Check out the key points in the thread below 👇

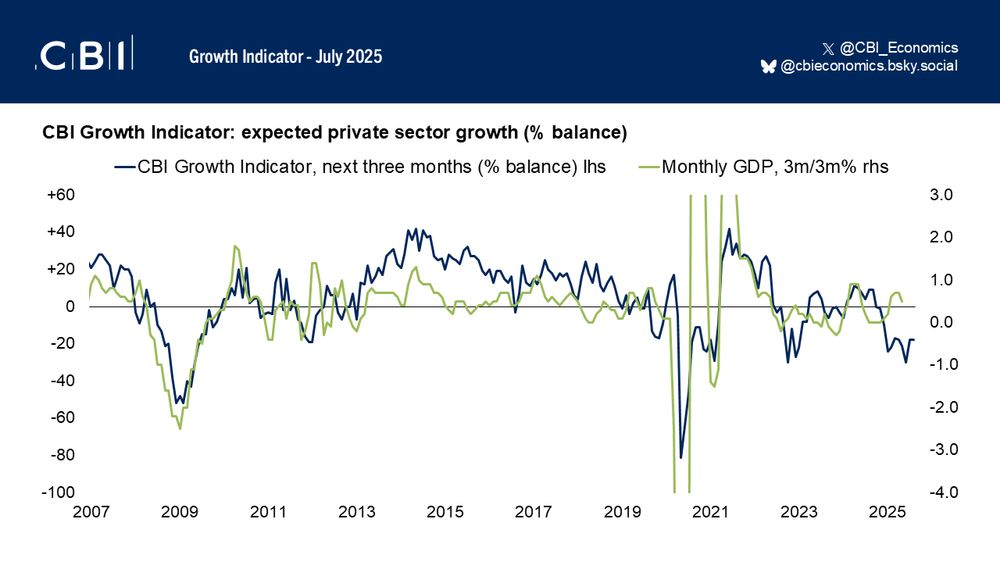

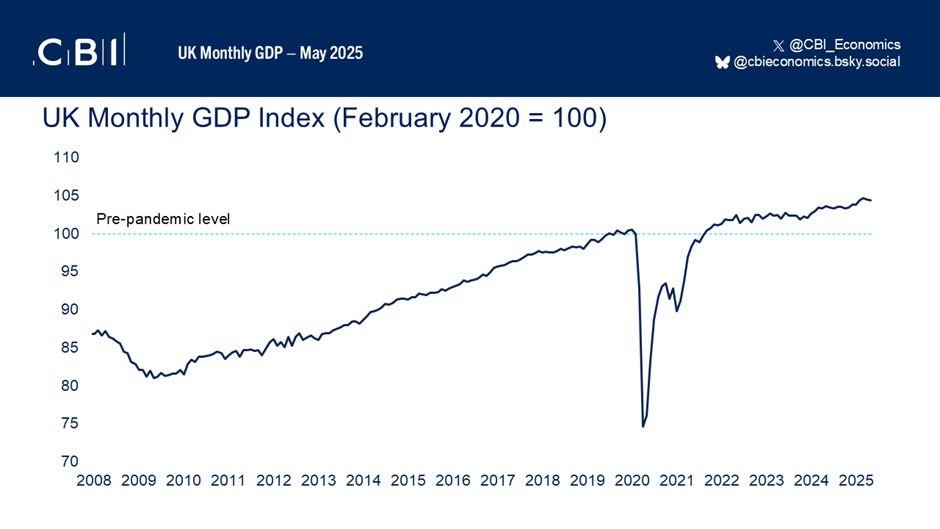

We project UK #GDP growth of 1.4% in 2025, 1.3% in 2026, and 1.5% in 2027. Moderate growth masks continued subdued momentum in household spending and business investment, while longer-term prospects remain constrained by weak productivity.

🧵👇

Check out the key points in the thread below 👇

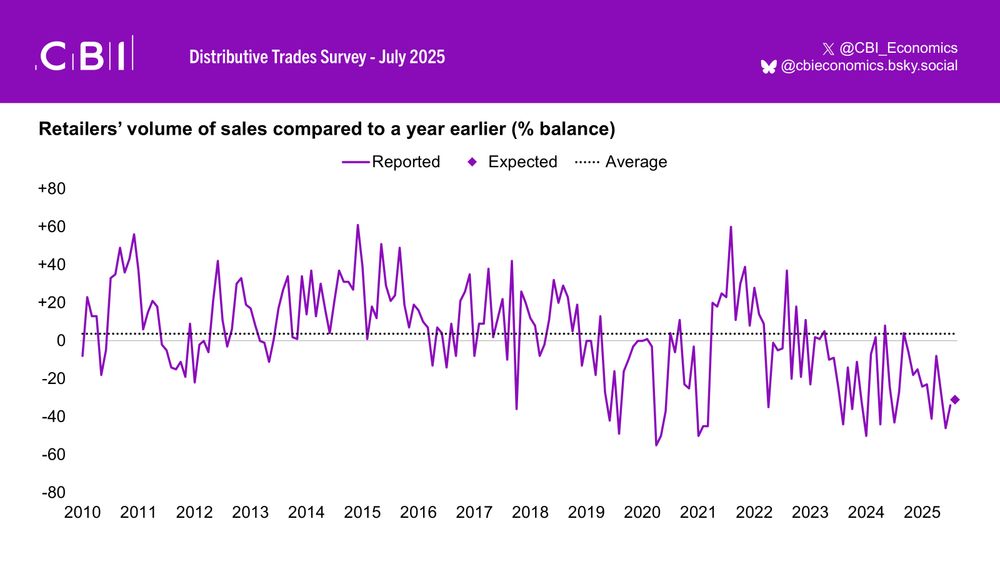

Check out the key figures from the latest CBI DTS 👇

Check out the key figures from the latest CBI DTS 👇

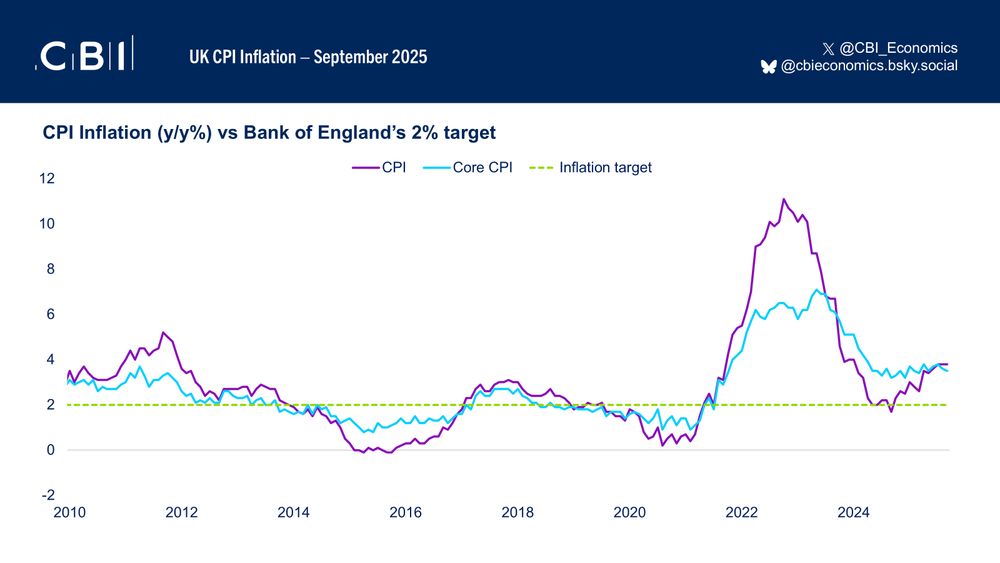

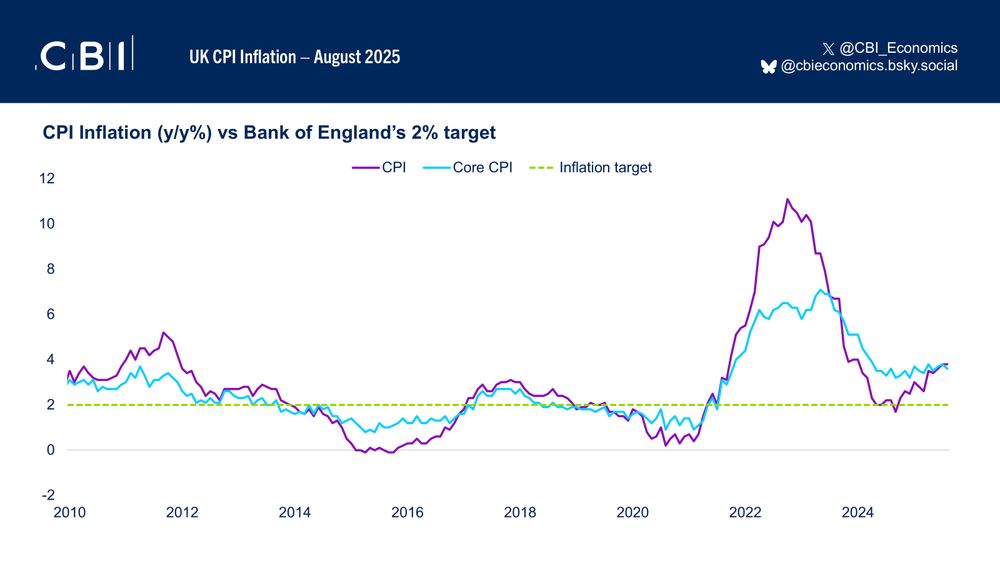

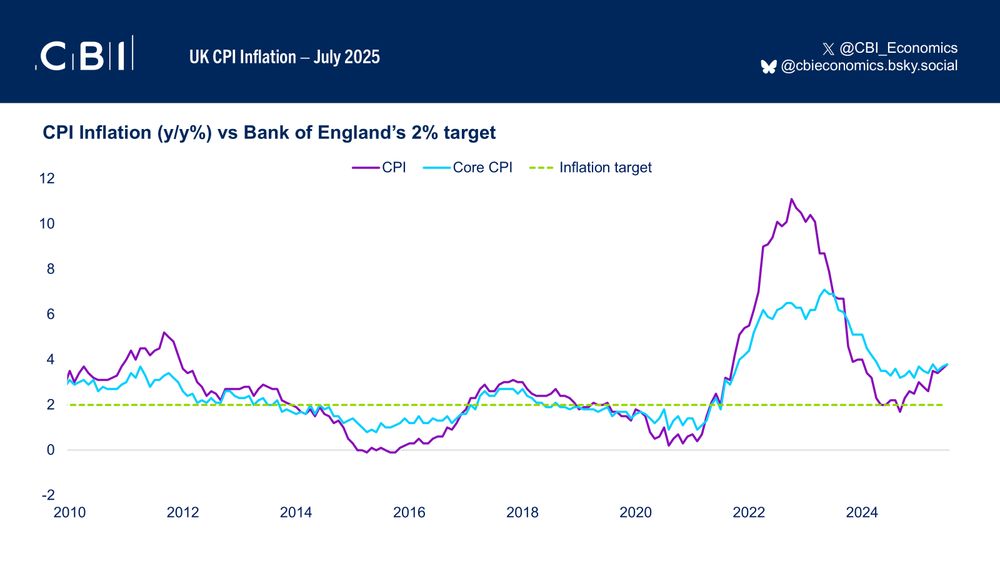

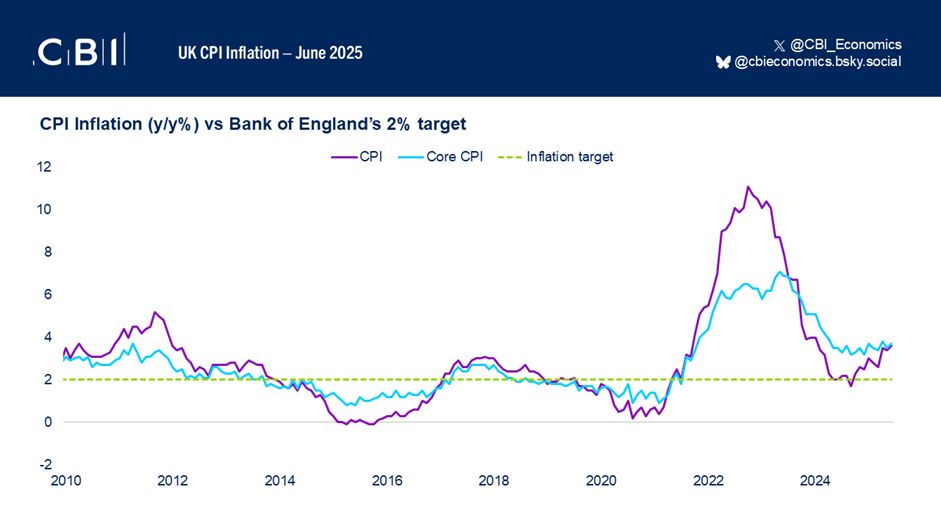

The Bank's central forecast expects inflation to slow to 2% by H1 2027, based on market expectations that interest rates will fall to a terminal rate of 3.5% in H1 2026.

🧵👇

The Bank's central forecast expects inflation to slow to 2% by H1 2027, based on market expectations that interest rates will fall to a terminal rate of 3.5% in H1 2026.

🧵👇

Our Q3 Economic Deep Dive helps business leaders cut through the noise on demand, costs & labour markets. 🔍

Exclusive to CBI members🔒: www.cbi.org.uk/articles/eco...

Our Q3 Economic Deep Dive helps business leaders cut through the noise on demand, costs & labour markets. 🔍

Exclusive to CBI members🔒: www.cbi.org.uk/articles/eco...

Check out the findings from the survey 👇🧵

Check out the findings from the survey 👇🧵

Check out the results of the survey 👇

Check out the results of the survey 👇

Read our latest blog 👉

www.cbi.org.uk/articles/the...

Read our latest blog 👉

www.cbi.org.uk/articles/the...

🧵 of key takeaways 👇

🧵 of key takeaways 👇

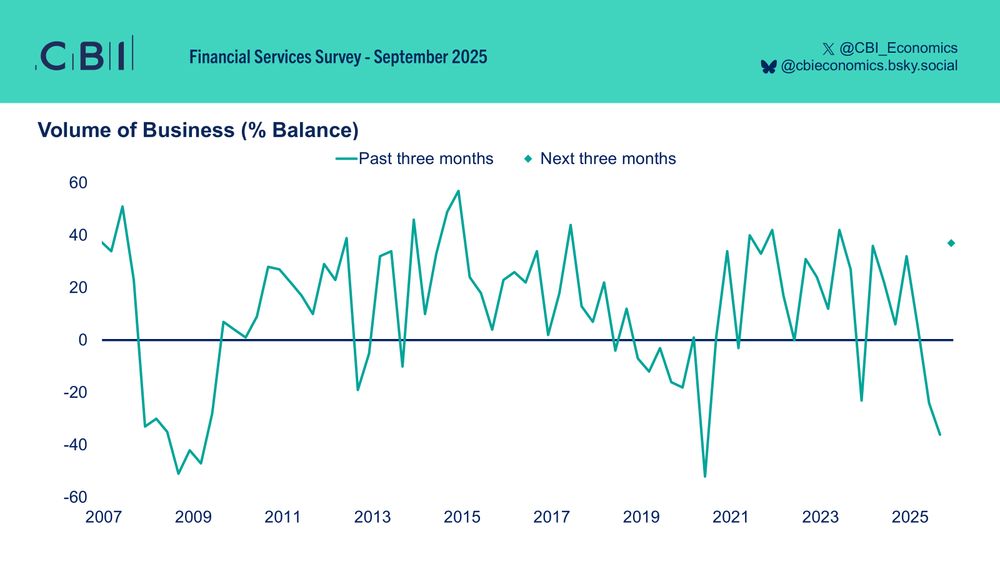

The latest CBI Growth Indicator shows continued weakness across the economy, extending a run of negative sentiment that began in late 2024

The latest CBI Growth Indicator shows continued weakness across the economy, extending a run of negative sentiment that began in late 2024

Key takeaways from the survey 🧵👇

Key takeaways from the survey 🧵👇