https://gianlucabenigno.substack.com/

https://sites.google.com/view/gianlucabenigno/home;

We often treat debt as a purely fiscal issue, searching for magic numbers (38T, 45T) or debt-to-GDP ratios (90%, 120%) beyond which everything unravels. But that misses the bigger picture. #debt #US #fiscalpolicy

open.substack.com/pub/pierpa61...

We often treat debt as a purely fiscal issue, searching for magic numbers (38T, 45T) or debt-to-GDP ratios (90%, 120%) beyond which everything unravels. But that misses the bigger picture. #debt #US #fiscalpolicy

open.substack.com/pub/pierpa61...

www.linkedin.com/feed/update/...

www.linkedin.com/feed/update/...

Rising support for “no cuts”: In March 2025, 4 FOMC participants saw no cuts in 2025. In June, that number has increased to 7, showing increased caution within the committee on easing policy further.

Rising support for “no cuts”: In March 2025, 4 FOMC participants saw no cuts in 2025. In June, that number has increased to 7, showing increased caution within the committee on easing policy further.

#UKinflation #CPI #wages #BoE #interestrates #monetarypolicy

#UKinflation #CPI #wages #BoE #interestrates #monetarypolicy

open.substack.com/pub/gianluca...

open.substack.com/pub/gianluca...

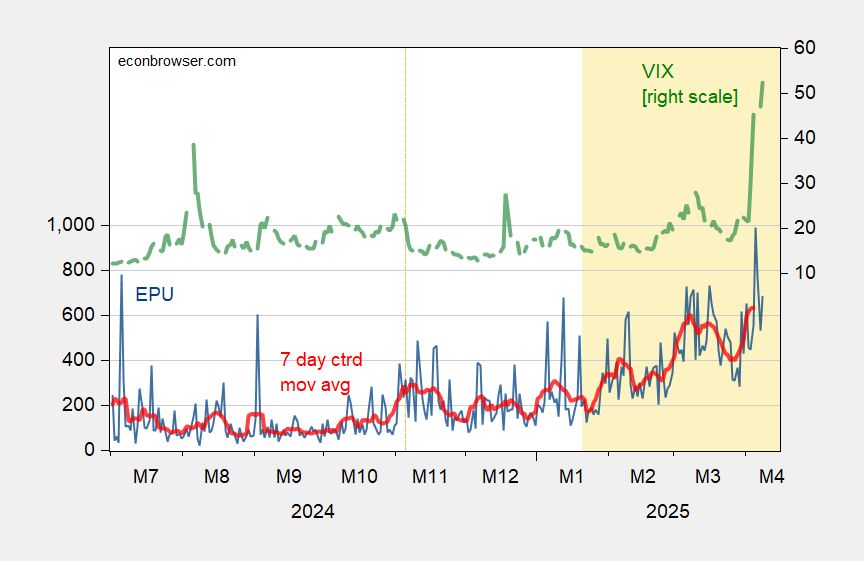

econbrowser.com/archives/202...

econbrowser.com/archives/202...

open.substack.com/pub/gianluca...

open.substack.com/pub/gianluca...

gianlucabenigno.substack.com/p/us-january...

gianlucabenigno.substack.com/p/us-january...

open.substack.com/pub/gianluca...

open.substack.com/pub/gianluca...

The Global Financial Resource curse is a depressed growth outcome under financial integration, resulting in low growth, low productivity, and super-low real interest rates

The Global Financial Resource curse is a depressed growth outcome under financial integration, resulting in low growth, low productivity, and super-low real interest rates

For example, services inflation is in general higher than pre-pandemic with more variations across countries.

For example, services inflation is in general higher than pre-pandemic with more variations across countries.

In my blog, I argue that American consumers' dissatisfaction with the economic outlook is more closely tied to high prices than the control of inflation. I explore how behavioral factors might explain this connection.

In my blog, I argue that American consumers' dissatisfaction with the economic outlook is more closely tied to high prices than the control of inflation. I explore how behavioral factors might explain this connection.

(open.substack.com/pub/gianluca...).

(open.substack.com/pub/gianluca...).