https://sites.google.com/site/evgeniapassari/

🇬🇷🇫🇷🇬🇧

cepr.org/voxeu/column...

#EconSky

cepr.org/voxeu/column...

#EconSky

discuss Geoeconomics and Strategic Minerals for the Green Transition

discuss Geoeconomics and Strategic Minerals for the Green Transition

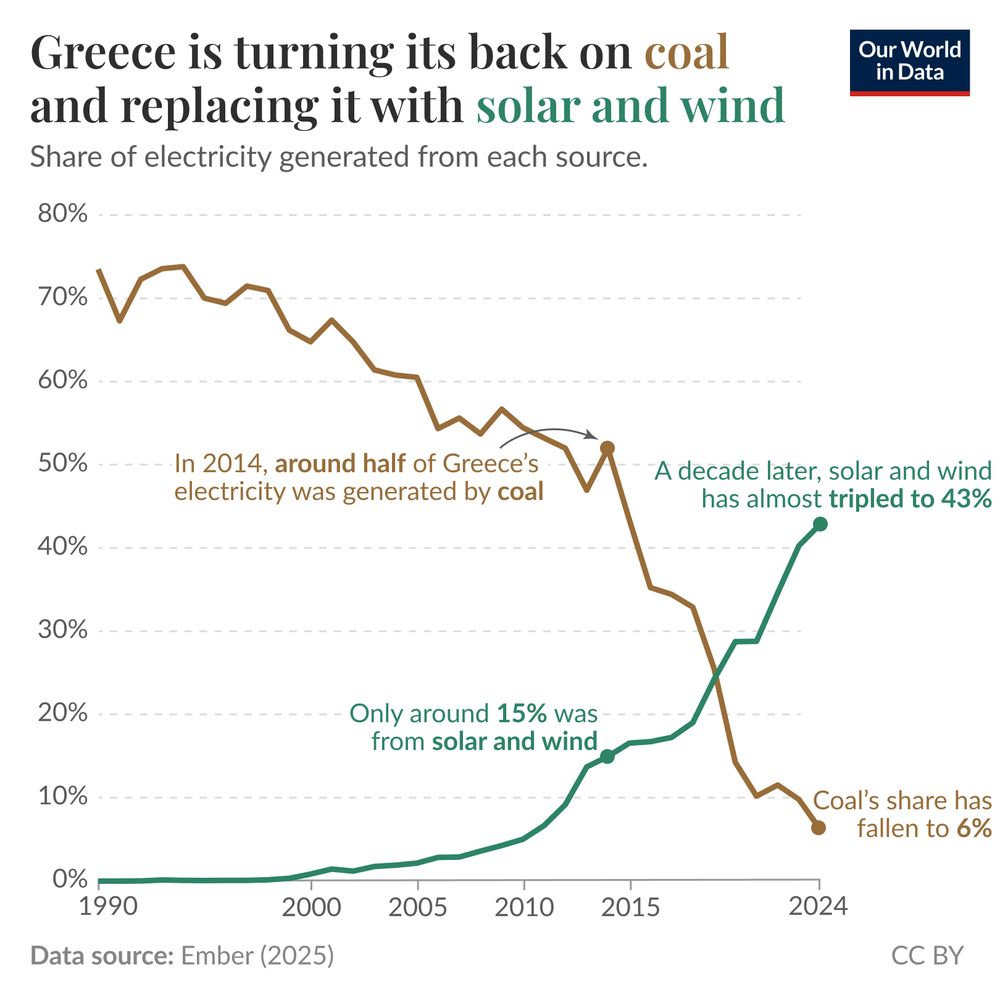

A decade later, that share has fallen to just 6%.

A decade later, that share has fallen to just 6%.

on.ft.com/42ujjqk

on.ft.com/42ujjqk

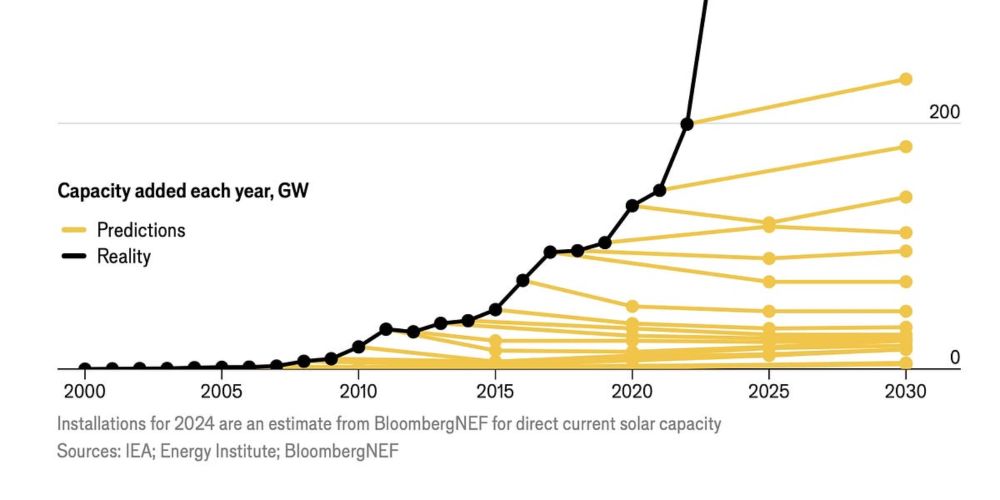

www.nytimes.com/2025/04/13/b...

www.nytimes.com/2025/04/13/b...

So what happens when tariffs get imposed on Canada?

The answers are quite unsettling, for the American people... and for everyone else edconway.substack.com/p/america-st...

So what happens when tariffs get imposed on Canada?

The answers are quite unsettling, for the American people... and for everyone else edconway.substack.com/p/america-st...