www.barrineau.substack.com

Ex-USN, ex-CIA

www.wsj.com/world/americ...

www.wsj.com/world/americ...

giftarticle.ft.com/giftarticle/...

giftarticle.ft.com/giftarticle/...

www.reuters.com/business/aut...

www.reuters.com/business/aut...

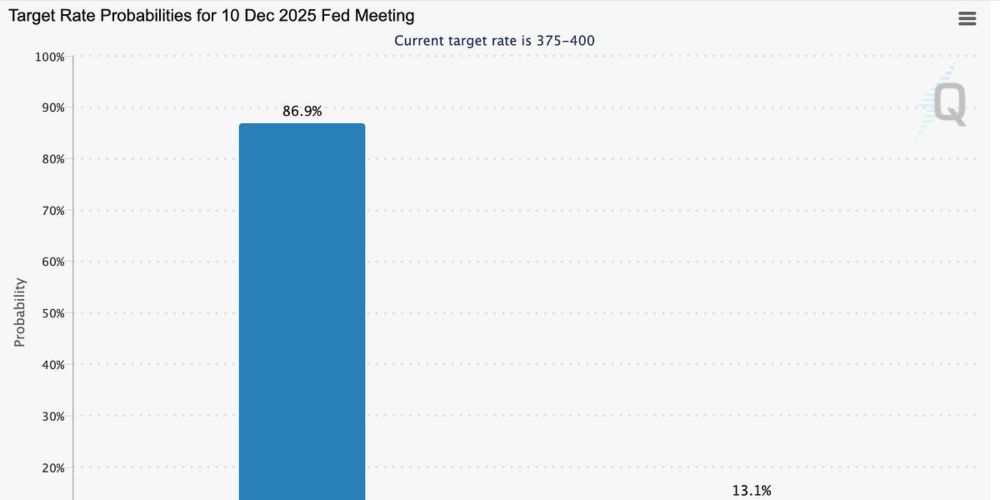

If Powell resorts to the tired line that "rates are moderately restrictive" in the presser this afternoon, you are welcome to scream in disbelief along with me.

If Powell resorts to the tired line that "rates are moderately restrictive" in the presser this afternoon, you are welcome to scream in disbelief along with me.

www.wsj.com/world/china/...

www.wsj.com/world/china/...

1. You want low inflation but you raise tariffs that boost prices.

2. You want to win the AI race, but you cripple new wind and solar power to run data centers.

3. You want strong growth but you round up legal workers by the thousands that reduces your labor supply.

1. You want low inflation but you raise tariffs that boost prices.

2. You want to win the AI race, but you cripple new wind and solar power to run data centers.

3. You want strong growth but you round up legal workers by the thousands that reduces your labor supply.

giftarticle.ft.com/giftarticle/...

giftarticle.ft.com/giftarticle/...

www.apolloacademy.com/the-daily-sp...

www.apolloacademy.com/the-daily-sp...

giftarticle.ft.com/giftarticle/...

giftarticle.ft.com/giftarticle/...

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

The 80% is getting battered from all sides.

on.ft.com/4rzWDAY

The 80% is getting battered from all sides.

on.ft.com/4rzWDAY

www.nytimes.com/2025/11/30/u...

www.nytimes.com/2025/11/30/u...

www.wsj.com/world/russia...

www.wsj.com/world/russia...