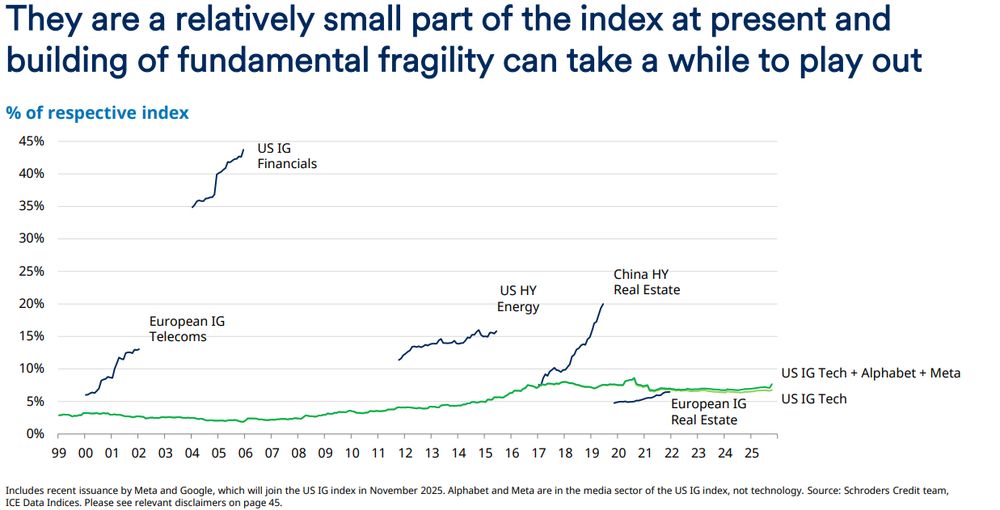

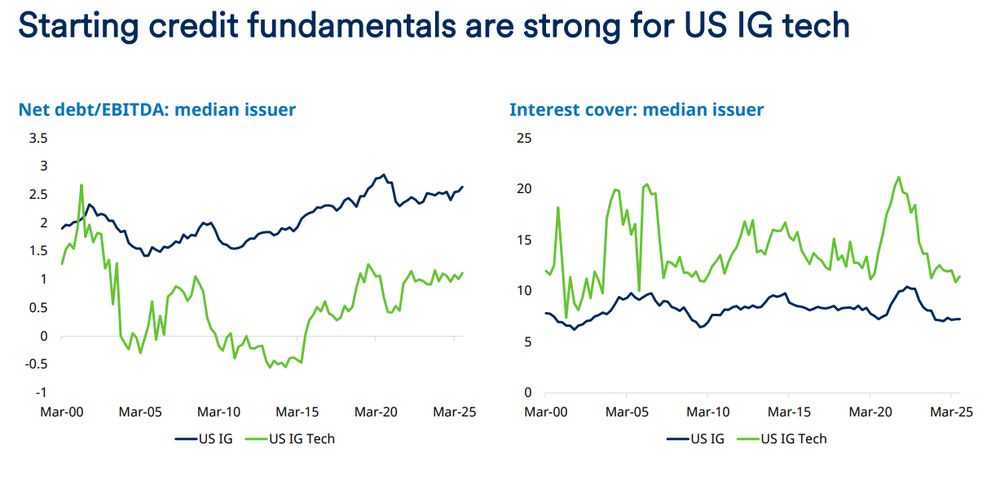

Debt/ equity and interest coverage is extremely favourable. Moreover tech is underrepresented in IG indices given how cash rich they’ve been until now!

Debt/ equity and interest coverage is extremely favourable. Moreover tech is underrepresented in IG indices given how cash rich they’ve been until now!

GPU rental costs

Utilisation rate

Depreciation length

Energy costs

Interest rate

Nadella explained, running a training shell isn’t a good enough business for Microsoft - inference which allows for cross selling is

GPU rental costs

Utilisation rate

Depreciation length

Energy costs

Interest rate

Nadella explained, running a training shell isn’t a good enough business for Microsoft - inference which allows for cross selling is

Semianalysis expects azure revenue to accelerate to 50% YoY by end 2026

Semianalysis expects azure revenue to accelerate to 50% YoY by end 2026

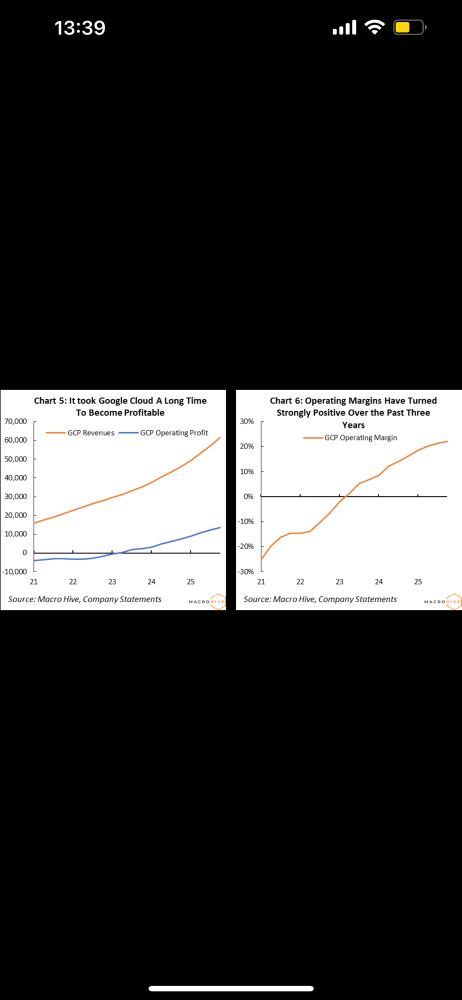

Back then, HBS suggested the IaaS cloud biz were commodities with no moats. The moat however is in services and scale!

Back then, HBS suggested the IaaS cloud biz were commodities with no moats. The moat however is in services and scale!

Again we don’t know if accelerated compute is a platform shift yet or not, but if it is then this is what could await! Why risk it?

Again we don’t know if accelerated compute is a platform shift yet or not, but if it is then this is what could await! Why risk it?

1) record inflows

2) western markets commanding a premium, not China

3) trades taking profit on gold, but staying long silver due to the arb

1) record inflows

2) western markets commanding a premium, not China

3) trades taking profit on gold, but staying long silver due to the arb

Pre-pandemic, a 3.5% hiring rate was more consistent with a 1.7% or so layoff rate. Today, that rate is just 1.2%.

Truly unique in recent history

Pre-pandemic, a 3.5% hiring rate was more consistent with a 1.7% or so layoff rate. Today, that rate is just 1.2%.

Truly unique in recent history

There’s a large segment of cyclical and economically sensitive part of the market doing well:

There’s a large segment of cyclical and economically sensitive part of the market doing well:

Each time this happened over the past few years, CESI was right and led

Each time this happened over the past few years, CESI was right and led