🚨 Gold hits record high as investors pile in to safe haven💰

business-money.com/announcement... @nigeljgreen.bsky.social

#Gold #SafeHaven #Investing #FinancialNews #GoldPrices #GoldForecast #PreciousMetals

business-money.com/announcement... @nigeljgreen.bsky.social

#Gold #SafeHaven #Investing #FinancialNews #GoldPrices #GoldForecast #PreciousMetals

Gold hits record high as investors pile in to safe haven - Business Money

business-money.com

September 5, 2025 at 10:49 AM

Everybody can reply

#Altın #Gümüş #ANZBank #AltınTahmini #GümüşTahmini #GoldForecast #SilverForecast #PreciousMetals #Investing #Ekonomi #Economy

October 16, 2025 at 8:46 PM

Everybody can reply

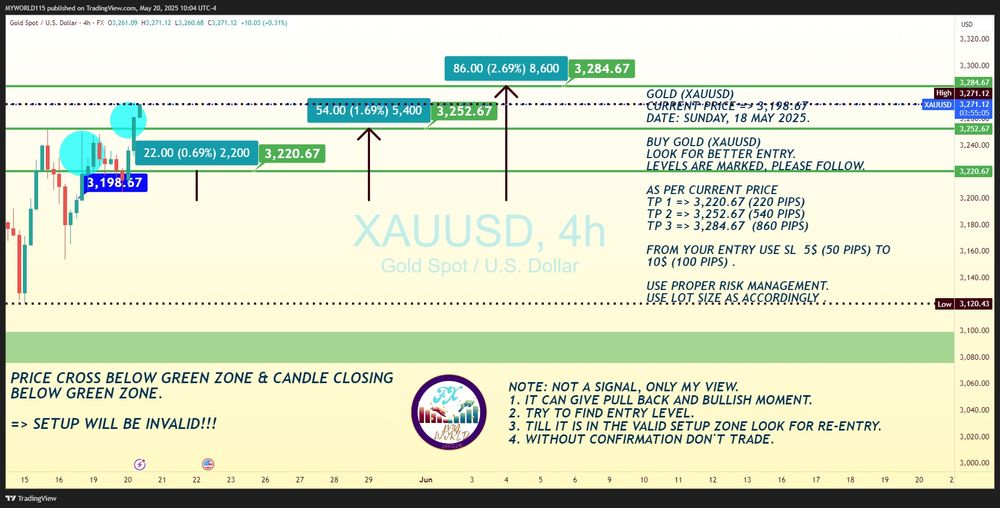

UPDATE

ALL 3 TP HIT!!

GOLD (XAUUSD) HIT TP 3 => 3284.67 (860 PIPS)

#GoldForecast #TradingCommunity #FXChartSetup #ForexMadeSimple #TradeWithConfidence #XAUUSDStrategy #InvestSmart #GoldRush2025 #SimpleCharting #ForexEducation

ALL 3 TP HIT!!

GOLD (XAUUSD) HIT TP 3 => 3284.67 (860 PIPS)

#GoldForecast #TradingCommunity #FXChartSetup #ForexMadeSimple #TradeWithConfidence #XAUUSDStrategy #InvestSmart #GoldRush2025 #SimpleCharting #ForexEducation

May 20, 2025 at 6:32 PM

Everybody can reply

1 likes

Gold Weekly Forecast: Geopolitics Could Push to New ATH - Forex Crunch #GoldForecast #Geopolitics #Investment #FinancialMarkets #GoldPrices

Gold Weekly Forecast: Geopolitics Could Push to New ATH - Forex Crunch

Gold Weekly Forecast: Geopolitics Could Push to New ATH Forex Crunch

http://dlvr.it/TLMLjf

dlvr.it

June 15, 2025 at 8:12 AM

Everybody can reply

GOLD (XAUUSD) HIT TP 2 => 3252.67 (540 PIPS)

#GoldForecast #TradingCommunity #FXChartSetup #ForexMadeSimple #TradeWithConfidence #XAUUSDStrategy #InvestSmart #GoldRush2025 #SimpleCharting #ForexEducation

#GoldForecast #TradingCommunity #FXChartSetup #ForexMadeSimple #TradeWithConfidence #XAUUSDStrategy #InvestSmart #GoldRush2025 #SimpleCharting #ForexEducation

May 20, 2025 at 4:43 PM

Everybody can reply

1 likes

| ctrendfx.com | bit.ly/CTrendFX1 #GoldForecast #GoldPrices #GoldmanSachs #InvestmentBanking #CentralBanks

Goldman Sachs lifts gold forecast. Could get above US$4200 by end 2025 in extreme case

Goldman Sachs has raised its year-end 2025 gold price forecast to USD 3,300 per ounce, up from a previous estimate of USD 3,100. The investment bank also widened its projected trading range to USD 3,250–3,520, citing continued strong demand from Asian central banks.

According to Goldman, large-scale gold purchases by these central banks are likely to persist for another three to six years as they work toward reaching their long-term reserve targets. This sustained buying is expected to be a key driver of upward pressure on prices.

The bank also noted that medium-term risks remain tilted to the upside. In more extreme, tail-risk scenarios, gold could even climb beyond USD 4,200 per ounce by the end of 2025.

This article was written by Eamonn Sheridan at www.forexlive.com.

dlvr.it

March 26, 2025 at 11:18 PM

Everybody can reply

$4,000 Gold? Is the Summer Lull Hiding a Major Breakout.

#goldforecast #inflationhedge #moneysupply #economicupdate #goldbullion #investingin2025 #goldandsilver #fiatcurrency #hardassets #stackingsilver #goldbreakout

#goldforecast #inflationhedge #moneysupply #economicupdate #goldbullion #investingin2025 #goldandsilver #fiatcurrency #hardassets #stackingsilver #goldbreakout

August 3, 2025 at 8:42 AM

Everybody can reply

Aurudium.com Review | Aurudium Review

Gold Price Challenge 2025

Where’s gold today? Look at the chart, take your guess, and claim your bragging rights. Closest prediction wins the spotlight. Ready to test your gold instincts?

#Aurudium #GoldPriceChallenge #PreciousMetals #TradingQuiz #GoldForecast

Gold Price Challenge 2025

Where’s gold today? Look at the chart, take your guess, and claim your bragging rights. Closest prediction wins the spotlight. Ready to test your gold instincts?

#Aurudium #GoldPriceChallenge #PreciousMetals #TradingQuiz #GoldForecast

August 19, 2025 at 8:37 AM

Everybody can reply

#Gold #GoldMarket #GoldPrice #Gold2025 #Investing #Commodities #SafeHaven #Geopolitics #CentralBanks #Inflation #MarketOutlook #GoldRally #Trading #Finance #XAUUSD #EconomicUncertainty #Tariffs #MarketAnalysis #GoldForecast #Bullion

April 4, 2025 at 11:25 PM

Everybody can reply

🚨 Gold hits record high as investors pile in to safe haven💰

business-money.com/announcement...

#Gold #SafeHaven #Investing #FinancialNews #GoldPrices #GoldForecast #PreciousMetals

business-money.com/announcement...

#Gold #SafeHaven #Investing #FinancialNews #GoldPrices #GoldForecast #PreciousMetals

Gold hits record high as investors pile in to safe haven - Business Money

business-money.com

September 5, 2025 at 10:53 AM

Everybody can reply

XAUUSD 4H - Liquidity GrabComplete | Bullish Continuation in PI #XAUUSD #GoldAnalysis #ForexTrading #LiquidityGrab #BullishContinuation #4HChart #TechnicalAnalysis #PriceAction #TraderMindset #ForexSetup #MarketStructure #DayTrading #OrbitFX #GoldBulls #GoldForecast

May 29, 2025 at 7:44 AM

Everybody can reply

1 likes

#Gold #GoldMarket #GoldPrice #Gold2025 #Investing #Commodities #SafeHaven #Geopolitics #CentralBanks #Inflation #MarketOutlook #GoldRally #Trading #Finance #XAUUSD #EconomicUncertainty #Tariffs #MarketAnalysis #GoldForecast #Bullion

April 4, 2025 at 11:16 PM

Everybody can reply

📊 Gold prices in 2025: What are investors expecting? Watch our new short to see the forecasts and top ways to invest.

🎥 youtube.com/shorts/NPOnz...

#GoldForecast #InvestingTips #SmartMoney

🎥 youtube.com/shorts/NPOnz...

#GoldForecast #InvestingTips #SmartMoney

June 27, 2025 at 8:01 AM

Everybody can reply