If the progress is material, then the benefit of switching is worth the activation energy.

If the progress is material, then the benefit of switching is worth the activation energy.

The AI industry spent 2025 convinced that pre-training scaling laws had hit a wall. Models weren’t improving just from adding more compute during training.

The AI industry spent 2025 convinced that pre-training scaling laws had hit a wall. Models weren’t improving just from adding more compute during training.

The answer is yes, or at least yes in our case. Here’s our current effort :

The answer is yes, or at least yes in our case. Here’s our current effort :

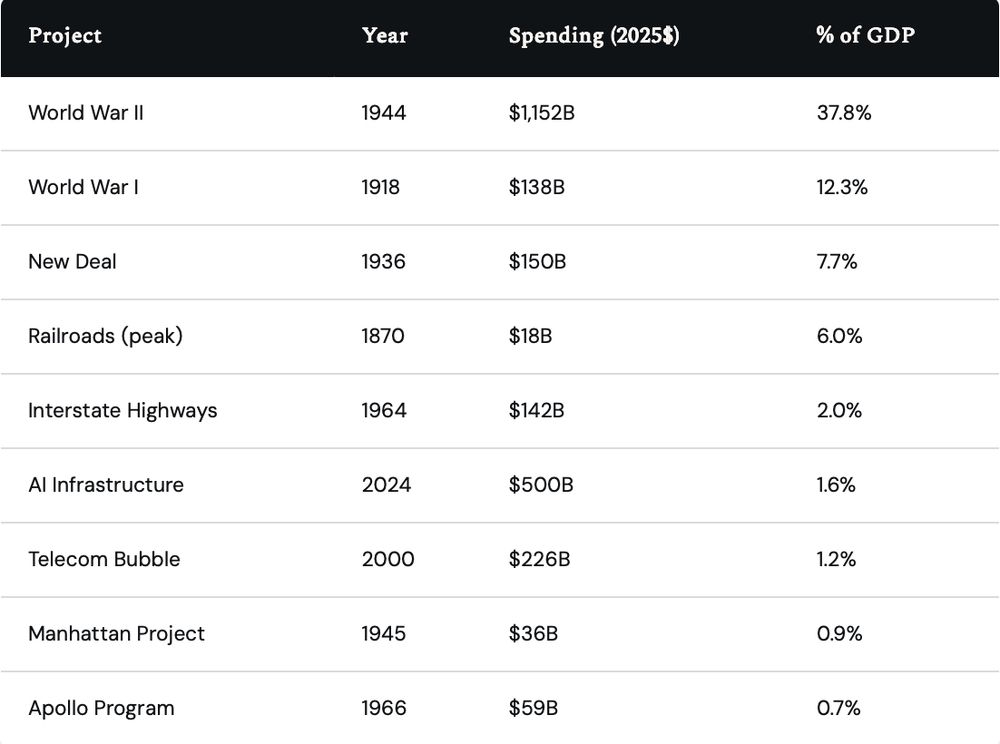

If we assume OpenAI represents 30% of the market, total AI infrastructure spending would reach $983B annually by 2030, or 2.8% of GDP.

If we assume OpenAI represents 30% of the market, total AI infrastructure spending would reach $983B annually by 2030, or 2.8% of GDP.

AI infrastructure today sits at 1.6%, just above the telecom bubble’s 1.2% & well below the major historical mobilizations.

AI infrastructure today sits at 1.6%, just above the telecom bubble’s 1.2% & well below the major historical mobilizations.

As the amount of data expands & I process more technology podcasts every day, I’m sure I’ll need a data lake. At that point, I can migrate to DuckLake.

Small data becomes big data faster than you know it.

As the amount of data expands & I process more technology podcasts every day, I’m sure I’ll need a data lake. At that point, I can migrate to DuckLake.

Small data becomes big data faster than you know it.

Aside from ease of use, there are real price-performance advantages. MotherDuck systems are two to four times faster than a Snowflake 3XL & from a tenth to a hundredth of the price.

Aside from ease of use, there are real price-performance advantages. MotherDuck systems are two to four times faster than a Snowflake 3XL & from a tenth to a hundredth of the price.

As I collect more & more podcast information, my data has grown. I’m using a larger instance of MotherDuck.

As I collect more & more podcast information, my data has grown. I’m using a larger instance of MotherDuck.

Both companies are spending at or above their cash positions on AI infrastructure. Microsoft is committing 137% of its cash reserves to annualized capex, while Google’s capex represents 93% of its cash position.

Both companies are spending at or above their cash positions on AI infrastructure. Microsoft is committing 137% of its cash reserves to annualized capex, while Google’s capex represents 93% of its cash position.

The answer is not much! All the fun is in the private markets.

Multiples haven’t moved outside of a narrow band since the post-Covid crash in 2022.

The answer is not much! All the fun is in the private markets.

Multiples haven’t moved outside of a narrow band since the post-Covid crash in 2022.