We estimate our model using Bayesian IRF matching and find a very good fit for key variables to MP shocks.

Bottom line: NK models with capacity utilization can potentially explain both recent as well as historical inflation behavior

We estimate our model using Bayesian IRF matching and find a very good fit for key variables to MP shocks.

Bottom line: NK models with capacity utilization can potentially explain both recent as well as historical inflation behavior

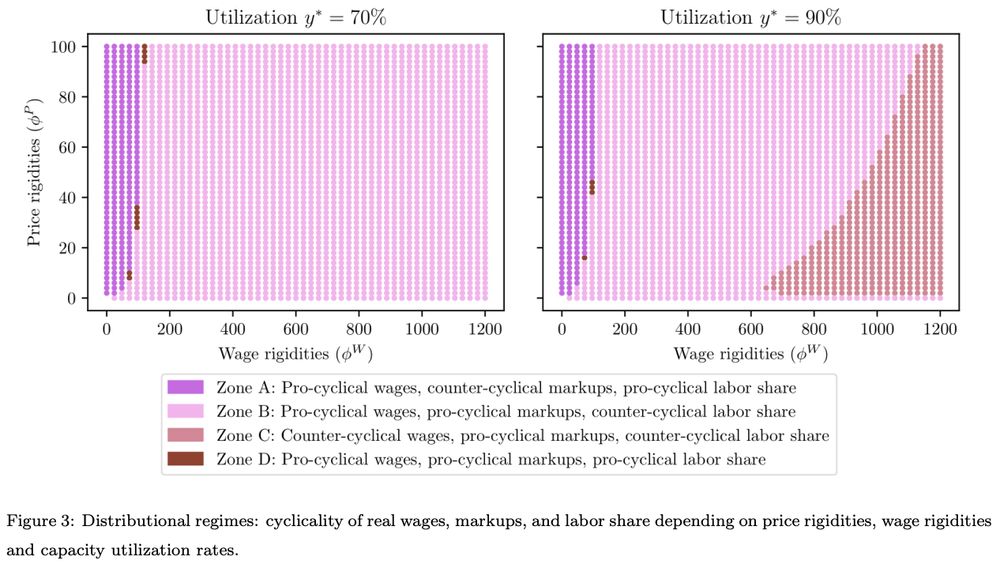

Procyclical markups are more likely when:

➡️ High utilization rate y* when shock occurs

➡️ Prices have relatively lower nominal rigidities than wages

Procyclical markups are more likely when:

➡️ High utilization rate y* when shock occurs

➡️ Prices have relatively lower nominal rigidities than wages

⭐️ Capacity utilization rate y* appears as a state variable in the linearized PC

⭐️ Reflects nonlinearities due to *product market* tightness

⭐️ Capacity utilization rate y* appears as a state variable in the linearized PC

⭐️ Reflects nonlinearities due to *product market* tightness

⭐️When y* is high → inflation responds immediately, driven primarily by higher markups and muted productivity effects (right panel)

⭐️When y* is high → inflation responds immediately, driven primarily by higher markups and muted productivity effects (right panel)

Firms set capacity before observing variable demand → optimal to hold some "precautionary" capacity

When demand manifests, firms produce by utilizing capacity (ala labor effort in Burnside 93)-*upto max capacity*!

Firms set capacity before observing variable demand → optimal to hold some "precautionary" capacity

When demand manifests, firms produce by utilizing capacity (ala labor effort in Burnside 93)-*upto max capacity*!

When does inflation increase slowly ("hump-shaped") vs rapidly? When do different drivers (wages, markups, etc) play bigger roles?

My #JMP explores these Qs by bringing a key variable back to the center of the debate: capacity utilization

A thread 🧵👇

When does inflation increase slowly ("hump-shaped") vs rapidly? When do different drivers (wages, markups, etc) play bigger roles?

My #JMP explores these Qs by bringing a key variable back to the center of the debate: capacity utilization

A thread 🧵👇