kpmg.com/us/en/articl...

kpmg.com/us/en/articl...

bobeunlimited.substack.com/p/the-feds-e...

bobeunlimited.substack.com/p/the-feds-e...

Global easings are slowing and hikes are creeping back in for 2026. With the disinflation dividend behind us, markets at highs supported by dovish policy face a tougher liquidity environment ahead.

bobeunlimited.substack.com/p/end-of-the...

Global easings are slowing and hikes are creeping back in for 2026. With the disinflation dividend behind us, markets at highs supported by dovish policy face a tougher liquidity environment ahead.

bobeunlimited.substack.com/p/end-of-the...

institute.bankofamerica.com/content/dam/...

institute.bankofamerica.com/content/dam/...

Fantasies from large scale QE are everywhere this morning when similar dynamics just months ago during the debt ceiling period shows this Fed T-bill buying will almost certainly be dead money.

bobeunlimited.substack.com/p/this-is-yo...

Fantasies from large scale QE are everywhere this morning when similar dynamics just months ago during the debt ceiling period shows this Fed T-bill buying will almost certainly be dead money.

bobeunlimited.substack.com/p/this-is-yo...

Fed debates over the exact level of neutral rates misses the big picture that even near-perfect conditions lately have not stabilized the soft labor market and their policies can't do much about it.

bobeunlimited.substack.com/p/a-wobble-o...

Fed debates over the exact level of neutral rates misses the big picture that even near-perfect conditions lately have not stabilized the soft labor market and their policies can't do much about it.

bobeunlimited.substack.com/p/a-wobble-o...

x.com/paures12/sta...

x.com/paures12/sta...

Vol has been crushed, growth views have narrowed to 2%, and investors assume every setback brings stimulus. With risks priced near zero even the smallest shocks will come as a surprise to the markets.

bobeunlimited.substack.com/p/pervasive-...

Vol has been crushed, growth views have narrowed to 2%, and investors assume every setback brings stimulus. With risks priced near zero even the smallest shocks will come as a surprise to the markets.

bobeunlimited.substack.com/p/pervasive-...

www.pionline.com/asset-manage...

www.pionline.com/asset-manage...

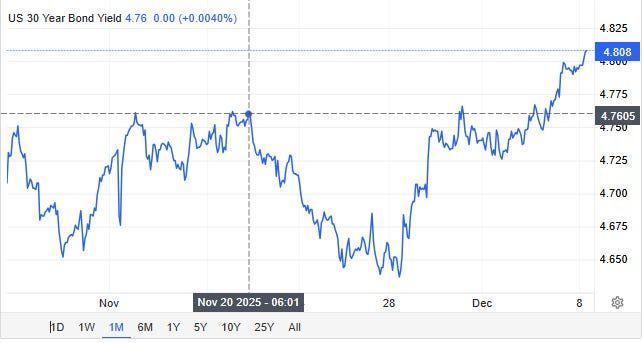

Long end yields are rising even with greater expectations of easing. These moves higher in the rates that matter suggest the Fed's ability to pump the economy and markets may be limited ahead.

bobeunlimited.substack.com/p/the-feds-e...

Long end yields are rising even with greater expectations of easing. These moves higher in the rates that matter suggest the Fed's ability to pump the economy and markets may be limited ahead.

bobeunlimited.substack.com/p/the-feds-e...

youtu.be/h5NRE4nv_XA?...

youtu.be/h5NRE4nv_XA?...

youtu.be/dgrwW4BTQvQ?...

youtu.be/dgrwW4BTQvQ?...

bobeunlimited.substack.com/p/latent-tar...

bobeunlimited.substack.com/p/latent-tar...

bobeunlimited.substack.com/p/strong-hh-...

bobeunlimited.substack.com/p/strong-hh-...

bobeunlimited.substack.com/p/feds-dead-...

bobeunlimited.substack.com/p/feds-dead-...

www.marketwatch.com/story/why-in...

www.marketwatch.com/story/why-in...