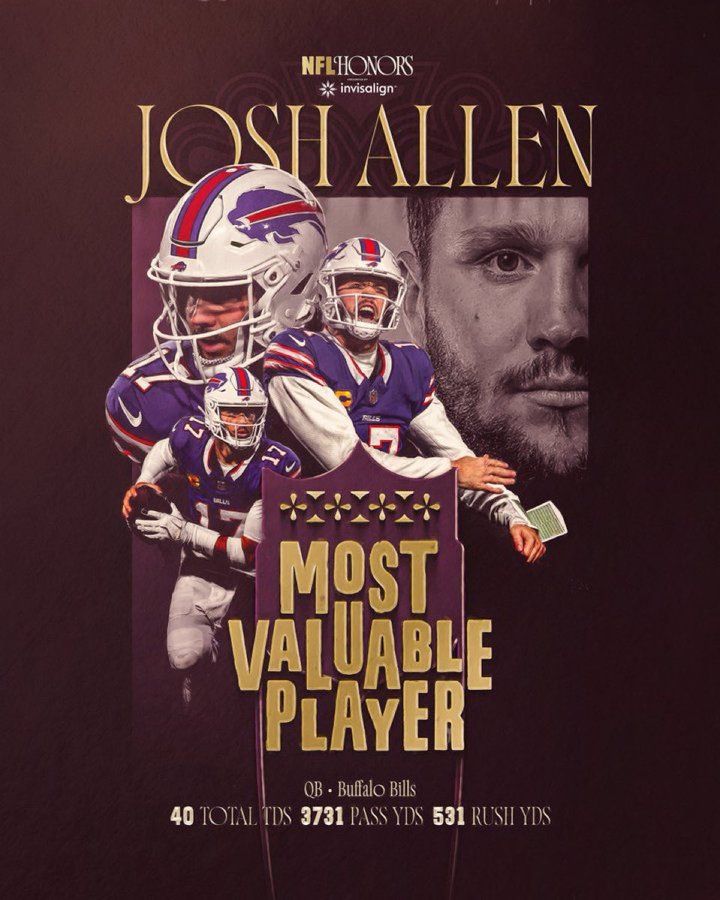

📍tacoma, wa

#GoBills

Will this increase help lower- and middle-income retirees?

Nope, and here’s why. 🧵

Will this increase help lower- and middle-income retirees?

Nope, and here’s why. 🧵

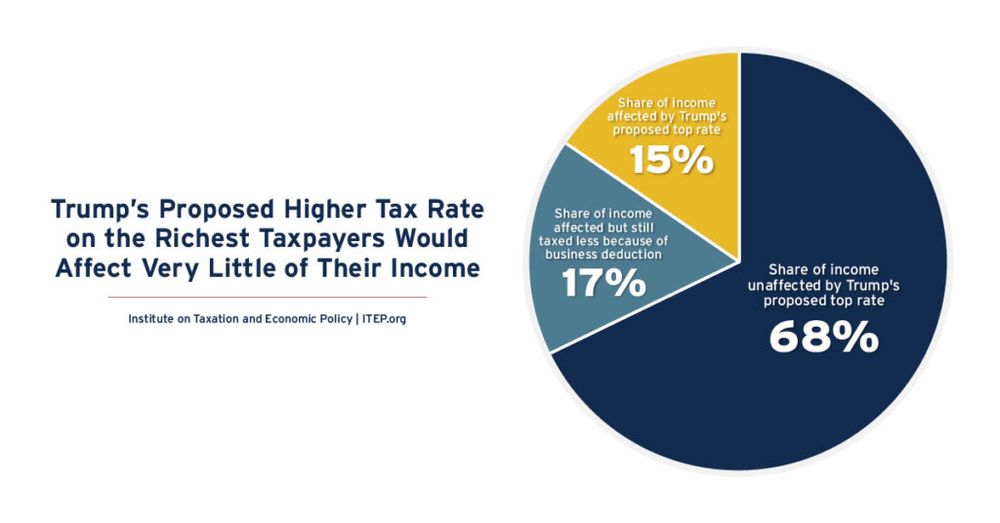

There are a range of federal actions coming together that will leave states with less money to meet their responsibilities.

State lawmakers should be ready.

itep.org/sharp-turn-i...

There are a range of federal actions coming together that will leave states with less money to meet their responsibilities.

State lawmakers should be ready.

itep.org/sharp-turn-i...

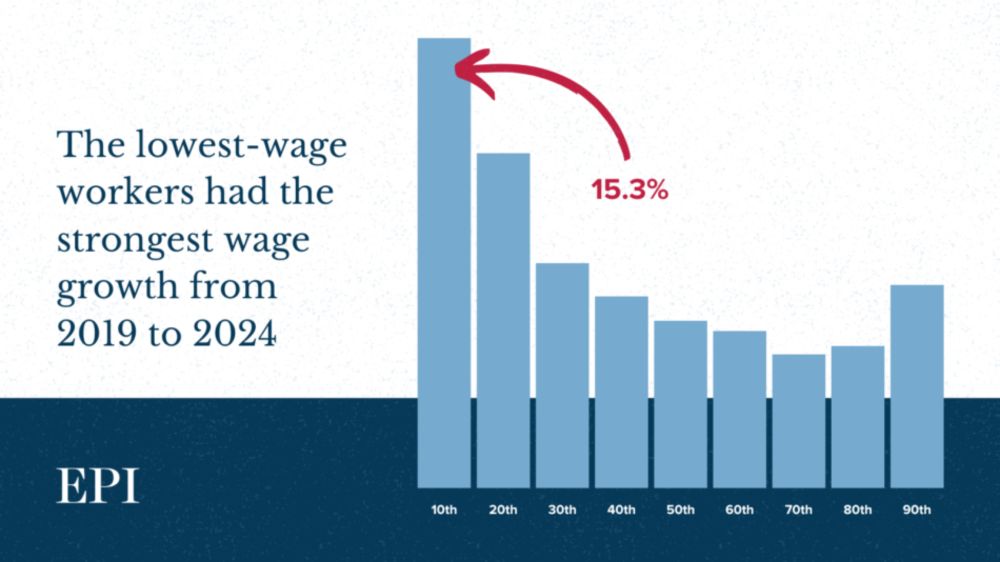

This was no accident: government COVID relief measures, a tight labor market & low unemployment gave low-wage workers better job opportunities & leverage.

www.epi.org/publication/...

This was no accident: government COVID relief measures, a tight labor market & low unemployment gave low-wage workers better job opportunities & leverage.

www.epi.org/publication/...

@apnews.com

apnews.com/article/irs-...

His EOs threaten to punish legal immigrants by doubling their taxes (invoking a never-used 1934 law); expatriating their kids; and blocking them from the US entirely

wapo.st/4hkbEB6

His EOs threaten to punish legal immigrants by doubling their taxes (invoking a never-used 1934 law); expatriating their kids; and blocking them from the US entirely

wapo.st/4hkbEB6

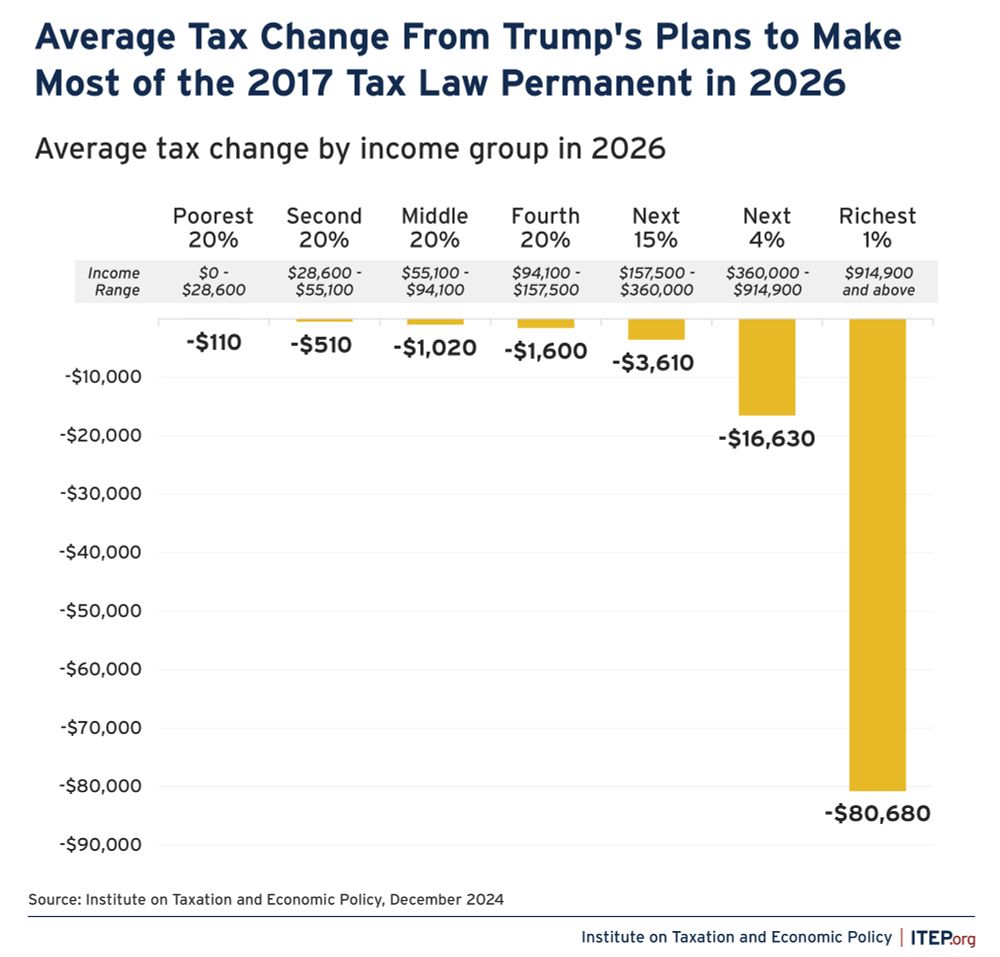

The plan includes all major provisions except the $10,000 SALT cap which Trump has indicated he would not extend. itep.org/trump-tax-la...

The plan includes all major provisions except the $10,000 SALT cap which Trump has indicated he would not extend. itep.org/trump-tax-la...

www.nytimes.com/2022/01/05/o...

www.nytimes.com/2022/01/05/o...

propub.li/41EtbPK

propub.li/41EtbPK