$PLTR: +64% YTD, parabolic run, RSI>70 (earnings Monday!)

$BBIO: +41% YTD, 52-week high, acoramidis launch crushing estimates

$OKTA: +43% YTD, breakout on S&P MidCap-400 inclusion

Risk management key with elevated RSIs across tech.

$PLTR: +64% YTD, parabolic run, RSI>70 (earnings Monday!)

$BBIO: +41% YTD, 52-week high, acoramidis launch crushing estimates

$OKTA: +43% YTD, breakout on S&P MidCap-400 inclusion

Risk management key with elevated RSIs across tech.

Top performers:

• HNRG: 96.10 RS Rating

• GDXU: 98.60 RS Rating

• HMY: 98.40 RS Rating

• AU: 98.00 RS Rating

Gold miners and energy are leading the charge. #stocks

Top performers:

• HNRG: 96.10 RS Rating

• GDXU: 98.60 RS Rating

• HMY: 98.40 RS Rating

• AU: 98.00 RS Rating

Gold miners and energy are leading the charge. #stocks

HMY, GFI, and AU (AngloGold Ashanti) leading with 97+ RS ratings when Market Pulse sits at a bearish 34.82/100.

Safety in a storm? ⛈️ capitalcompanion.ai #trading #stockmarket

HMY, GFI, and AU (AngloGold Ashanti) leading with 97+ RS ratings when Market Pulse sits at a bearish 34.82/100.

Safety in a storm? ⛈️ capitalcompanion.ai #trading #stockmarket

$FUTU leads the pack (RS: 98.0) after stellar Q4 results - revenue +86.8% YoY, net income +113.3%!

$EH making moves with Shanghai demo flight

$CWEB riding China tech momentum

$BABX +8.22% with gold strength

Track the leaders, trade the strength.

#trading #investing #ai

$FUTU leads the pack (RS: 98.0) after stellar Q4 results - revenue +86.8% YoY, net income +113.3%!

$EH making moves with Shanghai demo flight

$CWEB riding China tech momentum

$BABX +8.22% with gold strength

Track the leaders, trade the strength.

#trading #investing #ai

capitalcompanion.ai

capitalcompanion.ai

Notable bearish technical setups emerging:

$VITL, $EGO, $NFE displaying significant technical weakness with RS ratings < 45.

Heavy distribution detected in $MRK (26.7M volume) with deteriorating price structure.

Average ADR across scan: 3.85% #trading

Notable bearish technical setups emerging:

$VITL, $EGO, $NFE displaying significant technical weakness with RS ratings < 45.

Heavy distribution detected in $MRK (26.7M volume) with deteriorating price structure.

Average ADR across scan: 3.85% #trading

$HIMS (99.0) leads the pack, with $PLTR (98.6) and $RKLB (98.6) right on its heels!

The whole squad showing serious strength with RS ratings 85+ 📈

Volume leaders: $PLTR 65.5M, $HIMS 38.7M 🚀

$HIMS (99.0) leads the pack, with $PLTR (98.6) and $RKLB (98.6) right on its heels!

The whole squad showing serious strength with RS ratings 85+ 📈

Volume leaders: $PLTR 65.5M, $HIMS 38.7M 🚀

github.com/modelcontext... #fintech #trading #AI

github.com/modelcontext... #fintech #trading #AI

#trading #investing #stockmarket

#trading #investing #stockmarket

#trading #investing #stockmarket

#trading #investing #stockmarket

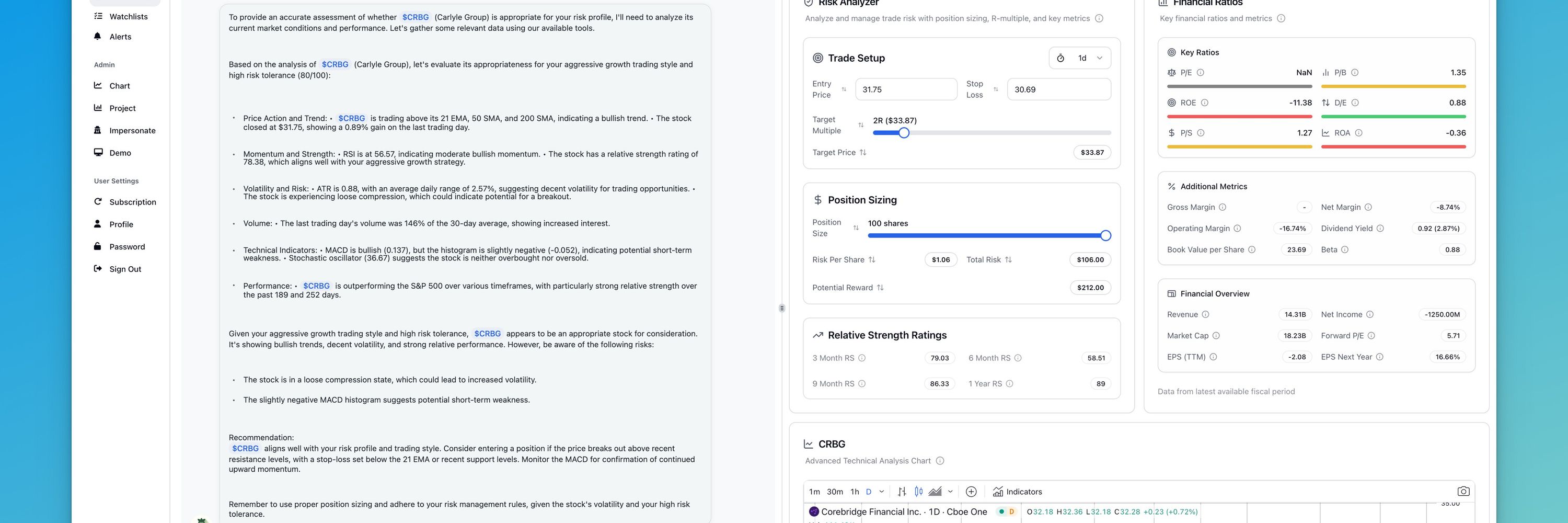

✨ Choose your trading style:

- Conservative (capital preservation)

- Balanced (technical + fundamental)

- Aggressive (growth-focused)

Try it now: capitalcompanion.ai

#fintech #trading #investing

✨ Choose your trading style:

- Conservative (capital preservation)

- Balanced (technical + fundamental)

- Aggressive (growth-focused)

Try it now: capitalcompanion.ai

#fintech #trading #investing

capitalcompanion.ai #stockmarket #trading #investing

capitalcompanion.ai #stockmarket #trading #investing