Helene Meisler

@hmeisler.bsky.social

I write a daily column for https://pro.thestreet.com/author/helene-meisler on the markets. Worked at Cowen, GS, Cargill. Former Asian Expat: S'pore & Shanghai. Tennis fan. Love to cook.

Big sale at Crate and Barrel so decided to get a new one.

Put this into your economic calculations!

Put this into your economic calculations!

November 8, 2025 at 7:54 PM

Big sale at Crate and Barrel so decided to get a new one.

Put this into your economic calculations!

Put this into your economic calculations!

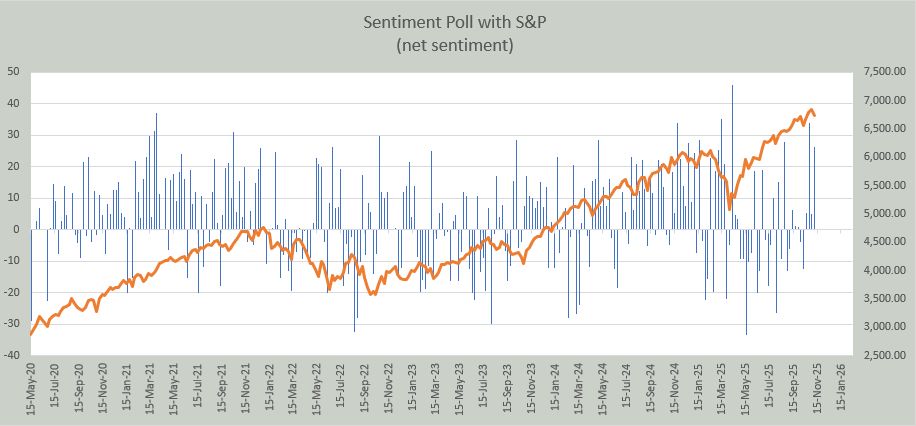

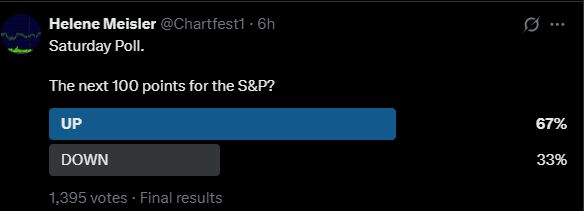

The results are in and folks lean Up for the 4th straight week. That is the longest UP streak since March.

Thanks for participating!

Thanks for participating!

November 8, 2025 at 6:04 PM

The results are in and folks lean Up for the 4th straight week. That is the longest UP streak since March.

Thanks for participating!

Thanks for participating!

Naz new lows. 20 dma

November 8, 2025 at 1:38 PM

Naz new lows. 20 dma

NYSE new lows. 20 dma.

November 8, 2025 at 1:37 PM

NYSE new lows. 20 dma.

My pinned tweet hard at work this week

November 7, 2025 at 2:39 PM

My pinned tweet hard at work this week

NAAIM Exposure down to 90.

See my pinned tweet.

See my pinned tweet.

November 6, 2025 at 6:39 PM

NAAIM Exposure down to 90.

See my pinned tweet.

See my pinned tweet.

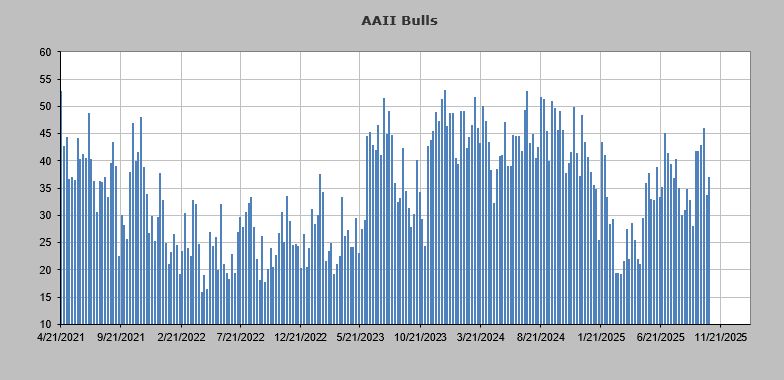

AAII Day Traders--and seriously real investors do not jump around like this--pulled in their horns a bit. Still more bulls than bears.

Bulls 38% (-6)

Bears 36.3% (unched)

Bulls 38% (-6)

Bears 36.3% (unched)

November 6, 2025 at 12:06 PM

AAII Day Traders--and seriously real investors do not jump around like this--pulled in their horns a bit. Still more bulls than bears.

Bulls 38% (-6)

Bears 36.3% (unched)

Bulls 38% (-6)

Bears 36.3% (unched)

I do believe this h/s top looks like it came out of a textbook. CCL

@conorsen.bsky.social

@conorsen.bsky.social

November 4, 2025 at 8:55 PM

I do believe this h/s top looks like it came out of a textbook. CCL

@conorsen.bsky.social

@conorsen.bsky.social

Here's one more sentiment indicator, Luke.

Market Vane % bulls. 72%. last time: December. Before that: July 2024

Market Vane % bulls. 72%. last time: December. Before that: July 2024

November 4, 2025 at 12:25 PM

Here's one more sentiment indicator, Luke.

Market Vane % bulls. 72%. last time: December. Before that: July 2024

Market Vane % bulls. 72%. last time: December. Before that: July 2024

@conorsen.bsky.social This is the chart I can't take my eyes off. Someone has been supporting it at 325 for months. The company? Dunno. but that's the level.

November 3, 2025 at 7:19 PM

@conorsen.bsky.social This is the chart I can't take my eyes off. Someone has been supporting it at 325 for months. The company? Dunno. but that's the level.

Did I draw in the K properly @ivanthek.bsky.social ??

November 3, 2025 at 7:09 PM

Did I draw in the K properly @ivanthek.bsky.social ??

NAAIM Exposure ticks over 100. First reading over 100 since July 2024

October 30, 2025 at 4:12 PM

NAAIM Exposure ticks over 100. First reading over 100 since July 2024

AAII Day Traders are at it again.

Most bulls/fewest bears since 10/8

Bulls 44% (+7)

Bears 36.9 (-6)

Most bulls/fewest bears since 10/8

Bulls 44% (+7)

Bears 36.9 (-6)

October 30, 2025 at 10:33 AM

AAII Day Traders are at it again.

Most bulls/fewest bears since 10/8

Bulls 44% (+7)

Bears 36.9 (-6)

Most bulls/fewest bears since 10/8

Bulls 44% (+7)

Bears 36.9 (-6)

October 29, 2025 at 12:34 PM

The results are in and folks lean bullishly. I looked at the last 3 spikes of bullishness. 2/3 saw the following week down. The one week that was up was up about 1/2%, and that was in mid March so we went right back down the following week.

Thanks for voting!

Thanks for voting!

October 25, 2025 at 5:12 PM

The results are in and folks lean bullishly. I looked at the last 3 spikes of bullishness. 2/3 saw the following week down. The one week that was up was up about 1/2%, and that was in mid March so we went right back down the following week.

Thanks for voting!

Thanks for voting!

30 dma of equity put/call ratio. You need to squint but it is now lowest since 2021 but nowhere near the lows of 2021

October 25, 2025 at 12:26 PM

30 dma of equity put/call ratio. You need to squint but it is now lowest since 2021 but nowhere near the lows of 2021

WDC. Interesting close

October 24, 2025 at 8:44 PM

WDC. Interesting close

NAAIM folks back over 90 (90.35)

October 23, 2025 at 3:07 PM

NAAIM folks back over 90 (90.35)

AAII a mite more bullish this week but not enough to change things.

Bulls 36.9% (+3)

Bears 42.7% (-3.5)

Bulls 36.9% (+3)

Bears 42.7% (-3.5)

October 23, 2025 at 10:58 AM

AAII a mite more bullish this week but not enough to change things.

Bulls 36.9% (+3)

Bears 42.7% (-3.5)

Bulls 36.9% (+3)

Bears 42.7% (-3.5)

Yesterday's TRIN was 1.53, highest since 7/9

October 22, 2025 at 11:01 AM

Yesterday's TRIN was 1.53, highest since 7/9

The results from Saturday's poll.

Folks are leaning bullish for the first time in 3 weeks.

Thanks for voting!

Folks are leaning bullish for the first time in 3 weeks.

Thanks for voting!

October 19, 2025 at 11:21 AM

The results from Saturday's poll.

Folks are leaning bullish for the first time in 3 weeks.

Thanks for voting!

Folks are leaning bullish for the first time in 3 weeks.

Thanks for voting!