"Thank you Mother Mary for saving us from war. 1938."

Marienthal Monastery, Hesse

"Thank you Mother Mary for saving us from war. 1938."

Marienthal Monastery, Hesse

Deutsche:

Deutsche:

Do check it out if you’re interested in #impactinvesting and it’s surprisingly large variety!

Do check it out if you’re interested in #impactinvesting and it’s surprisingly large variety!

🎶 ManuscriptCentral, you're my retro flame 🎶

Now online: tomusic.ai/music/71e84f...

🎶 ManuscriptCentral, you're my retro flame 🎶

Now online: tomusic.ai/music/71e84f...

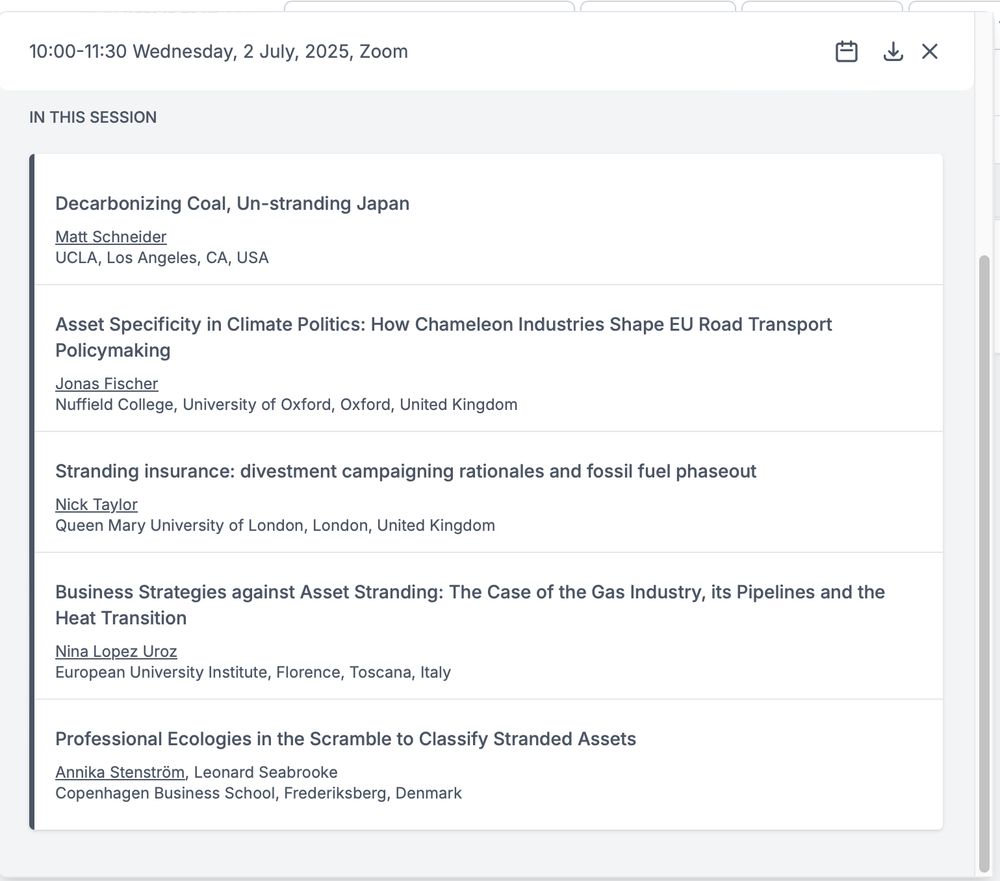

All SASE participants are very welcome to join us on Zoom today at 4PM!

Let me know if you have any Qs!

All SASE participants are very welcome to join us on Zoom today at 4PM!

Let me know if you have any Qs!

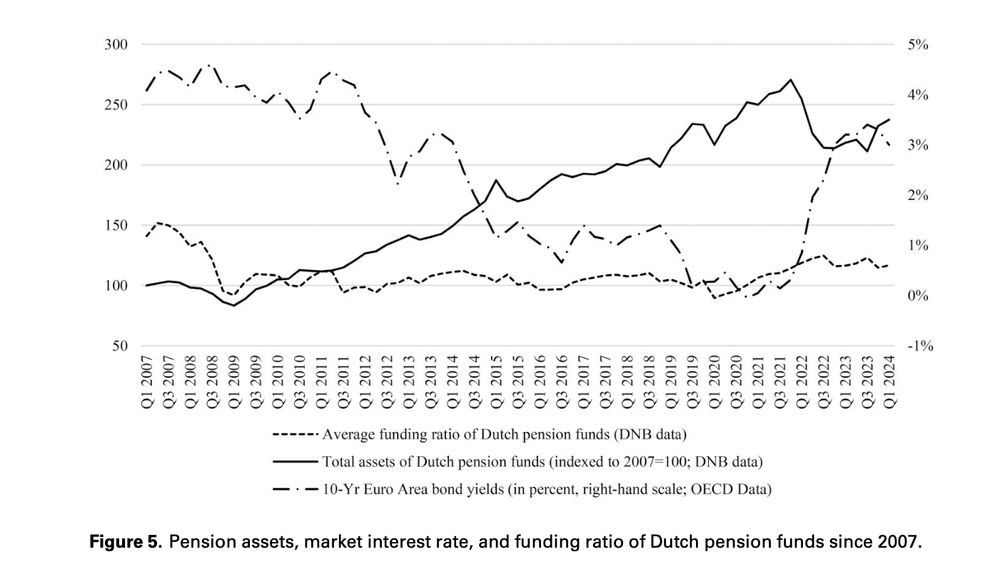

Pension funds need to discount liabilities with market interest rates. This means that they have more resources available when rates increase - even if, as in 2021/22, their assets lose value.

Pension funds need to discount liabilities with market interest rates. This means that they have more resources available when rates increase - even if, as in 2021/22, their assets lose value.

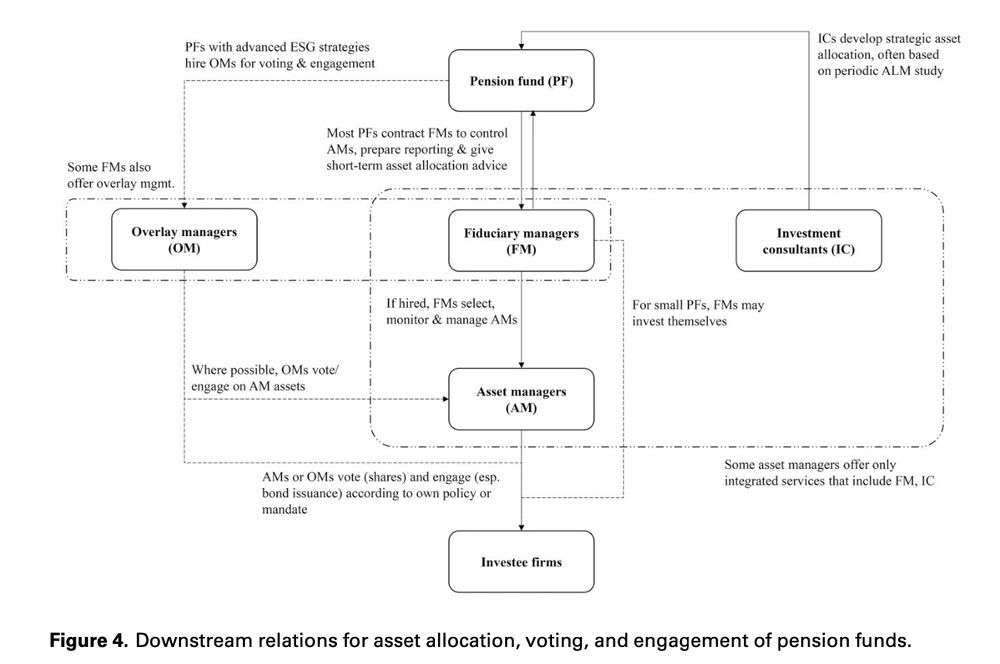

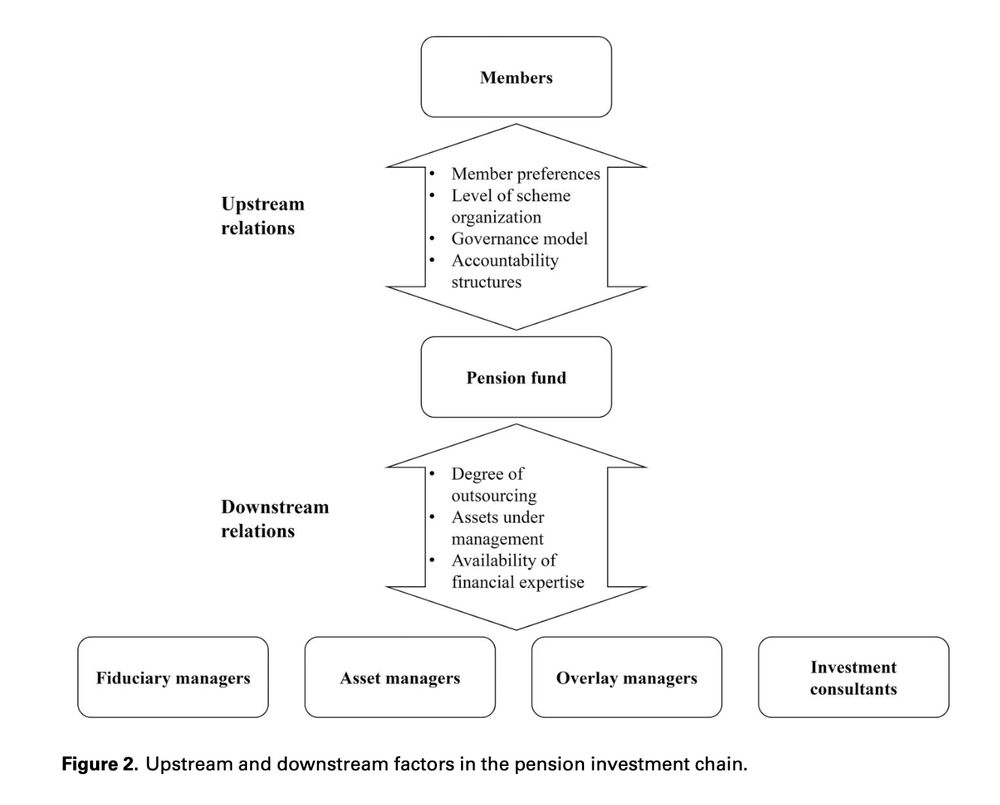

As we describe in detail in the paper, the pension investment chain is somewhat complex and it includes both constraining and enabling factors.

As we describe in detail in the paper, the pension investment chain is somewhat complex and it includes both constraining and enabling factors.

PF boards have rather high autonomy vis-a-vis members as they can carve out discretionary space. But their autonomy is much more constrained vis-a-vis the financial sector.

We describe factors of asymmetric autonomy in detail in the paper.

PF boards have rather high autonomy vis-a-vis members as they can carve out discretionary space. But their autonomy is much more constrained vis-a-vis the financial sector.

We describe factors of asymmetric autonomy in detail in the paper.

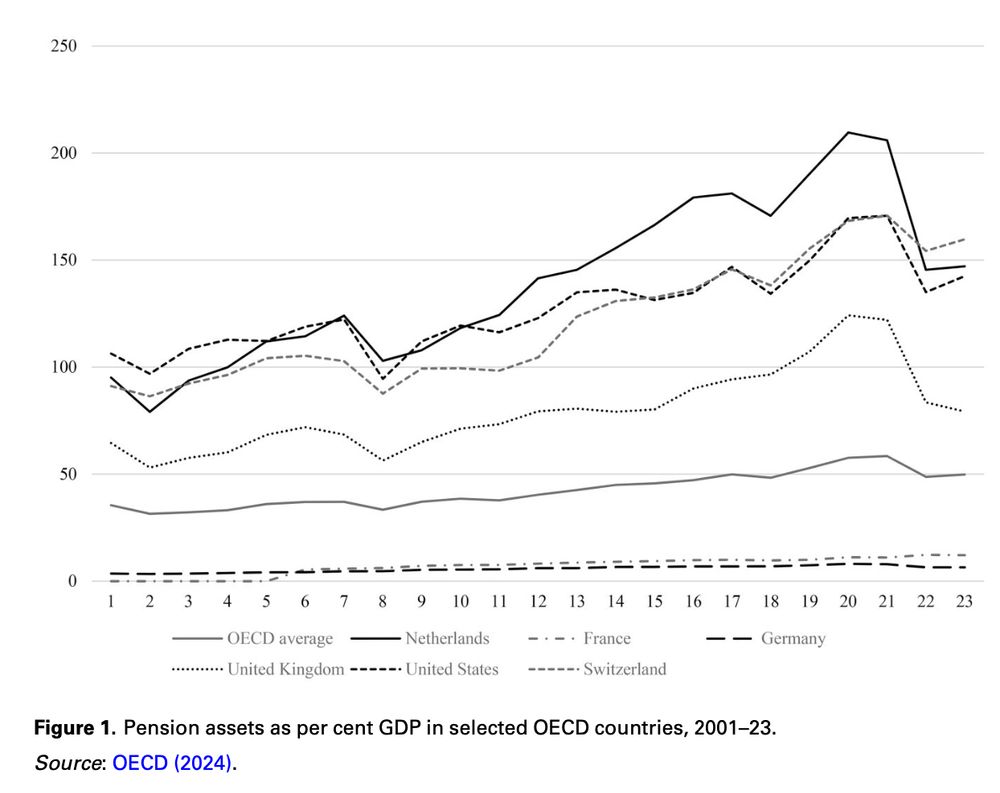

Dutch pension funds are not just quantitatively significant as some of the worlds' largest asset owners - they are also qualitatively significant as they give members a lot of voice.

How does this translate into investment?

Dutch pension funds are not just quantitatively significant as some of the worlds' largest asset owners - they are also qualitatively significant as they give members a lot of voice.

How does this translate into investment?

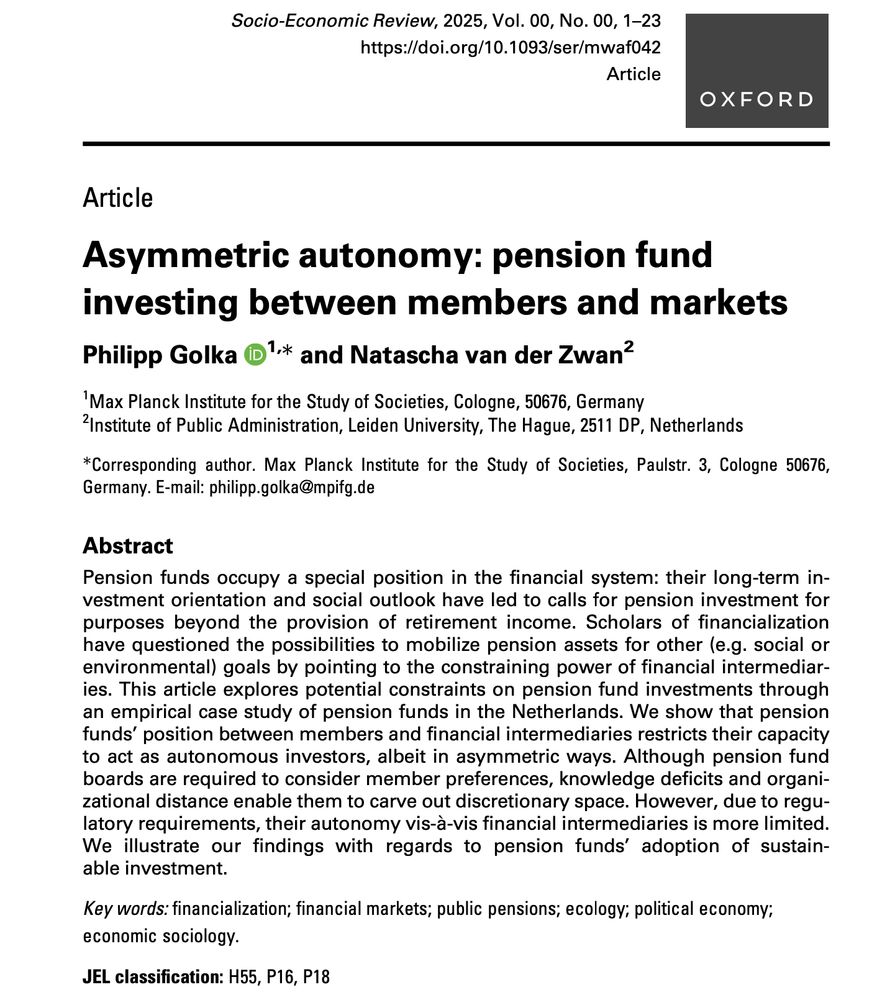

@nataschavanderzwan.bsky.social and I investigate this through an in-depth study of how some of the most important asset owners - pension funds - invest.

Now out in SER!

🧵

@nataschavanderzwan.bsky.social and I investigate this through an in-depth study of how some of the most important asset owners - pension funds - invest.

Now out in SER!

🧵

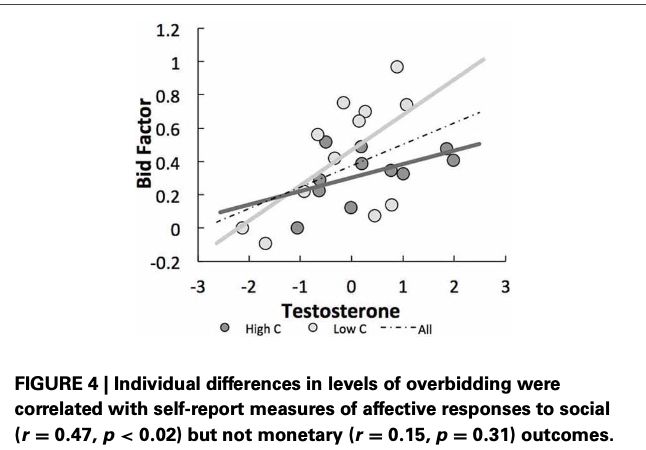

If you're a hedge fund manager and want to set up an aggressive tesosterone-based trading strategy, hmu!

If you're a hedge fund manager and want to set up an aggressive tesosterone-based trading strategy, hmu!

So what, then, *is* an asset?

So what, then, *is* an asset?

Assets are boundary objects that facilitate various forms of social relations. We thus need to study their lifecycle from assetization, asset management to deassetization to understand them.

Assets are boundary objects that facilitate various forms of social relations. We thus need to study their lifecycle from assetization, asset management to deassetization to understand them.