A better fix is abolishing NICs on all pension contributions and removing pensioners' NIC exemption (best fix: combine NI & income tax).

A better fix is abolishing NICs on all pension contributions and removing pensioners' NIC exemption (best fix: combine NI & income tax).

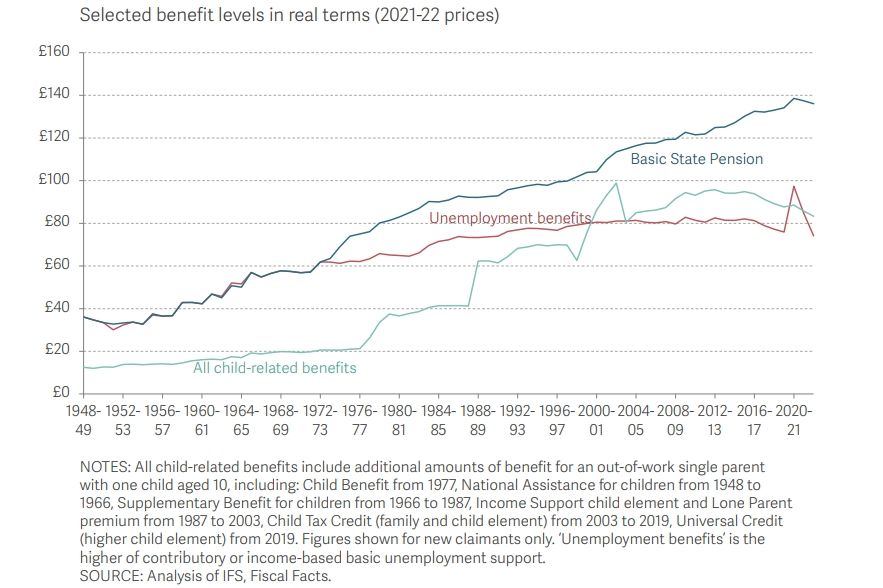

Lowest earners are better off with pensioner than non-pensioner benefits.

A couple needs ~full state pensions + ~£140k pension pot each at retirement to hit median after housing costs living standards. Median 55 y/o pension wealth is ~£80k; ~on track, even with no more pension savings?

Lowest earners are better off with pensioner than non-pensioner benefits.

A couple needs ~full state pensions + ~£140k pension pot each at retirement to hit median after housing costs living standards. Median 55 y/o pension wealth is ~£80k; ~on track, even with no more pension savings?

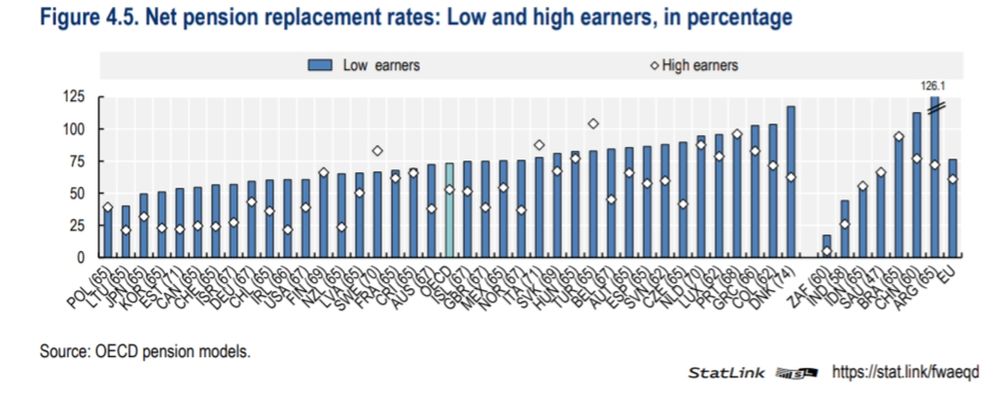

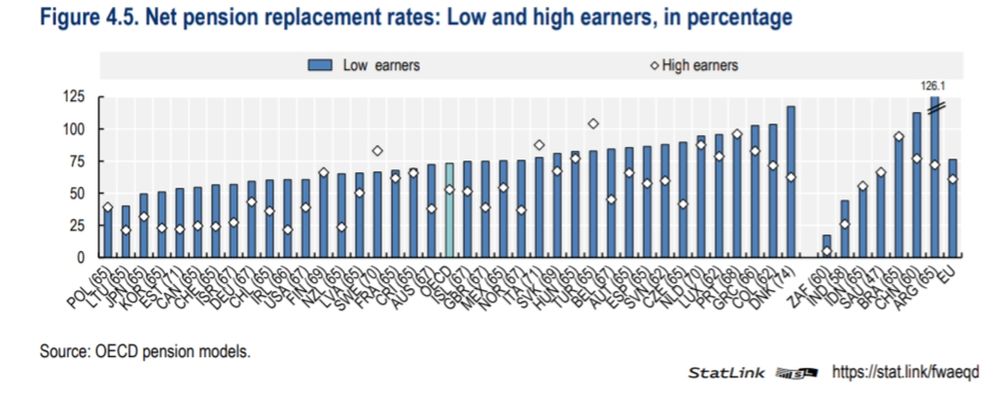

You can also compare UK state pension provision for low earners to other countries; they compare more favourably than median earners.

You can also compare UK state pension provision for low earners to other countries; they compare more favourably than median earners.

If they don't have greater needs than someone a few years younger, they shouldn't be provided with a more generous safety net: those relying on the safety net shouldn't receive lower payments until they hit an arbitrary "retirement age".

If they don't have greater needs than someone a few years younger, they shouldn't be provided with a more generous safety net: those relying on the safety net shouldn't receive lower payments until they hit an arbitrary "retirement age".

But overall, great news to see a move away from means testing!

But overall, great news to see a move away from means testing!

If I had to choose, I'd much rather live off £1,000 a month, than £400 a month on Universal Credit's standard allowance.

I'm not arguing for more inequality, I'm arguing against prioritising better off groups for more Gov spending.

If I had to choose, I'd much rather live off £1,000 a month, than £400 a month on Universal Credit's standard allowance.

I'm not arguing for more inequality, I'm arguing against prioritising better off groups for more Gov spending.

There's less poverty among pensioners than non-pensioners. Pensioner-only benefits just aren't a sensible priority for more Government spending.

There's less poverty among pensioners than non-pensioners. Pensioner-only benefits just aren't a sensible priority for more Government spending.

The result for low-earners (which is most relevant for pensioner benefits discussions) is slightly above average in any case, so for simplicity "around average" seems about right.

The result for low-earners (which is most relevant for pensioner benefits discussions) is slightly above average in any case, so for simplicity "around average" seems about right.

These trade-offs exist, we're not in a utopia of limitless consumption yet sadly.

These trade-offs exist, we're not in a utopia of limitless consumption yet sadly.

Which isn't a sensible priority, when non-pensioner benefits are lower

Which isn't a sensible priority, when non-pensioner benefits are lower

I'd certainly much rather live off ~£1,000 per month, than universal credit's standard allowance of ~£400 per month for a single person.

I'd certainly much rather live off ~£1,000 per month, than universal credit's standard allowance of ~£400 per month for a single person.