Enduring Structural Power? Assessing the Dominance of the Anglosphere in Global Finance Before the Trump Turn

Includes novel visualizations of global finance (banking, portfolio inv & FDI) showing persistent US centrality

hrcak.srce.hr/clanak/487488

Enduring Structural Power? Assessing the Dominance of the Anglosphere in Global Finance Before the Trump Turn

Includes novel visualizations of global finance (banking, portfolio inv & FDI) showing persistent US centrality

hrcak.srce.hr/clanak/487488

Seen in Berlin today

Seen in Berlin today

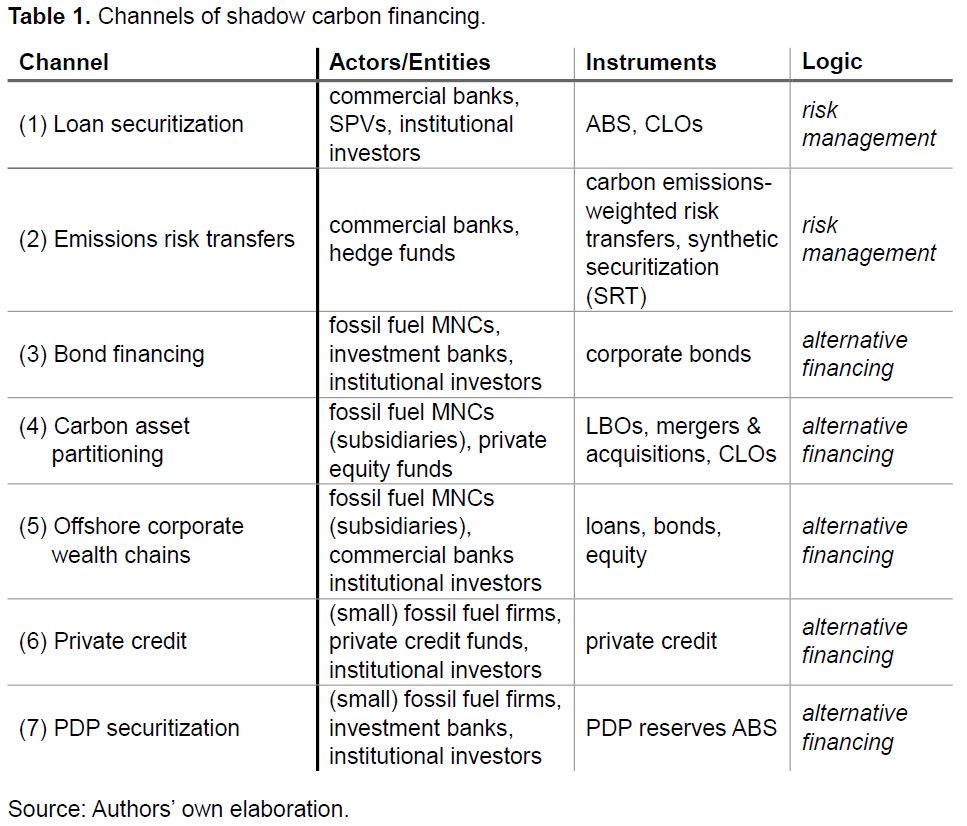

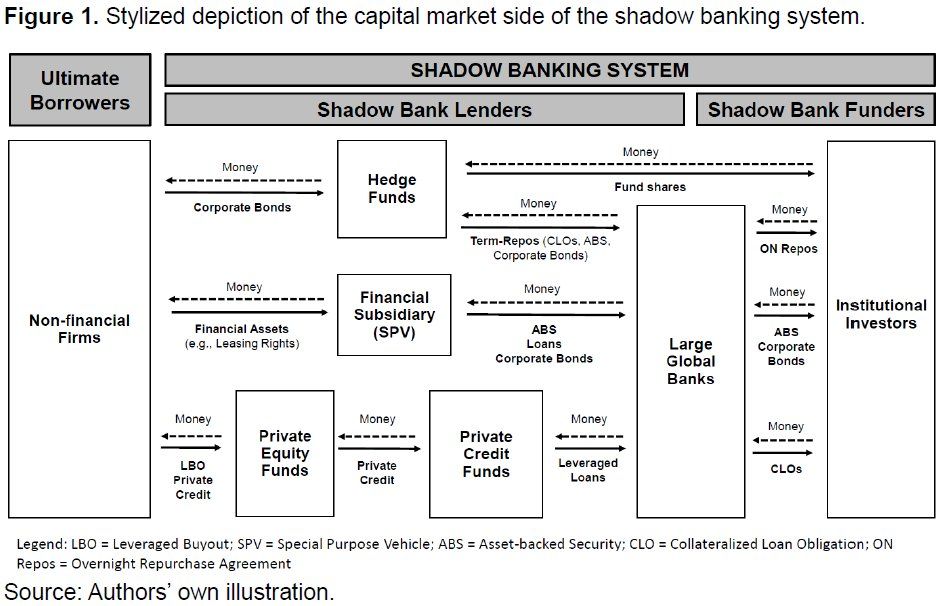

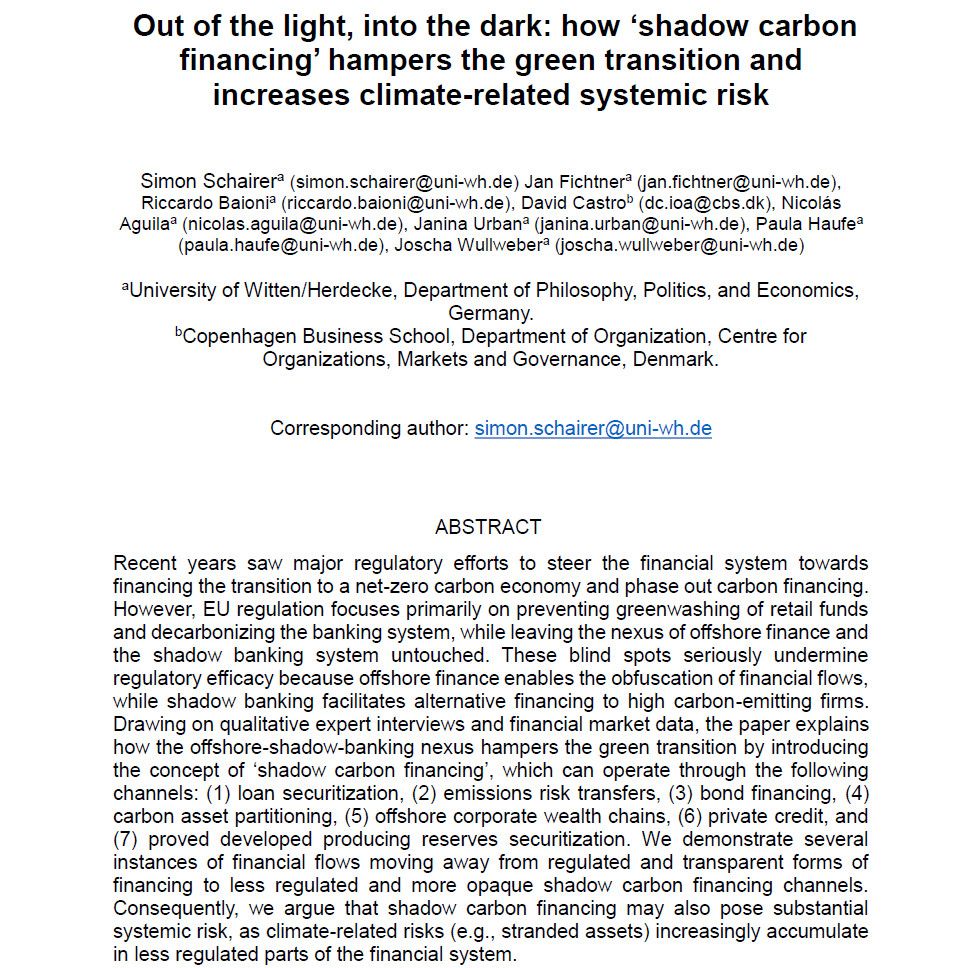

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

All-time high in new permisson of wind power in Germany in 2024! Plus new all-time high in new solar power installation - and record permission of electricity grid expansion.

Outstanding work by @bmwk.de & @robert-habeck.de that accelerates decarbonization in Germany massively.

All-time high in new permisson of wind power in Germany in 2024! Plus new all-time high in new solar power installation - and record permission of electricity grid expansion.

Outstanding work by @bmwk.de & @robert-habeck.de that accelerates decarbonization in Germany massively.

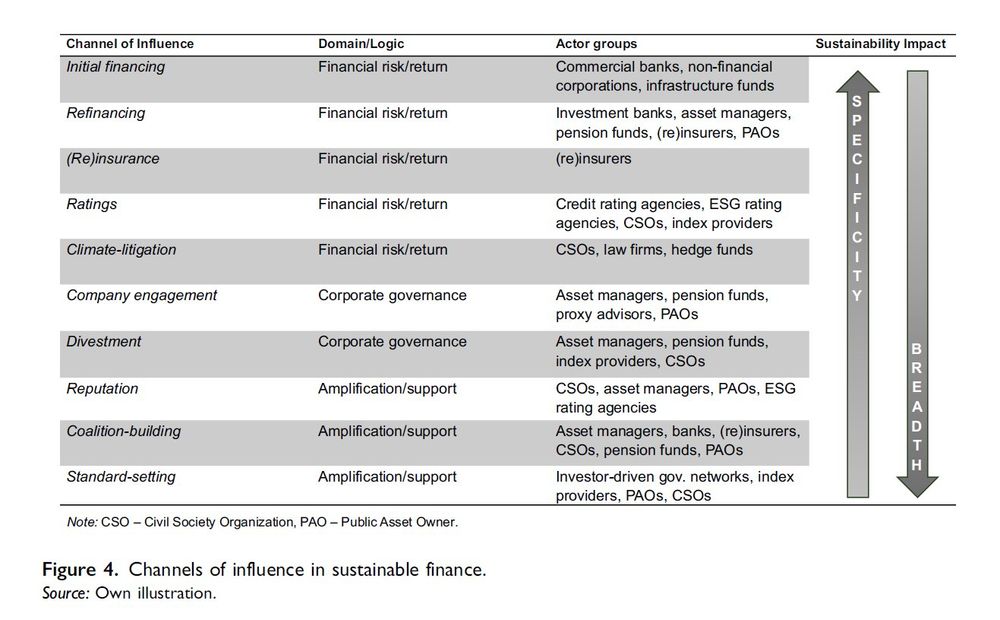

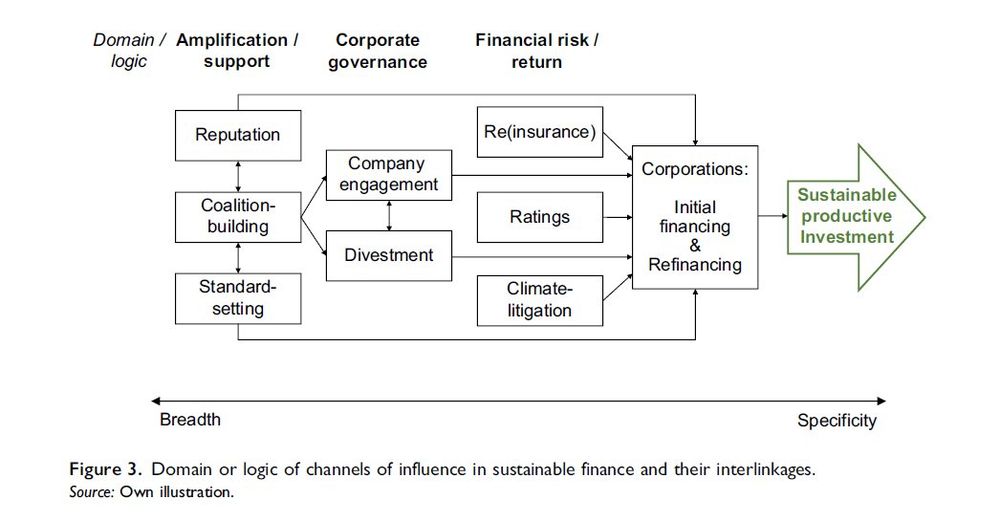

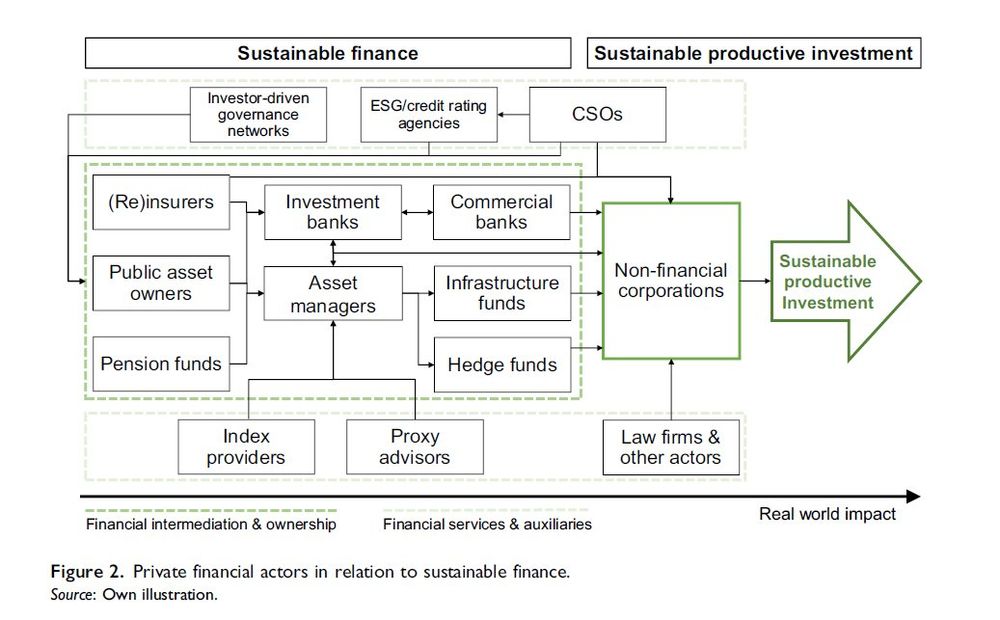

We thus argue that sustainable finance is not exclusively about investing or providing finance, but crucially also about changing corporate practices toward greater sustainability.

We thus argue that sustainable finance is not exclusively about investing or providing finance, but crucially also about changing corporate practices toward greater sustainability.

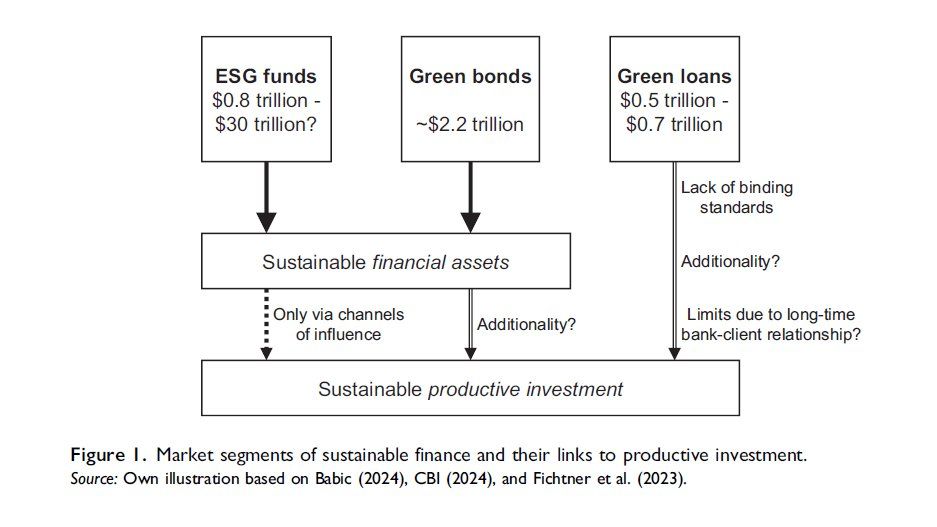

Because most of sufi creates *financial assets* and not *productive investment* which drives decarbonization.

Because most of sufi creates *financial assets* and not *productive investment* which drives decarbonization.

Channels of influence in sustainable finance:

A framework for conceptualizing how private actors shape the green transition

www.cambridge.org/core/journal...

A 🧵 on our main arguments:

Channels of influence in sustainable finance:

A framework for conceptualizing how private actors shape the green transition

www.cambridge.org/core/journal...

A 🧵 on our main arguments:

And btw, none of these funds create direct "additionality".

If you want to know more about the topic of ESG / sustainable investing & the lack of sustainability impact creation, take a look at a recent paper with

J. Petry & R. Jaspert:

onlinelibrary.wiley.com/doi/full/10....

🧵 end.

And btw, none of these funds create direct "additionality".

If you want to know more about the topic of ESG / sustainable investing & the lack of sustainability impact creation, take a look at a recent paper with

J. Petry & R. Jaspert:

onlinelibrary.wiley.com/doi/full/10....

🧵 end.

The key problem for all data gathering attempts is that there are no hard standards (although there have been recent efforts by the industry).

Take US sustainable funds, for instance. GSIA says they are $8.4trillion, but according to Morningstar they manage just $300billion!

The key problem for all data gathering attempts is that there are no hard standards (although there have been recent efforts by the industry).

Take US sustainable funds, for instance. GSIA says they are $8.4trillion, but according to Morningstar they manage just $300billion!

Investment strategies that focus on "corporate engagement and shareholder action" do have the potential to create a significant sustainability impact. Problem is: these funds do not commit to hard consistent standards & impact is hard to measure (engagement is mostly private)

Investment strategies that focus on "corporate engagement and shareholder action" do have the potential to create a significant sustainability impact. Problem is: these funds do not commit to hard consistent standards & impact is hard to measure (engagement is mostly private)

First, look at 'ESG integration' - assets collapsed from $25trn to $5trn! This category is extremely vague and thus very prone to greenwashing. But also the screening strategies simply exclude a few baddies (eg coal) and otherwise look quite similar to conventional funds.

First, look at 'ESG integration' - assets collapsed from $25trn to $5trn! This category is extremely vague and thus very prone to greenwashing. But also the screening strategies simply exclude a few baddies (eg coal) and otherwise look quite similar to conventional funds.

Wow, so just over $30 trillion - or 24% of all global fund assets - is sustainable, that's amazing. A quarter of all funds are sustainable and help decarbonization etc, right?

It sounds almost too good to be true - and that's because it is.

Wow, so just over $30 trillion - or 24% of all global fund assets - is sustainable, that's amazing. A quarter of all funds are sustainable and help decarbonization etc, right?

It sounds almost too good to be true - and that's because it is.