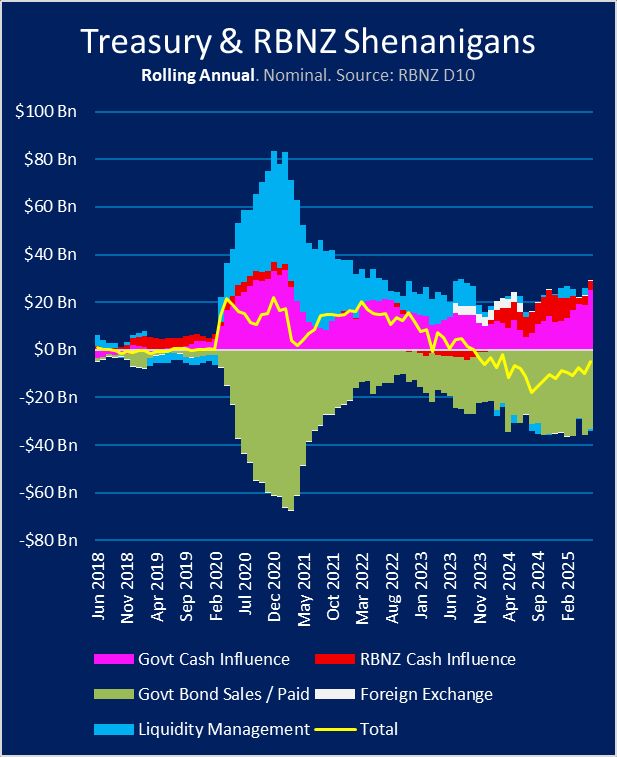

1. Govt spending adds brand new $ into the economy. Taxation destroys used $.

2. Govt debt goes up when Govt spends new $ into the economy. Govt debt goes down when Govt collects tax.

3. Bond sales destroy $. Govt debt does not change. [1/n]

1. Govt spending adds brand new $ into the economy. Taxation destroys used $.

2. Govt debt goes up when Govt spends new $ into the economy. Govt debt goes down when Govt collects tax.

3. Bond sales destroy $. Govt debt does not change. [1/n]

In fact, that's an accounting certainty.

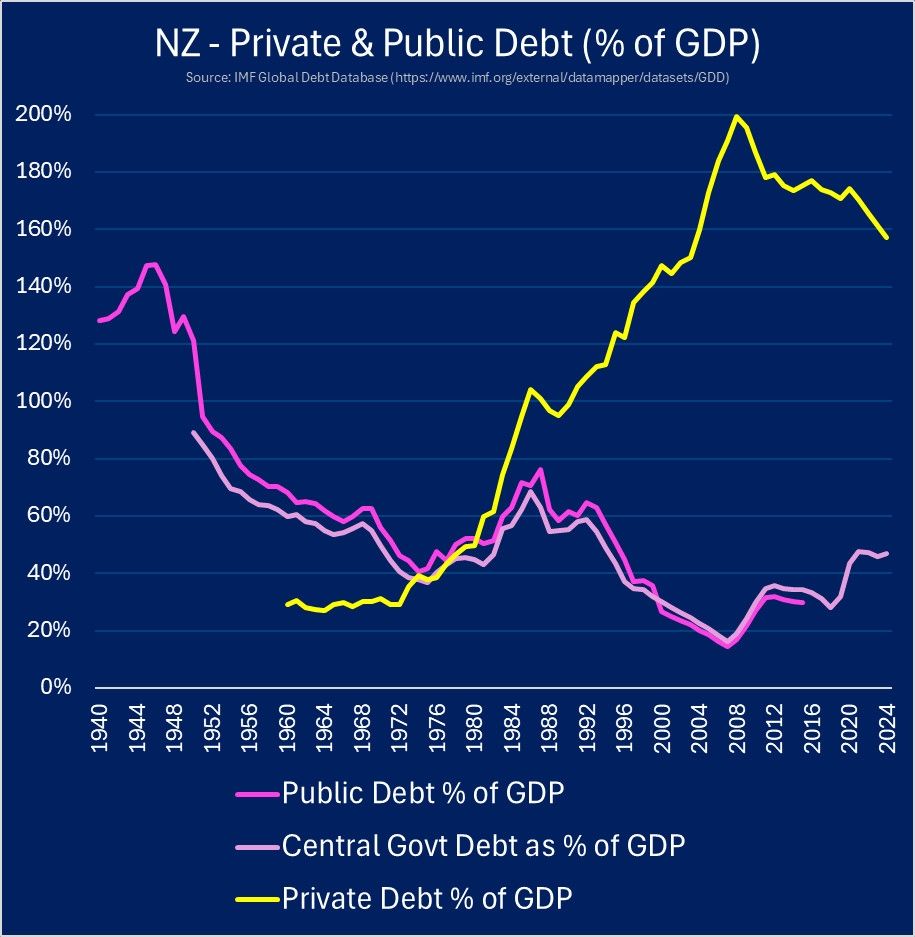

Our financial wealth is the mirror of our financial debt. Let's have a look at some examples... [4/n]

In fact, that's an accounting certainty.

Our financial wealth is the mirror of our financial debt. Let's have a look at some examples... [4/n]

Feel free to share, comment, like - all that good stuff.

neweconomicmanagement.substack.com/p/the-infini...

Feel free to share, comment, like - all that good stuff.

neweconomicmanagement.substack.com/p/the-infini...

neweconomicmanagement.substack.com/p/child-pove...

neweconomicmanagement.substack.com/p/child-pove...

neweconomicmanagement.substack.com/p/the-state-...

neweconomicmanagement.substack.com/p/the-state-...

This post will provide some ideas and frames of how to frame your own thoughts and conversations about how government spending actually works.

Like, share and subscribe for more (if you want)!

This post will provide some ideas and frames of how to frame your own thoughts and conversations about how government spending actually works.

Like, share and subscribe for more (if you want)!

Critically, sector deficits / surpluses have to balance. One sector's liability is always another sector's assets.

Descriptive commentary in image ALT text.