Richard Rubin

@richardrubindc.bsky.social

U.S. Tax Policy Reporter at The Wall Street Journal in Washington.

(On Signal richardrubindc.08)

(On Signal richardrubindc.08)

New from me: The corporate tax cuts from this year's law are running into a roadblock -- the 2022 corporate minimum tax.

Companies (Meta, Qualcomm) are disclosing billions of dollars in tax breaks they can't use. And there's pressure on Treasury to ease the rules.

www.wsj.com/politics/pol...

Companies (Meta, Qualcomm) are disclosing billions of dollars in tax breaks they can't use. And there's pressure on Treasury to ease the rules.

www.wsj.com/politics/pol...

Trump’s Tax Cuts Are Exposing Companies to Biden’s Tax Hike

Democrats’ older alternative minimum tax claws back billions of dollars in savings from the newer GOP law.

www.wsj.com

November 9, 2025 at 12:14 PM

New from me: The corporate tax cuts from this year's law are running into a roadblock -- the 2022 corporate minimum tax.

Companies (Meta, Qualcomm) are disclosing billions of dollars in tax breaks they can't use. And there's pressure on Treasury to ease the rules.

www.wsj.com/politics/pol...

Companies (Meta, Qualcomm) are disclosing billions of dollars in tax breaks they can't use. And there's pressure on Treasury to ease the rules.

www.wsj.com/politics/pol...

New from me: Documents show how sweeping a request ICE made for IRS tax records -- and how IRS pushed back until the resulting handover was much, much narrower.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

How the IRS and ICE Tussled During Trump’s Deportation Push

Newly disclosed documents provide new details on the back-and-forth over providing sensitive taxpayer information to immigration officials.

www.wsj.com

October 30, 2025 at 11:00 PM

New from me: Documents show how sweeping a request ICE made for IRS tax records -- and how IRS pushed back until the resulting handover was much, much narrower.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

The SALT cap is now $40,000, but it shrinks very quickly once income exceeds $500k. All-in marginal tax rates are over 50% in that range in some states.

We go through some key tax-planning ideas:

www.wsj.com/personal-fin...

We go through some key tax-planning ideas:

www.wsj.com/personal-fin...

How to Squeeze the Most From the New SALT Cap

Taxpayers can act now to make the most of an increase in state and local tax deductions when they file 2025 taxes in the spring.

www.wsj.com

October 27, 2025 at 2:09 PM

The SALT cap is now $40,000, but it shrinks very quickly once income exceeds $500k. All-in marginal tax rates are over 50% in that range in some states.

We go through some key tax-planning ideas:

www.wsj.com/personal-fin...

We go through some key tax-planning ideas:

www.wsj.com/personal-fin...

Reposted by Richard Rubin

Tariffs brought in record revenue in fiscal year 2025 for the U.S. government. But how much did that change the overall picture? Five takeaways from @richardrubindc.bsky.social and me today on what has changed about the federal budget—and what hasn’t. www.wsj.com/economy/tari...

Tariffs Are Way Up. Interest on Debt Tops $1 Trillion. And DOGE Didn’t Do Much.

The books have closed on the U.S. government’s fiscal 2025. Here’s what has changed about the federal budget—and what hasn’t.

www.wsj.com

October 9, 2025 at 2:00 PM

Tariffs brought in record revenue in fiscal year 2025 for the U.S. government. But how much did that change the overall picture? Five takeaways from @richardrubindc.bsky.social and me today on what has changed about the federal budget—and what hasn’t. www.wsj.com/economy/tari...

New from me today: Democratic-backed tax bills introduced since OBBBA enactment have called for expanding some of Trump's "no tax on" policies.

It's a nod to their popularity -- and an attempt to highlight the new law's limits.

www.wsj.com/politics/pol...

It's a nod to their popularity -- and an attempt to highlight the new law's limits.

www.wsj.com/politics/pol...

Some Democrats Want to Upsize Trump’s New Tax Cuts

Bills try to tap into economic populism and expand breaks for tipped employees, overtime and seniors.

www.wsj.com

October 1, 2025 at 1:30 PM

New from me today: Democratic-backed tax bills introduced since OBBBA enactment have called for expanding some of Trump's "no tax on" policies.

It's a nod to their popularity -- and an attempt to highlight the new law's limits.

www.wsj.com/politics/pol...

It's a nod to their popularity -- and an attempt to highlight the new law's limits.

www.wsj.com/politics/pol...

If you fall into one of the new law's preferred groups, you can go quite a way up the income scale before you have to pay federal income tax.

We visualized a few examples:

www.wsj.com/personal-fin...

We visualized a few examples:

www.wsj.com/personal-fin...

How the New Tax Law Can Drive Your Bill to $0

It’s easier for some middle-income Americans to eliminate their tax bills without arcane strategies.

www.wsj.com

September 29, 2025 at 7:22 PM

If you fall into one of the new law's preferred groups, you can go quite a way up the income scale before you have to pay federal income tax.

We visualized a few examples:

www.wsj.com/personal-fin...

We visualized a few examples:

www.wsj.com/personal-fin...

New from me today: What tax do billionaires pay?

The corporate tax, which is a crucial component of the US revenue system at the very top of the income distribution, according to a new study.

www.wsj.com/personal-fin...

The corporate tax, which is a crucial component of the US revenue system at the very top of the income distribution, according to a new study.

www.wsj.com/personal-fin...

The Tax That Billionaires Actually Pay

Nearly 40% of taxes at the very top come through the corporate income levy, study says.

www.wsj.com

August 25, 2025 at 2:16 PM

New from me today: What tax do billionaires pay?

The corporate tax, which is a crucial component of the US revenue system at the very top of the income distribution, according to a new study.

www.wsj.com/personal-fin...

The corporate tax, which is a crucial component of the US revenue system at the very top of the income distribution, according to a new study.

www.wsj.com/personal-fin...

New from me:

The "no tax on overtime" deduction is big, popular -- and a little messy.

Employers and workers are starting to grapple with the rules for who qualifies and who doesn't.

www.wsj.com/politics/pol...

The "no tax on overtime" deduction is big, popular -- and a little messy.

Employers and workers are starting to grapple with the rules for who qualifies and who doesn't.

www.wsj.com/politics/pol...

Who Gets ‘No Tax on Overtime’? It’s Messy.

Employers and workers start grappling with limited scope of new tax deduction

www.wsj.com

July 31, 2025 at 1:19 PM

New from me:

The "no tax on overtime" deduction is big, popular -- and a little messy.

Employers and workers are starting to grapple with the rules for who qualifies and who doesn't.

www.wsj.com/politics/pol...

The "no tax on overtime" deduction is big, popular -- and a little messy.

Employers and workers are starting to grapple with the rules for who qualifies and who doesn't.

www.wsj.com/politics/pol...

New from us today: The tax law made five separate changes that will affect incentives for charitable giving.

How will that all shake out?

www.wsj.com/politics/pol...

How will that all shake out?

www.wsj.com/politics/pol...

Trump Tax Megalaw Upends Charitable Giving

Nonprofits, already under strain, face “mixed bag” from the law’s changes to giving incentives.

www.wsj.com

July 30, 2025 at 12:50 PM

New from us today: The tax law made five separate changes that will affect incentives for charitable giving.

How will that all shake out?

www.wsj.com/politics/pol...

How will that all shake out?

www.wsj.com/politics/pol...

New from me:

US exporters -- particularly those with factories and research expenses -- scored a big win in the tax law.

www.wsj.com/politics/pol...

US exporters -- particularly those with factories and research expenses -- scored a big win in the tax law.

www.wsj.com/politics/pol...

U.S. Exporters Get Welcome Surprise in Trump Tax Law

Restructured deduction is driving down tax rates for capital-intensive manufacturers of aircraft and other products.

www.wsj.com

July 29, 2025 at 12:42 PM

New from me:

US exporters -- particularly those with factories and research expenses -- scored a big win in the tax law.

www.wsj.com/politics/pol...

US exporters -- particularly those with factories and research expenses -- scored a big win in the tax law.

www.wsj.com/politics/pol...

We're doing a live Q-and-A today on the recent WSJ poll, including Americans' dim views of the new tax-and-spending law.

Lob in your questions now:

www.wsj.com/politics/pol...

Lob in your questions now:

www.wsj.com/politics/pol...

Live Q&A: Trump, Taxes and Midterms—Ask Your Questions About the WSJ Poll

Join a real-time, written chat with WSJ reporters on Monday, July 28, from 2 p.m. to 3 p.m. ET. WSJ subscribers can submit their questions at any time in the comments space below.

www.wsj.com

July 28, 2025 at 1:52 PM

We're doing a live Q-and-A today on the recent WSJ poll, including Americans' dim views of the new tax-and-spending law.

Lob in your questions now:

www.wsj.com/politics/pol...

Lob in your questions now:

www.wsj.com/politics/pol...

IG update: As of May, IRS workforce was down 25% from this year's 103,000 starting point.

Pretty even spread over job types, including a 26% decline in revenue agents (auditors).

Here are all the details:

www.tigta.gov/sites/defaul...

Pretty even spread over job types, including a 26% decline in revenue agents (auditors).

Here are all the details:

www.tigta.gov/sites/defaul...

www.tigta.gov

July 22, 2025 at 1:48 PM

IG update: As of May, IRS workforce was down 25% from this year's 103,000 starting point.

Pretty even spread over job types, including a 26% decline in revenue agents (auditors).

Here are all the details:

www.tigta.gov/sites/defaul...

Pretty even spread over job types, including a 26% decline in revenue agents (auditors).

Here are all the details:

www.tigta.gov/sites/defaul...

CBO current policy (CP) score is useful for the pattern. You see expanded tax cuts happen first (deficits up against CP by $597B in 26-29). Those expire and spending cuts come ($936B deficit reduction against CP in 30-34).

Unless Congress extends "no tax on" & cancels spending cuts.

Unless Congress extends "no tax on" & cancels spending cuts.

July 21, 2025 at 6:52 PM

CBO current policy (CP) score is useful for the pattern. You see expanded tax cuts happen first (deficits up against CP by $597B in 26-29). Those expire and spending cuts come ($936B deficit reduction against CP in 30-34).

Unless Congress extends "no tax on" & cancels spending cuts.

Unless Congress extends "no tax on" & cancels spending cuts.

New from us: The tax law retools Opportunity Zones, trying to push more money into rural areas largely left behind by a program for left-behind areas.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

GOP Reshapes Opportunity Zones to Target Trump Country

New tax-and-spending law expands benefits for investments in sparsely populated regions.

www.wsj.com

July 17, 2025 at 1:28 PM

New from us: The tax law retools Opportunity Zones, trying to push more money into rural areas largely left behind by a program for left-behind areas.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

So post-enactment, the current policy baseline is no longer current policy.

Are we calling it:

--Baseline formerly known as current policy

--The then-current policy baseline

--Prior policy baseline

None of those are particularly fun and/or clear.

Are we calling it:

--Baseline formerly known as current policy

--The then-current policy baseline

--Prior policy baseline

None of those are particularly fun and/or clear.

July 15, 2025 at 3:50 PM

So post-enactment, the current policy baseline is no longer current policy.

Are we calling it:

--Baseline formerly known as current policy

--The then-current policy baseline

--Prior policy baseline

None of those are particularly fun and/or clear.

Are we calling it:

--Baseline formerly known as current policy

--The then-current policy baseline

--Prior policy baseline

None of those are particularly fun and/or clear.

The school-voucher/scholarship tax credit in the GOP tax bill is unlike any other tax break. Our story:

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

The Tax Bill Would Deliver a Big Win for Private Schools—and Investors

School-choice advocates see a ‘revolution within the tax code.’

www.wsj.com

June 23, 2025 at 1:31 PM

The school-voucher/scholarship tax credit in the GOP tax bill is unlike any other tax break. Our story:

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

All the noise about the SALT cap is around $10k, $30k, or $40k. But there are a ton of dollars in the much messier and more technical debate about cap workarounds for businesses.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

Republicans Clamp Down on SALT Workaround for Business Owners

Accountants, dentists and business groups are making a last-ditch effort to get the GOP to back off in President Trump’s megabill.

www.wsj.com

June 23, 2025 at 1:30 PM

All the noise about the SALT cap is around $10k, $30k, or $40k. But there are a ton of dollars in the much messier and more technical debate about cap workarounds for businesses.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

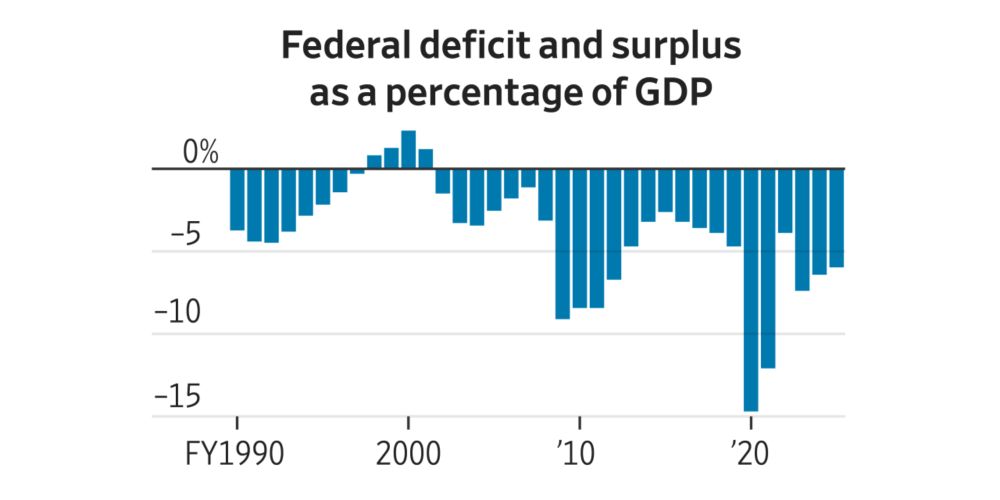

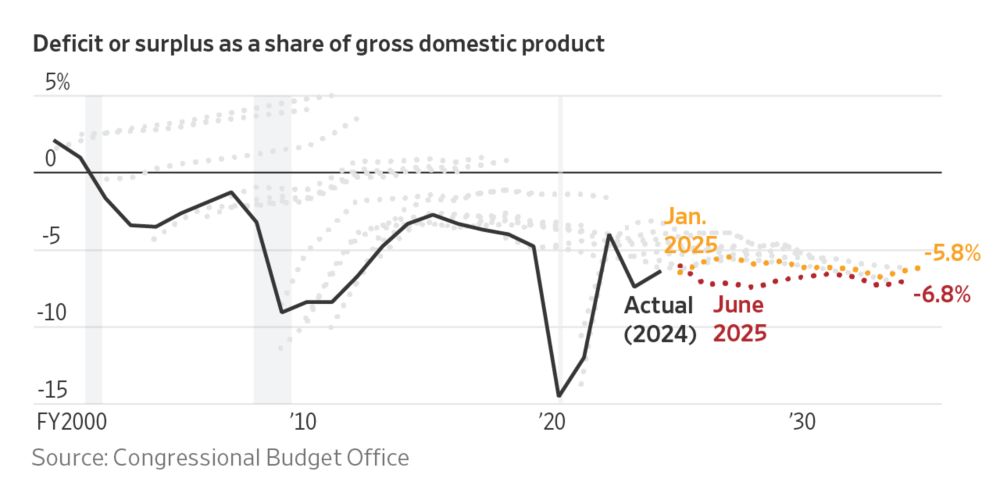

New from us today: A visual look at how and why the US turned from budget surpluses to deficits over the past quarter-century.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

The Path to Record Deficits

A generation ago, the federal budget was briefly in surplus. Now, it appears headed for a record stretch of peacetime deficits. What happened?

www.wsj.com

June 18, 2025 at 2:10 PM

New from us today: A visual look at how and why the US turned from budget surpluses to deficits over the past quarter-century.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

CBO says the House GOP megabill gets more expensive when economic effects are included. Our new story:

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

GOP Megabill Would Increase Deficits Even More After Including Economic Growth, CBO Says

House version of tax and spending proposal would boost GDP, but interest rates would rise, too.

www.wsj.com

June 17, 2025 at 6:53 PM

CBO says the House GOP megabill gets more expensive when economic effects are included. Our new story:

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

Reposted by Richard Rubin

Thanks to @richardrubindc.bsky.social for featuring this work in his recent article on the debate around the macroeconomic impacts of the OBBBA: www.wsj.com/economy/trum...

Republicans and Economists at Odds Over Whether Megabill Will Spur Growth Boom

A raging debate over policies’ effects on economic growth and deficits is at the core of this summer’s fiscal fight in Congress.

www.wsj.com

June 8, 2025 at 3:07 PM

Thanks to @richardrubindc.bsky.social for featuring this work in his recent article on the debate around the macroeconomic impacts of the OBBBA: www.wsj.com/economy/trum...

New from me: An interview with CBO Director Phill Swagel, who's bearing the brunt of Republican attacks on the budget scorekeeping agency.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

Exclusive | Congress’s Budget Referee Confronts Swarm of GOP Critics

In an interview, Phill Swagel defended the CBO’s forecasting record as Republicans blast the fiscal scorekeeping agency’s assessment of their tax-and-spending megabill.

www.wsj.com

June 6, 2025 at 5:19 PM

New from me: An interview with CBO Director Phill Swagel, who's bearing the brunt of Republican attacks on the budget scorekeeping agency.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

There's noise about trying to do more spending cuts in the Senate bill. But addressing many of the senators' concerns--Medicaid cuts, IRA phaseouts, tax-cut permanence--require more money to avoid even bigger deficit increases.

My latest on the $$ squeeze in the Senate:

www.wsj.com/politics/pol...

My latest on the $$ squeeze in the Senate:

www.wsj.com/politics/pol...

GOP Senators’ Demands Push Megabill Price Tag Up

Stances on Medicaid, clean energy and tax cuts complicate passage of President Trump’s agenda.

www.wsj.com

June 4, 2025 at 1:28 PM

There's noise about trying to do more spending cuts in the Senate bill. But addressing many of the senators' concerns--Medicaid cuts, IRA phaseouts, tax-cut permanence--require more money to avoid even bigger deficit increases.

My latest on the $$ squeeze in the Senate:

www.wsj.com/politics/pol...

My latest on the $$ squeeze in the Senate:

www.wsj.com/politics/pol...

Some spousal news...

Some personal news: I'm now editor-in-chief of @votebeat.org

I'm incredibly proud of our excellent team's objective, nonpartisan coverage of elections and voting, which has never been more essential. I'm honored to work with our staff every day.

I'm incredibly proud of our excellent team's objective, nonpartisan coverage of elections and voting, which has never been more essential. I'm honored to work with our staff every day.

May 30, 2025 at 1:22 PM

Some spousal news...