Thoughts are things. Choose the good ones.

awealthofcommonsense.com/2025/01/is-t...

awealthofcommonsense.com/2025/01/is-t...

Look at this metric:

- % S&P 500 with RSI below 30 (yesterday): 31.5%

- % S&P 500 with RSI below 30 (9/30/22) : 31.9%

👇

Look at this metric:

- % S&P 500 with RSI below 30 (yesterday): 31.5%

- % S&P 500 with RSI below 30 (9/30/22) : 31.9%

👇

www.youtube.com/watch?v=--l_...

www.youtube.com/watch?v=--l_...

Just don’t call him a Bond King.

Brand new epic edition of The Compound and Friends. We love you, Merry Christmas 🎄

podcasts.thecompoundnews.com/show/TCAF/is...

Just don’t call him a Bond King.

Brand new epic edition of The Compound and Friends. We love you, Merry Christmas 🎄

podcasts.thecompoundnews.com/show/TCAF/is...

👉 We have had 5 in the current bull run.

Meaning, it would be normal if we saw several more pullbacks before this bull market ends.

👇

👉 We have had 5 in the current bull run.

Meaning, it would be normal if we saw several more pullbacks before this bull market ends.

👇

- Blue bars are sector returns YTD

- Red dots are avg return of stock within sector

- Bottom shows over/under performance of the average stock vs its sector.

The best sectors YTD also have their average stocks underperforming sharply.

👇

- Blue bars are sector returns YTD

- Red dots are avg return of stock within sector

- Bottom shows over/under performance of the average stock vs its sector.

The best sectors YTD also have their average stocks underperforming sharply.

👇

1. Annoying mistakes (investing in underperforming funds)

2. Self-inflicted mistakes (high fees, over-trading, etc)

3. Painful mistakes (sell at the bottom of a bear market)

4. Endgame mistakes (fraud, losing it all)

awealthofcommonsense.com/2024/12/the-...

1. Annoying mistakes (investing in underperforming funds)

2. Self-inflicted mistakes (high fees, over-trading, etc)

3. Painful mistakes (sell at the bottom of a bear market)

4. Endgame mistakes (fraud, losing it all)

awealthofcommonsense.com/2024/12/the-...

1️⃣ The S&P 500 has gained 20%+ for two straight years

Three 20%+ years hasn't happened outside of the 1990

But are stocks doomed? Not necessarily.

Big gains happen more often than you think.

1️⃣ The S&P 500 has gained 20%+ for two straight years

Three 20%+ years hasn't happened outside of the 1990

But are stocks doomed? Not necessarily.

Big gains happen more often than you think.

But the internals paint a rosier picture.

- 55% of stocks are advancing in the index.

Not as "risk off" within.

👇

But the internals paint a rosier picture.

- 55% of stocks are advancing in the index.

Not as "risk off" within.

👇

via Chart Kid @mattcerminaro.bsky.social

via Chart Kid @mattcerminaro.bsky.social

Highly recommend giving this a listen 🎧

👇

youtu.be/oqzryxsLp64?...

Highly recommend giving this a listen 🎧

👇

youtu.be/oqzryxsLp64?...

Contrarian investing ideas from one of my favorite people on Wall Street

podcasts.thecompoundnews.com/show/TCAF/th...

Contrarian investing ideas from one of my favorite people on Wall Street

podcasts.thecompoundnews.com/show/TCAF/th...

That's just not true.

I brought the data. In 2H 2024:

- The S&P 500 is +11.8%

- But the average S&P 500 stock is +13.7%

So the average stock is outperforming the index in 2H by 2%.

Next time you hear the "narrow market" narrative, reference this.

👇

That's just not true.

I brought the data. In 2H 2024:

- The S&P 500 is +11.8%

- But the average S&P 500 stock is +13.7%

So the average stock is outperforming the index in 2H by 2%.

Next time you hear the "narrow market" narrative, reference this.

👇

Manufacturing has fallen from 20% to 10% of US GDP over the last 50 years.

@mattcerminaro.bsky.social:

Manufacturing has fallen from 20% to 10% of US GDP over the last 50 years.

@mattcerminaro.bsky.social:

8/12 categories cheaper this year vs last year.

👇

8/12 categories cheaper this year vs last year.

👇

You can’t make this up 😂

You can’t make this up 😂

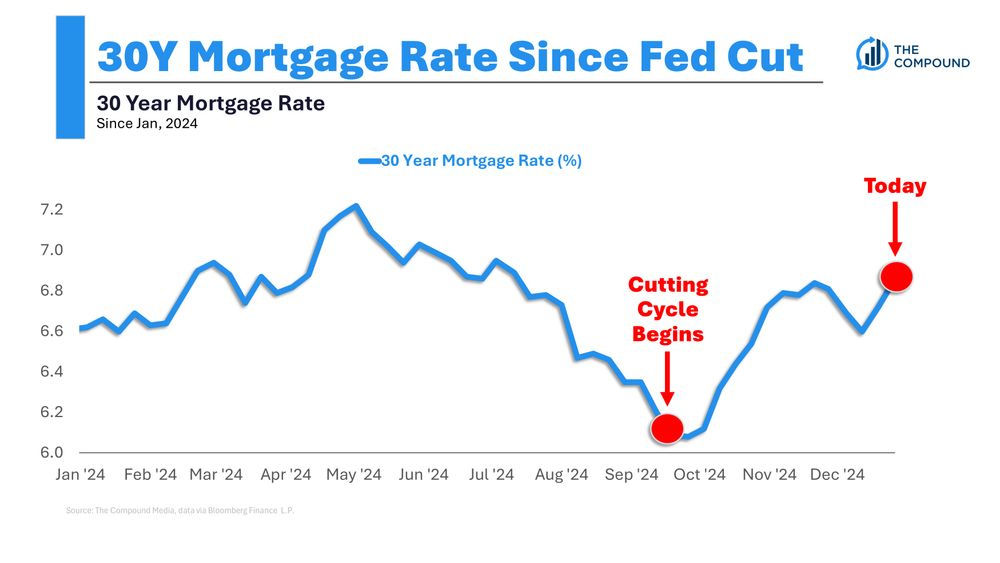

Yes, the economy is under a lot of pressure and rates are high across the board, but some combo of Fed cuts/politics/momentum has suddenly made Americans more optimistic about the future...

Yes, the economy is under a lot of pressure and rates are high across the board, but some combo of Fed cuts/politics/momentum has suddenly made Americans more optimistic about the future...

8/12 categories cheaper this year vs last year.

👇

8/12 categories cheaper this year vs last year.

👇

- New high in S&P 500 price

- New high in S&P 500 breadth

No divergence there.

✅ for bulls.

👇

- New high in S&P 500 price

- New high in S&P 500 breadth

No divergence there.

✅ for bulls.

👇