Visit www.itep.org to find our work.

More info: linktr.ee/_itep

States have a simple way to address this problem and raise much-needed revenue.

It's well past time for a Wealth Proceeds Tax.

States have a simple way to address this problem and raise much-needed revenue.

It's well past time for a Wealth Proceeds Tax.

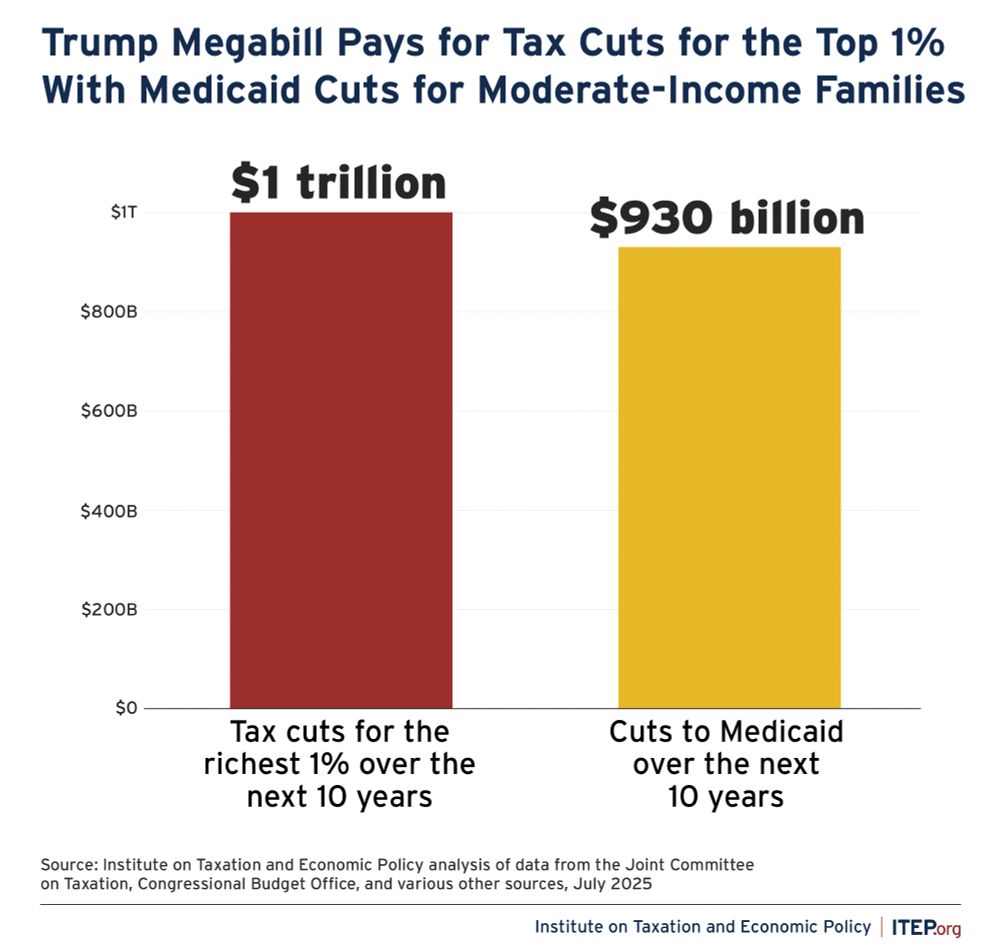

But health care tax credits that support millions of middle- and low-income Americans get cut.

Yet another example that shows we have two tax codes, one for the rich and one for everyone else.

But health care tax credits that support millions of middle- and low-income Americans get cut.

Yet another example that shows we have two tax codes, one for the rich and one for everyone else.

But most of our state & local tax systems are regressive, leading to widening inequality and underfunded public services.

But most of our state & local tax systems are regressive, leading to widening inequality and underfunded public services.

This tax break gives virtually all its benefits to millionaire and billionaire venture capitalists.

Keeping it would cost $1.2 billion in yearly revenue across 38 states.

This tax break gives virtually all its benefits to millionaire and billionaire venture capitalists.

Keeping it would cost $1.2 billion in yearly revenue across 38 states.

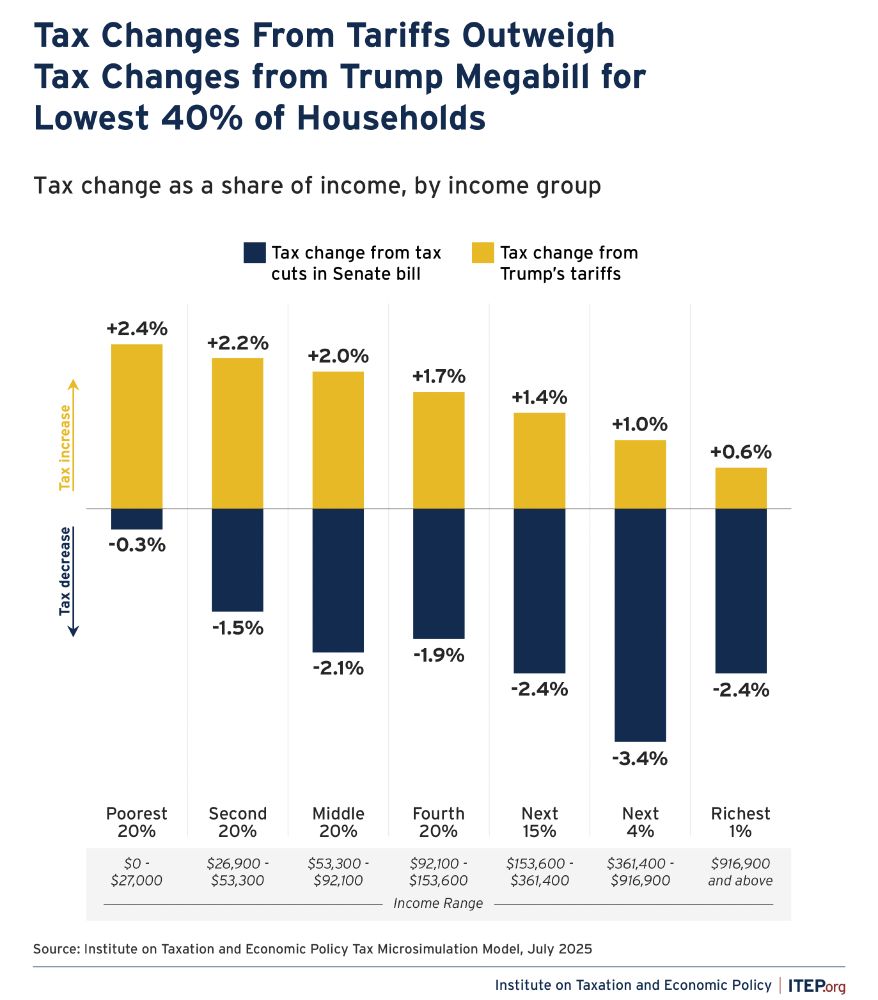

Any tax cuts they might see will be negated by tariffs that ask more from lower-income Americans.

Any tax cuts they might see will be negated by tariffs that ask more from lower-income Americans.

Any benefits for the bottom 40% of Americans are wiped out by tariffs and expired health care tax credits.

As wealth inequality worsens, this only fuels it.

Any benefits for the bottom 40% of Americans are wiped out by tariffs and expired health care tax credits.

As wealth inequality worsens, this only fuels it.

The average millionaire in these states will receive an annual tax cut worth more than 50x the average tax cut for non-millionaires.

These states could lose more than $2.2 billion in revenue per year.

The average millionaire in these states will receive an annual tax cut worth more than 50x the average tax cut for non-millionaires.

These states could lose more than $2.2 billion in revenue per year.

Our webinar will explore how states can chart their own course.

Learn more on our homepage, or sign up here:

us02web.zoom.us/webinar/regi...

Our webinar will explore how states can chart their own course.

Learn more on our homepage, or sign up here:

us02web.zoom.us/webinar/regi...

Any lawmaker serious about helping struggling families should push for a permanent expansion of the Child Tax Credit.

Otherwise, families across the country face unnecessary hardship.

Any lawmaker serious about helping struggling families should push for a permanent expansion of the Child Tax Credit.

Otherwise, families across the country face unnecessary hardship.

- Keep the 2017 tax cuts for those making under $400,00

- Expand the CTC

- Don't extend corporate and high-income tax cuts

This approach would be much fairer than the new law and cost half as much in revenue.

- Keep the 2017 tax cuts for those making under $400,00

- Expand the CTC

- Don't extend corporate and high-income tax cuts

This approach would be much fairer than the new law and cost half as much in revenue.

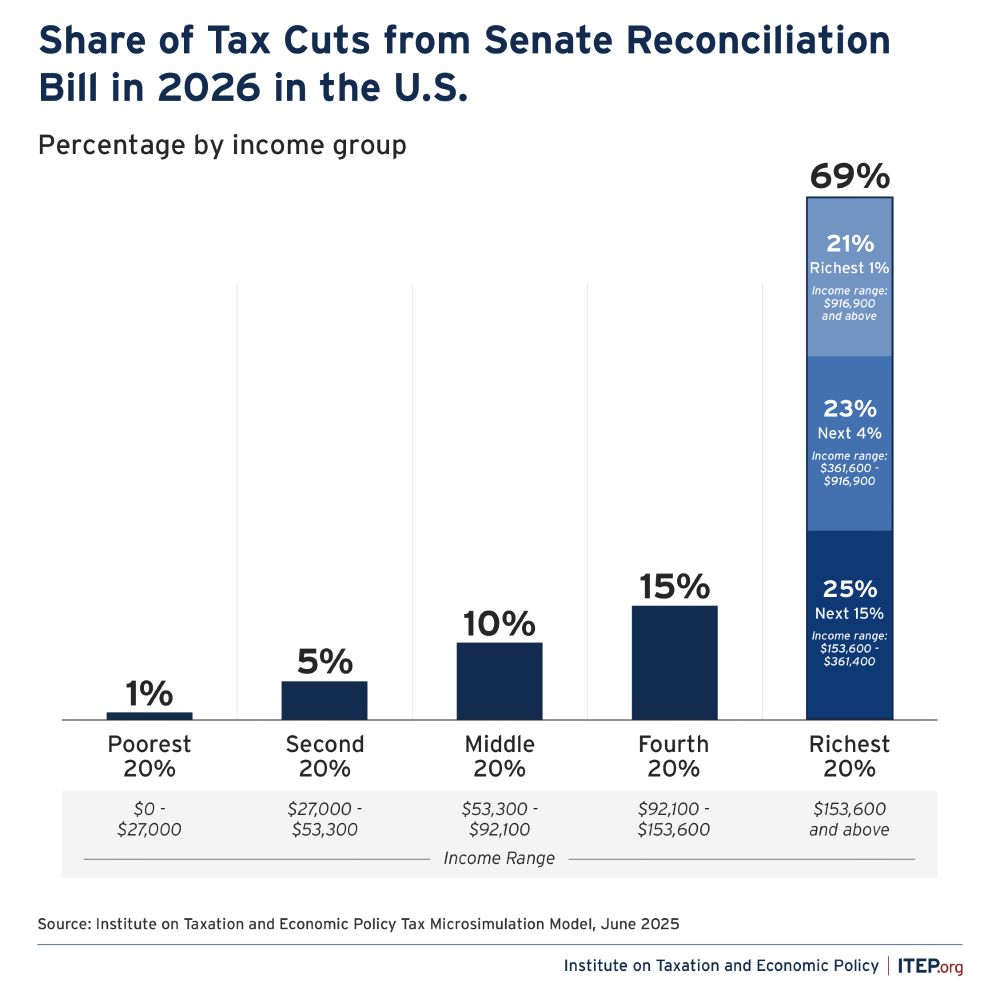

But President Trump and Congressional Republicans continue to promote the idea that these tax cuts mainly benefit regular Americans.

Here's what’s in it for the wealthy.

But President Trump and Congressional Republicans continue to promote the idea that these tax cuts mainly benefit regular Americans.

Here's what’s in it for the wealthy.

You can submit your application by emailing a resume and cover letter to [email protected].

You can submit your application by emailing a resume and cover letter to [email protected].

Once fully implemented, the state will lose $2.5 billion per year.

This will lead to significant budget instability and place public services at risk, all while largely benefiting the rich.

Once fully implemented, the state will lose $2.5 billion per year.

This will lead to significant budget instability and place public services at risk, all while largely benefiting the rich.

For the bottom 40% of Americans, the tariffs would be greater than the tax cuts.

Higher prices will impact low- to middle-income households more than the wealthy.

For the bottom 40% of Americans, the tariffs would be greater than the tax cuts.

Higher prices will impact low- to middle-income households more than the wealthy.

This bill will only widen the already-huge chasm between the rich and the rest of America.

This bill will only widen the already-huge chasm between the rich and the rest of America.

Future generations will pay for the multitrillion-dollar debt increase.

And what for? Massive, expensive tax cuts to the wealthiest few.

Future generations will pay for the multitrillion-dollar debt increase.

And what for? Massive, expensive tax cuts to the wealthiest few.

For the bottom 40% of Americans, the tariffs would be greater than the tax cuts.

Working-class Americans pay more for the tax cuts given to the wealthiest few.

For the bottom 40% of Americans, the tariffs would be greater than the tax cuts.

Working-class Americans pay more for the tax cuts given to the wealthiest few.

In three states, the richest 1% could gain an average of over $100,000 worth of tax cuts in just one year.

Find your state here:

In three states, the richest 1% could gain an average of over $100,000 worth of tax cuts in just one year.

Find your state here:

But Senate Republicans now want to create a permanent, 100% tax credit for private school voucher donations.

Billions in public revenue that could fund public schools will go to vouchers instead.

But Senate Republicans now want to create a permanent, 100% tax credit for private school voucher donations.

Billions in public revenue that could fund public schools will go to vouchers instead.

@amyhanauer.bsky.social: "So a couple would be able to leave $29.99 million to their heirs before anyone pays a penny in estate tax."

@kaine.senate.gov: "I guess they assume $30 million would just be too much."

@amyhanauer.bsky.social: "So a couple would be able to leave $29.99 million to their heirs before anyone pays a penny in estate tax."

@kaine.senate.gov: "I guess they assume $30 million would just be too much."

That's about a third of all Americans who would be worse off while the rich get much richer. www.cbo.gov/publication/...

That's about a third of all Americans who would be worse off while the rich get much richer. www.cbo.gov/publication/...

Here’s a look at how generous the Senate proposal is for NC millionaires.

Here’s a look at how generous the Senate proposal is for NC millionaires.