ITEP

@itep.org

Informing the debate on tax policy nationwide with research and data-driven solutions.

Visit www.itep.org to find our work.

More info: linktr.ee/_itep

Visit www.itep.org to find our work.

More info: linktr.ee/_itep

Pinned

Stay informed on tax policy. Follow our staff here! go.bsky.app/N6gc5iB

The corporate minimum tax ensures that the largest profitable corporations pay at least some taxes.

"There’s a pretty clear incentive for a fiscally responsible Congress...to make sure this backstop is working properly."

www.wsj.com/politics/pol...

"There’s a pretty clear incentive for a fiscally responsible Congress...to make sure this backstop is working properly."

www.wsj.com/politics/pol...

Trump’s Tax Cuts Are Exposing Companies to Biden’s Tax Hike

Democrats’ older alternative minimum tax claws back billions of dollars in savings from the newer GOP law.

www.wsj.com

November 10, 2025 at 9:17 PM

The corporate minimum tax ensures that the largest profitable corporations pay at least some taxes.

"There’s a pretty clear incentive for a fiscally responsible Congress...to make sure this backstop is working properly."

www.wsj.com/politics/pol...

"There’s a pretty clear incentive for a fiscally responsible Congress...to make sure this backstop is working properly."

www.wsj.com/politics/pol...

The Trump admin is focused on gutting the corporate minimum tax.

The Treasury Department has been enacting unlegislated tax cuts, carving out billions of dollars in breaks for huge corporations.

That's on top of the huge corp. tax cuts passed in July.

www.nytimes.com/2025/11/08/b...

The Treasury Department has been enacting unlegislated tax cuts, carving out billions of dollars in breaks for huge corporations.

That's on top of the huge corp. tax cuts passed in July.

www.nytimes.com/2025/11/08/b...

How the Trump Administration Is Giving Even More Tax Breaks to the Wealthy

www.nytimes.com

November 10, 2025 at 5:30 PM

The Trump admin is focused on gutting the corporate minimum tax.

The Treasury Department has been enacting unlegislated tax cuts, carving out billions of dollars in breaks for huge corporations.

That's on top of the huge corp. tax cuts passed in July.

www.nytimes.com/2025/11/08/b...

The Treasury Department has been enacting unlegislated tax cuts, carving out billions of dollars in breaks for huge corporations.

That's on top of the huge corp. tax cuts passed in July.

www.nytimes.com/2025/11/08/b...

Americans want lawmakers to address the need for better public services in the face of absurd wealth inequality.

"If Congress isn’t listening to the people, it sure would be refreshing if lawmakers in New York and other states would do so."

www.wsj.com/us-news/the-...

"If Congress isn’t listening to the people, it sure would be refreshing if lawmakers in New York and other states would do so."

www.wsj.com/us-news/the-...

The Economics Behind Zohran Mamdani’s Biggest Plans

New York’s mayor-elect has promised ambitious social programs funded primarily through higher taxes on businesses and the city’s highest earners. We break down the numbers.

www.wsj.com

November 7, 2025 at 7:18 PM

Americans want lawmakers to address the need for better public services in the face of absurd wealth inequality.

"If Congress isn’t listening to the people, it sure would be refreshing if lawmakers in New York and other states would do so."

www.wsj.com/us-news/the-...

"If Congress isn’t listening to the people, it sure would be refreshing if lawmakers in New York and other states would do so."

www.wsj.com/us-news/the-...

Important tax measures were on the ballot this week, and the outcomes are clear: people want investments in their communities.

Voters value what they gain from paying for public services with public money.

itep.org/2025-tax-bal...

Voters value what they gain from paying for public services with public money.

itep.org/2025-tax-bal...

In 2025, Voters Said Yes to Public Resources and Community Investments

Important tax measures were on the ballot this week, and the outcomes are clear: many voters support new state and local spending to support critical services in their communities.

itep.org

November 7, 2025 at 3:36 PM

Important tax measures were on the ballot this week, and the outcomes are clear: people want investments in their communities.

Voters value what they gain from paying for public services with public money.

itep.org/2025-tax-bal...

Voters value what they gain from paying for public services with public money.

itep.org/2025-tax-bal...

The Trump administration is ending Direct File, the IRS's free tax-filing program. It's another win for the corporate tax prep industry.

But the success of the short-lived Direct File program can set a precedent for future Congresses and administrations.

itep.org/trump-admini...

But the success of the short-lived Direct File program can set a precedent for future Congresses and administrations.

itep.org/trump-admini...

Trump Raises the Price of Filing a Tax Return

The move was expected, given heavy lobbying from tax prep companies like Intuit and H&R Block to put a halt to the IRS’s popular Direct File program.

itep.org

November 6, 2025 at 4:36 PM

The Trump administration is ending Direct File, the IRS's free tax-filing program. It's another win for the corporate tax prep industry.

But the success of the short-lived Direct File program can set a precedent for future Congresses and administrations.

itep.org/trump-admini...

But the success of the short-lived Direct File program can set a precedent for future Congresses and administrations.

itep.org/trump-admini...

Direct File had tremendous potential to make tax filing less expensive, faster, and easier for millions of Americans.

What stands in the way is a tax prep industry that makes billions from being the middleman between you and filing your taxes.

What stands in the way is a tax prep industry that makes billions from being the middleman between you and filing your taxes.

👀 Scoop: IRS Direct File, the free government-backed program that let you file your taxes for free, is dead.

IRS wrote to state tax agencies saying it would not be operational this coming tax season, per records I've obtained.

IRS Direct File: 2023-2025.

(Story from when the pilot launched.)

IRS wrote to state tax agencies saying it would not be operational this coming tax season, per records I've obtained.

IRS Direct File: 2023-2025.

(Story from when the pilot launched.)

IRS tests free e-filing system that could compete with tax-prep giants

The tax agency has quietly built its own prototype system for filing tax returns digitally and free of charge, according to current and former officials.

www.washingtonpost.com

November 5, 2025 at 7:17 PM

Direct File had tremendous potential to make tax filing less expensive, faster, and easier for millions of Americans.

What stands in the way is a tax prep industry that makes billions from being the middleman between you and filing your taxes.

What stands in the way is a tax prep industry that makes billions from being the middleman between you and filing your taxes.

Colorado voters have decided that their wealthy residents can contribute a little more in taxes.

That revenue will fund free school meals and food assistance across the state.

Progressive taxes remain a popular choice.

www.9news.com/article/news...

That revenue will fund free school meals and food assistance across the state.

Progressive taxes remain a popular choice.

www.9news.com/article/news...

Colorado voters approve Propositions LL and MM

Both statewide measures on the Colorado ballot this election were about funding free school meals for all kids.

www.9news.com

November 5, 2025 at 3:55 PM

Colorado voters have decided that their wealthy residents can contribute a little more in taxes.

That revenue will fund free school meals and food assistance across the state.

Progressive taxes remain a popular choice.

www.9news.com/article/news...

That revenue will fund free school meals and food assistance across the state.

Progressive taxes remain a popular choice.

www.9news.com/article/news...

States are grappling with budget challenges and deep cuts in federal funding.

To avoid losing billions more in revenue, state lawmakers should decide not to adopt these 4 costly corporate tax provisions in the new federal law.

itep.org/states-obbba...

To avoid losing billions more in revenue, state lawmakers should decide not to adopt these 4 costly corporate tax provisions in the new federal law.

itep.org/states-obbba...

Why States Shouldn’t Go Along With OBBBA’s Corporate Tax Breaks: A Practical Guide

States should immediately decouple from four costly corporate tax provisions in the new federal tax law.

itep.org

November 4, 2025 at 2:56 PM

States are grappling with budget challenges and deep cuts in federal funding.

To avoid losing billions more in revenue, state lawmakers should decide not to adopt these 4 costly corporate tax provisions in the new federal law.

itep.org/states-obbba...

To avoid losing billions more in revenue, state lawmakers should decide not to adopt these 4 costly corporate tax provisions in the new federal law.

itep.org/states-obbba...

Oil and gas companies receive enormous tax breaks in the U.S.

A @factcoalition.bsky.social report found that 11 of these companies are paying 5x more income tax to foreign governments.

And under the new Trump tax law, oil-industry tax avoidance could get worse.

itep.org/oil-gas-comp...

A @factcoalition.bsky.social report found that 11 of these companies are paying 5x more income tax to foreign governments.

And under the new Trump tax law, oil-industry tax avoidance could get worse.

itep.org/oil-gas-comp...

Oil and Gas Companies Are Paying Less Tax to the U.S. than to Foreign Governments

Since 2017, these companies paid $135 billion in income taxes to foreign governments, but just $29 billion to the U.S.

itep.org

November 3, 2025 at 3:51 PM

Oil and gas companies receive enormous tax breaks in the U.S.

A @factcoalition.bsky.social report found that 11 of these companies are paying 5x more income tax to foreign governments.

And under the new Trump tax law, oil-industry tax avoidance could get worse.

itep.org/oil-gas-comp...

A @factcoalition.bsky.social report found that 11 of these companies are paying 5x more income tax to foreign governments.

And under the new Trump tax law, oil-industry tax avoidance could get worse.

itep.org/oil-gas-comp...

Meta was recently hit with a $16 billion tax bill.

Despite a lavish summer of corporate tax cuts, Meta’s tax increase is entirely attributable to an important tax reform championed by the Biden administration in 2022.

itep.org/meta-tax-16-...

Despite a lavish summer of corporate tax cuts, Meta’s tax increase is entirely attributable to an important tax reform championed by the Biden administration in 2022.

itep.org/meta-tax-16-...

Biden Tax Reforms Take a $16 Billion Bite Out of Trump’s Big Tax Giveaway to Meta

Meta’s earnings setback is entirely attributable to an important tax reform championed by the Biden administration in 2022.

itep.org

October 31, 2025 at 3:44 PM

Meta was recently hit with a $16 billion tax bill.

Despite a lavish summer of corporate tax cuts, Meta’s tax increase is entirely attributable to an important tax reform championed by the Biden administration in 2022.

itep.org/meta-tax-16-...

Despite a lavish summer of corporate tax cuts, Meta’s tax increase is entirely attributable to an important tax reform championed by the Biden administration in 2022.

itep.org/meta-tax-16-...

Wealth inequality gets worse when working households pay more in taxes than wealthy owners.

States have a simple way to address this problem and raise much-needed revenue.

It's well past time for a Wealth Proceeds Tax.

States have a simple way to address this problem and raise much-needed revenue.

It's well past time for a Wealth Proceeds Tax.

October 30, 2025 at 4:44 PM

Wealth inequality gets worse when working households pay more in taxes than wealthy owners.

States have a simple way to address this problem and raise much-needed revenue.

It's well past time for a Wealth Proceeds Tax.

States have a simple way to address this problem and raise much-needed revenue.

It's well past time for a Wealth Proceeds Tax.

The government gives tax breaks to the wealthy for buying private jets.

But health care tax credits that support millions of middle- and low-income Americans get cut.

Yet another example that shows we have two tax codes, one for the rich and one for everyone else.

But health care tax credits that support millions of middle- and low-income Americans get cut.

Yet another example that shows we have two tax codes, one for the rich and one for everyone else.

October 27, 2025 at 4:40 PM

The government gives tax breaks to the wealthy for buying private jets.

But health care tax credits that support millions of middle- and low-income Americans get cut.

Yet another example that shows we have two tax codes, one for the rich and one for everyone else.

But health care tax credits that support millions of middle- and low-income Americans get cut.

Yet another example that shows we have two tax codes, one for the rich and one for everyone else.

Most people agree that progressive tax codes — where the wealthy pay a higher tax rate than low- and middle-income families — are fair.

But most of our state & local tax systems are regressive, leading to widening inequality and underfunded public services.

But most of our state & local tax systems are regressive, leading to widening inequality and underfunded public services.

October 24, 2025 at 4:39 PM

Most people agree that progressive tax codes — where the wealthy pay a higher tax rate than low- and middle-income families — are fair.

But most of our state & local tax systems are regressive, leading to widening inequality and underfunded public services.

But most of our state & local tax systems are regressive, leading to widening inequality and underfunded public services.

Reposted by ITEP

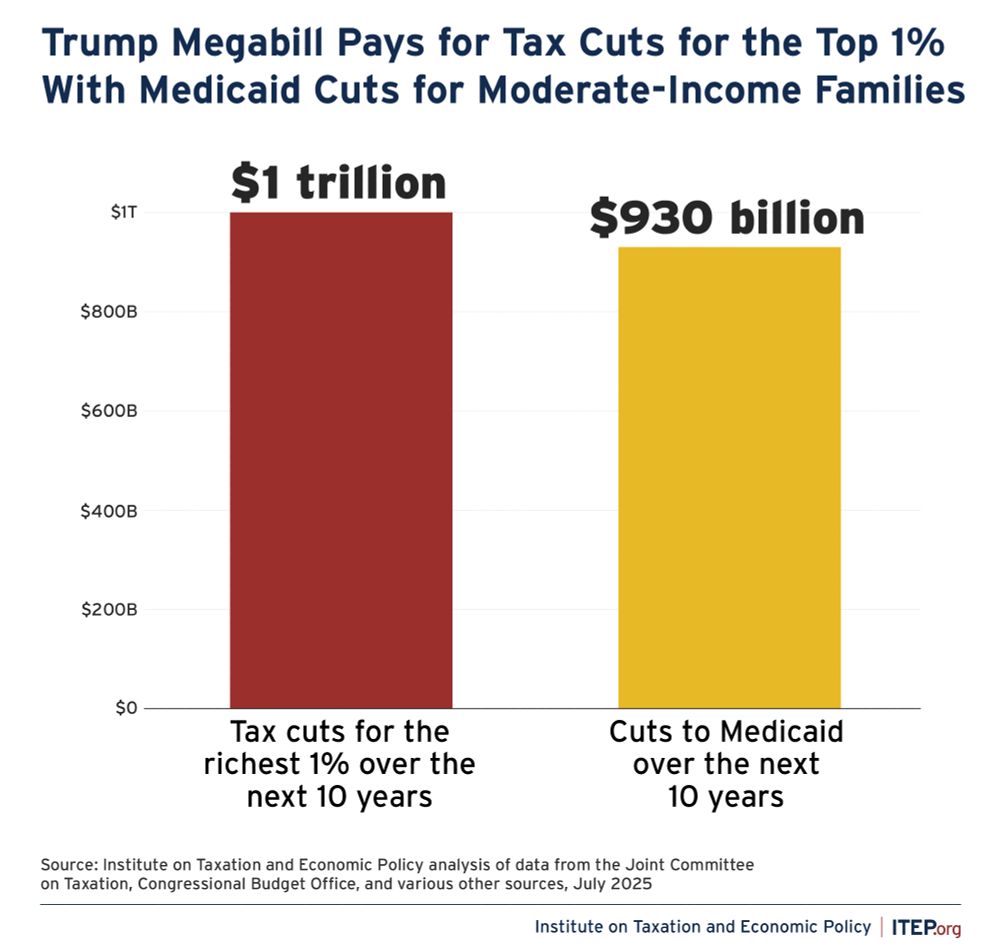

Reminder that the richest 1% of Americans will receive $1 trillion in tax cuts over the next decade, thanks to the tax bill that Trump and Congressional Republicans passed this year. itep.org/top-1-to-rec...

October 24, 2025 at 3:50 PM

Reminder that the richest 1% of Americans will receive $1 trillion in tax cuts over the next decade, thanks to the tax bill that Trump and Congressional Republicans passed this year. itep.org/top-1-to-rec...

As states figure out which federal tax changes are worth keeping, here's one that isn't.

This tax break gives virtually all its benefits to millionaire and billionaire venture capitalists.

Keeping it would cost $1.2 billion in yearly revenue across 38 states.

This tax break gives virtually all its benefits to millionaire and billionaire venture capitalists.

Keeping it would cost $1.2 billion in yearly revenue across 38 states.

October 23, 2025 at 6:46 PM

As states figure out which federal tax changes are worth keeping, here's one that isn't.

This tax break gives virtually all its benefits to millionaire and billionaire venture capitalists.

Keeping it would cost $1.2 billion in yearly revenue across 38 states.

This tax break gives virtually all its benefits to millionaire and billionaire venture capitalists.

Keeping it would cost $1.2 billion in yearly revenue across 38 states.

The new Trump tax law favors the richest taxpayers and corporations.

Many lawmakers who were vocal supporters of this bill will see direct benefits while most of their constituents will benefit little or will be worse off.

itep.org/members-cong...

Many lawmakers who were vocal supporters of this bill will see direct benefits while most of their constituents will benefit little or will be worse off.

itep.org/members-cong...

Some Members of Congress Will Cash in from New Tax Law

Many lawmakers who were vocal supporters of this bill will see direct personal benefits while most of their constituents benefit little or will be worse off.

itep.org

October 22, 2025 at 2:06 PM

The new Trump tax law favors the richest taxpayers and corporations.

Many lawmakers who were vocal supporters of this bill will see direct benefits while most of their constituents will benefit little or will be worse off.

itep.org/members-cong...

Many lawmakers who were vocal supporters of this bill will see direct benefits while most of their constituents will benefit little or will be worse off.

itep.org/members-cong...

Corporate income taxes were $77 billion lower this year.

The companies enjoying the biggest tax breaks include some of the multinational corporations that were already paying close to zero before more tax cuts were passed this summer. itep.org/trump-tax-la...

The companies enjoying the biggest tax breaks include some of the multinational corporations that were already paying close to zero before more tax cuts were passed this summer. itep.org/trump-tax-la...

Well, That Was Fast: Trump Tax Law’s New Corporate Breaks are Already Worsening the Deficit

Corporate income taxes for the fiscal year that ended in September are $77 billion lower than in the previous year, a 15 percent drop.

itep.org

October 21, 2025 at 2:05 PM

Corporate income taxes were $77 billion lower this year.

The companies enjoying the biggest tax breaks include some of the multinational corporations that were already paying close to zero before more tax cuts were passed this summer. itep.org/trump-tax-la...

The companies enjoying the biggest tax breaks include some of the multinational corporations that were already paying close to zero before more tax cuts were passed this summer. itep.org/trump-tax-la...

The tax cuts Trump signed earlier this year barely reach the bottom 40% of Americans.

Any tax cuts they might see will be negated by tariffs that ask more from lower-income Americans.

Any tax cuts they might see will be negated by tariffs that ask more from lower-income Americans.

October 20, 2025 at 4:34 PM

The tax cuts Trump signed earlier this year barely reach the bottom 40% of Americans.

Any tax cuts they might see will be negated by tariffs that ask more from lower-income Americans.

Any tax cuts they might see will be negated by tariffs that ask more from lower-income Americans.

This year's major tax changes overwhelmingly benefit the wealthy.

Any benefits for the bottom 40% of Americans are wiped out by tariffs and expired health care tax credits.

As wealth inequality worsens, this only fuels it.

Any benefits for the bottom 40% of Americans are wiped out by tariffs and expired health care tax credits.

As wealth inequality worsens, this only fuels it.

October 17, 2025 at 2:42 PM

This year's major tax changes overwhelmingly benefit the wealthy.

Any benefits for the bottom 40% of Americans are wiped out by tariffs and expired health care tax credits.

As wealth inequality worsens, this only fuels it.

Any benefits for the bottom 40% of Americans are wiped out by tariffs and expired health care tax credits.

As wealth inequality worsens, this only fuels it.

These five states gave the biggest tax cuts to millionaires this year.

The average millionaire in these states will receive an annual tax cut worth more than 50x the average tax cut for non-millionaires.

These states could lose more than $2.2 billion in revenue per year.

The average millionaire in these states will receive an annual tax cut worth more than 50x the average tax cut for non-millionaires.

These states could lose more than $2.2 billion in revenue per year.

October 16, 2025 at 7:32 PM

These five states gave the biggest tax cuts to millionaires this year.

The average millionaire in these states will receive an annual tax cut worth more than 50x the average tax cut for non-millionaires.

These states could lose more than $2.2 billion in revenue per year.

The average millionaire in these states will receive an annual tax cut worth more than 50x the average tax cut for non-millionaires.

These states could lose more than $2.2 billion in revenue per year.

States should opt out of the Qualified Small Business Stock (QSBS) tax break.

Why? This tax break:

- benefits few small businesses

- mostly serves venture capitalists

- will cost more than $1 billion in revenue across 38 states

itep.org/qsbs-trump-t...

Why? This tax break:

- benefits few small businesses

- mostly serves venture capitalists

- will cost more than $1 billion in revenue across 38 states

itep.org/qsbs-trump-t...

Quite Some BS: Expanded ‘QSBS’ Giveaway in Trump Tax Law Threatens State Revenues and Enriches the Wealthy

States should decouple from the federal Qualified Small Business Stock (QSBS) exemption.

itep.org

October 15, 2025 at 2:36 PM

States should opt out of the Qualified Small Business Stock (QSBS) tax break.

Why? This tax break:

- benefits few small businesses

- mostly serves venture capitalists

- will cost more than $1 billion in revenue across 38 states

itep.org/qsbs-trump-t...

Why? This tax break:

- benefits few small businesses

- mostly serves venture capitalists

- will cost more than $1 billion in revenue across 38 states

itep.org/qsbs-trump-t...

What are progressive and regressive tax systems? How do state and local governments raise funds? What principles are used to shape the tax code?

These are just some of the kinds of questions that our new Guide to State & Local Taxes can answer.

itep.org/tax-guide/

These are just some of the kinds of questions that our new Guide to State & Local Taxes can answer.

itep.org/tax-guide/

ITEP Guide to State & Local Taxes

The ITEP Guide to State & Local Taxes offers citizens, advocates, journalists, and policymakers a detailed primer on state and local tax policy. The guide explains a wide range of tax concepts and spe...

itep.org

October 14, 2025 at 2:32 PM

What are progressive and regressive tax systems? How do state and local governments raise funds? What principles are used to shape the tax code?

These are just some of the kinds of questions that our new Guide to State & Local Taxes can answer.

itep.org/tax-guide/

These are just some of the kinds of questions that our new Guide to State & Local Taxes can answer.

itep.org/tax-guide/

Reposted by ITEP

Ongoing fun project: following quarterly earnings calls where corporate execs are asked to quantify the effect of OBBBA on their cash taxes. This generally only comes up when a industry analysts ask. The candor is, in turns, refreshing and horrifying. (1/x)

itep.org/trump-tax-la...

itep.org/trump-tax-la...

Well, That Was Fast: Trump Tax Law’s New Corporate Breaks are Already Worsening the Deficit

Corporate income taxes for the fiscal year that ended in September are $77 billion lower than in the previous year, a 15 percent drop.

itep.org

October 9, 2025 at 11:42 PM

Ongoing fun project: following quarterly earnings calls where corporate execs are asked to quantify the effect of OBBBA on their cash taxes. This generally only comes up when a industry analysts ask. The candor is, in turns, refreshing and horrifying. (1/x)

itep.org/trump-tax-la...

itep.org/trump-tax-la...

"...while it’s unclear where Leavitt sourced her $9.1 billion health care price tag, data provided by ITEP shows that undocumented immigrants themselves pay more than 10 times that in U.S. taxes — including $96.7 billion in 2022 alone." finance.yahoo.com/news/us-taxp...

US taxpayers pay the bill when ‘illegal’ immigrants go to emergency room, White House says — here’s the truth

Here’s what the data says about the real impact of undocumented patients on the health care system.

finance.yahoo.com

October 10, 2025 at 2:22 PM

"...while it’s unclear where Leavitt sourced her $9.1 billion health care price tag, data provided by ITEP shows that undocumented immigrants themselves pay more than 10 times that in U.S. taxes — including $96.7 billion in 2022 alone." finance.yahoo.com/news/us-taxp...

The Trump administration wants to weaken the IRS. That's been clear from the funding and staff cuts made so far this year.

Now nearly 50% of the agency has been furloughed.

This only benefits the wealthiest Americans and corporations that avoid paying taxes.

www.cnn.com/2025/10/09/p...

Now nearly 50% of the agency has been furloughed.

This only benefits the wealthiest Americans and corporations that avoid paying taxes.

www.cnn.com/2025/10/09/p...

IRS furloughs nearly half its staff amid shutdown, prompting chaos and confusion | CNN Politics

The Internal Revenue Service began furloughing nearly half its staff Wednesday because of the ongoing government shutdown, sparking chaos and confusion among employees as the news rippled through agen...

www.cnn.com

October 9, 2025 at 6:58 PM

The Trump administration wants to weaken the IRS. That's been clear from the funding and staff cuts made so far this year.

Now nearly 50% of the agency has been furloughed.

This only benefits the wealthiest Americans and corporations that avoid paying taxes.

www.cnn.com/2025/10/09/p...

Now nearly 50% of the agency has been furloughed.

This only benefits the wealthiest Americans and corporations that avoid paying taxes.

www.cnn.com/2025/10/09/p...