#HousingMarket #RealEstateEconomics #Affordability #Outlook #2026Forecast

#HousingMarket #RealEstateEconomics #Affordability #Outlook #2026Forecast

Put more simply, the 2026 housing market will look steadier but still be far from 'normal'.

Put more simply, the 2026 housing market will look steadier but still be far from 'normal'.

#CRE #CommercialRealEstate #Lending #CMBS #Multifamily #Industrial #Office #Economy

#CRE #CommercialRealEstate #Lending #CMBS #Multifamily #Industrial #Office #Economy

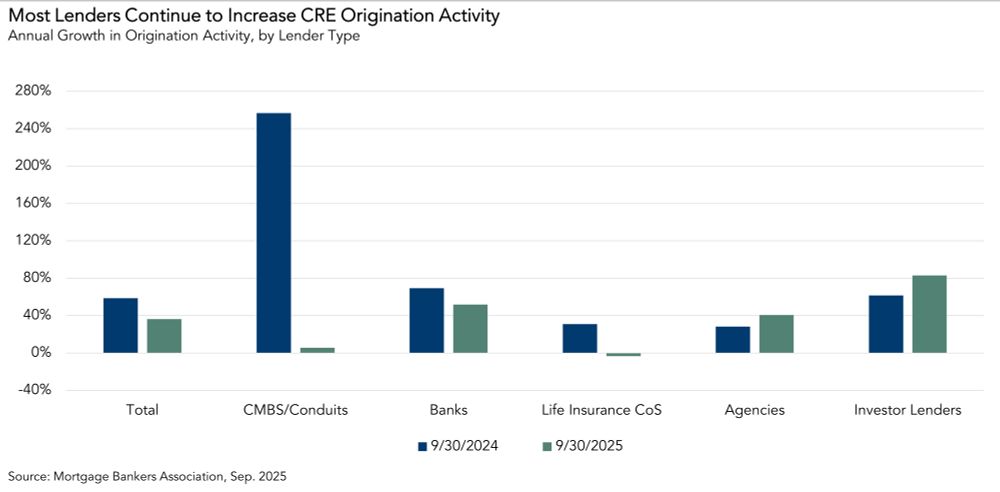

Most lender types increased origination volumes in the third quarter, with banks and agencies contributing to the overall rise. Life insurance companies were the only cohort to edge lower, declining about 3.5%. CMBS issuance slowed...

Most lender types increased origination volumes in the third quarter, with banks and agencies contributing to the overall rise. Life insurance companies were the only cohort to edge lower, declining about 3.5%. CMBS issuance slowed...

-- What improving affordability and income growth mean for a slow but steady recovery

Listen to the full episode on Spotify or your favorite podcast platform, or follow the link below: blog.firstam.com/reconomy-pod...

-- What improving affordability and income growth mean for a slow but steady recovery

Listen to the full episode on Spotify or your favorite podcast platform, or follow the link below: blog.firstam.com/reconomy-pod...

-- Is a price crash looming?

-- Are foreclosures coming back?

-- Are home sales “dead forever”?

-- Why house-price slowdowns are part of a normal market adjustment

-- Is a price crash looming?

-- Are foreclosures coming back?

-- Are home sales “dead forever”?

-- Why house-price slowdowns are part of a normal market adjustment

#CRE #Industrial #Midwest

#CRE #Industrial #Midwest

-- Industrial outdoor storage, cold storage, and other niche asset classes that are coming into their own.

-- Industrial outdoor storage, cold storage, and other niche asset classes that are coming into their own.