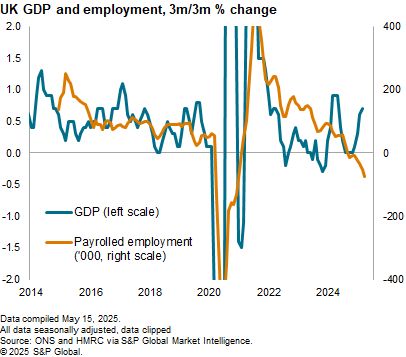

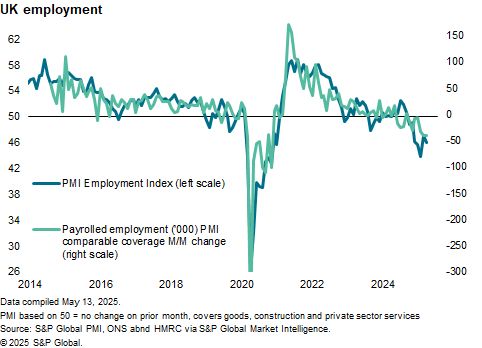

"Anecdotal evidence suggested that fragile confidence among

clients and subdued underlying demand had resulted in lower workloads at the end of the year."

"Anecdotal evidence suggested that fragile confidence among

clients and subdued underlying demand had resulted in lower workloads at the end of the year."

www.bls.gov/cpi/

www.bls.gov/cpi/

#econsky @aaronsojourner.org @betseystevenson.bsky.social @justinwolfers.bsky.social @jasonfurman.bsky.social @jedkolko.bsky.social

#econsky @aaronsojourner.org @betseystevenson.bsky.social @justinwolfers.bsky.social @jasonfurman.bsky.social @jedkolko.bsky.social

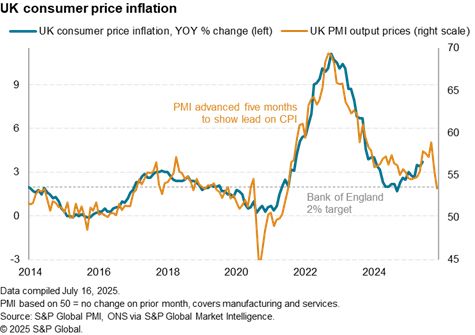

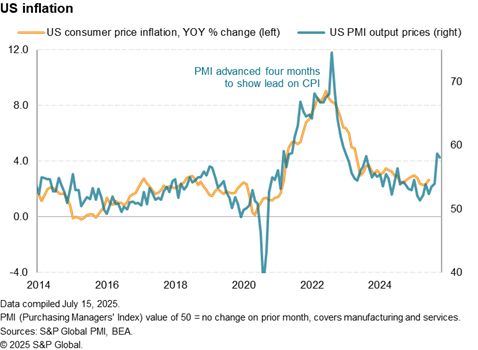

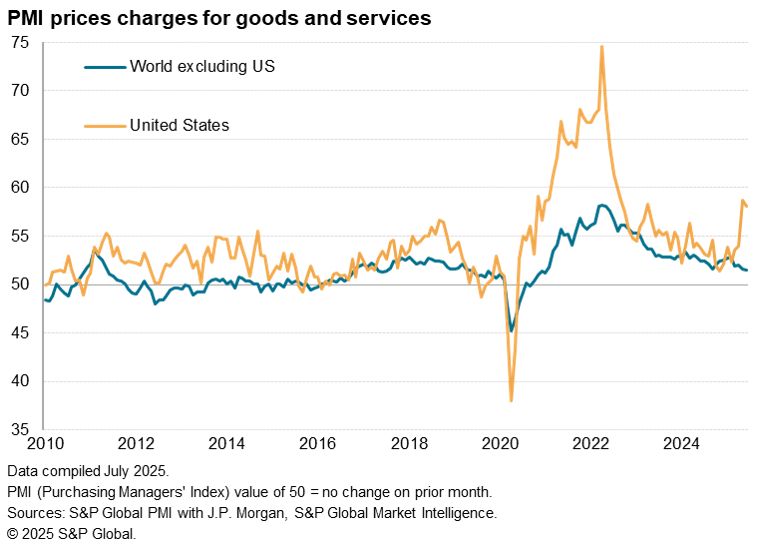

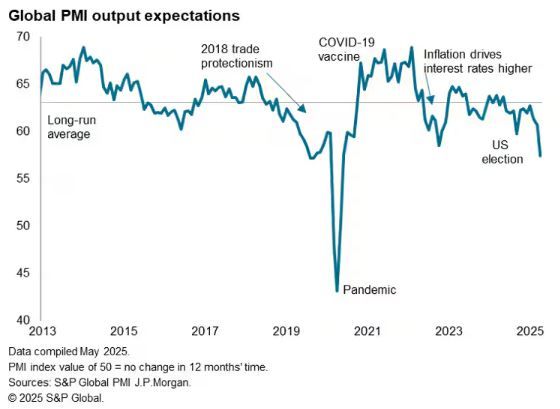

www.spglobal.com/marketintell...

www.spglobal.com/marketintell...

Read all about it in our Week Ahead preview: www.spglobal.com/marketintell...

Read all about it in our Week Ahead preview: www.spglobal.com/marketintell...

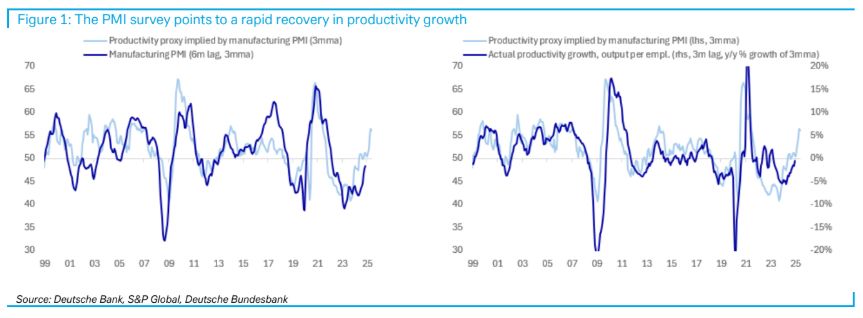

(c) Deutsche Bank

(c) Deutsche Bank

Read more in our free-to-read preview of the week ahead: www.spglobal.com/marketintell...

Read more in our free-to-read preview of the week ahead: www.spglobal.com/marketintell...

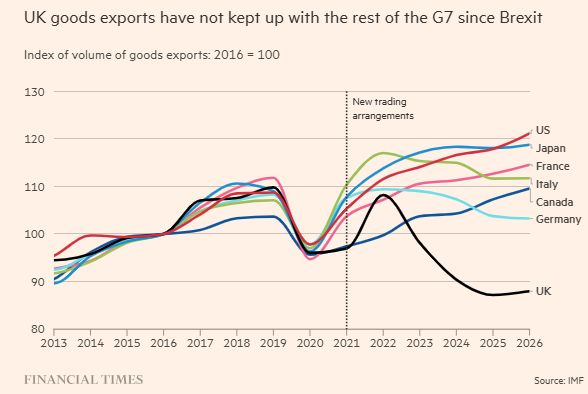

Spoiler, it does not end happily

www.ft.com/content/342d...