https://econweb.umd.edu/~drechsel/

The full paper can be found here: www.aeaweb.org/articles?id=...

Thank you to everyone who helped me write it back in the day 😊

The full paper can be found here: www.aeaweb.org/articles?id=...

Thank you to everyone who helped me write it back in the day 😊

I am looking forward to moderating the event

🕚 11 AM EDT / 5 PM CEST

💬 Can the #Fed move markets with #words alone? Find out in this groundbreaking #webinar with Amy Handlan (Brown) presenting "#Text #Shocks and #Monetary #Surprises," moderated by @tdecon.bsky.social

#EconTwitter #EconSky #AI #ML #NLP

I am looking forward to moderating the event

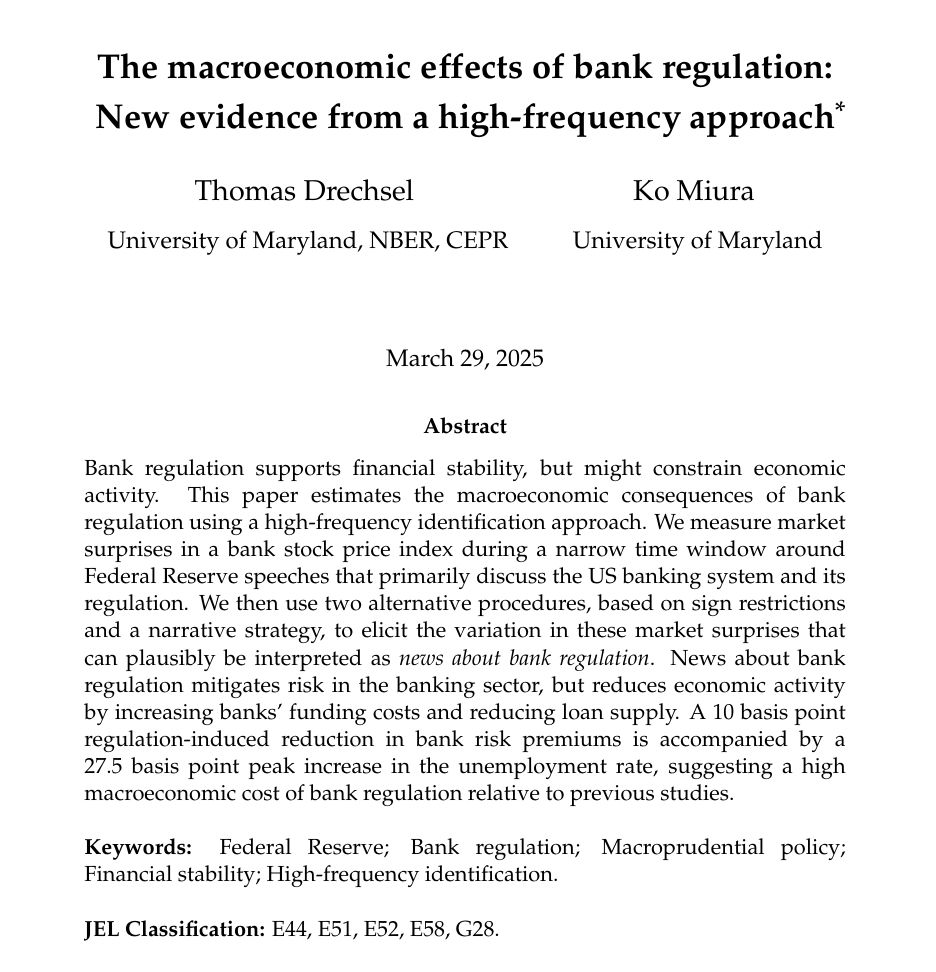

𝐓𝐡𝐞 𝐌𝐚𝐜𝐫𝐨𝐞𝐜𝐨𝐧𝐨𝐦𝐢𝐜 𝐄𝐟𝐟𝐞𝐜𝐭𝐬 𝐨𝐟 𝐁𝐚𝐧𝐤 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐢𝐨𝐧: 𝐍𝐞𝐰 𝐄𝐯𝐢𝐝𝐞𝐧𝐜𝐞 𝐟𝐫𝐨𝐦 𝐚 𝐇𝐢𝐠𝐡-𝐅𝐫𝐞𝐪𝐮𝐞𝐧𝐜𝐲 𝐀𝐩𝐩𝐫𝐨𝐚𝐜𝐡

Joint with Ko Miura

econweb.umd.edu/~drechsel/pa...

𝐓𝐡𝐞 𝐌𝐚𝐜𝐫𝐨𝐞𝐜𝐨𝐧𝐨𝐦𝐢𝐜 𝐄𝐟𝐟𝐞𝐜𝐭𝐬 𝐨𝐟 𝐁𝐚𝐧𝐤 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐢𝐨𝐧: 𝐍𝐞𝐰 𝐄𝐯𝐢𝐝𝐞𝐧𝐜𝐞 𝐟𝐫𝐨𝐦 𝐚 𝐇𝐢𝐠𝐡-𝐅𝐫𝐞𝐪𝐮𝐞𝐧𝐜𝐲 𝐀𝐩𝐩𝐫𝐨𝐚𝐜𝐡

Joint with Ko Miura

econweb.umd.edu/~drechsel/pa...

🗣️ @tdecon.bsky.social (@univofmaryland.bsky.social and @cepr.org)

⏰17:00

📍Online.

🔗https://s.mtrbio.com/ujbldhjhyj

🗃️ IMHOS seminar

#Economics #EconSky

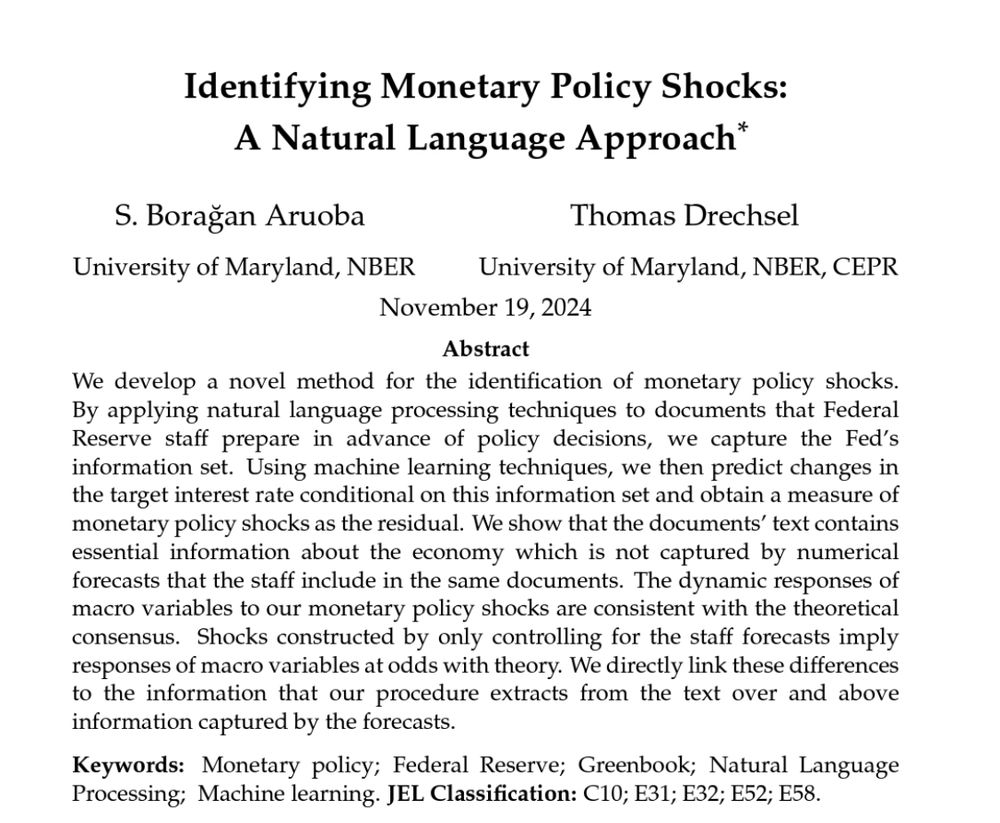

with Boragan Aruoba

was just conditionally accepted at AEJ:Macro!

Latest version:

econweb.umd.edu/~drechsel/pa...

Our estimated shocks, Fed sentiments & more are available here:

econweb.umd.edu/~drechsel/fi...

with Boragan Aruoba

was just conditionally accepted at AEJ:Macro!

Latest version:

econweb.umd.edu/~drechsel/pa...

Our estimated shocks, Fed sentiments & more are available here:

econweb.umd.edu/~drechsel/fi...

I will present my research on the economic consequences of political pressure on the Federal Reserve: econweb.umd.edu/~drechsel/pa...

I will present my research on the economic consequences of political pressure on the Federal Reserve: econweb.umd.edu/~drechsel/pa...

“I'll demand that interest rates drop immediately— and likewise, they should be dropping all over the world”

t.co/TqxNo1lUjZ

“I'll demand that interest rates drop immediately— and likewise, they should be dropping all over the world”

t.co/TqxNo1lUjZ

How often did US Presidents meet with Federal Reserve officials?

Figure shows large variation, e.g.

Clinton: 6x

Nixon: 160x

In the paper, I combine this new data with a narrative approach to gauge the economic effects of political pressure on the Fed

How often did US Presidents meet with Federal Reserve officials?

Figure shows large variation, e.g.

Clinton: 6x

Nixon: 160x

In the paper, I combine this new data with a narrative approach to gauge the economic effects of political pressure on the Fed

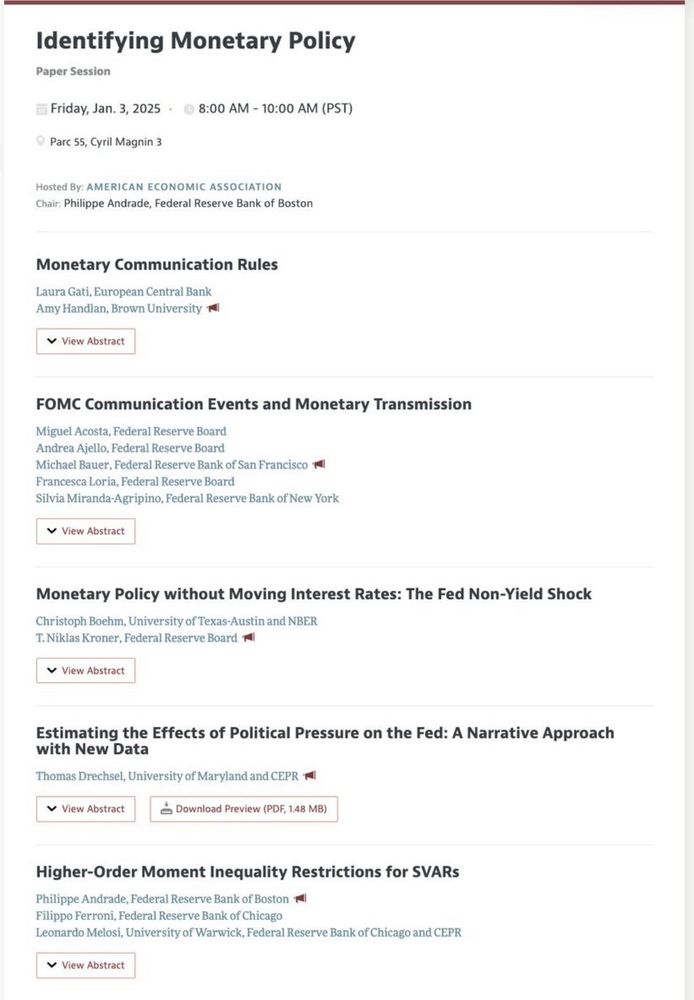

Check out this nice session on Friday morning: "Identifying Monetary Policy"

With presentations by Amy Handlan @michaeldbauer.bsky.social @kronerniklas.bsky.social myself and Philippe Andrade

Thank you Philippe for organizing! #ASSA2025

Check out this nice session on Friday morning: "Identifying Monetary Policy"

With presentations by Amy Handlan @michaeldbauer.bsky.social @kronerniklas.bsky.social myself and Philippe Andrade

Thank you Philippe for organizing! #ASSA2025

"Identifying Monetary Policy Shocks: A Natural

Language Approach" - with Boragan Aruoba

We use natural language processing techniques to identify monetary policy shocks!

Paper available here: econweb.umd.edu/~drechsel/pa...

"Identifying Monetary Policy Shocks: A Natural

Language Approach" - with Boragan Aruoba

We use natural language processing techniques to identify monetary policy shocks!

Paper available here: econweb.umd.edu/~drechsel/pa...

www.econ.umd.edu/graduate/job...

www.econ.umd.edu/graduate/job...

In the paper, I estimate the effects of political pressure on the Fed through time, using new data

Link to the full paper here:

econweb.umd.edu/~drechsel/pa...

In the paper, I estimate the effects of political pressure on the Fed through time, using new data

Link to the full paper here:

econweb.umd.edu/~drechsel/pa...

We show that higher income inequality tightens financing conditions for bank-dependent firms compared to those accessing stock/bond markets

The reason is that high income households tend to save in stocks/bonds instead of deposits

We show that higher income inequality tightens financing conditions for bank-dependent firms compared to those accessing stock/bond markets

The reason is that high income households tend to save in stocks/bonds instead of deposits