Thanks for getting this far! Please read the paper, circulate to those who might be interested, and let us know what you think.

/Fin

Thanks for getting this far! Please read the paper, circulate to those who might be interested, and let us know what you think.

/Fin

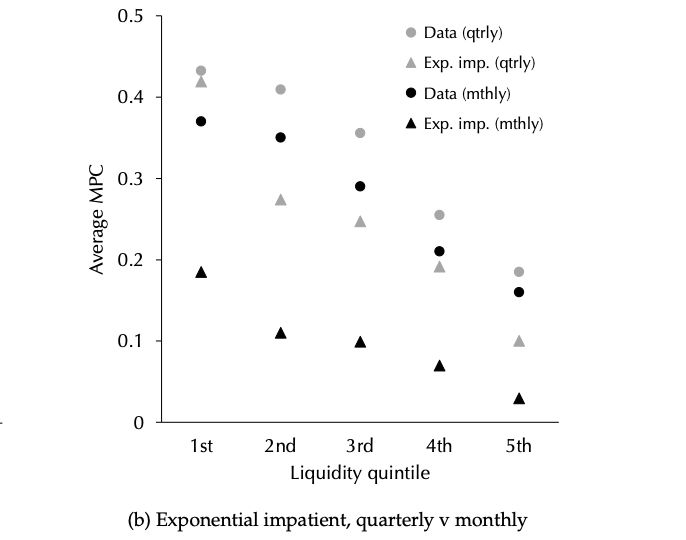

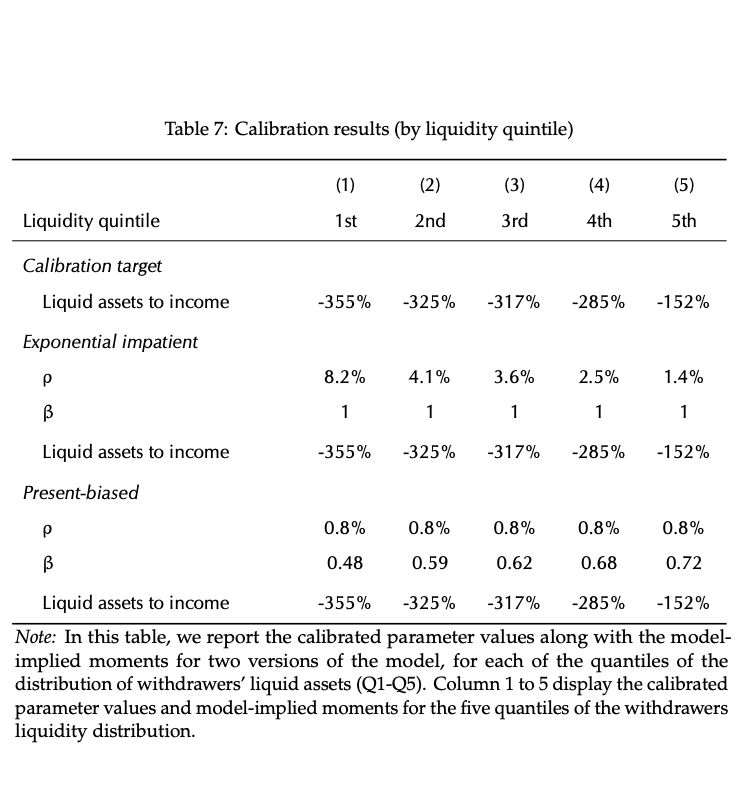

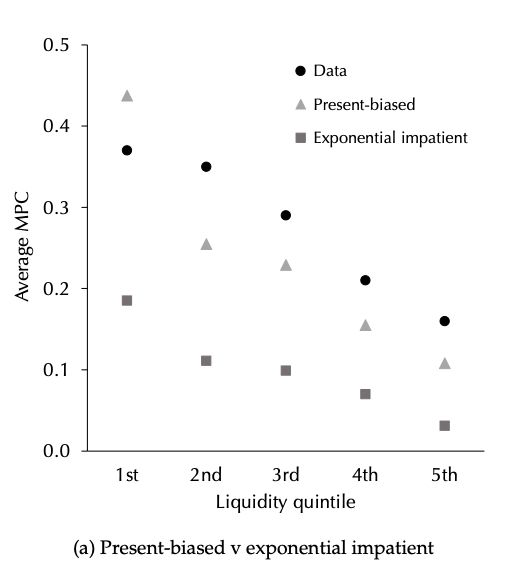

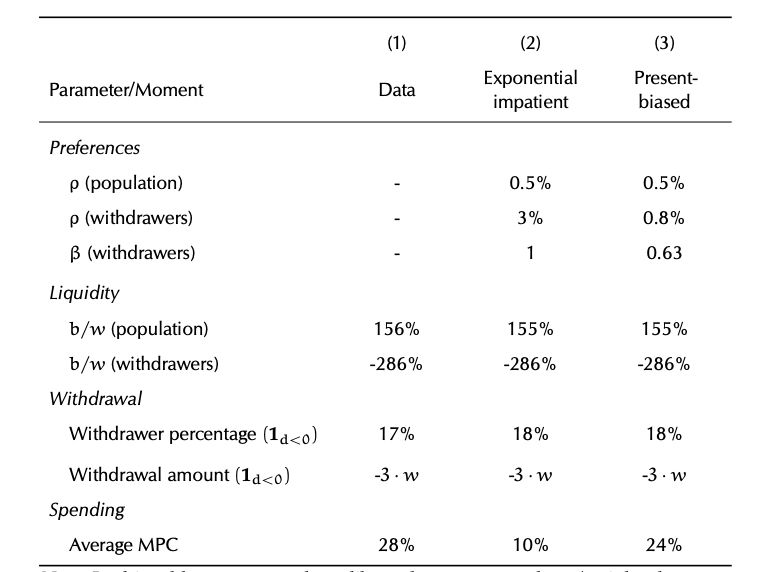

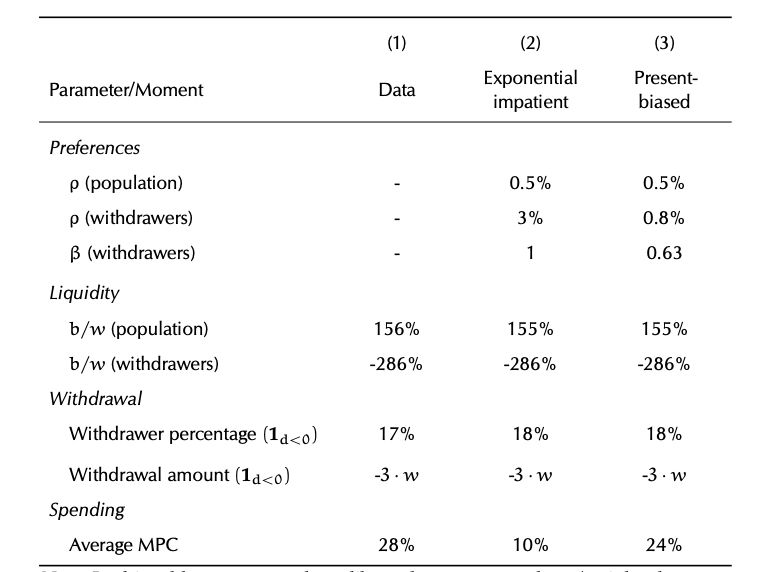

We compare two types of preferences in the model: heterogeneous exponential discounting (impatience) and heterogeneous hyperbolic discounting (present bias).

We compare two types of preferences in the model: heterogeneous exponential discounting (impatience) and heterogeneous hyperbolic discounting (present bias).

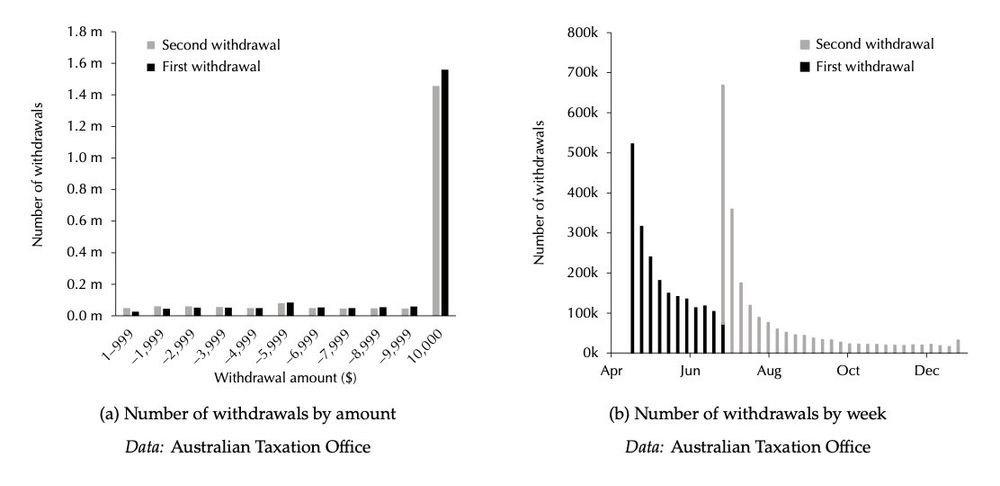

1) strong selection into withdrawing retirement savings on the basis of poor financial health; and

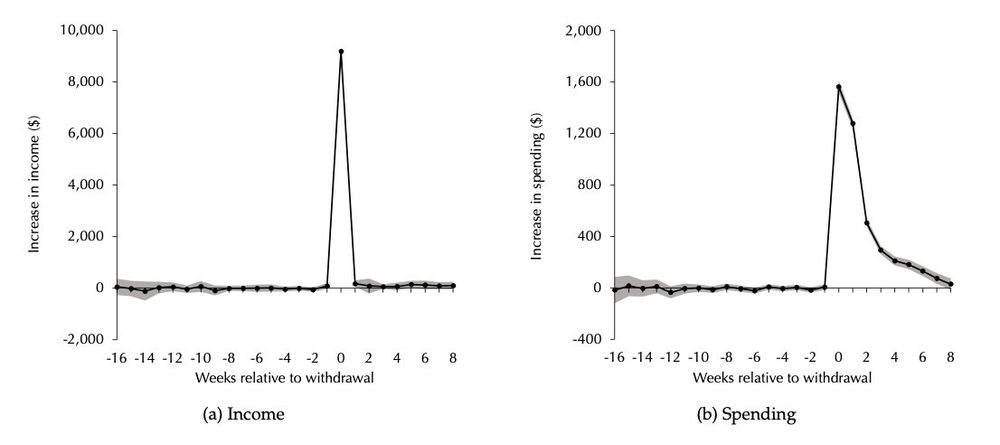

2) a very large and sharp spending response, positively correlated with selection.

1) strong selection into withdrawing retirement savings on the basis of poor financial health; and

2) a very large and sharp spending response, positively correlated with selection.