Kimberly Clausing

@kclausing.bsky.social

Economist; Professor @law.ucla.edu; senior fellow @piie.com; former tax DAS at Treasury; Author, Open: The Progressive Case for Free Trade, Immigration, and Global Capital

At least these small businesses are standing up for the integrity of the constitution (and demonstrating the harmful economic effects of tariffs).

www.nytimes.com/live/2025/11...

www.nytimes.com/live/2025/11...

November 5, 2025 at 7:55 PM

At least these small businesses are standing up for the integrity of the constitution (and demonstrating the harmful economic effects of tariffs).

www.nytimes.com/live/2025/11...

www.nytimes.com/live/2025/11...

(7/7) For more on a comparison of relevant climate policy actions for the United States, see this recent work:

papers.ssrn.com/sol3/papers....

ceepr.mit.edu/wp-content/u...

papers.ssrn.com/sol3/papers....

ceepr.mit.edu/wp-content/u...

September 25, 2025 at 1:07 PM

(7/7) For more on a comparison of relevant climate policy actions for the United States, see this recent work:

papers.ssrn.com/sol3/papers....

ceepr.mit.edu/wp-content/u...

papers.ssrn.com/sol3/papers....

ceepr.mit.edu/wp-content/u...

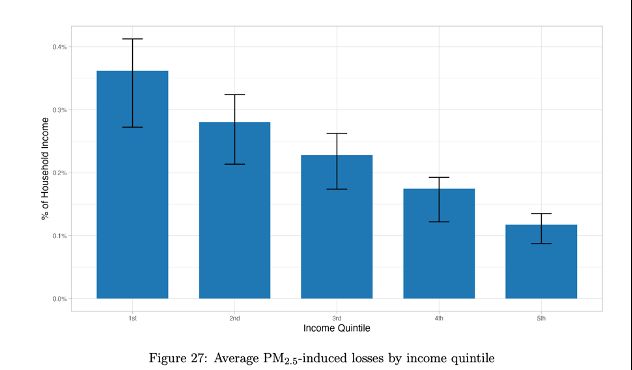

(5/7) Further, climate policy *inaction* is regressive, harming poorer counties and households disproportionately. Poorer counties are more exposed to risks such as wildfire particulates, and the higher costs of home insurance and cooling are a larger share of income for poorer households.

September 25, 2025 at 1:07 PM

(5/7) Further, climate policy *inaction* is regressive, harming poorer counties and households disproportionately. Poorer counties are more exposed to risks such as wildfire particulates, and the higher costs of home insurance and cooling are a larger share of income for poorer households.

(4/7) In the United States, natural disasters are far more consequential than heat, for both costs and mortality risks. Increased particulate matter from smoke causes more deaths than heat (as cold deaths fall); home insurance price increases are more important than higher cooling costs.

September 25, 2025 at 1:07 PM

(4/7) In the United States, natural disasters are far more consequential than heat, for both costs and mortality risks. Increased particulate matter from smoke causes more deaths than heat (as cold deaths fall); home insurance price increases are more important than higher cooling costs.

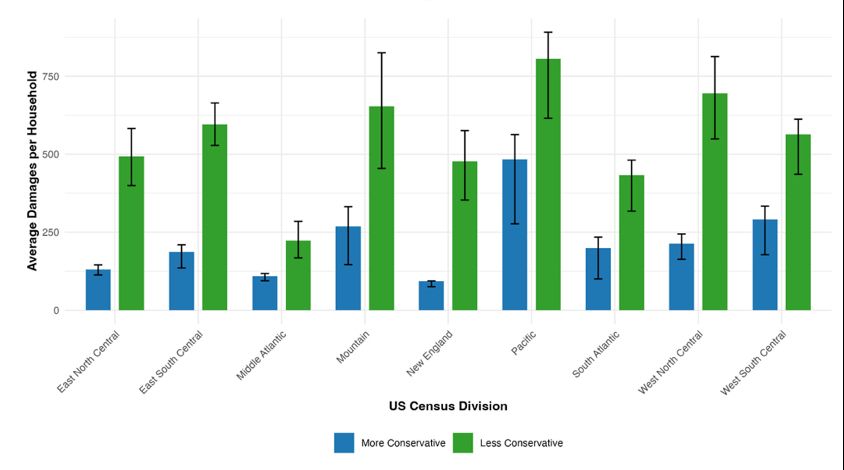

(3/7) When it comes to climate change, “blue” counties and “red” counties suffer similarly, with slightly higher costs for Trump-voting counties in comparison to Harris-voting counties.

September 25, 2025 at 1:07 PM

(3/7) When it comes to climate change, “blue” counties and “red” counties suffer similarly, with slightly higher costs for Trump-voting counties in comparison to Harris-voting counties.

(2/7) Guided by the literature, we examine several key vectors through which climate inaction affects households. Overall, household damages total nearly $600 by one estimate, and damages reach about $900 for ten percent of households.

September 25, 2025 at 1:07 PM

(2/7) Guided by the literature, we examine several key vectors through which climate inaction affects households. Overall, household damages total nearly $600 by one estimate, and damages reach about $900 for ten percent of households.

🧵 (1/7) With @knittelmit.bsky.social and @cwolfram.bsky.social, happy to announce our new paper on “Who Bears the Burden of Climate Inaction?”, just posted for BPEA @brookings.edu.

We find large climate cost impacts that vary by both geography and income.

www.brookings.edu/articles/who...

We find large climate cost impacts that vary by both geography and income.

www.brookings.edu/articles/who...

September 25, 2025 at 1:07 PM

🧵 (1/7) With @knittelmit.bsky.social and @cwolfram.bsky.social, happy to announce our new paper on “Who Bears the Burden of Climate Inaction?”, just posted for BPEA @brookings.edu.

We find large climate cost impacts that vary by both geography and income.

www.brookings.edu/articles/who...

We find large climate cost impacts that vary by both geography and income.

www.brookings.edu/articles/who...

(7/8) Together with the OBBBA, this fiscal switch of lower income tax revenues, higher tariff revenues, and spending cuts targeting poorer Americans will leave most Americans with lower after-tax incomes.

September 24, 2025 at 5:34 PM

(7/8) Together with the OBBBA, this fiscal switch of lower income tax revenues, higher tariff revenues, and spending cuts targeting poorer Americans will leave most Americans with lower after-tax incomes.

(6/8) In terms of progressivity, tariffs are far less progressive than the income tax; they harm poor and middle-class Americans more than rich Americans for the simple reason that they fall on consumption, not savings, and savings rates increase with income.

September 24, 2025 at 5:34 PM

(6/8) In terms of progressivity, tariffs are far less progressive than the income tax; they harm poor and middle-class Americans more than rich Americans for the simple reason that they fall on consumption, not savings, and savings rates increase with income.

(5/8) In terms of efficiency, tariffs perform poorly relative to other tax instruments, for reasons discussed at length in the paper. At current levels, efficiency losses approach one third of revenue raised.

September 24, 2025 at 5:34 PM

(5/8) In terms of efficiency, tariffs perform poorly relative to other tax instruments, for reasons discussed at length in the paper. At current levels, efficiency losses approach one third of revenue raised.

(4/8) Once accounting for mechanical offsets, our revenue findings are compatible with recent 10-year estimates of tariff revenues, but readers should note these studies are not strictly comparable, and exemptions and evasion might reduce revenues further.

September 24, 2025 at 5:34 PM

(4/8) Once accounting for mechanical offsets, our revenue findings are compatible with recent 10-year estimates of tariff revenues, but readers should note these studies are not strictly comparable, and exemptions and evasion might reduce revenues further.

(3/8) In terms of revenue, we calculate tariff “Laffer curves” under multiple modeling assumptions, finding that tariff revenues peak at a level far short of what it would take to replace (or even dramatically reduce) income tax revenues.

September 24, 2025 at 5:34 PM

(3/8) In terms of revenue, we calculate tariff “Laffer curves” under multiple modeling assumptions, finding that tariff revenues peak at a level far short of what it would take to replace (or even dramatically reduce) income tax revenues.

(2/8) While tariffs have long been employed for various narrow aims, their use in today’s US economy is far more significant. Tariffs are a tax. In our paper, we evaluate the use of tariffs by broad tax policy criteria: revenue, efficiency, progressivity, and tax administration.

September 24, 2025 at 5:34 PM

(2/8) While tariffs have long been employed for various narrow aims, their use in today’s US economy is far more significant. Tariffs are a tax. In our paper, we evaluate the use of tariffs by broad tax policy criteria: revenue, efficiency, progressivity, and tax administration.

🧵 (1/8) My new working paper with Maurice Obstfeld, “Tariffs as Fiscal Policy”, was just posted today @piie.com. Within, we evaluate the new role that tariffs are playing in the US economy.

www.piie.com/publications...

www.piie.com/publications...

September 24, 2025 at 5:34 PM

🧵 (1/8) My new working paper with Maurice Obstfeld, “Tariffs as Fiscal Policy”, was just posted today @piie.com. Within, we evaluate the new role that tariffs are playing in the US economy.

www.piie.com/publications...

www.piie.com/publications...

Something to bear in mind when spending time online. Social media and polarization are... related. Nice graphic from @financialtimes.com.

September 5, 2025 at 2:00 PM

Something to bear in mind when spending time online. Social media and polarization are... related. Nice graphic from @financialtimes.com.

Survey respondents are connecting the dots between Trump's ruinous fixation on tariffs/deportations and their own dissatisfaction with economic disruption and cost increases.

wapo.st/4n4W7ru

wapo.st/4n4W7ru

September 2, 2025 at 2:02 PM

Survey respondents are connecting the dots between Trump's ruinous fixation on tariffs/deportations and their own dissatisfaction with economic disruption and cost increases.

wapo.st/4n4W7ru

wapo.st/4n4W7ru

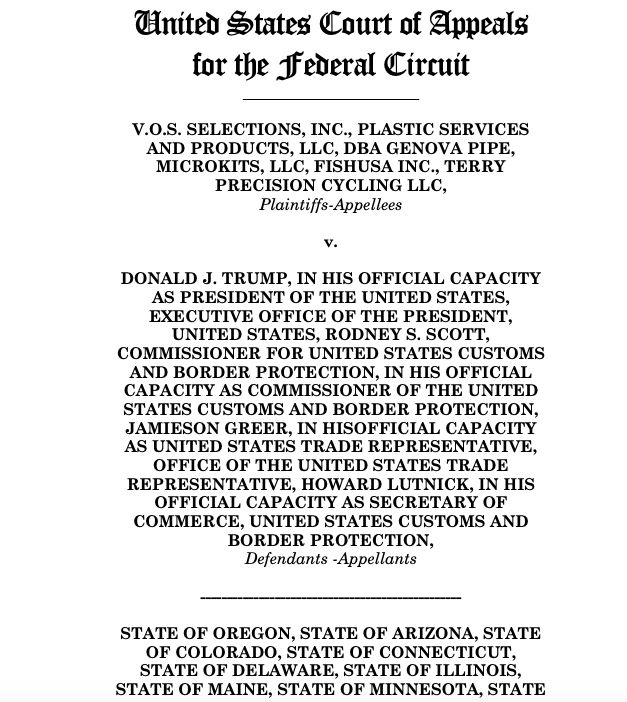

US Appeals Court rejects Trump Administration's IEEPA tariffs.

The IEEPA tariffs are about 70 percent of them, by revenue.

Link to full details here:

storage.courtlistener.com/recap/gov.us...

The IEEPA tariffs are about 70 percent of them, by revenue.

Link to full details here:

storage.courtlistener.com/recap/gov.us...

August 29, 2025 at 10:00 PM

US Appeals Court rejects Trump Administration's IEEPA tariffs.

The IEEPA tariffs are about 70 percent of them, by revenue.

Link to full details here:

storage.courtlistener.com/recap/gov.us...

The IEEPA tariffs are about 70 percent of them, by revenue.

Link to full details here:

storage.courtlistener.com/recap/gov.us...

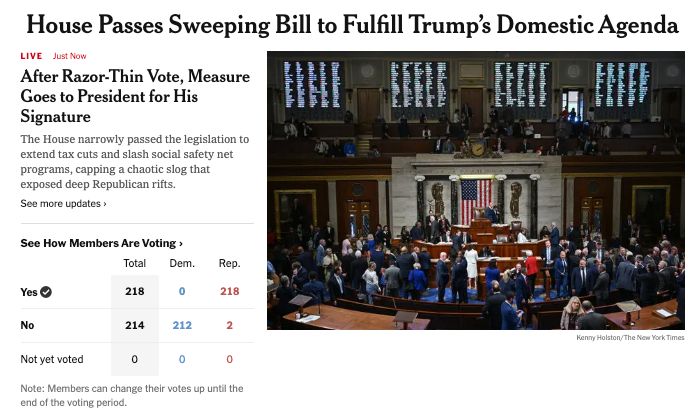

So OBBB is soon law. My thoughts, in yesterday's blog.

Three ways the big budget bill fails Americans www.piie.com/blogs/realti...

Three ways the big budget bill fails Americans www.piie.com/blogs/realti...

July 3, 2025 at 6:35 PM

So OBBB is soon law. My thoughts, in yesterday's blog.

Three ways the big budget bill fails Americans www.piie.com/blogs/realti...

Three ways the big budget bill fails Americans www.piie.com/blogs/realti...

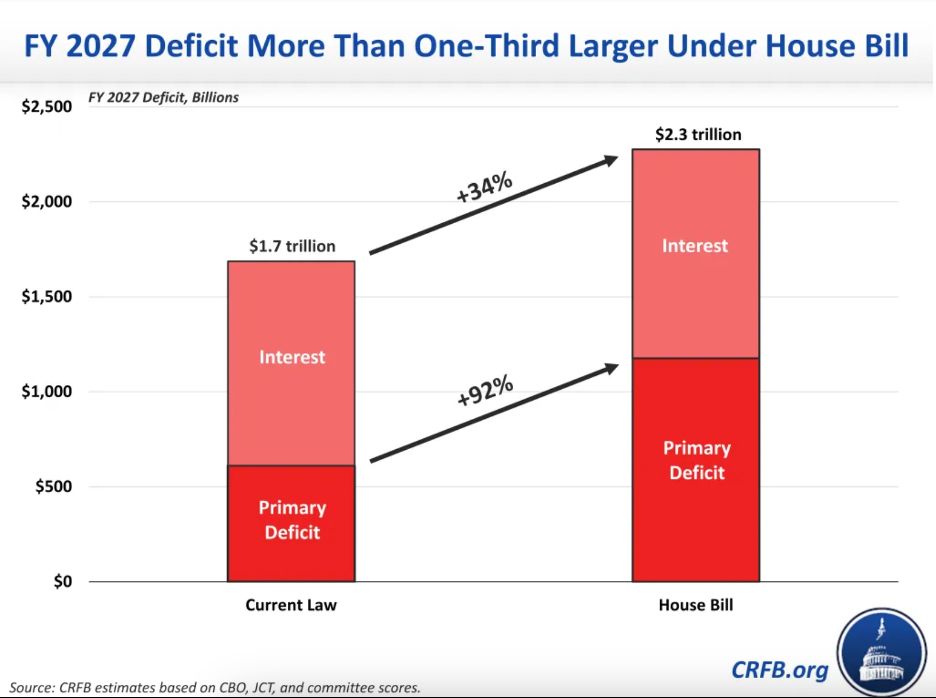

(2/4) First, higher interest rates will reduce the bang for the buck for taxpayers; more and more of tax dollars will finance prior debts instead of government services. And US fiscal irresponsibility may generate risk premiums that compounds this effect.

June 27, 2025 at 5:29 PM

(2/4) First, higher interest rates will reduce the bang for the buck for taxpayers; more and more of tax dollars will finance prior debts instead of government services. And US fiscal irresponsibility may generate risk premiums that compounds this effect.

Barry Eichengreen on the lessons of history and the risks associated with unfettered stablecoin proliferation.

www.nytimes.com/2025/06/17/o...

www.nytimes.com/2025/06/17/o...

June 17, 2025 at 11:19 PM

Barry Eichengreen on the lessons of history and the risks associated with unfettered stablecoin proliferation.

www.nytimes.com/2025/06/17/o...

www.nytimes.com/2025/06/17/o...

Re point 1, multiple sources show minimal growth effects from OBBB, due to both poor policy design and the drag of higher interest costs. See this excellent graphic from

@brendanvduke.bsky.social

@brendanvduke.bsky.social

June 11, 2025 at 5:54 PM

Re point 1, multiple sources show minimal growth effects from OBBB, due to both poor policy design and the drag of higher interest costs. See this excellent graphic from

@brendanvduke.bsky.social

@brendanvduke.bsky.social

(1/4) Some of the perils of OBBB deficits:

1. higher interest rates a drag on growth

2. government spending cuts are offset by higher govt. interest payments, a terrible deal for taxpayers

3. higher interest costs will also swamp tax benefits for many households

1. higher interest rates a drag on growth

2. government spending cuts are offset by higher govt. interest payments, a terrible deal for taxpayers

3. higher interest costs will also swamp tax benefits for many households

June 11, 2025 at 5:54 PM

(1/4) Some of the perils of OBBB deficits:

1. higher interest rates a drag on growth

2. government spending cuts are offset by higher govt. interest payments, a terrible deal for taxpayers

3. higher interest costs will also swamp tax benefits for many households

1. higher interest rates a drag on growth

2. government spending cuts are offset by higher govt. interest payments, a terrible deal for taxpayers

3. higher interest costs will also swamp tax benefits for many households

#2 The bill is stunningly regressive; it will leave many worse off. CBO, Budget Lab,Tax Policy Center, Penn Wharton all agree. This vivid graphic is from Budget Lab, showing combined effects of regressive spending cuts and regressive tax cuts. (All *before* we consider regressive tariffs on top!)

May 21, 2025 at 6:35 PM

#2 The bill is stunningly regressive; it will leave many worse off. CBO, Budget Lab,Tax Policy Center, Penn Wharton all agree. This vivid graphic is from Budget Lab, showing combined effects of regressive spending cuts and regressive tax cuts. (All *before* we consider regressive tariffs on top!)

🧵 (1/4) There are four fundamental flaws of the House tax bill.

#1 It is fiscally irresponsible; all reputable sources agree. Bond markets & downgrades show US financial fragility; this is a bad time to take on trillions in additional debt toward no useful policy rationale.

#1 It is fiscally irresponsible; all reputable sources agree. Bond markets & downgrades show US financial fragility; this is a bad time to take on trillions in additional debt toward no useful policy rationale.

May 21, 2025 at 6:35 PM

🧵 (1/4) There are four fundamental flaws of the House tax bill.

#1 It is fiscally irresponsible; all reputable sources agree. Bond markets & downgrades show US financial fragility; this is a bad time to take on trillions in additional debt toward no useful policy rationale.

#1 It is fiscally irresponsible; all reputable sources agree. Bond markets & downgrades show US financial fragility; this is a bad time to take on trillions in additional debt toward no useful policy rationale.

(4/ ) @BudgetModel shows a similarly stark picture when pairing tax and spending; they also add dynamic effects. Middle-aged poor people fare the worst, a lifetime hit of about $40k. Whereas rich elderly people gain the most.

budgetmodel.wharton.upenn.edu/issues/2025/...

budgetmodel.wharton.upenn.edu/issues/2025/...

May 20, 2025 at 2:42 PM

(4/ ) @BudgetModel shows a similarly stark picture when pairing tax and spending; they also add dynamic effects. Middle-aged poor people fare the worst, a lifetime hit of about $40k. Whereas rich elderly people gain the most.

budgetmodel.wharton.upenn.edu/issues/2025/...

budgetmodel.wharton.upenn.edu/issues/2025/...