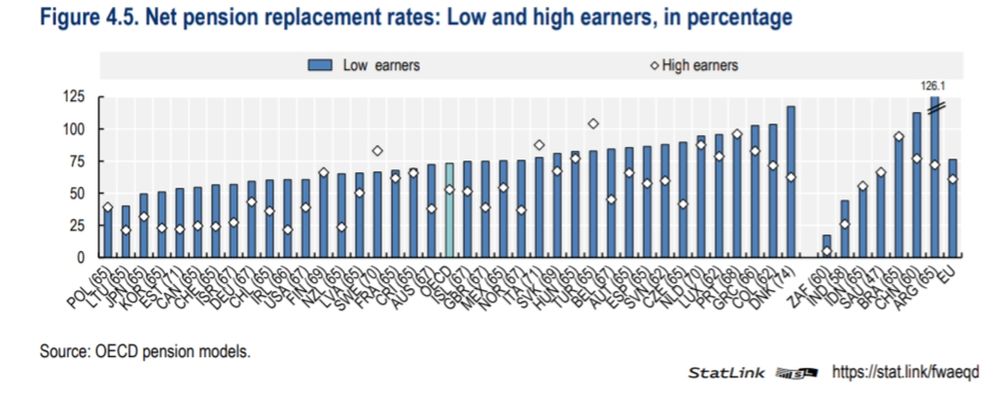

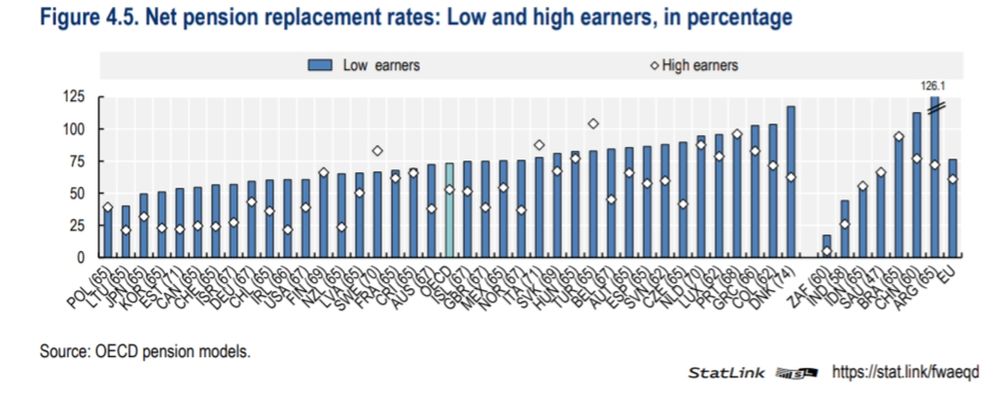

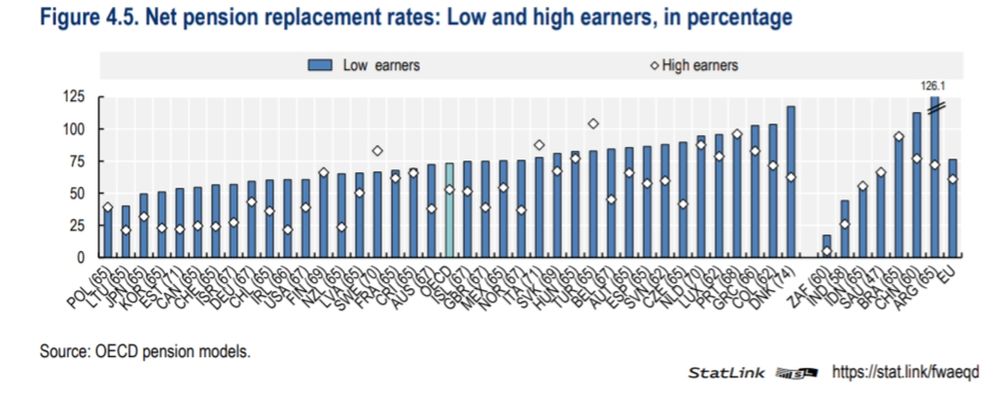

You can also compare UK state pension provision for low earners to other countries; they compare more favourably than median earners.

You can also compare UK state pension provision for low earners to other countries; they compare more favourably than median earners.

The result for low-earners (which is most relevant for pensioner benefits discussions) is slightly above average in any case, so for simplicity "around average" seems about right.

The result for low-earners (which is most relevant for pensioner benefits discussions) is slightly above average in any case, so for simplicity "around average" seems about right.

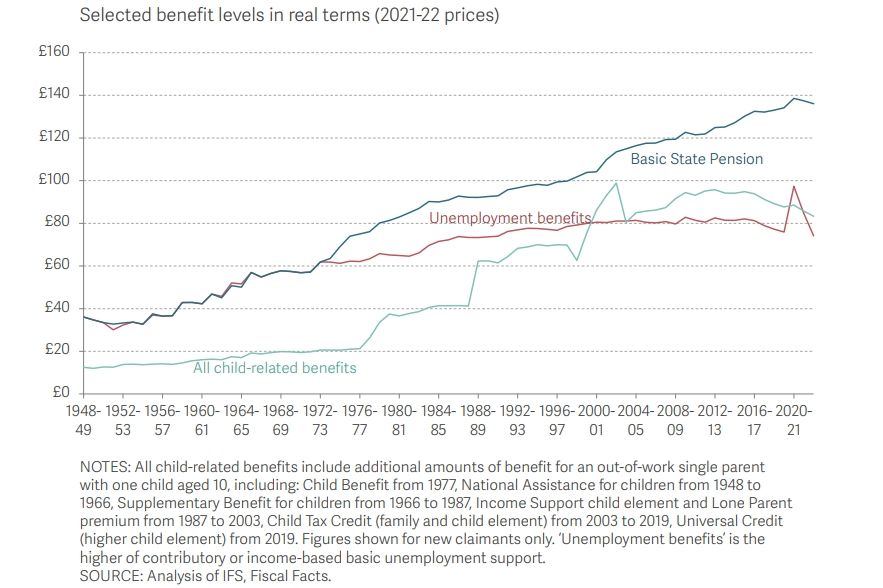

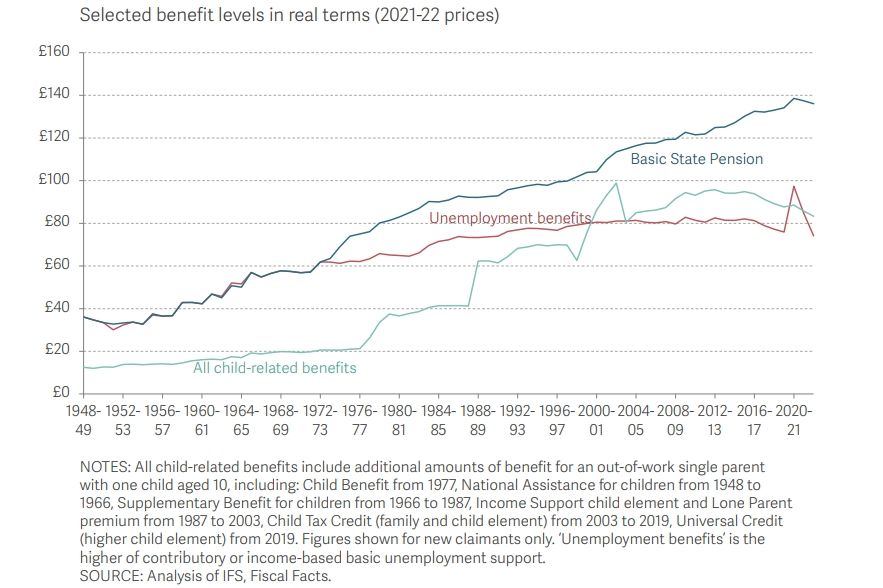

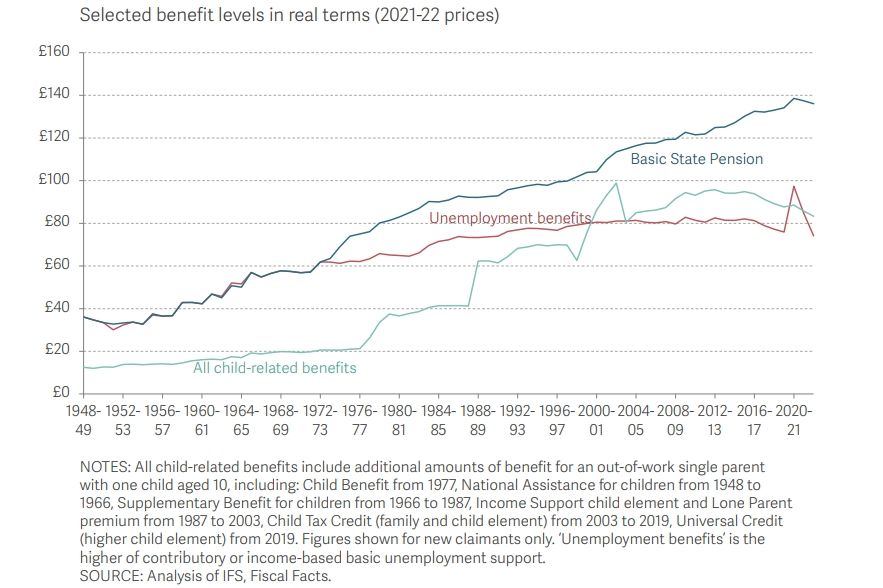

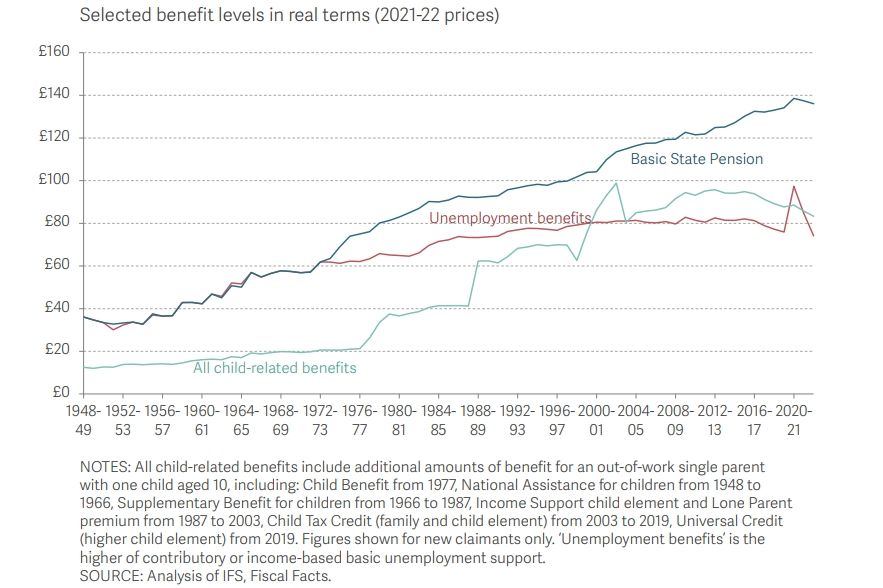

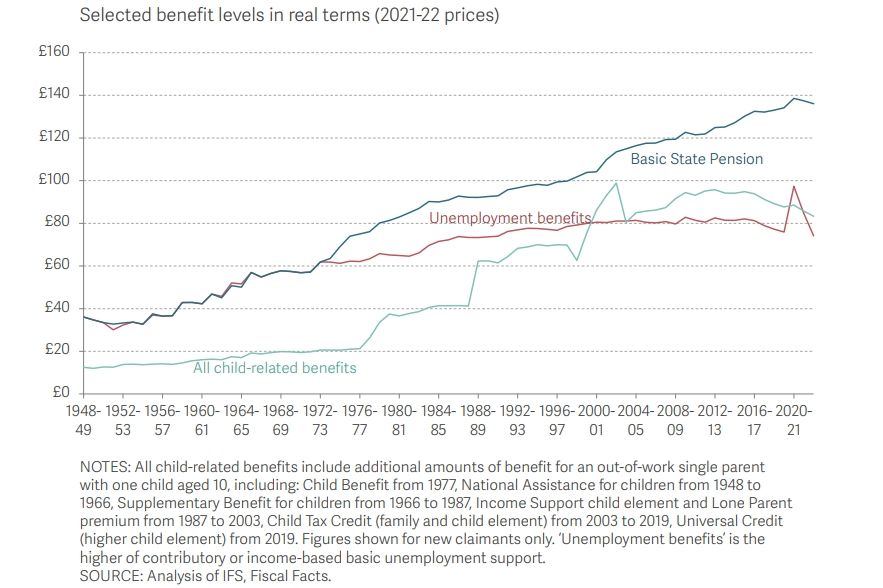

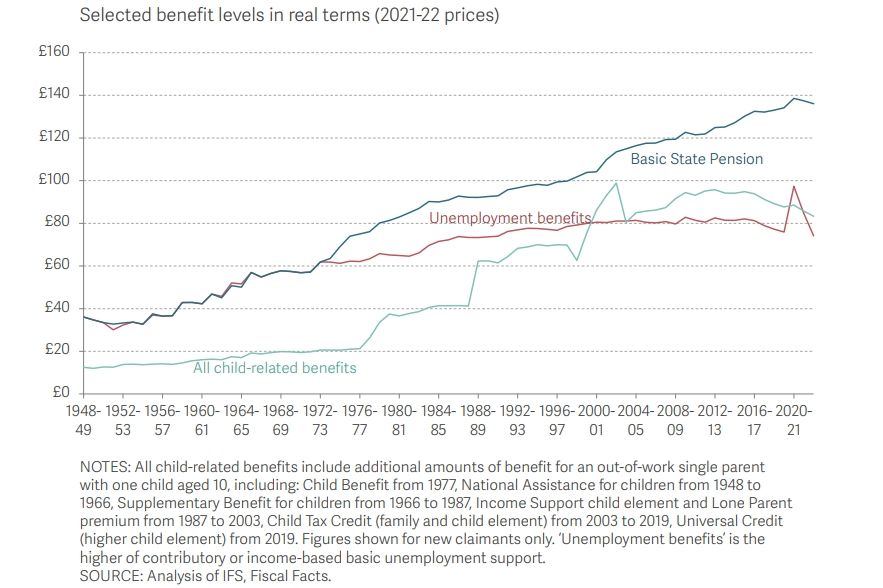

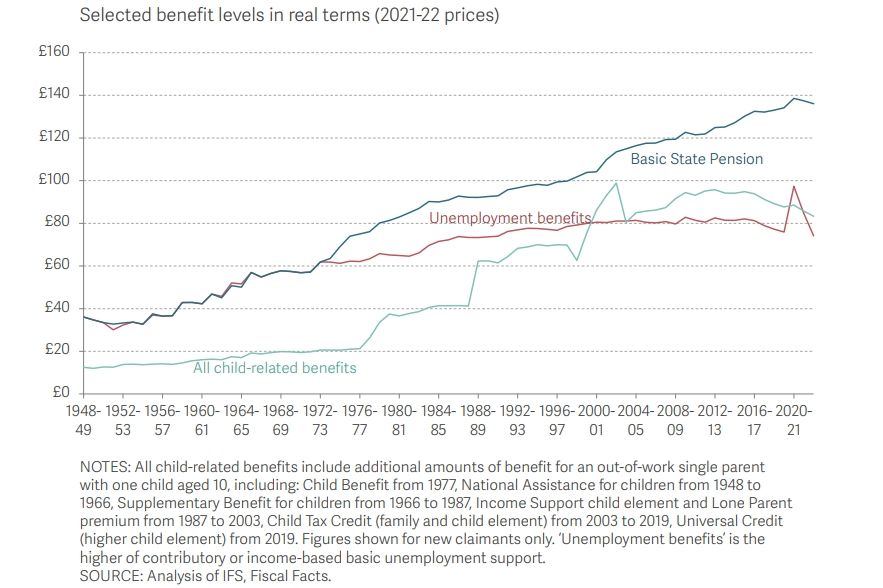

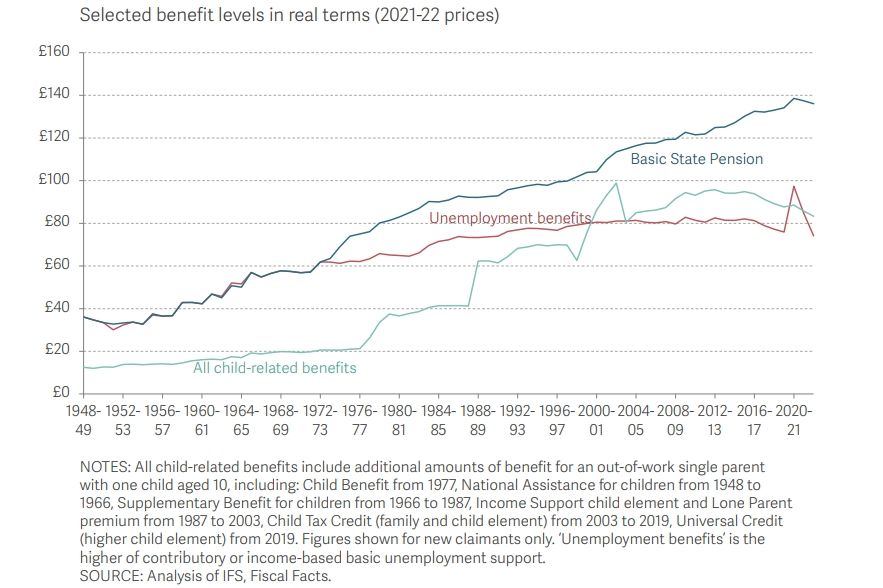

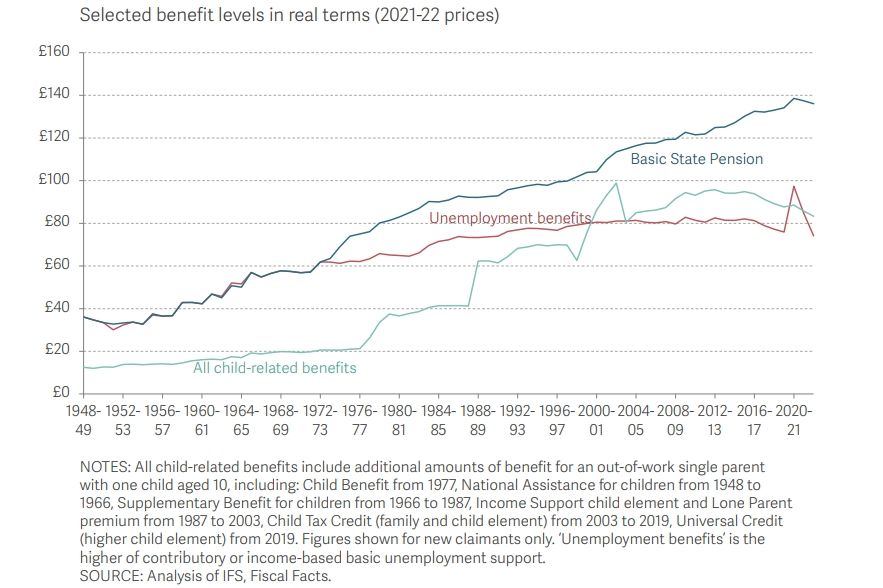

The second is whole-income. I completely agree that it's not the correct comparator for the state pension (it moves onto other points), which is non-pensioner benefits, which are much lower (hence no one likes raising SPA!).

The second is whole-income. I completely agree that it's not the correct comparator for the state pension (it moves onto other points), which is non-pensioner benefits, which are much lower (hence no one likes raising SPA!).

1. They ignore implicit rental incomes from property (average pensioner owns their home outright).

2. They ignore the costs of raising children.

1. They ignore implicit rental incomes from property (average pensioner owns their home outright).

2. They ignore the costs of raising children.

But the key point is that average non-pensioners are roughly as well off as average pensioners, but there's much fewer low-income pensioners than non-pensioners.

But the key point is that average non-pensioners are roughly as well off as average pensioners, but there's much fewer low-income pensioners than non-pensioners.

Pensioner poverty's lower than non-pensioner, they're not a sensible priority.

Pensioner poverty's lower than non-pensioner, they're not a sensible priority.

Not that higher is always better in these cases. The money needs to come from somewhere. So is the aim to eg raise pensioner benefits, and also pensioner-only taxes on the better off?

Not that higher is always better in these cases. The money needs to come from somewhere. So is the aim to eg raise pensioner benefits, and also pensioner-only taxes on the better off?

Make the right comparisons, and the UK's mid-range.

Make the right comparisons, and the UK's mid-range.

Close that gap, and most of these discussions disappear, replaced with a discussion on the right level for that combined safety net.

Close that gap, and most of these discussions disappear, replaced with a discussion on the right level for that combined safety net.

I.e. including changes in benefits received, as well as changes in tax paid. It leads to some significantly different shapes.

I.e. including changes in benefits received, as well as changes in tax paid. It leads to some significantly different shapes.

About the same as the country as a whole. Pensioners aren't especially cash-strapped, they have roughly the same incomes as everyone else.

About the same as the country as a whole. Pensioners aren't especially cash-strapped, they have roughly the same incomes as everyone else.