Our takeaway: (un)sophistication. Emotion laden news mattered more than tailored renewal letters.

Our takeaway: (un)sophistication. Emotion laden news mattered more than tailored renewal letters.

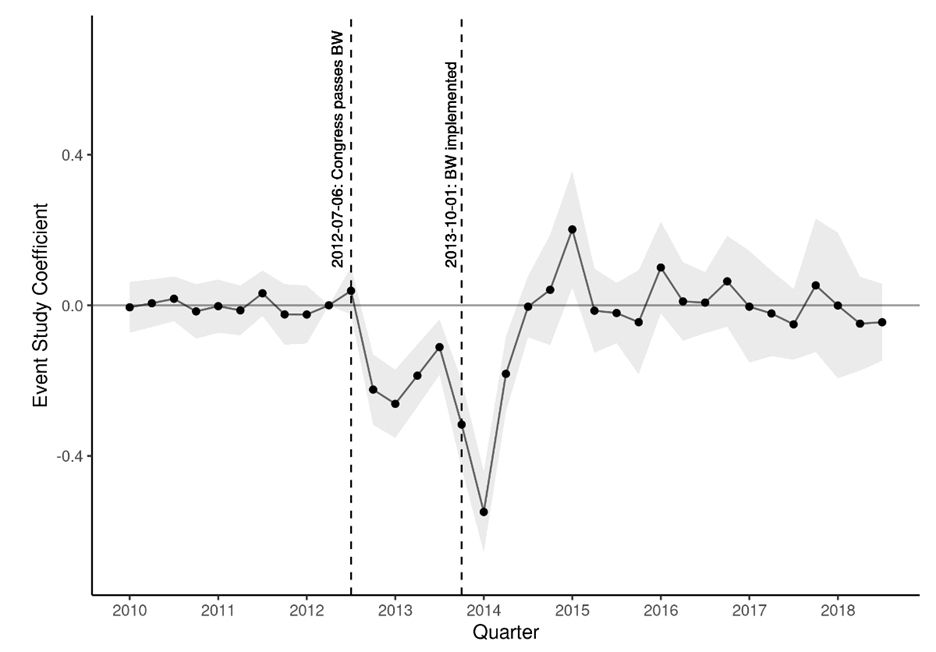

Anticipation(!). Are consumers being super-sophisticated? Find out below. (Spoiler: They’re not.)

Anticipation(!). Are consumers being super-sophisticated? Find out below. (Spoiler: They’re not.)

What did they actually do? They drop their insurance (smh). Using diff-in-diff estimations, we find that 25% of SRLs stop insuring.

What did they actually do? They drop their insurance (smh). Using diff-in-diff estimations, we find that 25% of SRLs stop insuring.

Severe climate events (floods, wildfires) are raising insurance costs – on average, home insurance premiums increased 21% this year. Will policyholders keep insuring their homes?

We (@blcollier2.bsky.social, @tobiashuber.bsky.social, Andreas Richter & I) explore this in a new working paper.

Severe climate events (floods, wildfires) are raising insurance costs – on average, home insurance premiums increased 21% this year. Will policyholders keep insuring their homes?

We (@blcollier2.bsky.social, @tobiashuber.bsky.social, Andreas Richter & I) explore this in a new working paper.

Me: Sure, how much work can that be?

The answer is 5 hours.

Me: Sure, how much work can that be?

The answer is 5 hours.