Leo Schwartz

@leoschwartz.bsky.social

Senior reporter at Fortune Magazine covering the future of money // Writing Term Sheet on Mondays // Past: @restofworld // [email protected]

Scoop: Meta is looking to get back into the stablecoin game 3 years after the failure of Libra/Diem.

Sources told @bdanweiss.bsky.social and me that Meta is holding early discussions with crypto companies about stablecoin integration with a focus on creator payouts.

fortune.com/crypto/2025/...

Sources told @bdanweiss.bsky.social and me that Meta is holding early discussions with crypto companies about stablecoin integration with a focus on creator payouts.

fortune.com/crypto/2025/...

Exclusive: Meta in talks to deploy stablecoins three years after giving up on landmark crypto project

The social media giant is exploring how to use stablecoins to pay content creators, among other uses, according to sources familiar with the matter.

fortune.com

May 9, 2025 at 12:44 PM

Scoop: Meta is looking to get back into the stablecoin game 3 years after the failure of Libra/Diem.

Sources told @bdanweiss.bsky.social and me that Meta is holding early discussions with crypto companies about stablecoin integration with a focus on creator payouts.

fortune.com/crypto/2025/...

Sources told @bdanweiss.bsky.social and me that Meta is holding early discussions with crypto companies about stablecoin integration with a focus on creator payouts.

fortune.com/crypto/2025/...

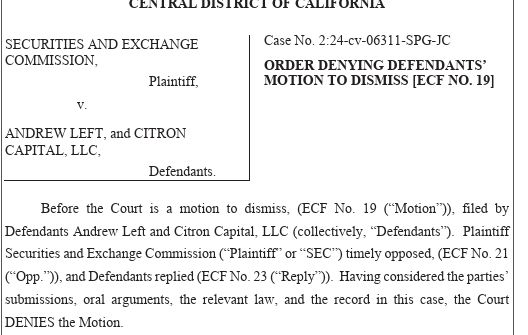

A judge denied the prominent short-seller Andrew Left's motion to dismiss an SEC lawsuit against him, which alleged a scheme to defraud his followers by publishing false and misleading statements about his stock recommendations

storage.courtlistener.com/recap/gov.us...

storage.courtlistener.com/recap/gov.us...

April 23, 2025 at 4:44 PM

A judge denied the prominent short-seller Andrew Left's motion to dismiss an SEC lawsuit against him, which alleged a scheme to defraud his followers by publishing false and misleading statements about his stock recommendations

storage.courtlistener.com/recap/gov.us...

storage.courtlistener.com/recap/gov.us...

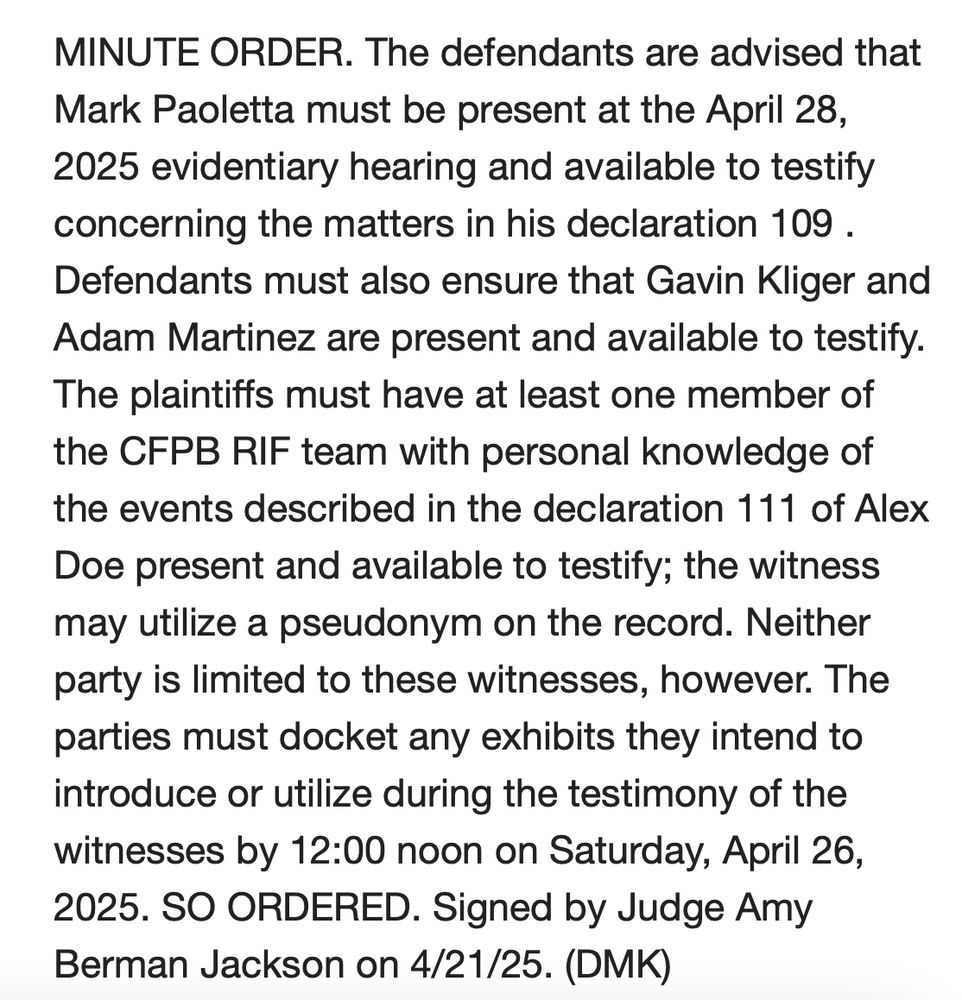

Gavin Kliger, the DOGE staffer who led layoffs at the CFPB, will have to testify at an April 28 hearing

April 21, 2025 at 4:20 PM

Gavin Kliger, the DOGE staffer who led layoffs at the CFPB, will have to testify at an April 28 hearing

Trump keeps threatening to fire Fed chair Jerome Powell — but can he?

I spoke with legal experts to understand the Trump administration's attempt to overturn nearly a century of precedent, and whether the Fed really is special:

fortune.com/article/trum...

I spoke with legal experts to understand the Trump administration's attempt to overturn nearly a century of precedent, and whether the Fed really is special:

fortune.com/article/trum...

Trump's knives are out for Jerome Powell, setting up a Supreme Court showdown over the Fed’s independence

The Fed is special. Why the Supreme Court may let Trump fire other agency heads—but not Jerome Powell.

fortune.com

April 21, 2025 at 3:07 PM

Trump keeps threatening to fire Fed chair Jerome Powell — but can he?

I spoke with legal experts to understand the Trump administration's attempt to overturn nearly a century of precedent, and whether the Fed really is special:

fortune.com/article/trum...

I spoke with legal experts to understand the Trump administration's attempt to overturn nearly a century of precedent, and whether the Fed really is special:

fortune.com/article/trum...

Court filings from Friday detail the DOGE-led, 36-hour scramble to conduct mass layoffs at the Consumer Financial Protection Bureau—an action that a federal judge has temporarily blocked

fortune.com/article/cons...

fortune.com/article/cons...

Court filings describe DOGE-driven, scream-filled, 36-hour mass layoff scramble at consumer protection agency

As the Trump administration seeks to gut the Consumer Financial Protection Bureau, employees are fighting back.

fortune.com

April 21, 2025 at 2:05 PM

Court filings from Friday detail the DOGE-led, 36-hour scramble to conduct mass layoffs at the Consumer Financial Protection Bureau—an action that a federal judge has temporarily blocked

fortune.com/article/cons...

fortune.com/article/cons...

I spoke with House Financial Services chair French Hill about squaring Trump's tariff strategy with his own free trade background, passing crypto legislation, and Congressional resolutions to defang the Consumer Financial Protection Bureau:

fortune.com/2025/04/16/f...

fortune.com/2025/04/16/f...

Trump’s tariffs can be beneficial in the long term but Congress needs a more active role, says top GOP lawmaker

As chair of the House Financial Services Committee, Hill is helping shepherd key crypto legislation.

fortune.com

April 16, 2025 at 1:37 PM

I spoke with House Financial Services chair French Hill about squaring Trump's tariff strategy with his own free trade background, passing crypto legislation, and Congressional resolutions to defang the Consumer Financial Protection Bureau:

fortune.com/2025/04/16/f...

fortune.com/2025/04/16/f...

@jessicakmathews.bsky.social and I have a new profile of Bo Hines, the 29-year-old heading Trump's sweeping crypto agenda.

We had a chance to interview Hines and review his calendar through FOIA. We also have new details about his deep financial ties to Trump world.

fortune.com/article/dona...

We had a chance to interview Hines and review his calendar through FOIA. We also have new details about his deep financial ties to Trump world.

fortune.com/article/dona...

Donald Trump’s 29-year-old crypto guru lays out the president’s plans for regulating crypto and rolling back a Biden-era crackdown

Since his appointment, Bo Hines has become a mini-celebrity in the crypto world—with CEOs, billionaire investors, and lobbyists vying for face time.

fortune.com

April 14, 2025 at 2:05 PM

@jessicakmathews.bsky.social and I have a new profile of Bo Hines, the 29-year-old heading Trump's sweeping crypto agenda.

We had a chance to interview Hines and review his calendar through FOIA. We also have new details about his deep financial ties to Trump world.

fortune.com/article/dona...

We had a chance to interview Hines and review his calendar through FOIA. We also have new details about his deep financial ties to Trump world.

fortune.com/article/dona...

Reposted by Leo Schwartz

Scoop: The lead attorney on the SEC's lawsuit against Elon Musk resigned last week, partly over concerns about how the case would be resolved.

This comes just days after Musk's DOGE entered the SEC:

fortune.com/2025/04/09/s...

This comes just days after Musk's DOGE entered the SEC:

fortune.com/2025/04/09/s...

SEC lawyer heading case on Elon Musk's Twitter acquistion resigns, cites “heartbreaking” decision

Robin Andrews led contentious litigation against Musk that was filed shortly before President Trump took office.

fortune.com

April 9, 2025 at 7:45 PM

Scoop: The lead attorney on the SEC's lawsuit against Elon Musk resigned last week, partly over concerns about how the case would be resolved.

This comes just days after Musk's DOGE entered the SEC:

fortune.com/2025/04/09/s...

This comes just days after Musk's DOGE entered the SEC:

fortune.com/2025/04/09/s...

Scoop: The lead attorney on the SEC's lawsuit against Elon Musk resigned last week, partly over concerns about how the case would be resolved.

This comes just days after Musk's DOGE entered the SEC:

fortune.com/2025/04/09/s...

This comes just days after Musk's DOGE entered the SEC:

fortune.com/2025/04/09/s...

SEC lawyer heading case on Elon Musk's Twitter acquistion resigns, cites “heartbreaking” decision

Robin Andrews led contentious litigation against Musk that was filed shortly before President Trump took office.

fortune.com

April 9, 2025 at 7:45 PM

Scoop: The lead attorney on the SEC's lawsuit against Elon Musk resigned last week, partly over concerns about how the case would be resolved.

This comes just days after Musk's DOGE entered the SEC:

fortune.com/2025/04/09/s...

This comes just days after Musk's DOGE entered the SEC:

fortune.com/2025/04/09/s...

Big scoop from @bdanweiss.bsky.social: The Department of Justice is disbanding its crypto enforcement unit

fortune.com/crypto/2025/...

fortune.com/crypto/2025/...

Justice Department scraps crypto unit as Trump further loosens oversight of digital assets

The National Cryptocurrency Enforcement Unit was established in 2021 and prosecuted major crypto-related felonies.

fortune.com

April 8, 2025 at 11:51 AM

Big scoop from @bdanweiss.bsky.social: The Department of Justice is disbanding its crypto enforcement unit

fortune.com/crypto/2025/...

fortune.com/crypto/2025/...

Over the past few years, Trump's business empire has dramatically shifted from real estate and licensing to his publicly traded Trump Media shares and crypto holdings. Conflict of interest concerns from his first term look quaint in hindsight.

From the new mag issue:

fortune.com/2025/03/25/t...

From the new mag issue:

fortune.com/2025/03/25/t...

What is Trump really worth?

The president is worth at least $4.9 billion, and crypto assets like $TRUMP and World Liberty Financial could add billions more.

fortune.com

March 25, 2025 at 4:13 PM

Over the past few years, Trump's business empire has dramatically shifted from real estate and licensing to his publicly traded Trump Media shares and crypto holdings. Conflict of interest concerns from his first term look quaint in hindsight.

From the new mag issue:

fortune.com/2025/03/25/t...

From the new mag issue:

fortune.com/2025/03/25/t...

As the Senate prepares for a landmark vote on stablecoin legislation, Sen. Elizabeth Warren is circulating a memo laying out risks, from Big Tech control of the financial system to consumer safety:

fortune.com/crypto/2025/...

fortune.com/crypto/2025/...

Senate poised to advance landmark crypto bill, Warren warns of Elon Musk 'controlling' financial system

The Senate is expected to markup a stablecoin bill on Thursday.

fortune.com

March 12, 2025 at 4:32 PM

As the Senate prepares for a landmark vote on stablecoin legislation, Sen. Elizabeth Warren is circulating a memo laying out risks, from Big Tech control of the financial system to consumer safety:

fortune.com/crypto/2025/...

fortune.com/crypto/2025/...

Almost a year ago, the a16z-backed fintech Synapse collapsed, trapping $200 million in customer assets and revealing the wobbly, unregulated infrastructure underlying much of our new financial system.

My investigation w/ @agarfinks.bsky.social on what went wrong:

fortune.com/2025/03/07/s...

My investigation w/ @agarfinks.bsky.social on what went wrong:

fortune.com/2025/03/07/s...

The spectacular Synapse collapse: Inside the ugliest divorce in fintech, which left $200 million in customer money frozen

Is the failure of this buzzy startup a canary in the coal mine for bigger problems in fintech?

fortune.com

March 10, 2025 at 2:25 PM

Almost a year ago, the a16z-backed fintech Synapse collapsed, trapping $200 million in customer assets and revealing the wobbly, unregulated infrastructure underlying much of our new financial system.

My investigation w/ @agarfinks.bsky.social on what went wrong:

fortune.com/2025/03/07/s...

My investigation w/ @agarfinks.bsky.social on what went wrong:

fortune.com/2025/03/07/s...

The Senate voted tonight to repeal key financial regulation that would have supervised digital payment platforms for fraud, privacy, and, ironically, debanking.

A major win for Silicon Valley and Elon Musk's payment ambitions for X:

fortune.com/2025/03/05/c...

A major win for Silicon Valley and Elon Musk's payment ambitions for X:

fortune.com/2025/03/05/c...

In a win for Silicon Valley, Senate votes to overturn key payments regulation that could benefit Elon Musk’s X

The rule was enacted under the Biden administration’s Consumer Financial Protection Bureau last November.

fortune.com

March 6, 2025 at 1:03 AM

The Senate voted tonight to repeal key financial regulation that would have supervised digital payment platforms for fraud, privacy, and, ironically, debanking.

A major win for Silicon Valley and Elon Musk's payment ambitions for X:

fortune.com/2025/03/05/c...

A major win for Silicon Valley and Elon Musk's payment ambitions for X:

fortune.com/2025/03/05/c...

🧵In late November, 26-year-old Suchir Balaji was found dead in his SF apartment. Just a month before, he had gone public with concerns that his former employer, OpenAI, was breaking copyright laws.

While officials deemed his death a suicide, his mother has become convinced he was murdered

While officials deemed his death a suicide, his mother has become convinced he was murdered

February 10, 2025 at 3:23 PM

🧵In late November, 26-year-old Suchir Balaji was found dead in his SF apartment. Just a month before, he had gone public with concerns that his former employer, OpenAI, was breaking copyright laws.

While officials deemed his death a suicide, his mother has become convinced he was murdered

While officials deemed his death a suicide, his mother has become convinced he was murdered

Are activist short-sellers going extinct?

After Hindenburg Research announced it was closing up shop last week, I spoke with other traders, including Andrew Left, about the increasingly perilous field:

fortune.com/2025/01/23/a...

After Hindenburg Research announced it was closing up shop last week, I spoke with other traders, including Andrew Left, about the increasingly perilous field:

fortune.com/2025/01/23/a...

Are famous short sellers going extinct? The exit of Hindenburg Research and Andrew Left shows the risky trade is shrinking

Indicted short seller Andrew Left tells Fortune a “chilling effect” is making “everyone think twice.”

fortune.com

January 23, 2025 at 5:44 PM

Are activist short-sellers going extinct?

After Hindenburg Research announced it was closing up shop last week, I spoke with other traders, including Andrew Left, about the increasingly perilous field:

fortune.com/2025/01/23/a...

After Hindenburg Research announced it was closing up shop last week, I spoke with other traders, including Andrew Left, about the increasingly perilous field:

fortune.com/2025/01/23/a...

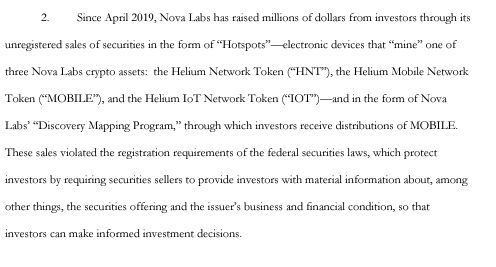

I feel like this went under the radar yesterday, but one of the last actions by Gary Gensler's SEC was to sue Nova Labs, the developer of Helium, for illegal securities offerings — including its newest product, Helium Mobile

January 18, 2025 at 8:56 PM

I feel like this went under the radar yesterday, but one of the last actions by Gary Gensler's SEC was to sue Nova Labs, the developer of Helium, for illegal securities offerings — including its newest product, Helium Mobile

CoinDesk owners Bullish fired the publication's three top editors, including EIC Kevin Reynolds, this morning following newsroom controversy over the removal of an article about billionaire Justin Sun:

fortune.com/crypto/2024/...

fortune.com/crypto/2024/...

CoinDesk ownership Bullish fires top editorial staff amid newsroom controversy

CoinDesk CEO Sara Stratoberdha told editorial staff on Friday that the company that editor-in-chief Kevin Reynolds and two deputies were let go.

fortune.com

December 20, 2024 at 3:39 PM

CoinDesk owners Bullish fired the publication's three top editors, including EIC Kevin Reynolds, this morning following newsroom controversy over the removal of an article about billionaire Justin Sun:

fortune.com/crypto/2024/...

fortune.com/crypto/2024/...

Scoop: Turmoil at CoinDesk after its new owners forced editors to remove an article about billionaire Justin Sun.

Matt Murray, former WSJ EIC and new WaPo editor, resigned as editorial committee chair, and staff are raising concerns over independence:

fortune.com/crypto/2024/...

Matt Murray, former WSJ EIC and new WaPo editor, resigned as editorial committee chair, and staff are raising concerns over independence:

fortune.com/crypto/2024/...

Billionaire Justin Sun pushed CoinDesk’s new ownership to remove article about banana-eating, editorial chair Matt Murray resigns

The crypto exchange Bullish purchased CoinDesk in late 2023 for close to $75 million.

fortune.com

December 19, 2024 at 12:17 AM

Scoop: Turmoil at CoinDesk after its new owners forced editors to remove an article about billionaire Justin Sun.

Matt Murray, former WSJ EIC and new WaPo editor, resigned as editorial committee chair, and staff are raising concerns over independence:

fortune.com/crypto/2024/...

Matt Murray, former WSJ EIC and new WaPo editor, resigned as editorial committee chair, and staff are raising concerns over independence:

fortune.com/crypto/2024/...

Non-GBTC crypto ads are back.

Also, headed to D.C. for the Blockchain Association’s Policy Summit — let me know if you’ll be there too

Also, headed to D.C. for the Blockchain Association’s Policy Summit — let me know if you’ll be there too

December 16, 2024 at 3:13 PM

Non-GBTC crypto ads are back.

Also, headed to D.C. for the Blockchain Association’s Policy Summit — let me know if you’ll be there too

Also, headed to D.C. for the Blockchain Association’s Policy Summit — let me know if you’ll be there too

This deserves feature-length treatment

December 13, 2024 at 7:47 PM

This deserves feature-length treatment

If you can't get enough of Hawk Tuah, I broke down the apparent rug pull with input from insiders, blockchain analysts, and a former DOJ prosecutor who says that Welch could face civil and even criminal charges.

Sadly, she wouldn't talk with me again:

fortune.com/crypto/2024/...

Sadly, she wouldn't talk with me again:

fortune.com/crypto/2024/...

Hawk Tuah girl wanted to reward fans with a memecoin—crypto insiders turned it into a 'one-day pump and dump'

Was Haliey Welch used as a marketing stunt to promote a rug pull?

fortune.com

December 10, 2024 at 6:32 PM

If you can't get enough of Hawk Tuah, I broke down the apparent rug pull with input from insiders, blockchain analysts, and a former DOJ prosecutor who says that Welch could face civil and even criminal charges.

Sadly, she wouldn't talk with me again:

fortune.com/crypto/2024/...

Sadly, she wouldn't talk with me again:

fortune.com/crypto/2024/...

Depressing to see Eater decimated when the new business model for restaurant reviews is TikTok influencers who are paid by the places they're "reviewing"

Is food criticism doomed?

Is food criticism doomed?

December 6, 2024 at 4:24 PM

Depressing to see Eater decimated when the new business model for restaurant reviews is TikTok influencers who are paid by the places they're "reviewing"

Is food criticism doomed?

Is food criticism doomed?

Scoop w/ @jessicakmathews.bsky.social: The fintech unicorn Stash laid off 40% of staff in October as its co-founders returned as co-CEOs.

It's the second layoff this year for the company, once valued at $1.4 billion, which is closing a new funding round

fortune.com/2024/12/04/s...

It's the second layoff this year for the company, once valued at $1.4 billion, which is closing a new funding round

fortune.com/2024/12/04/s...

Exclusive: Fintech unicorn Stash laid off 40% of its workforce after CEO left

The company has had two major layoffs in 2024 and says it’s now cash flow positive.

fortune.com

December 5, 2024 at 1:40 PM

Scoop w/ @jessicakmathews.bsky.social: The fintech unicorn Stash laid off 40% of staff in October as its co-founders returned as co-CEOs.

It's the second layoff this year for the company, once valued at $1.4 billion, which is closing a new funding round

fortune.com/2024/12/04/s...

It's the second layoff this year for the company, once valued at $1.4 billion, which is closing a new funding round

fortune.com/2024/12/04/s...