We are grateful for funding from @arnoldventures.bsky.social that supports this work!

We are grateful for funding from @arnoldventures.bsky.social that supports this work!

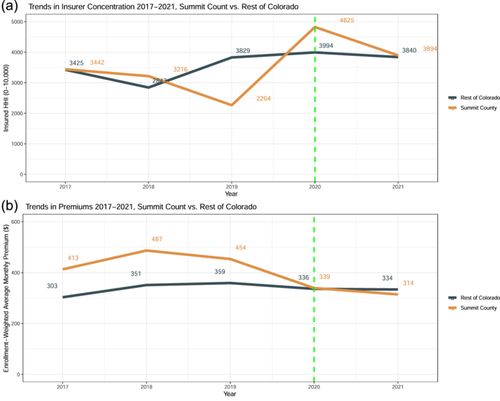

There are a number of aspects that made this coalition unique. However, our findings point to the potential effectiveness of the approach.

There are a number of aspects that made this coalition unique. However, our findings point to the potential effectiveness of the approach.

We are very grateful to @arnoldventures.bsky.social for funding this work.

We are very grateful to @arnoldventures.bsky.social for funding this work.

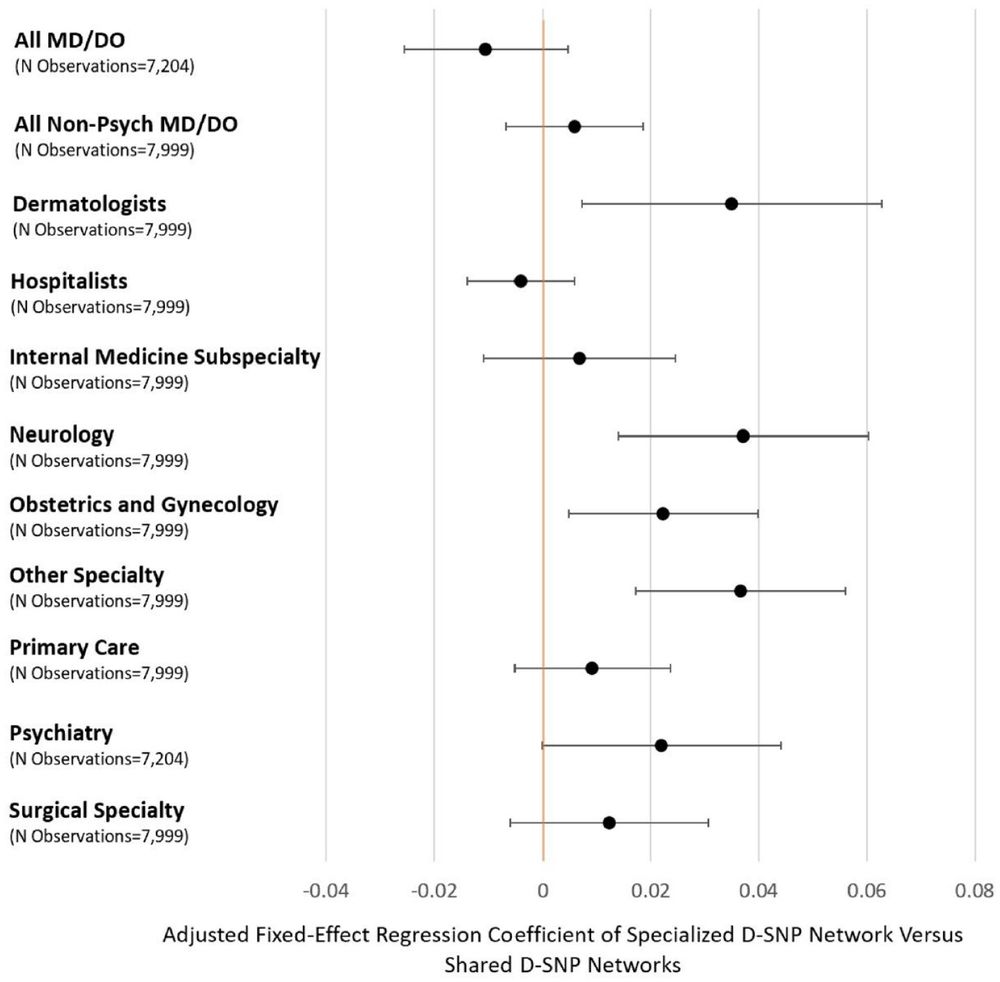

3. When D-SNP networks were specialized, they tended to include a larger share of specialists that commonly treat conditions more prevalent among dually eligible enrollees.

3. When D-SNP networks were specialized, they tended to include a larger share of specialists that commonly treat conditions more prevalent among dually eligible enrollees.

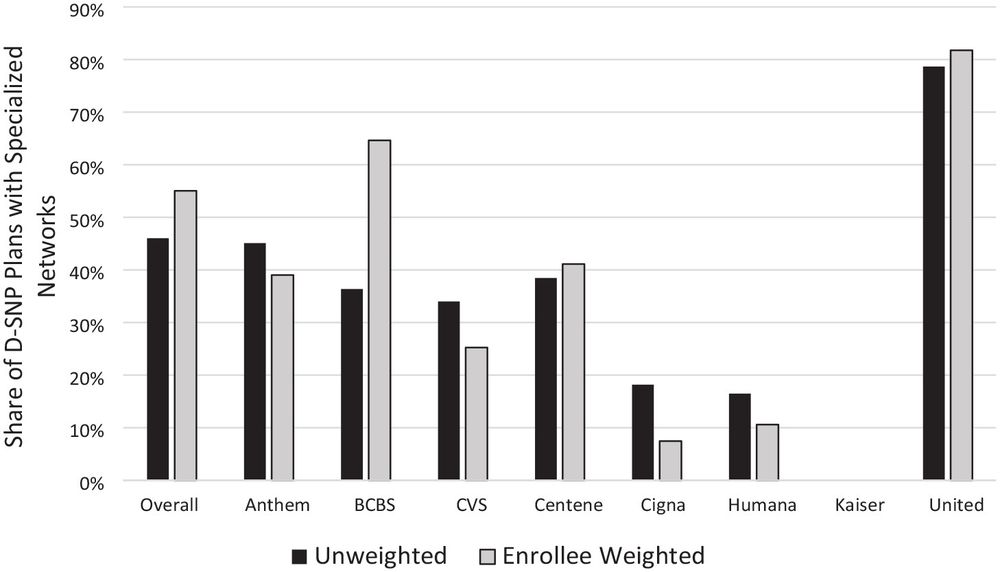

1. Only about half D-SNP plan provider networks were at all distinct from provider networks in standard MA plans offered by the same insurer.

2. These specialized networks were much more common among Fully Integrated Dual Eligible Plans (FIDEs).

1. Only about half D-SNP plan provider networks were at all distinct from provider networks in standard MA plans offered by the same insurer.

2. These specialized networks were much more common among Fully Integrated Dual Eligible Plans (FIDEs).