Organised by @clubdemadrid.bsky.social, it proposes a pathway for international tax cooperation.

www.theguardian.com/business/202...

#FfD4

It’s time to #PayWhereYouPlay not ‘pay-where-you-say’. cthi.taxjustice.net/

It’s time to #PayWhereYouPlay not ‘pay-where-you-say’. cthi.taxjustice.net/

Check out the latest update to the Corporate Tax Haven Index bit.ly/4pd4faX . 🌍✊

#TaxJustice #PayWhereYouPlay #CTHI

Check out the latest update to the Corporate Tax Haven Index bit.ly/4pd4faX . 🌍✊

#TaxJustice #PayWhereYouPlay #CTHI

"The world should support a UN treaty that reconciles global taxation with human rights."

@greenpeace.org @hrw.org

#COP30 #UNtaxConvention #TaxForClimate

taz.de/Globale-Steu...

"The world should support a UN treaty that reconciles global taxation with human rights."

@greenpeace.org @hrw.org

#COP30 #UNtaxConvention #TaxForClimate

taz.de/Globale-Steu...

taxjustice.net/topics/un-ta...

taxjustice.net/topics/un-ta...

#UNtaxConvention #TaxJustice2025

#UNtaxConvention #TaxJustice2025

A US-backed global gag order preventing governments from naming multinationals shifting billions into tax havens cost countries $475bn in lost tax. #NameTheTaxCheaters

See what our findings reveal: bit.ly/49wNnH0

A US-backed global gag order preventing governments from naming multinationals shifting billions into tax havens cost countries $475bn in lost tax. #NameTheTaxCheaters

See what our findings reveal: bit.ly/49wNnH0

www.cnbcafrica.com/2025/the-us-...

www.cnbcafrica.com/2025/the-us-...

Why must #TaxSovereignty & #ClimateJustice go hand in hand for #JustTransitions? Find out in our latest blog 🔗 bit.ly/3KgiImR

Why must #TaxSovereignty & #ClimateJustice go hand in hand for #JustTransitions? Find out in our latest blog 🔗 bit.ly/3KgiImR

Join #ClimateforChange2025 to unite #TaxJustice & #ClimateJustice for fair finance and a just transition.

👉 bit.ly/4jbO2zp #COP30

Join #ClimateforChange2025 to unite #TaxJustice & #ClimateJustice for fair finance and a just transition.

👉 bit.ly/4jbO2zp #COP30

www.afr.com/politics/fed...

www.afr.com/politics/fed...

#FinancialSecrecy

#FinancialSecrecy

Quick recap of how these claims went from gospel to bogus.

www.thelondoneconomic.com/politics/no-...

Quick recap of how these claims went from gospel to bogus.

The UK must make sure its tax policy represents the will of its people, not the yarn of lobbyists #TaxTheSuperRich

taxjustice.net/press/hmrc-d...

The UK must make sure its tax policy represents the will of its people, not the yarn of lobbyists #TaxTheSuperRich

taxjustice.net/press/hmrc-d...

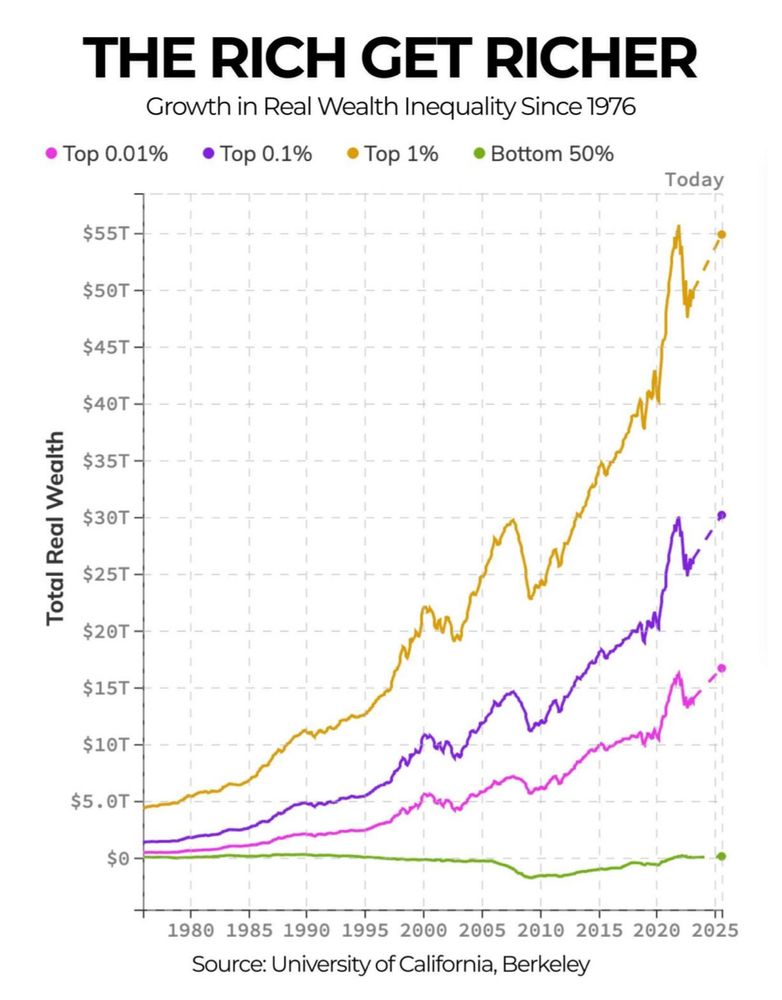

The rich got richer and richer, super rich, mega rich. They are dictating policies.

So it gets worse — and they get richer. It tears our societies apart.

The rich got richer and richer, super rich, mega rich. They are dictating policies.

So it gets worse — and they get richer. It tears our societies apart.

Member States", but UN equivalent would raise significant revenues.

Results show higher revenues from UN STTR, & reinforce benefits of a UN Tax Convention.

➡️ www.southcentre.int/press-releas...

Member States", but UN equivalent would raise significant revenues.

🧵on their claims today

www.thetimes.com/article/bill...

🧵on their claims today

www.thetimes.com/article/bill...

Us: That's less than 1% of UK millionaires

News: Wait, 16500 'liquid' millionaires (most mobile) are leaving. That's a lot if you only count 'liquid' ones

Us: That's still less than 3% of UK 'liquid' millionaires. So +97% are choosing to stay

News:😡

Us: That's less than 1% of UK millionaires

News: Wait, 16500 'liquid' millionaires (most mobile) are leaving. That's a lot if you only count 'liquid' ones

Us: That's still less than 3% of UK 'liquid' millionaires. So +97% are choosing to stay

News:😡

@toveryding.bsky.social speaking truth to power on the lack of space for Civil Society participation at the #FfD4 Conference 🔥🔥🔥💪💪💪

#FfD4People #SystemChangeNow #EraOfJustice

@toveryding.bsky.social speaking truth to power on the lack of space for Civil Society participation at the #FfD4 Conference 🔥🔥🔥💪💪💪

#FfD4People #SystemChangeNow #EraOfJustice

👉 Zu den Empfehlungen: www.steuerdebatte.info/ablauf/empfe...

👉 Zu den Empfehlungen: www.steuerdebatte.info/ablauf/empfe...